Ultimate Guide To Insurance Agent Portal Software In 2024

Looking for insurance agent portal software that fits your agency’s workflow and improves operational efficiency?

Understand the landscape of these platforms with our focused guide that reveals how to leverage their capabilities for better customer relationships and increased productivity.

Dive into the features that matter, from policy and document management to CRM integration, and learn how they can strengthen your business for the demands of the modern insurance marketplace.

Contents

- What Are Insurance Agent Portal Software Solutions?

- Key Features of Top Insurance Agent Portal Solutions

- Creating a Customized Insurance Agent Portal For Your Business

- Evaluating Insurance Agent Portal Software Providers

- Stratoflow – your custom insurance software experts

- Why It’s so Important: True Value of Insurance Agent Portal Software

Key Takeaways

- Insurance agent portal software is designed to improve the efficiency and productivity of agents by integrating policy and customer management, document handling, and reporting tools in a customizable, secure platform that can increase productivity by over 40% and speed policy processes.

- These portal solutions streamline operations, enhance customer service through self-service options, and reduce manual tasks. They offer key features such as customer and claims management, policy management, commission tracking, integrations with existing systems, and robust security measures.

- When customizing an insurance agent portal, consider leveraging low-code development for rapid customization, ensure flexible access for different user roles, provide multichannel support and branding options, and carefully evaluate software providers based on reputation, experience, scalability, flexibility, customer support, and training offerings.

What Are Insurance Agent Portal Software Solutions?

Insurance agent portal software solutions are specialized digital platforms designed to meet the unique needs of insurance agents and brokers.

These platforms combine functionalities such as:

- Policy management,

- Customer Relationship Management (CRM),

- Document management,

- Reporting tools

into a single, integrated system.

The result?

A powerful tool that significantly reduces manual paperwork and eases the administrative burden on agents.

Known as insurance portal solutions, these insurtech software solutions are designed not only to improve efficiency, but also to enhance the customer experience. Because they are customizable and flexible, these platforms can be tailored with modules and features to fit the different workflows and business needs of different insurance agencies.

They also include robust security measures to protect sensitive customer information and ensure compliance with industry regulations and standards. With the ability to increase agent productivity by over 40% and quadruple the speed of the policy cycle, it’s easy to see why many insurers are eager to implement these portal solutions.

The Importance of Tech Solutions in the Insurance Industry – Statistics

Software solutions have become a cornerstone in the transformation of the insurance industry, driving efficiency, innovation, and customer satisfaction.

These key statistics highlight the pivotal role these technologies play in enhancing operational performance and competitive advantage in a rapidly evolving market.

- Insurance Digital Transformation: The insurance industry increasingly relies on digital technology to develop products, assess claims, and provide customers with a satisfying experience.

- Cloud Adoption: Insurers are expected to significantly ramp up adoption and migrate a growing share of their compute environment to the public cloud within the next five years. This intention is reflected in the projected 32 percent annual growth in cloud services by 2025.

- Value Generation: The EBITDA run-rate impact of cloud on the insurance sector will be $70 billion to $110 billion by 2030 – in the top five of all sectors analyzed. When looking at EBITDA impact as a percentage of 2030 EBITDA, insurance is the top-ranked of all sectors, at 43–70 percent.

- Data Management: Data in the insurance industry is increasing exponentially, with a 90% increase in the last two years putting strong emphasis on data modernization efforts.

