The Role of Digitization in Insurance Industry And Its Future

What does digitization mean for the future of the insurance industry?

Digitization in the insurance industry has accelerated service delivery, improved the accuracy of risk assessment, and revolutionized customer interaction.

This article explores the integral role of digital tools and data analytics in transforming the industry. We’ll look at cases where digitization is leading to innovation in products, services, and operational strategies, and reflect on both the opportunities and hurdles that accompany this digital journey.

Join us for an insightful look at the ongoing digital evolution of insurance.

Key Takeaways

- Digital transformation in the insurance sector has led to enhanced customer service, streamlined operations, and improved processing of vast datasets, with innovations such as AI, data analytics, and digital self-service tools revolutionizing the industry.

- Digital transformation strategies in insurance rely on aligning IT with business goals, building a digital culture within organizations, and investing in modern technologies to adapt to changing market demands and increase operational efficiency.

- The move towards personalized insurance products and services is evident, with real-time data, telematics, IoT devices, and wearable technology enabling insurers to offer customized plans and fostering adaptability to consumer-specific needs.

Decoding Digitization in the Insurance Sector

In today’s fast-paced world, where digital technology touches every corner of our lives, the insurance industry is not lagging behind.

Imagine a world where buying insurance, managing policies and filing claims can all be done with just a few clicks on your smartphone. It’s not a distant future; it’s happening right now, thanks to digitalization.

This digital revolution in the insurance industry is transforming the way insurers do business, making it faster, more efficient, and more customer-friendly.

From using artificial intelligence to assess risk and set premiums to deploying chatbots for instant customer service, the insurance industry is harnessing the power of digital technologies to meet the changing needs and expectations of modern consumers.

This wave of digitization isn’t just about adopting new technologies; it’s a complete overhaul of the traditional insurance model, providing a seamless and personalized experience for customers while streamlining operations and reducing costs for providers.

As we dive deeper into this topic, we’ll explore how digital is reshaping the insurance landscape, creating opportunities and challenges, and setting a new standard for the industry.

Digitalization in insurance – key statistics

In the wake of the pandemic, the insurance industry has rapidly embraced digitalization to meet evolving customer needs and operational efficiencies. Let’s look at some statistics that underscore the true magnitude of this trend:

- The digitalization of the insurance industry has been significantly accelerated by the pandemic, with 96% of insurance CEOs confirming this trend

- 59% of European insurance companies were already implementing their digital transformation plans

- By 2024, the InsurTech market is expected to reach $10.14 billion.

- About 83% of insurers agreed that technology is redefining the insurance industry and customer expectations

- Approximately 55% of insurance carriers will invest in new technologies to better handle claims

