Complete Guide to CRM for Insurance Agents [+ 6 Best CRMs]

Looking for ways to improve customer relationships and increase sales in your insurance business?

Our complete guide to CRM for insurance agents is here to help.

We go into the details of CRM systems, covering everything from key features and challenges to strategies for overcoming those obstacles. We also provide an overview of the top 6 CRMs tailored for the insurance industry, giving you the insight you need to choose the right tool for your business.

Contents

- Importance of Insurance CRM Software

- Key features of Insurance CRM software

- The Value of Custom CRM Insurance Systems

- Six Best CRM Software Platforms for Insurance Agents

- Openkoda Insurance Management System

- Salesforce Financial Services Cloud

- HubSpot CRM

- Zoho CRM for Insurance

- Microsoft Dynamics 365 for Financial Services

- Applied Epic

- How can a CRM system help businesses to improve ROI?

- Main Challenges With CRM Systems for Insurance Agents

- Insurance CRM Software – Key Statistics And Trends

What is Insurance CRM Software and What Value Does it Provide?

In the insurance industry, where customer expectations and market dynamics are constantly changing, the role of insurance CRM (customer relationship management) software is critical.

Essentially, insurance CRM software acts as a central repository for all customer interactions, providing a 360-degree view of the customer journey. This comprehensive perspective is invaluable for personalizing customer service, streamlining sales processes, and improving operational efficiency.

By automating routine tasks and facilitating more effective communication, the software enables insurance professionals to focus on what really matters – building stronger relationships with their customers and tailoring insurance products to meet their specific needs.

Key features of Insurance CRM software

To make the most informed decision on your next CRM software, let’s dive into its key features and the value these systems brings to the table:

- Centralized Customer Data Management: This feature acts as the core of the CRM software, consolidating all customer-related information into a single, accessible database. It ensures that every interaction, from emails and phone calls to claims and policy renewals, is recorded and easily retrieved. This centralization helps insurance professionals provide personalized service and make informed decisions based on a customer’s history and preferences.

- Automated Workflow and Task Management: Automation streamlines repetitive and time-consuming tasks such as data entry, scheduling follow-ups, and sending renewal reminders. By reducing manual effort, it frees up staff to focus on more strategic activities, such as nurturing customer relationships and focusing on sales opportunities. It also minimizes the risk of human error, ensuring a smoother workflow.

- Multi-channel Communication Support: Insurance CRM software enables communication across multiple channels, including email, phone, social media, and web chat, providing flexibility and convenience for both customers and agents. This feature ensures that customers can interact with their insurance provider through their preferred medium, increasing customer satisfaction and retention.

- Sales Management and Lead Tracking: This aspect of CRM software helps insurance companies manage the sales pipeline more effectively, from lead generation to closing. By tracking leads and sales progress, insurers can identify potential bottlenecks, monitor conversion rates, and optimize sales strategies accordingly. They can also identify cross-selling and up-selling opportunities that can help increase revenue.

- Policy and Claims Management: Integrating policy and claims management functionality within the CRM system enables a more seamless process from policy issuance to claims handling. This feature ensures that all relevant information is easily accessible, enabling faster response times and improving the overall customer experience during the claims process.

CRM Insurance Systems: Custom vs. Proprietary Software

The insurance market is diverse, encompassing a wide range of specific niches, each dealing with different types of data and operations.

From health and life insurance to property and casualty insurance, the intricacies of each segment require unique functionality that generic CRM solutions often fail to fully address.

This diversity underscores the need to develop custom insurance CRM software tailored to the precise needs of each niche.

Custom CRM software development ensures that insurance providers can streamline operations, improve customer engagement, and maintain a competitive edge by leveraging a solution that is perfectly aligned with their specific business needs.

| Feature | Custom Insurance CRM Software | Proprietary CRM Insurance Software |

|---|---|---|

| Cost | High initial development cost + lower maintenance costs | Yearly subscription fee (varies by vendor, typically $10,000 – $100,000/year) |

| Advantages | – Tailored to exact business needs – Full control over features and integrations – High scalability – Unique user experience | – Ready to use, minimal setup – Continuous updates from vendor – Dedicated customer support – Typically integrates well with popular tools |

| Best For | – Large companies with unique processes – Businesses that need highly customized workflows – Companies looking for long-term investment and control | – Small to mid-sized companies – Businesses looking for quick implementation – Organizations with standard insurance workflows – Companies with limited development resources |

Custom Insurance CRM Software: A few Grains of Salt

Trying to develop custom CRM software specifically for the insurance industry is no small feat.