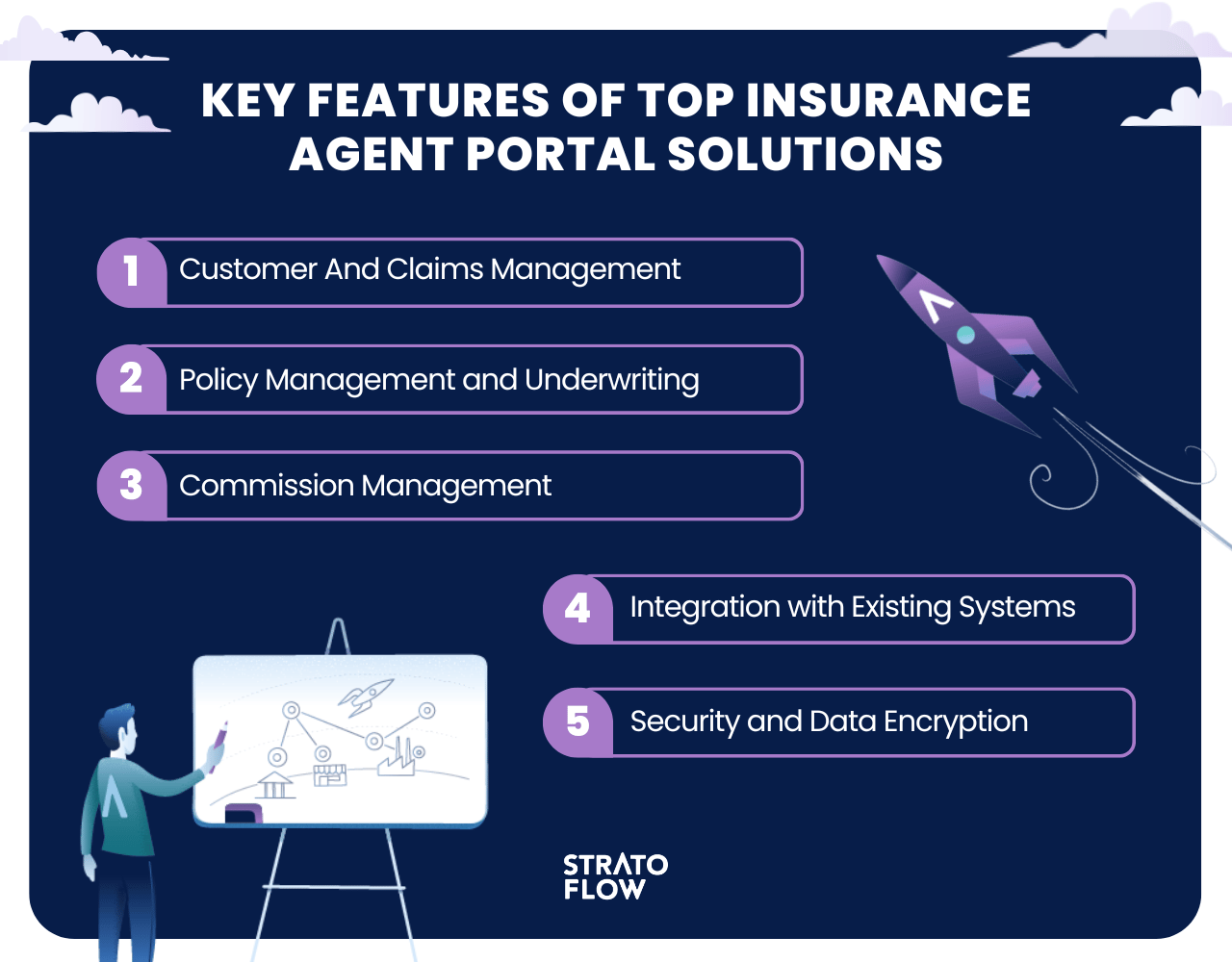

Key Features of Top Insurance Agent Portal Solutions

Understanding the key features of these platforms is as important as recognizing the benefits of insurance agent portal software.

Customer And Claims Management

In the area of customer and claims management, leading insurance portal software provides customers with 24/7 access to manage their policies through a customer portal, and facilitates convenient claims submission and payment.

Self-service portals play a critical role in this regard, allowing customers to log into their personalized accounts to view policy information and perform simple service tasks.

These self-service capabilities not only meet today’s customer expectations for online services, but also lead to higher customer retention by satisfying customers’ desire for independence in managing their policies. Self-service capabilities not only empower customers, but also free up service agents by allowing customers to perform routine tasks themselves.

Policy Management and Underwriting

Leading insurance portal software provides capabilities to streamline policy management and underwriting, which are integral components of insurance operations.

Insurance data can bring key features such as cloud-based accessibility, integration capabilities, self-service options, digital signatures, and comprehensive policy and claims management.

These features provide an all-in-one insurance management solution for multiple insurance policies.

