Data Modernization in Insurance Agencies

In the insurance industry, the key to unlocking new business opportunities often lies in how well a company can leverage its data.

That’s why data modernization is so important for businesses operating in that field.

In this article we’ll explore how insurance agencies are revolutionizing their operations by modernizing their data systems and improving their existing legacy software.

Contents

- What Exactly is Data Modernization?

- Value of Data Modernization in The Insurance Industry

- How to Conduct Data Modernization – Five Strategies From an Expert

- Strategy 1: Work only with seasoned professionals

- Strategy 2: Plan your data infrastructure for the future

- Strategy 3: Make data AI ready

- Strategy 4: Invest in API -first approach

- Strategy 5: Embrace Continuous Delivery and DevOps Practices

What Exactly is Data Modernization?

Data modernization is the strategic process of upgrading legacy data systems and practices to take advantage of more advanced, efficient, and scalable technologies.

It involves transitioning from legacy databases, software, and data processing methods to modern infrastructure such as cloud-based services, big data analytics platforms, and artificial intelligence-driven tools.

For companies in the insurance industry, data modernization offers transformative potential.

It enables insurers to harness vast amounts of structured and unstructured data from multiple sources, including social media and traditional policyholder information, to gain deeper insights into customer behavior, risk profiles, and insurance market trends.

These comprehensive data and analytics capabilities support more accurate risk assessment, personalized policy offerings, efficient claims handling, and improved customer experience.