It requires a nuanced understanding of the industry’s unique challenges, from regulatory compliance to the intricate data management needs of various insurance niches.

That’s why it’s important to stress the importance of partnering with custom development companies that have extensive experience building software specifically for this industry.

Their experience ensures that CRM software is developed with the precision and functionality required to handle complex insurance processes. In addition, working with developers experienced in the insurance industry greatly increases the likelihood of delivering high-quality software products on time and within budget.

Six Best CRM Software Platforms for Insurance Agents

When looking for customer relationship management software tailored for the insurance industry and insurance agents, it’s important to choose systems that offer features specifically designed to meet the unique challenges of the industry. These challenges include managing customer policies, tracking claims, automating workflows, and ensuring compliance with industry regulations.

Below, we’ve selected six of the most important systems in the insurance CRM market in 2024. Be sure to review their key features and benefits to make an informed decision on which one to choose.

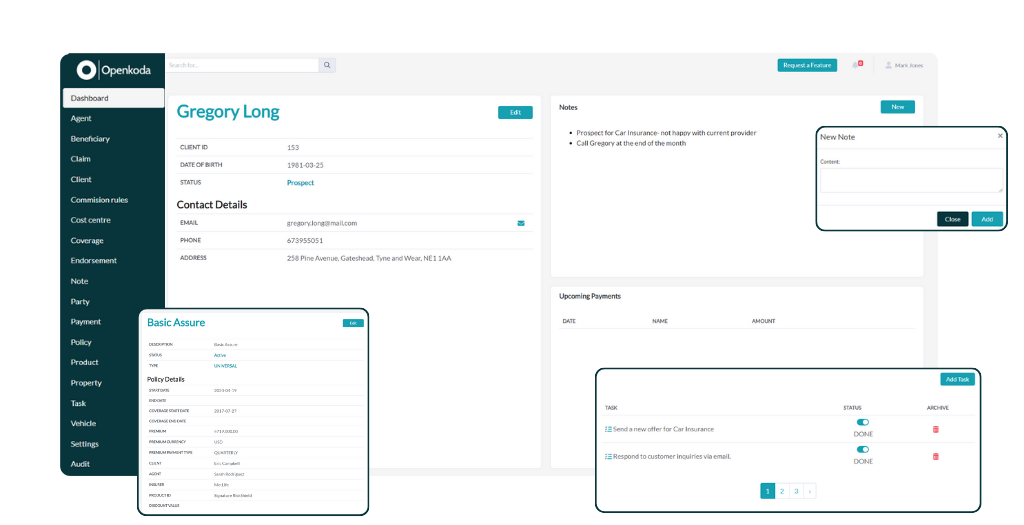

Openkoda Insurance Management System

The Openkoda Insurance Agency Management System is a comprehensive, open source software solution designed specifically to meet the needs of insurance brokers and agencies looking to streamline operations and improve customer engagement.

Leveraging the power of artificial intelligence, this platform streamlines policy management, facilitates efficient customer communication and automates reporting processes, thereby increasing operational efficiency.

Openkoda’s open source software nature offers great flexibility, allowing agencies to modify and extend the system as their business evolves, free from the constraints of vendor lock-ins.

This ensures that insurance agencies can tailor the software to their unique requirements, integrating a wide range of applications to extend functionality and adapt to changing business needs.

That might sound complicated but any experienced Java developer can develop additional functionality easily and much faster than with other tools available on the market giving you a CRM system that is perfectly adjusted to your business case.

Key features

- Open Source and AI-Driven: The system is open source, providing flexibility and customization options to fit specific business needs. It employs AI to streamline policy management, reporting automation, and offers an AI companion for generating code extensions and improving efficiency.