They enable easy policy access and renewal, agent portal access, and streamlined claims processing tailored to the insurer’s business model and product offerings. As a result, insurance agents can focus on strategic tasks instead of getting bogged down in administrative tasks.

Commission Management

Since commissions are a significant part of insurance agents’ income, leading insurance portal software helps them effectively track and manage their earnings. With these features, agents can keep an eye on their performance and income, enabling them to set up advanced insurance growth strategies and plan their efforts for maximum returns.

These commission management features not only provide transparency, but also motivate agents to perform better. With a clear view of their earnings, agents can set clear goals and work towards achieving them. This not only increases their productivity, but also results in better customer service, as motivated agents are more likely to go the extra mile for their customers.

Integration with Existing Systems

Seamless integration with existing systems is a feature offered by leading insurance portal software solutions. This is crucial as it enables efficient data management, a critical aspect of an insurance agent’s role due to the handling of extensive paperwork and client information. The integration of CRM and billing platforms facilitates more efficient policy processing, renewals, and client follow-ups, streamlining the overall workflow for insurance agents.

Utilizing cloud infrastructure in insurance agent portal software offers several benefits, including:

- On-demand resources

- Scalable growth

- Support for expansion without limitations

- Enhanced overall efficiency and integration between systems

Aligning the requirements of the insurance portal with those of the existing core systems is crucial for achieving these benefits.

Security and Data Encryption

Given the industry norm of handling sensitive customer information, the need for robust security measures cannot be compromised. As AI in insurance industry is gaining more and more traction top insurance portal software implements security features such as AI-powered fraud detection and encryption to protect against data breaches and ensure regulatory compliance.

Encryption protects data at rest on devices and in transit with tools such as HTTPS and full-disk encryption, making it difficult for unauthorized parties to interpret stolen information. Features such as multi-factor authentication (MFA) increase security by requiring additional verification beyond passwords through codes sent via text, email, or an authentication application.

Secure messaging systems and email encryption, along with defined security roles, ensure secure and controlled communications and data handling between agents and customers.

[Read also: The Best Insurance Agency Management Systems You Must Know 2024]