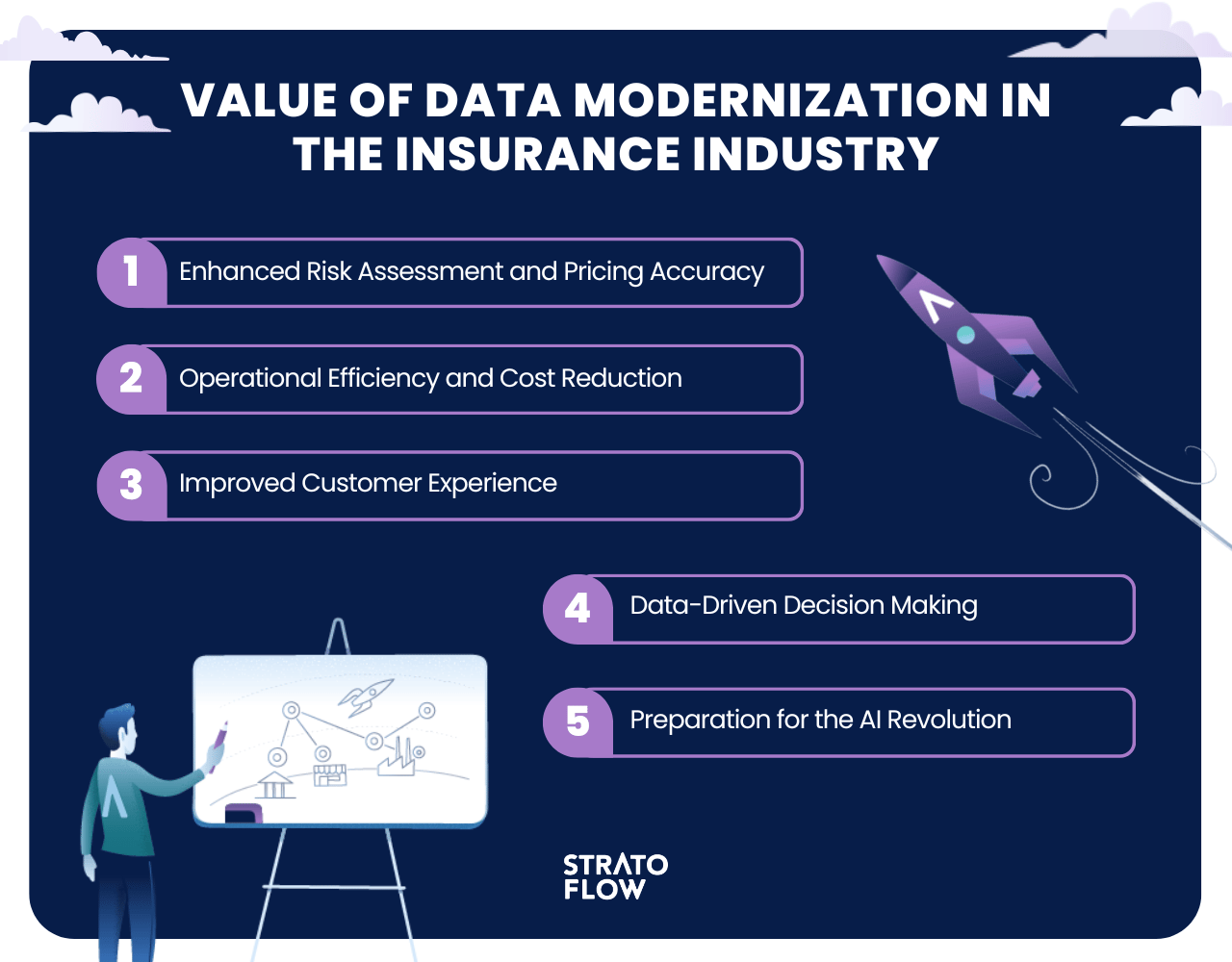

Value of Data Modernization in The Insurance Industry

In today’s fast-paced insurance world, staying ahead means using technology intelligently.

Data modernization is a big step for insurance companies looking to improve and stay competitive.

By moving from old, legacy systems to newer, more efficient ones, they can realize several important benefits. Here are five of the most important benefits insurance companies can gain from data modernization projects.

Enhanced Risk Assessment and Pricing Accuracy

By modernizing data systems, insurers can integrate and analyze a broader range of data types and sources, including real-time data from connected devices and social media.

This capability enables a more nuanced understanding of the risks associated with insuring individuals or businesses.

Operational Efficiency and Cost Reduction

Replacing or upgrading legacy systems with modern, automated solutions streamlines many of the manual processes that are time-consuming and error-prone.

Processes such as claims processing, underwriting, and customer service can be significantly accelerated, reducing operational costs.

Automation also allows for better resource allocation, as employees spend less time on routine tasks and more time on strategic initiatives. This efficiency not only reduces costs, but also improves employee satisfaction and productivity.

Improved Customer Experience

Data modernization also facilitates a more personalized and responsive customer experience. With access to detailed insights about customers’ preferences, behaviors, and needs, insurance companies can offer tailored products, recommend appropriate coverages, and provide proactive services.

Data-Driven Decision Making and Innovation

Access to real-time, high-quality data and advanced analytics enables insurance companies to make informed strategic decisions.

The insurance industry drives innovation by identifying market trends, opportunities, and challenges before competitors do. Companies can explore new business models, such as usage-based insurance, and develop innovative products and services that meet evolving customer needs. Ultimately, data modernization positions insurers to lead in a competitive landscape shaped by insurance digitalization.

Preparation for the AI Revolution

Modernizing data infrastructure prepares companies for the insurance AI revolution, enabling them to effectively leverage AI and machine learning technologies.

This readiness not only optimizes current operations, but also paves the way for innovations such as automated claims processing, personalized insurance policies based on AI algorithms, and predictive analytics for risk management.