- Customizable 360° Dashboard: Offers a customizable dashboard that consolidates documents, policies, meetings, calendars, notes, and other functions in one place for easier policy management

- Central Repository for Policy Documents: Facilitates easy document management with features for uploading, downloading, printing, and exporting documents and data.

- Personalized and Automated Messaging: Supports automated and personalized messaging to clients, including email and SMS, enhancing communication efficiency.

- Integration Capabilities: Allows for integration with a wide range of applications to enhance functionality, such as calendars for scheduling and claims management solutions.

- Flexibility and No Vendor Lock-ins: Designed for flexibility and scalability, it supports integration of custom functionalities and ensures that agencies can adapt and evolve without vendor restrictions.

Pros

- Open Source and Flexibility: Being open source, Openkoda allows insurance agencies to customize and extend the system to their specific needs without the constraints typically associated with proprietary software.

- Advanced Integration Capabilities: Openkoda’s design to integrate with a wide array of applications enhances its utility by allowing agencies to connect with essential tools and services seamlessly

- No Vendor Lock-ins: The platform’s open source nature and flexible design philosophy ensure that users are not locked into using Openkoda, giving them the freedom to evolve their tech stack as needed

Cons

- Potential Complexity: While being open source offers significant advantages in terms of flexibility and customization, it may require a higher technical skill level for customization and maintenance, potentially increasing the complexity for users without technical expertise.

- Resource Requirements for Customization: Customizing and extending the system to fit specific needs could require additional resources, including time and technical expertise, which might not be readily available for all agencies

Salesforce Financial Services Cloud

Salesforce Financial Services Cloud is designed to transform the customer experience in the financial services industry, including insurance, by providing a platform that connects disparate systems to provide a comprehensive view of each customer’s journey.

This CRM leverages Salesforce’s powerful platform to deliver personalized services with AI-driven insights, enabling insurance companies to more effectively manage customer relationships, from personal lines and policies to claims management.

Key Features:

- Customizable dashboards and analytics

- AI-powered insights

- Comprehensive client profiles

- Robust integration capabilities

Pros:

- Highly customizable to specific business needs

- Strong analytics and reporting capabilities

- Scalable for any business size

Cons:

- Can be complex and require training

- Higher cost, especially with customizations

- Additional costs for third-party integrations

HubSpot CRM

Known for its ease of use and flexibility, HubSpot CRM serves businesses of all sizes in a variety of industries, including insurance.

It offers a comprehensive suite of tools for sales, marketing, customer service, and content management – all in one easy-to-use interface. For insurance companies, HubSpot CRM can automate and manage customer interactions, track leads through the sales pipeline, and create personalized marketing campaigns.

Key Features:

- Lead and pipeline management

- Marketing automation

- Customer service tools

- Analytics and reporting

Pros:

- User-friendly interface

- Free version available

- Good sales and marketing tools

Cons:

- Advanced features require premium plans

- Cost increases with additional features and users

Zoho CRM for Insurance

Zoho CRM is an insurance agency CRM software for insurance brokers with a set of specialized tools designed to streamline their workflows.

This includes policy management, claims processing, and tracking commissions and sales performance. Zoho CRM provides a centralized platform for managing all customer interactions, increasing the efficiency and effectiveness of sales and support teams. Its automation capabilities reduce the need for manual data entry and follow-up, allowing agents to focus on building relationships and closing sales.

Key Features:

- Policy management

- Claims processing

- Commission tracking

- Sales automation

Pros:

- Affordable for various business sizes

- Good range of customizable features

- Integrates with Zoho’s suite

Cons:

- Interface can be cluttered

- Variable customer support quality

- Learning curve for customization

Microsoft Dynamics 365 for Financial Services

Microsoft Dynamics 365 for Financial Services offers a modular approach to CRM, allowing insurance companies to choose and customize the solutions that best fit their needs.

The platform is deeply integrated with the Microsoft ecosystem, including Office 365, providing users with a familiar environment that enhances productivity.

Key Features:

- Customer relationship and insights

- Operational efficiency tools

- Compliance tracking

- Integration with Microsoft suite

Pros:

- Deep integration with Microsoft products

- Flexible and customizable

- Strong data security

Cons:

- Learning curve for non-Microsoft users

- Can be costly for small businesses

- Technical expertise needed for customizations

Applied Epic

Applied Epic is a comprehensive agency management system that caters specifically to the needs of insurance agencies and brokerages.