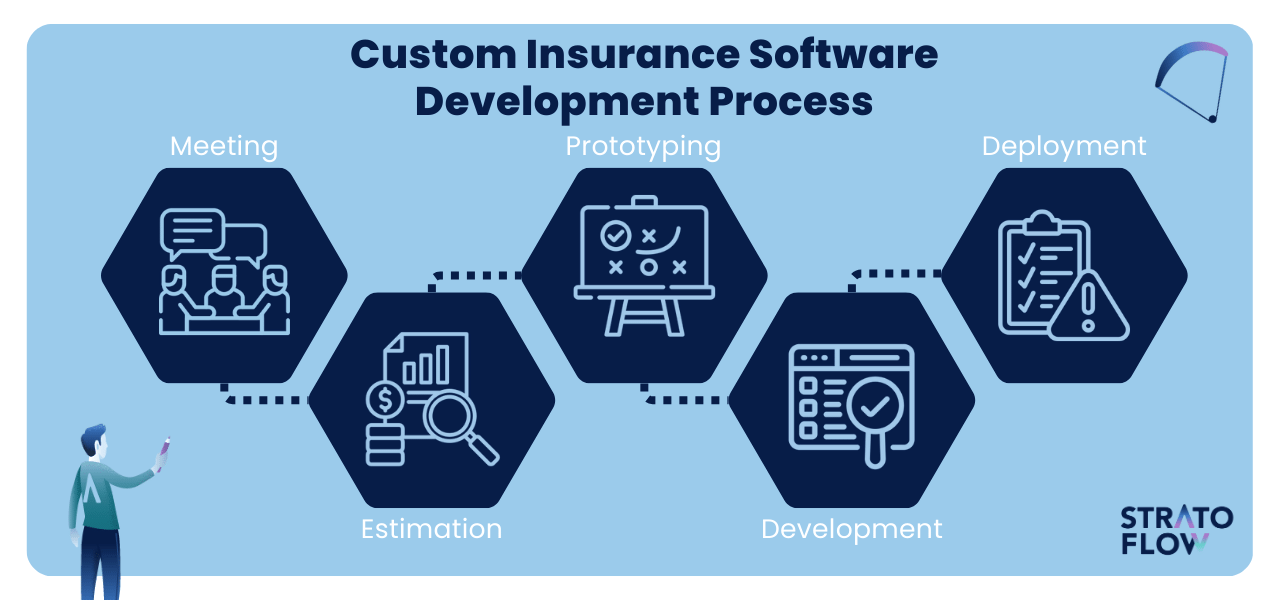

Creating a Customized Insurance Agent Portal For Your Business

Considering the wide range of features and benefits that insurance agent portal software offers, you may be thinking about implementing it for your company. But there’s a really high chance that none of the out-of-the-box systems currently on the market meet your requirements straight away. In such a case the only path forward is customization.

So, how do you customize a portal to meet your specific needs? Let’s explore the strategies and approaches that are critical to delivering quality insurance software products.

Leveraging low-code for rapid software development

One of the major trends in the software development landscape is low-code development platforms.

They enable rapid software creation and customization by reducing the need for extensive coding. This not only speeds up the development process, but also lowers the technical barrier, allowing non-technical members of your team to contribute to the software development process.