[Read also: Complete Guide to CRM for Insurance Agents [+ 6 Best CRMs]]

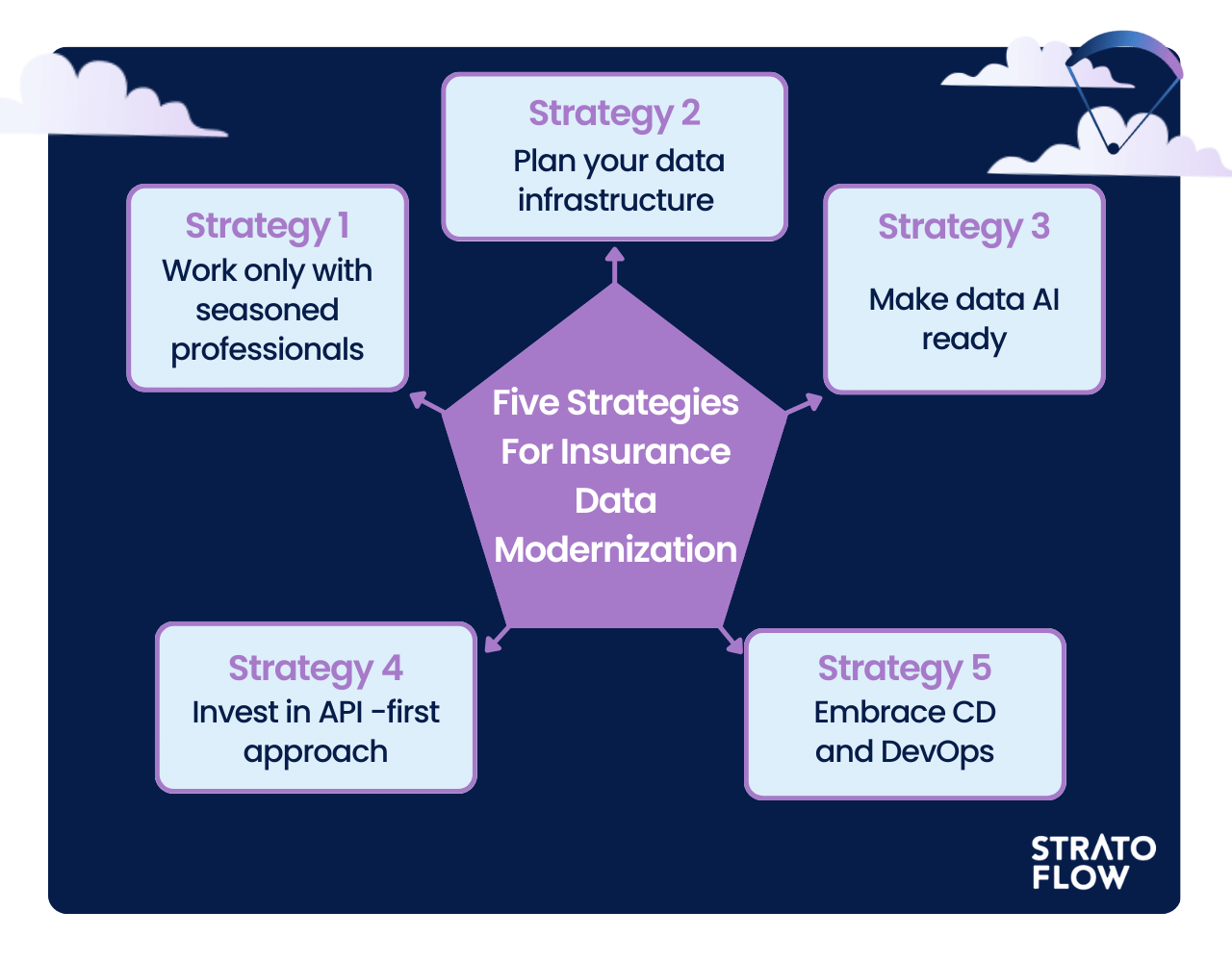

How to Conduct Data Modernization – Five Strategies From an Expert

Data modernization, especially in the insurance industry, is not an easy task. It can bring immense benefits and unlock new growth potential, but it must be done right.

That’s why we’ve outlined five key strategies for successful data modernization in the insurance industry. From partnering with experienced experts to adopting an AI-enabled infrastructure, these five key strategies and actionable insights are your blueprint for successfully navigating the modernization landscape.