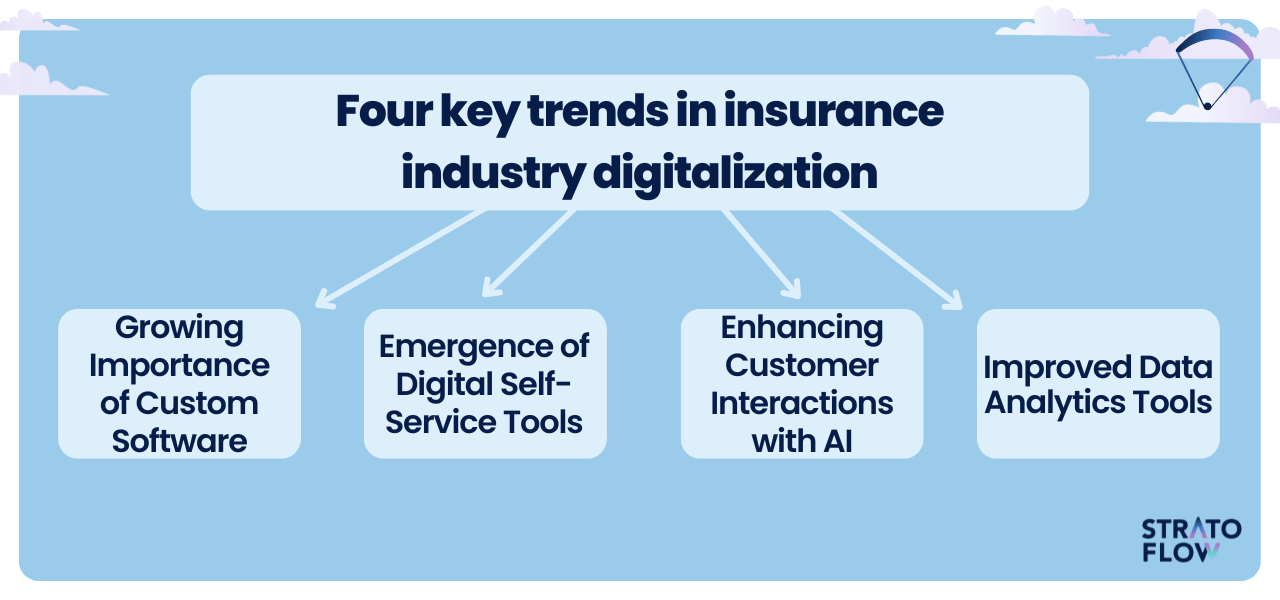

Four key trends in insurance industry digitalization

Exploring the digital transformation within the insurance industry reveals a landscape marked key insurance trends shaped by innovation and adaptability.

This section sheds light on how these advancements are redefining customer experiences, operational efficiency, and risk management strategies, offering a glimpse into the future of insurance in a digital age.

Growing Importance of Custom Software

The growing importance of custom software in the insurance industry is a reflection of the sector’s need for digital transformation and personalized customer experiences.

Custom software enables insurance companies to streamline their operations, from underwriting and claims processing to customer service and fraud detection, making these processes more efficient and cost-effective.

It also allows for the integration of advanced technologies such as artificial intelligence, and machine learning which can provide deeper insights into risk management, enhance predictive analytics, and improve data security.

Furthermore, custom software solutions cater to the specific needs of insurers, helping them to offer personalized products and services, thus enhancing customer satisfaction and loyalty.

This tailored approach not only improves operational efficiency but also positions insurance companies to better compete in a rapidly evolving digital marketplace, where customization and innovation are key to meeting the changing expectations of both individual and corporate clients.

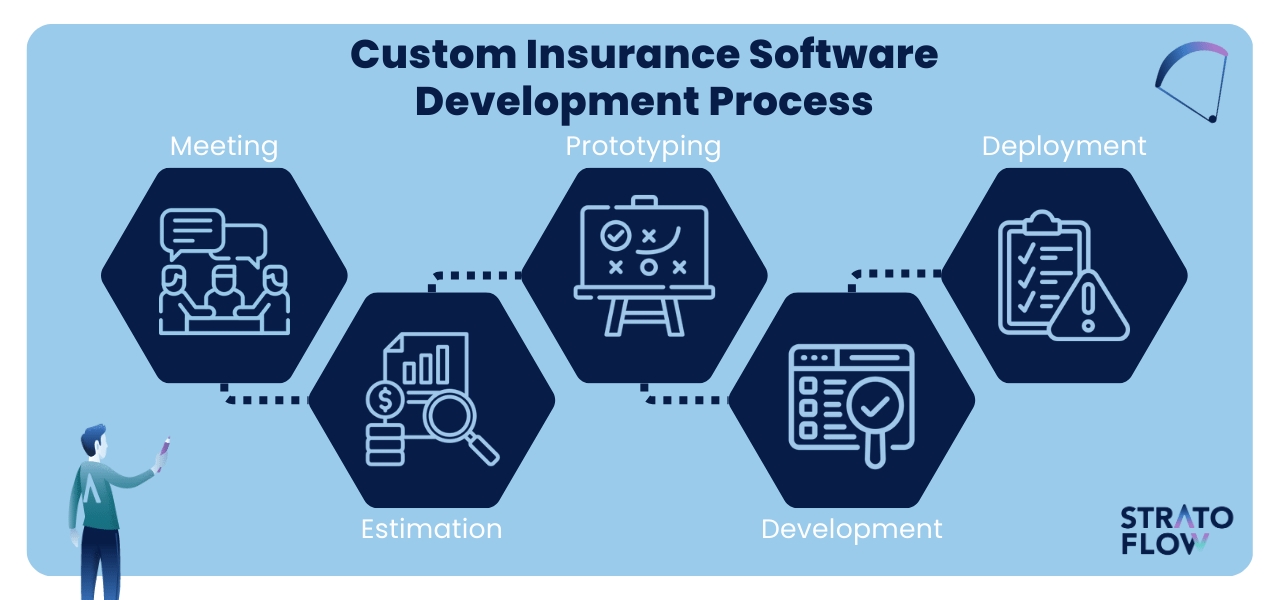

Stratoflow – Your Experts In Digital Technologies In The Insurance Industry

At Stratoflow, we pride ourselves on being the go-to experts for creating custom insurance software solutions tailored to the unique needs of the insurance industry.