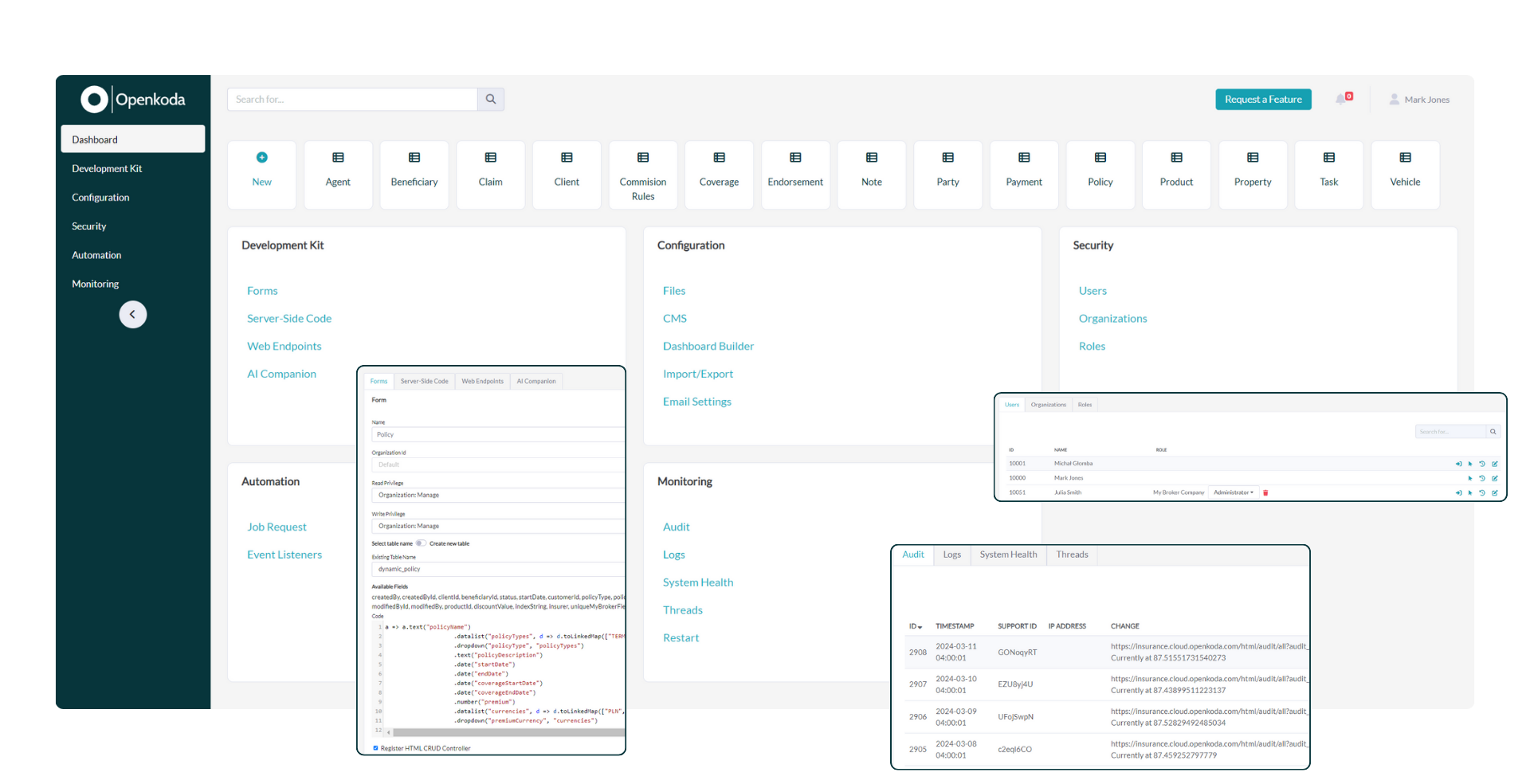

With rapid software development platforms like Openkoda, you can customize your insurance agent portal to meet your unique business needs.

Whether it’s changing the user interface, adding specific features, or integrating with other software, low-code platforms offer flexibility and control. This means you can have an insurance agent portal that goes beyond the standard features to meet your specific business needs.

Do you think that leveraging low code only enables you to build rather simple and limited software apps?

The reality is rather different.