Strategy 1: Work only with seasoned professionals

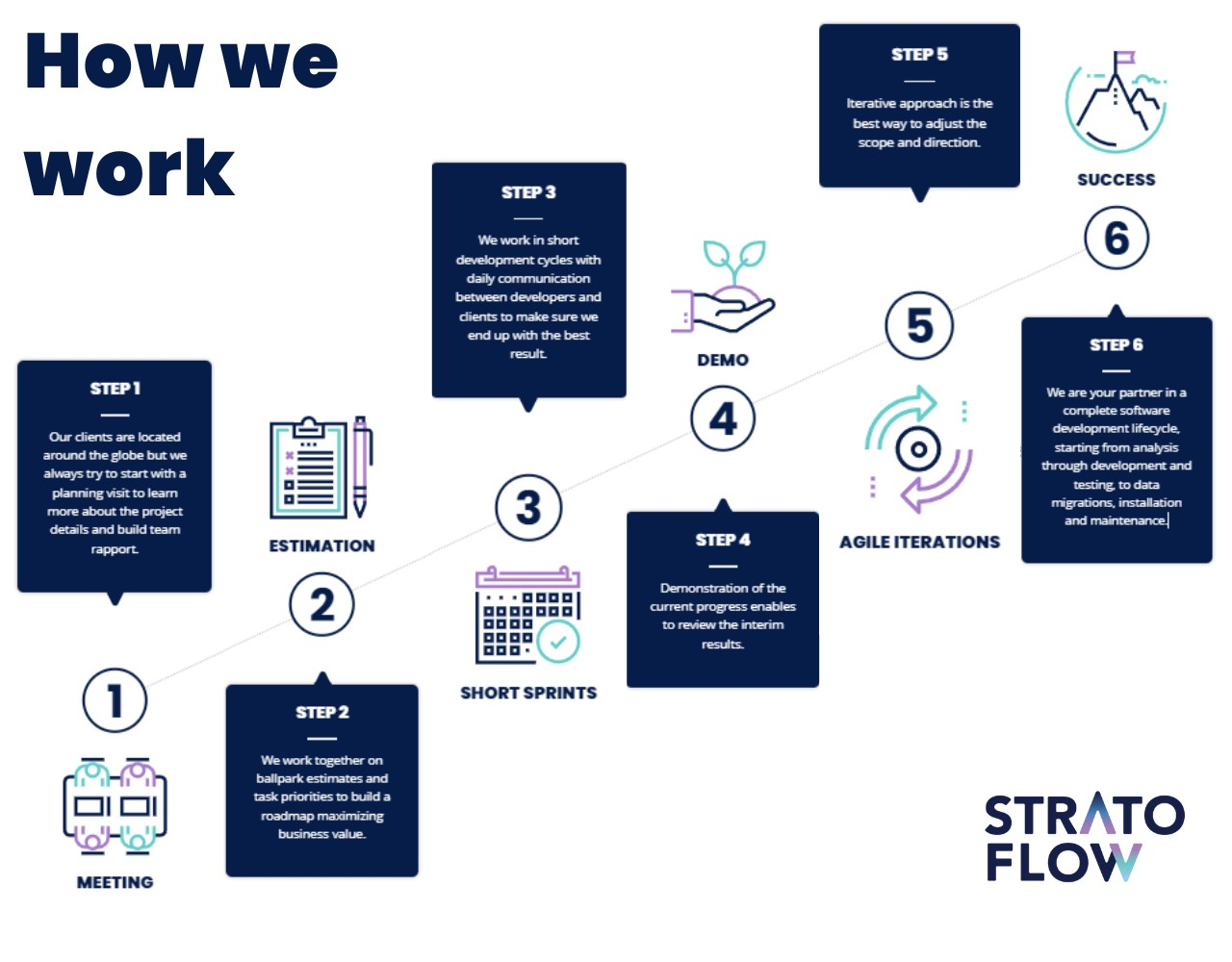

Deploying and managing enterprise software systems requires a high level of expertise.