Our approach emphasizes close collaboration and agile methodologies to ensure that the software we develop not only meets, but exceeds our clients’ expectations in digitizing their processes. We specialize in developing systems that are not only innovative, but also capable of handling significant loads without compromising performance.

If you’re looking to transform your insurance business with software that’s built to perform, we invite you to contact us. Let us see how we can make your vision a reality!

Emergence of Digital Self-Service Tools

Investment in digital customer service platforms and mobile applications is soaring as insurers strive to meet the growing demand for online services.

These digital self-service tools have revolutionized the way customers interact with their insurance providers, offering the convenience of 24/7 access from anywhere. The expansion of communication methods, including

- SMS

- digital platforms

- mobile applications

- Push notifications

These tools have enriched customer engagement by enabling diverse and personalized interactions. Virtual assistants and innovative development tools are rapidly improving customer service capabilities and simplifying insurance processes such as onboarding and claim submission.

Integrating digital experiences across customer journey touchpoints eliminates the need for customers to repeatedly submit the same information, personalizing their experience and reducing frustration.

The design of these tools is increasingly mobile-friendly, with features such as stop-and-continue functionality that maintains data continuity across sessions. Automation within customer self-service platforms enables real-time interactions and quick responses to inquiries, increasing both customer satisfaction and operational efficiency. By implementing these strategies, companies can improve customer satisfaction.

By continuously analyzing customer data and feedback, insurers can refine their digital platforms and ensure that the digital experience keeps pace with evolving customer behaviors and expectations.

Enhancing Customer Interactions with AI

AI-driven personalization has become a cornerstone of improving customer interactions in the insurance industry.

The use of AI in insurance and virtual assistants has revolutionized support systems, providing policyholders with instant, personalized assistance. These technologies not only respond to customer inquiries, but also proactively guide them through processes such as filing a claim, adding a level of efficiency that was previously unattainable. By processing natural language, AI extends the reach and inclusivity of insurers, offering support in multiple languages and adapting to diverse customer bases.

In addition, conversational AI tools serve a dual purpose – resolving customer inquiries while gathering valuable insights that can inform business strategies. Sentiment detection technology embedded in AI tools goes a step further by examining customer feedback during interactions. This enables organizations to proactively improve service quality, resulting in increased customer satisfaction and retention.

[Read also: Ultimate Guide To Insurance Agent Portal Software In 2024]

Data Analytics: A Game Changer for Risk Assessment

By leveraging machine learning algorithms, insurers are now able to:

- Optimize claims management

- Deploy sophisticated fraud detection methods that can identify irregular patterns and anomalies with precision

- Analyze market data, customer behavior, and competitor strategies

- Create dynamic pricing models and competitive product offerings that are both fair and tailored to customer needs

Data analytics has truly transformed the insurance industry.

Moreover, data analytics plays a critical role in the insurance sector in the following ways:

- Assessing and managing risks associated with climate change, sustainability, and geographic location

- Contributing to greater transparency and informed decision-making

- Enabling more granular and accurate risk assessments

- Fostering a culture of innovation that is attuned to the evolving landscape of risks and opportunities

The transformative power of data analytics in the insurance sector is evident, as it helps insurers adapt to the changing environment and make more informed decisions.