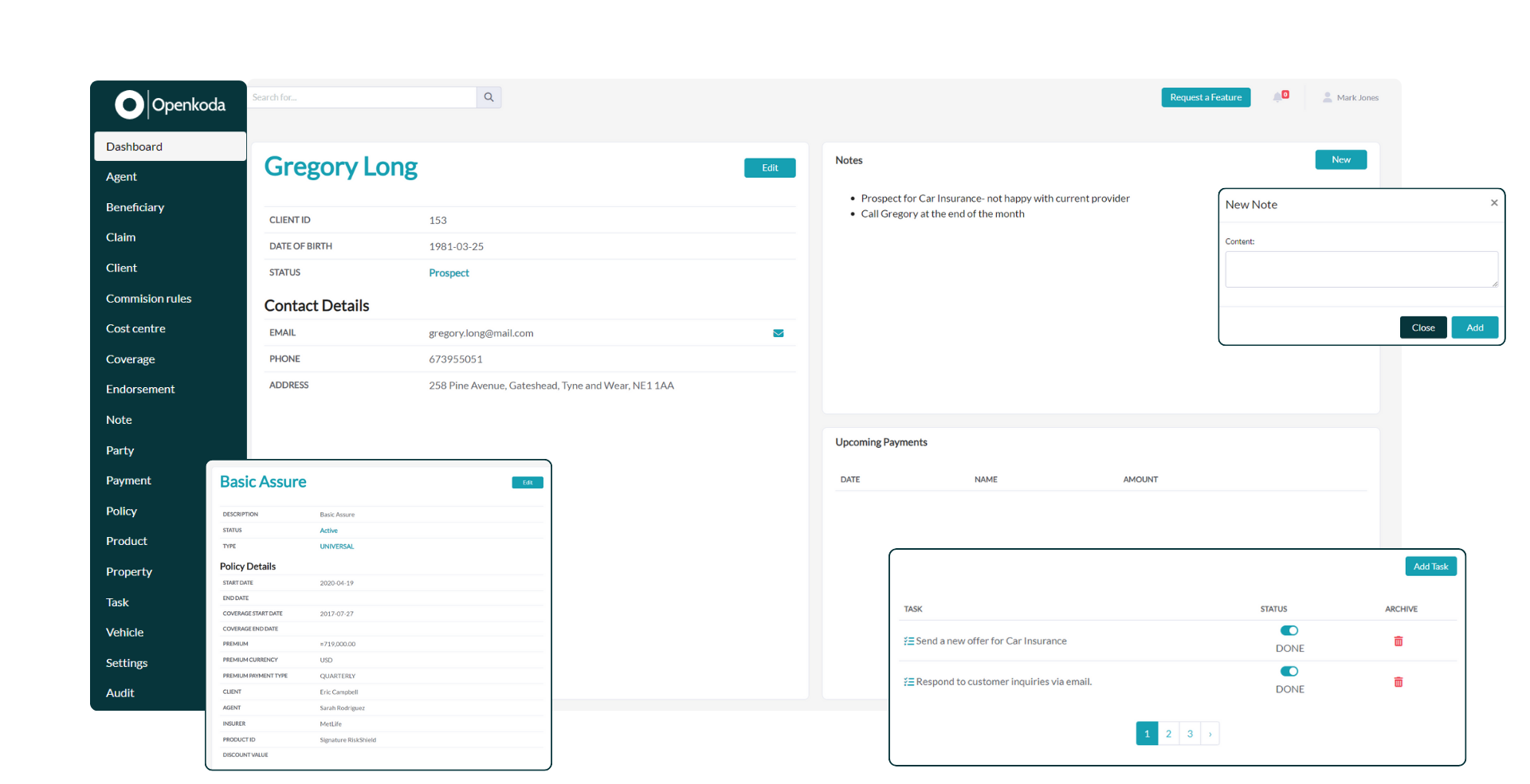

Openkoda Policy Management System built upon a solid open-source low-code core is an advanced AI-powered tool that is revolutionizing the way insurance business is managed.

Some of the key components of this tool include

- A bespoke platform designed to meet the evolving needs of the insurance industry

- The capability to refine and enhance operational workflows

- Options to add custom functionality based on unique business requirements

- Complete control over policy management

Openkoda gives insurance brokers complete control over policy management, allowing agents to streamline their workflow more efficiently.

With a customizable interface, Openkoda’s dashboard provides instant access to key metrics for detailed analysis – something that’s key in today’s data-driven economy.

In addition, Openkoda introduces an efficient document management system that organizes all key documents. This feature enhances regulatory adherence, reduces the likelihood of human error, and elevates the standard of customer care by optimizing the management of documentation.

Do you think that Openkoda fits your insurance business needs?

Flexible Access for Different User Types

Each user in an insurance agency has distinct needs and roles.

A good insurance agent portal should accommodate these varied requirements by offering flexible access for different user types. This could mean creating multiple user profiles, each with varied access levels and permissions based on the user’s role within the company.

Such flexibility allows for a more personalized user experience.

For instance, independent agents might require different features and access levels compared to underwriters. By creating specific portal profiles for each user type, you ensure that every user has access to the tools and information they need, enhancing efficiency and productivity.

Multichannel Support

In today’s digital age, users access software solutions on various devices and platforms.

As such, your insurance agent portal should offer multichannel support, ensuring a consistent user experience across different devices and platforms. From desktops to mobile devices, your portal should be fully responsive, meeting modern customer expectations.

But multichannel support goes beyond device compatibility. It also includes integrating digital interaction tools such as social media connections, chatbots, and video chat. These tools provide a unified interface for managing client communications across multiple channels, ensuring seamless customer interactions regardless of the channel they choose to use.

[Read also: The Role of Digitization in Insurance Industry And Its Future]

Branding and Personalization

An insurance agent portal serves as an extension of your brand.

As such, it should reflect your brand identity. Top insurance portal software allows for branding and personalization options, enabling you to maintain brand continuity. Whether it’s using your company’s own domain name or customizing the look and feel of the portal, these options allow you to create a portal that aligns with your brand image.

Branding goes beyond aesthetics.

It’s about creating a consistent and familiar experience for your users. By personalizing your insurance agent portal to match your brand identity, you build trust and loyalty with your users, enhancing customer satisfaction and retention.