Upgrading legacy systems and improving the way insurance companies handle data is a complex task. It requires not only technical know-how, but also a deep understanding of what insurance companies need and the rules they must follow.

This is why working with skilled custom software development companies on insurance data modernization is so important.

Companies like Stratoflow bring a knowledge and a proven track record in navigating the complex process of modernizing legacy systems, ensuring that the transition not only improves operational efficiency, but also aligns with strategic business goals.

Their experience in handling large-scale, sensitive data projects means they can adeptly manage the risks associated with data migration, implement robust security measures, and ensure compliance with industry standards and regulations.

But data modernization is not all that a custom insurance software development company like Stratoflow can do for your insurance business.

Insurtech companies like Stratoflow can become your own technology guide through the digital transformation of the insurance industry. Data modernization can only be the beginning of a deeper modernization process that encompasses the entire software architecture of an insurance company.

Stratoflow specializes in developing custom insurance systems such as:

- Insurance Agent Portal Software

- Agency Management Systems

- Software for Insurance Brokers

- Claims Management Software

- Policy Management Software

Stratoflow has also built Openkoda Insurance Policy Management Software – a ready-made tool that represent a solid core upon which you can build your own custom policy management cloud insurance software system faster – thanks to its low-code open-source core.

All of these systems play a crucial role in the day-to-day operations of insurance companies and if your organization doesn’t leverage them you’re missing out!

Don’t stop on data modernization!

Check out Stratoflow insurance software development services!

Strategy 2: Plan your data infrastructure for the future

Designing a data infrastructure that is future-ready involves more than just scalability and technology stack choices; it requires a thoughtful analysis of how users and data will interact with new tools.

An essential aspect of this planning is clarifying data ownership models and data acquisition strategies, which determine who can access, modify, and manage different types of data during the entire data lifecycle.

This foresight ensures that as your enterprise grows and evolves, your data infrastructure can support increasing volumes, variety, and the velocity of data while maintaining clear governance and compliance standards.

Sound data management is key.

When implemented successfully, this strategy ensures that your infrastructure can seamlessly handle growth and evolution, support increasing data volumes, and maintain strict governance standards.

Strategy 3: Make data AI ready

Preparing your data for the AI revolution involves more than just aggregating and organizing it; it involves structuring your data landscape in a way that aligns with advanced AI methodologies.

The use of ontologies and metamodels plays a critical role in this process, providing a structured framework that defines the relationships and categories within your data sets.

These models enable AI algorithms to better understand and interpret the context of data, resulting in more insightful analysis and predictions.

Making your data AI-ready with these tools ensures that your organization is not just collecting data, but is ready to derive meaningful, actionable insights from it.

Strategy 4: Invest in API -first approach

An API-first approach is a software development strategy that prioritizes the creation and design of application programming interfaces (APIs) at the beginning of the development process. This approach treats APIs as the foundational layer of your software, ensuring that they are fully planned and developed before implementing the core application or user interface.

Strategy 5: Embrace Continuous Delivery and DevOps Practices

To remain agile and responsive to market changes, organizations should adopt continuous delivery and DevOps practices.

This strategy involves automating the software development lifecycle to enable rapid, reliable, and repeatable application deployment.

By fostering a culture of collaboration between development, operations, and other stakeholders, DevOps practices help shorten development cycles, increase deployment frequency, and achieve faster time to market. Adopting these practices ensures that your systems can quickly adapt to business needs with minimal disruption and maximum efficiency.

[Read also: 10 Best Insurance Agency Growth Strategies You Must Know In 2024]

Data modernization in insurance – Conclusion

The data modernization journey is a big step for insurance agencies, but it’s worth it. Following these expert strategies can make this journey smoother and lead to better services for everyone involved.

Related Posts

Thank you for taking the time to read our blog post!