[Read also: The Best Insurance Agency Management Systems You Must Know 2024]

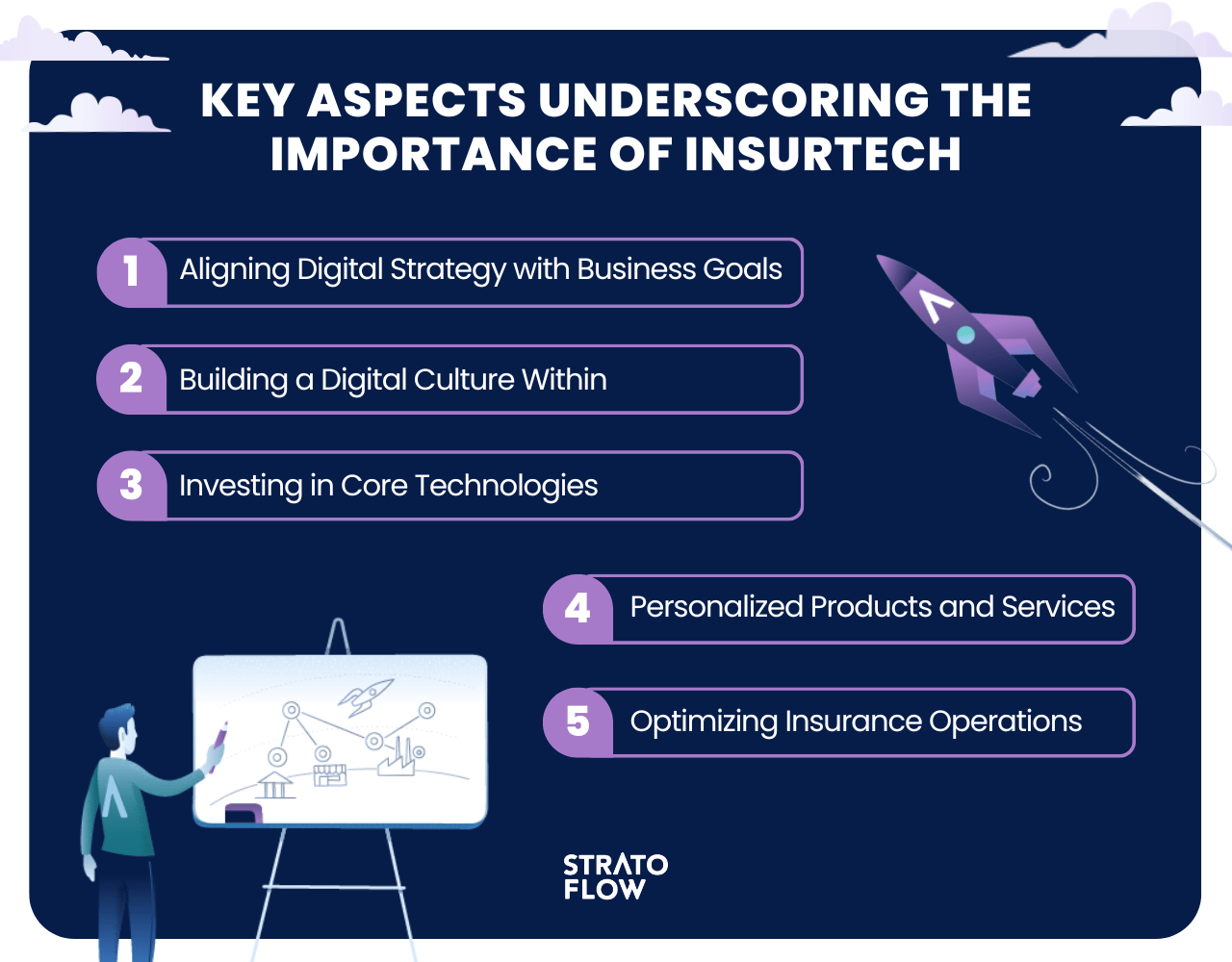

Your Strategy For Embracing Digital Transformation In The Insurance Industry

In an industry where staying competitive is paramount, insurance companies are under constant pressure to digitize their offerings and processes.

Rapid adaptation to digital transformation, as seen during the COVID-19 pandemic with the rapid adoption of digital health options, demonstrates the industry’s agility and responsiveness to change. However, the journey to digital excellence is not without its challenges. Historically low rates, a spike in claims, and the pandemic have forced the insurance industry to accelerate its digital transformation efforts.

The blueprint for digital transformation in insurance is a complex mosaic of strategies and cultural shifts. Aligning digital strategy with business goals, fostering a digital culture, and making strategic investments in core technologies are the pillars that support this transformative process. We explore these components further to understand their interrelationship and how they facilitate a successful transition into the digital era.