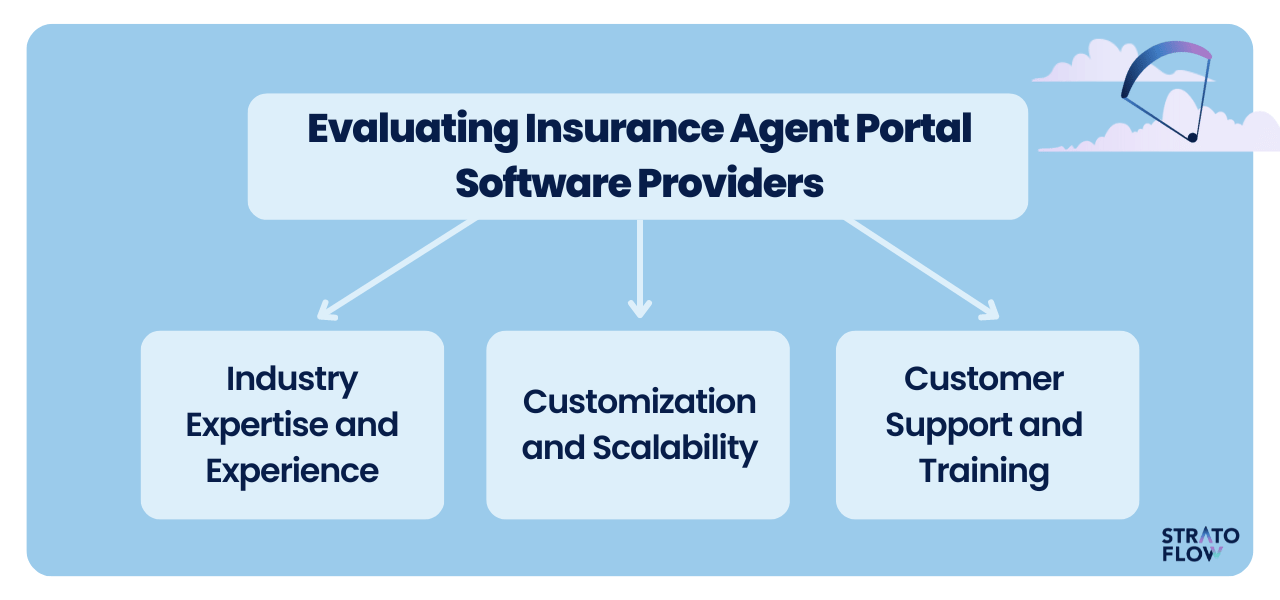

Evaluating Insurance Agent Portal Software Providers

The success of your portal implementation hinges on choosing the right custom software development company to tailor the software exactly to your business’ needs.

But amid numerous providers in the market, how do you select the right one?

Here are some factors to consider.

Industry Expertise and Experience

A provider’s reputation and experience serve as key indicators of their reliability and expertise.

Providers with a long-standing reputation and substantial experience in developing software solutions for companies in the insurance industry, such as insurance carriers, are often more reliable and knowledgeable about industry-specific needs, including insurance premiums.

Evaluating a vendor’s reputation and experience can be thoroughly conducted through methods such as:

- Clutch profile

- Proposal reviews

- Site visits

- Checking references

The involvement of stakeholders such as legal, compliance, and IT teams in the evaluation process can provide shared risk management and enhanced communication and coordination.

Customization and Scalability

In the rapidly changing business environment of today, scalability and flexibility are vital.

The best insurance agent portals offer customizability and scalability, enabling businesses to start with a basic setup and expand features as they grow. When discussing the technicalities of the project make sure that your software will be able to accommodate changing business models, such as transitioning from a traditional agency setup to a digital brokerage.

Investing in scalable solutions can result in enhanced performance and cost efficiency by reducing the need for ongoing hardware upgrades.

Continuous monitoring and optimization are vital for sustainable scalability, enabling the identification of bottlenecks and areas for improvement to adapt to changing workloads.

Customer Support and Training

Post-deployment support and maintenance are crucial for the smooth operation of custom software for the insurance companies.

Look for software vendors that provide comprehensive support and maintenance services. This includes timely updates, bug fixes, and the availability of customer support to address any issues. A commitment to ongoing support indicates that the developer is invested in the long-term success of the project.

[Read also: Insurance Outlook 2024: Top Insurance Industry Trends to Watch]

Stratoflow – your custom insurance software experts

Selecting a custom insurance software developer is more than a one-time transaction; it’s the beginning of a long-term partnership. That’s why you want only the best in the business.

At Stratoflow, we pride ourselves on our extensive experience in developing custom insurance software solutions.

Our expertise is underpinned by in-depth technical knowledge and an agile development methodology, ensuring that our solutions are both innovative and efficient. We specialize in tailoring software that streamlines operations, enhances customer engagement, and drives growth, starting with a robust core and expanding to include custom functionality.

We specialize in building:

- Agency Management Systems

- Software for Insurance Brokers

- Claims Management Software

- Policy Management Software

- CRM for Insurance Agents

Want to build your own insurance agent portal software? We would love to discuss how we can make your vision a reality!