Strategy 1: Aligning Digital Strategy with Business Goals

The foundation of successful digital transformation is aligning IT strategy with overarching business goals.

This ensures that every technology investment not only contributes to business value, but also drives the organization toward its long-term goals. Achieving this alignment requires a deep understanding of the role of technology within the business model-a responsibility that falls on both IT departments and business leaders.

Misalignment, often the result of poor communication, internal rivalry, or a lack of technical understanding among business leaders, can derail digital strategies. To avoid such pitfalls, cross-functional collaboration characterized by mutual accountability between business and IT leaders is critical.

As insurance companies navigate the waters of digital transformation, they must be vigilant in ensuring that their digital strategies are not only innovative, but also integrally linked to their business goals.

This requires a concerted effort from all levels of the organization, fostering an environment where technology investments are made with a clear vision of their impact on business outcomes.

Strategy 2: Building a Digital Culture Within

The success of digital transformation is inextricably linked to the cultivation of a digital culture within the insurance company.

This culture embraces innovation, encourages experimental learning, and promotes open communication about digital change. To help employees navigate the shift to digital platforms with confidence, insurance companies must provide comprehensive training and standardize environments equipped to handle complex digital tools. Effective communication is key to easing the transition, mitigating resistance, and aligning the workforce with new technological changes.

In addition, strengthening a digital culture may require attracting new talent with digital expertise or upskilling current employees to ensure that the organization’s human capital is aligned with its digital transformation strategies. To embrace digital transformation, adopting a digital culture is not a one-time event, but an ongoing process that evolves as technology advances. It requires a mindset that is both dynamic and open to change, laying the foundation for a successful and sustainable digital transformation journey.

Strategy 3: Investing in Core Systems and Technologies

Aging legacy systems can be a significant barrier to digital progress.

To combat this, insurers are moving to modern, cloud-native systems that provide the agility and scalability required in today’s fast-paced environment. Protecting sensitive data is paramount, requiring strong security measures such as multi-factor authentication and data encryption to ensure the integrity and confidentiality of customer information.

Addressing the talent shortage is also critical, as insurers must either cultivate a virtual workforce that is proficient in digital technologies or invest in the digital education of their existing teams. By implementing efficient data management solutions and a comprehensive strategy, insurers can standardize their data and consistently drive business results.

In addition, the adoption of cutting-edge technologies such as blockchain and artificial intelligence is transforming insurance transactions, making them more secure and efficient. Investing in core systems and technologies is not just about acquiring new tools, but strategically embedding them into the fabric of the business.

This ensures that such investments are not only cost-effective, but also make a meaningful contribution to the insurer’s ability to remain competitive and responsive to market demands.

Strategy 4: Personalized Products and Services: Meeting Customer Needs

Today’s insurance landscape is characterized by a shift from one-size-fits-all policies to personalized products and services that meet individual customer needs.

By analyzing customer data and preferences, insurers are creating tailored offerings that resonate with their customers. Let’s take a closer look at two examples of how personalization is reshaping the way insurance products are priced and offered to customers.

Leveraging Real-Time Data for Custom Offerings

Telematics and IoT devices are at the forefront of the insurance industry’s digital transformation, enabling the development of personalized dynamic insurance pricing that reflects actual customer behavior and usage.

The convergence of telematics and AI in insurance enables the creation of usage-based insurance premiums that take into account real-time vehicle usage and driving behavior. These advances have revolutionized sectors such as auto and home insurance, where usage-based insurance models are increasingly being adopted.

Through the strategic use of real-time data, insurers are able to provide customized offerings that are closely aligned with the individual needs and behaviors of their customers. This level of personalization not only provides customers with fairer and more relevant insurance options, but also fosters a sense of trust and loyalty toward their insurance providers.

The Impact of Wearable Devices on Health Insurance

Another interesting trend in the personalization of insurance is the use of wearable technology.

The integration of wearable devices into health insurance is changing the way policies are tailored and incentives are structured. Programs such as John Hancock Vitality and UnitedHealthcare Motion use data from wearable devices to offer discounts and rewards to encourage healthy behaviors and promote ongoing engagement in personal health management.

Despite the many benefits, the adoption of wearables in health insurance also presents challenges, such as ensuring privacy, accuracy, and effective integration of data from multiple device brands.

Nevertheless, the continuous stream of health data enriches the risk assessment process, provides insurers with updated insights into individuals’ health and activity levels, and enables more accurate and customized premium pricing.

Strategy 5: Optimizing Insurance Operations Through Automation

Intelligent Automation (IA) is a key driver in the quest for optimized insurance operations, integrating artificial intelligence, process automation, and business process management.

This synergy of technologies reduces operational risks and maximizes returns, leading to improvements in investment data timeliness and audit process efficiency.

Streamlining Claims Processing with Digital Tools

Digital tools are revolutionizing the claims process by significantly reducing paperwork and increasing processing speed through the use of e-signatures and digital documentation.

Custom web applications allow policyholders to submit claims, monitor their status, and interact directly with insurers, streamlining the entire claims process.

Predictive analytics powered by AI play a critical role in predicting claims and identifying potential fraud, which in turn accelerates claims management and processing. What’s more, new technologies such as AI and IoT are automating manual processes, not only providing valuable insights, but also achieving previously unattainable efficiencies in claims processing.

The possibilities are endless. The problem is tailoring these digital tools to insurance companies that operate in specific niches.

Often, without a tailored approach, these software solutions simply won’t be able to provide your company with a sufficient technological edge over your competitors, or simply won’t be efficient and cost-effective.

Do you operate in a specific niche? Does your business need a custom software solution to reach new heights? Contact us and our software development experts will see how we can improve your insurance business with modern digital tools.

Machine Learning in Fraud Detection

Machine learning is becoming an indispensable tool in the fight against fraud in the insurance industry.

By analyzing patterns in claims data, AI algorithms are able to uncover anomalies that may indicate fraudulent claims, allowing for prompt and effective action. Applying predictive modeling to insurance data helps identify high-risk claims and flag them for closer investigation, improving the overall claims management process.

In addition, incorporating technologies such as data analytics, biometrics, and identity verification greatly enhances insurers’ ability to detect and prevent fraud. Real-time monitoring of health data through wearable devices also helps reduce fraudulent claims while ensuring the accuracy and reliability of the data provided.

[Read also: Complete Guide to CRM for Insurance Agents [+ 6 Best CRMs]]

New Business Models and Revenue Streams in Digital Insurance

As digital transformation reshapes the insurance industry, new business models and revenue streams are emerging, challenging the status quo and ushering in a new era of innovation. Companies like Tesla and Discovery are creating insurance ecosystems that bundle insurance with other products or services, leveraging partnerships to capture a significant market share.

Recognizing the value of partnerships with InsurTech startups, traditional insurance companies are joining forces to innovate and enhance their offerings.

InsurTech startups are using new technologies to create hyper-personalized products and streamline the claims process, posing a formidable challenge to traditional business models. The rise of InsurTech has compelled traditional insurers to rethink their strategies, adopt digital transformations, and thereby reach a broader audience.

These new business models represent a paradigm shift in the insurance industry, moving away from the conventional approach and embracing a more dynamic, customer-centric, and technology-driven future. As traditional companies and InsurTech startups continue to forge partnerships and innovate, we can expect to see an even greater diversification of products and services that cater to the evolving needs of consumers.

[Read also: How to Streamline Your Insurance Business with Policy Administration System]

The Rise of Insurtech Startups and Their Influence

Insurtech startups are making waves in the insurance industry, driving innovation and challenging established practices with their digital solutions.

These startups are partnering with traditional companies to accelerate the digital transformation process, improving customer experience and operational efficiency. The direct digital channels offered by InsurTech companies allow customers to purchase policies without intermediaries, potentially reducing costs. They also make insurance more customer-centric by offering secure, convenient, and instantly available services.

By focusing on customer engagement, InsurTech startups are increasing satisfaction and loyalty through digital tools for policy management and claims processing. Their ability to create hyper-personalized products and simplify the claims process is transforming the customer experience in the insurance industry.

With an annual growth rate of more than 34%, InsurTech startups are leading the insurance digital transformation.

They are introducing innovative products tailored to niche markets or emerging risks, enabling insurers to effectively adapt to changing customer needs. With their innovative solutions and customer-centric platforms, these startups are expected to play a key role in shaping the future of digital insurance channels.