Contact us to schedule a quick introductory meeting!

Why It’s so Important: True Value of Insurance Agent Portal Software

The importance of insurance agent portal software in today’s landscape is undeniable, given its impressive capabilities. These platforms not only streamline operations, but also play a critical role in improving customer service and increasing agent productivity.

At last, it’s time to take a closer look at each of these aspects to drive the importance of making a well thought-out choice in this matter.

Enhanced Customer Service

In an age where instant access and self-service have become the norm, insurance portal implementation plays a critical role in enhancing broker portal software.

These insurance portals improve customer service by providing quick access to policy details, simplifying the renewal process, and efficiently handling customer inquiries. Self-service portals, a key component of these platforms, provide customers with easy access to policy information and account management through the self-service portal.

These self-service capabilities not only meet customer expectations for online service, but also increase customer retention by empowering customers to manage their own policies. Meanwhile, real-time notifications from the portal keep customers informed of policy changes, account updates, and renewals, resulting in increased customer satisfaction.

Streamlined Processes

Beyond enhancing customer service, insurance agent portal software offers the following benefits:

- Streamlines processes by automating manual tasks and reducing paperwork

- Helps in lowering costs

- Improves the overall workflow of insurance agents

- Allows for online access to insurance certificates

For instance, platforms like Openkoda Policy Management Tool, a cloud-based solution, assist brokers and agents in managing policy info more efficiently.

The streamlining doesn’t stop there.

Operational efficiency is further enhanced by portal software that aims to reduce the time internal teams spend on low-value tasks. With these platforms, routine tasks and routine service tasks are automated, and paperwork is reduced, freeing up agents to focus on more critical tasks.

Increased Agent Productivity

Insurance agent portal software offers several benefits when it comes to the productivity of the agents themeselves, including:

- Easy access to customer data and insurance services,

- Making agents’ work more efficient and effective,

- Real-time visibility and streamlining of communication through insurance agency management systems,

- Boosting agent productivity and performance.

Automation capabilities within these software solutions minimize errors and expedite processes like risk assessment, claims management, policy administration, and underwriting.

Self-service portals alleviate the burden of routine tasks from agency staff, empowering them to concentrate on client engagement and relationship enhancement. Furthermore, seamless integration with CRM systems enables automation of tasks, lead tracking, and more efficient management of customer relationships and agency operations.

[Read also: Top Software for Insurance Brokers in 2024]

Summary

In conclusion, insurance agent portal software solutions are more than just a digital tool for insurance agents and brokers.

They are a game-changer in the insurance industry, bringing about streamlined processes, enhanced customer service, and increased agent productivity. With the right provider and proper implementation, these software solutions can revolutionize your insurance business.

Frequently Asked Questions

What is insurance agent portal?

An insurance agent portal is a digital platform that connects insurance agents, clients, and brokers to manage relationships and offer various types of insurance policies.

What is portals for insurance?

Insurance portals are designed to offer seamless digital experiences for insurers and their clients, providing self-service options, process automation, and secure access to data and documents. This allows for efficient interaction between clients, employees, agents, and suppliers.

How much is insurance agent software?

The pricing for insurance agent software can vary depending on the provider and the specific features included. It’s important to request quotes from different vendors to compare options.

How does insurance agent portal software enhance customer service?

Insurance agent portal software enhances customer service by offering quick access to policy details, self-service options, and real-time notifications. This leads to improved customer satisfaction and streamlined communication.

What are some key features of top insurance agent portal solutions?

Top insurance agent portal solutions offer key features such as customer and claims management, policy management, commission management, integration with existing systems, and robust security measures. These features ensure streamlined operations and data protection for insurance agents.

Related Posts

We are Stratoflow, a custom software development company. We firmly believe that software craftsmanship, collaboration and effective communication is key in delivering complex software projects. This allows us to build advanced high-performance Java applications capable of processing vast amounts of data in a short time. We also provide our clients with an option to outsource and hire Java developers to extend their teams with experienced professionals. As a result, our Java software development services contribute to our clients’ business growth. We specialize in travel software, ecommerce software, and fintech software development. In addition, we are taking low-code to a new level with our Open-Source Low-Code Platform.