The impact of InsurTech startups on the insurance industry is undeniable, forcing traditional insurers to rapidly adapt and innovate. As these startups continue to develop disruptive technologies and business models, they are not only challenging incumbents, but also redefining what insurance can offer the modern consumer.

Subscription-Based Insurance and the Sharing Economy

The rise of the subscription economy has influenced customer expectations, leading to a demand for on-demand access, flexibility, and personalized services. Insurance companies are responding by adopting subscription-based models, allowing for real-time adjustments to coverages and aligning with the desires of modern consumers.

Technology advancements enable insurers like Innmeldt to transition to SaaS applications, utilizing APIs for underwriting and fraud protection services. Subscription models often come with additional services and high-value content, adding customer value and reflecting the bundled approach seen in companies like Discovery.

The insurance industry’s convergence with other sectors is also evident in embedded insurance offerings, signifying a significant shift in the traditional insurance market and reflecting the broader trend of the sharing economy.

Subscription-based and sharing economy models are reshaping the insurance landscape, offering a new level of customization and convenience that aligns with the lifestyles of today’s consumers. These models not only cater to the changing preferences of customers but also open up new avenues for agency growth strategies and differentiation within the insurance sector.

The Future Landscape of Digital Insurance Channels

The future landscape of digital insurance channels is poised to deliver:

- Seamless and personalized customer experiences

- Technology to enhance convenience and accessibility

- Refinement of digital marketing strategies to target new customer segments and personalize communications

This evolving landscape is indicative of a broader shift towards digital technology solutions in the insurance industry.

These developments will not only redefine the customer experience but also provide insurers with powerful tools to gain deeper insights and drive strategic decision-making.

Expansion of Online Portals and Mobile Apps

Online web apps and mobile apps have become ubiquitous in the insurance industry, emerging as critical digital channels that provide policyholders with convenient access to services and information.

The utilization of these digital means is on the rise, as customers increasingly seek the ability to manage their policies, file claims, and access real-time services at their fingertips. The industry is expected to continue this digital expansion, focusing on enhancing user experiences and offering services that are responsive and intuitive. This commitment to digital accessibility and convenience is reshaping the expectations of policyholders and setting new standards for customer service within the sector.

The ongoing enhancement of online portals and mobile applications is a testament to the insurance industry’s dedication to meeting the needs of a digitally savvy customer base. Through continuous innovation and user experience optimization, insurers are ensuring that their digital channels remain at the forefront of convenience and functionality.

Integrating Advanced Analytics for Better Data Insights

Advanced analytics is swiftly becoming a top priority for executives in the insurance sector, with a vast potential value at stake on a global scale.

Insurance companies that effectively employ advanced analytics in the EMEA region have witnessed a substantial uplift in operating profit, highlighting the transformative impact of analytics on the industry. Despite the promise of advanced analytics, its success is often hindered by challenges such as lack of executive sponsorship, slow development of use cases, and foundational gaps in data, talent, and technology.

Insurers that overcome these obstacles tend to adopt a value-backed strategy, align analytics with business use case execution, and systematically invest in enabling technologies.

By integrating advanced analytics into digital self-service tools, insurers can gain deeper insights into customer behavior, enabling them to tailor services more effectively and engage with customers in a more meaningful way. The integration of advanced analytics into digital channels is paving the way for insurers to not only understand their customers better but also to provide them with highly personalized and proactive services.

As the industry continues to harness the power of big data and analytics, we can expect to see a more informed and strategic approach to customer engagement and service delivery.

Intrgrating Bespoke Software For Superb Efficiency

Custom software development offers insurance companies a unique opportunity to significantly improve their operational efficiency and customer service by tailoring solutions to their specific needs and challenges. Let’s dive deeper into this concept with a concrete example:

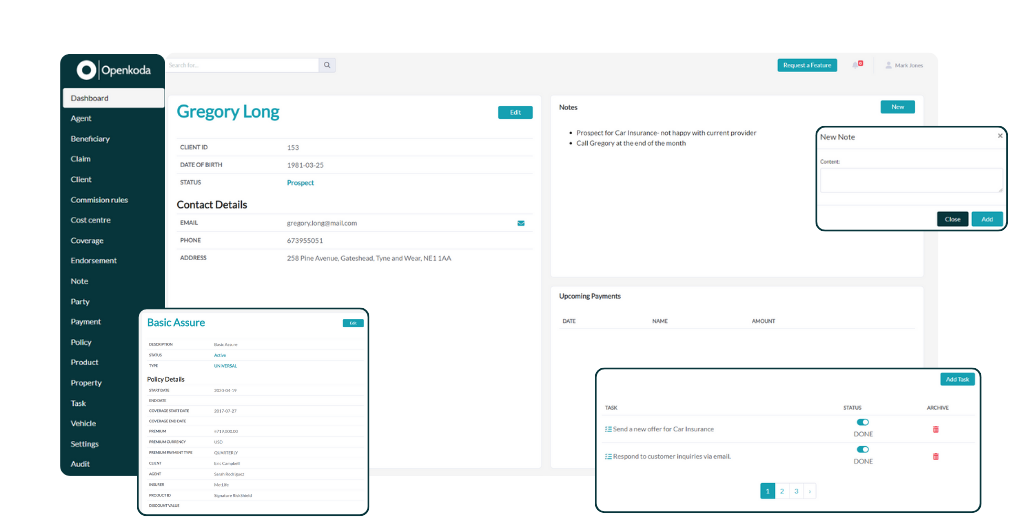

Let’s take an example in the form of a custom Openkoda Insurance Policy Management Software – an AI-powered software application that redefines policy management.

It is a flexible and adaptable software solution tailored for the insurance industry, with an emphasis on full customization and control over policy management without vendor lock-ins or user-based pricing. Key highlights include:

- A customizable platform that evolves with your business needs, allowing for specific feature requests.

- An integrated suite of tools for operational efficiency, including a 360-degree dashboard for real-time performance monitoring and deeper insights.

- Advanced document management for efficient handling of paperwork, ensuring compliance and improved customer service.

- AI-driven personalization for customer communications, enhancing experiences and relationships.

- Smart alerts for timely notifications about critical events, customizable to prioritize business-critical information.

What’s the biggest advantage of this system?

It’s adaptability.

Openkoda Insurance Policy Management Software acts as a foundation from which you can build your application to perfectly fit your business needs. This approach offers incredible cost and time savings compared to the standard custom software development process – something that is absolutely crucial in 2024.

All in all, by using software designed specifically for their needs, insurance companies can serve their customers better and faster, leading to happier customers and a stronger bottom line.

In short, investing in custom software is a smart move for insurance companies aiming to digitalize their processes and boost their overall efficiency.

[Read also: Top Software for Insurance Brokers in 2024]

Summary

As we conclude our journey through the insurance industry, it is clear that the impact of digital transformation is profound and far-reaching.

From the emergence of digital self-service tools that enhance customer interactions, to the optimization of operations through automation, to the rise of insurtech startups that challenge traditional models, the industry is undergoing a transformative revolution.

Insurers that invest in these areas will be well positioned to meet the evolving needs of their customers and thrive in an increasingly competitive and dynamic marketplace.

Frequently Asked Questions

What is digitalization in insurance?

Digitalization in insurance refers to the use of digital technology to enhance processes, products, and services within the insurance industry. It includes the adoption of various technologies to improve sales, management, and customer experience.

What is a digital insurance policy?

A digital insurance policy allows customers to manage their insurance online, without the need for in-person appointments or document filing, utilizing technology-first operations.

What are the advantages of having digitalized insurance policies schemes?

Digitalized insurance policies offer benefits such as protection from physical damage or loss, simplified know-your-customer process, and ease of managing multiple policies on a single platform. Additionally, they provide speed, agility, easy accessibility, and a user-friendly interface, ultimately enabling the creation and implementation of newer and better services.

How does digital transformation affect insurance?

Digital transformation in the insurance industry offers benefits such as convenience, personalization, faster claims processing, improved customer service, and increased transparency for customers. Additionally, insurers can streamline operations and enhance overall customer satisfaction through seamless digital experiences and advanced data analytics.

What are some examples of digital self-service tools in insurance?

Some examples of digital self-service tools in insurance are online customer service platforms, mobile apps, virtual assistants, and no-code development tools, which enable customers to manage policies, file claims, and interact with insurers at any time.

Related Posts

Thank you for taking the time to read our blog post!