It provides robust capabilities for managing the entire lifecycle of policies, from quoting and issuance to renewals and claims. Applied Epic also includes tools for sales management, accounting, and reporting, offering a 360-degree view of agency operations.

Key Features:

- Comprehensive policy management

- Sales tracking and financial accounting

- Mobile access

- Data analytics and reporting

Pros:

- Tailored for insurance agencies

- Strong policy management features

- Good support and training resources

Cons:

- High cost for smaller agencies

- Dated interface compared to modern CRMs

- Complex setup and customization

How can a CRM system help businesses to improve ROI?

A CRM system for insurance agents and insurance companies can significantly increase return on investment (ROI).

First and foremost, it centralizes customer data and makes it easily accessible to agents and support staff. This centralization provides a deeper understanding of customer needs and behaviors, enabling more targeted and effective sales strategies. By leveraging detailed customer profiles, insurance companies can identify cross-sell and up-sell opportunities to increase revenue per customer.

In addition, a CRM system streamlines workflow and automates many administrative tasks, such as policy renewals and claims processing. This automation reduces manual errors by insurance agents and lowers operating costs, allowing staff to focus on higher-value activities such as customer retention and acquisition.

The analytical capabilities of an insurance CRM system are another critical factor in improving ROI.

It provides insurance companies with actionable insights into insurance market trends, customer satisfaction, and the effectiveness of sales and marketing strategies.

In addition, CRM systems support multi-channel communication, ensuring that customers can interact with their insurance provider through their preferred channel, whether it is email, phone, social media, or chat. This flexibility improves the customer experience, increases engagement, and strengthens the customer relationship, contributing to higher retention rates.

Quantitative ROI Measurement

Measuring the ROI of insurance CRM systems involves understanding the costs involved (e.g., license, development, subscription) and the benefits gained, such as increased revenue, better access to customer data, and improved sales processes.

Effective CRM systems contribute to higher conversion rates, optimized sales strategies, and a more personalized service approach.

It’s been reported that CRM systems can deliver significant financial returns for insurance brokers. For example, according to Nucleus Research, the average ROI of a CRM system can be as high as $5.60 for every $1 spent, highlighting the direct financial benefits of CRM investments.

[Read also: 10 Best Insurance Agency Growth Strategies You Must Know In 2024]

Main Challenges With CRM Systems for Insurance Agents

Implementing CRM systems in the insurance sector presents several challenges that agents and companies must navigate to realize the full potential of these systems. Here are the main challenges with CRM systems for insurance agents, coupled with insights from industry experience:

Overcoming Data Integration and Processing Hurdles

One of the key challenges is integrating the CRM system with existing databases and applications.

Insurance companies often operate on legacy systems, and merging them with modern CRM solutions can be complex and time-consuming. Ensuring data quality during and after integration is critical, as inaccurate or incomplete data can lead to misguided strategies and customer dissatisfaction.

Futureproofing The System: Focus on Customization and Scalability

Insurance products and customer needs vary widely across market segments.

A one-size-fits-all CRM solution may not address specific needs. Tailoring the CRM system to an insurance company’s unique processes and workflows is critical, as is ensuring that the system is scalable to accommodate future growth and changes in business strategy.

Dealing With Compliance and Data Security

The insurance industry is heavily regulated, with strict guidelines on data handling and customer privacy.

CRM systems must be designed to comply with these regulations, incorporating robust security measures to protect sensitive customer information from data breaches and cyber-attacks. Ensuring compliance and securing data are ongoing challenges that require constant vigilance and updates to the CRM system.

Balancing Costs with Benefits

Implementing a CRM system requires a significant investment in software, hardware, and training. For some insurance companies, especially smaller ones, the upfront costs can be daunting.

In addition, it can take time to see a return on this investment. Companies must carefully evaluate the potential ROI and consider cost-effective solutions without compromising essential features and capabilities.

Staying Ahead: Keeping Pace with Technological Advancements

The technology landscape is rapidly evolving, and insurance CRM systems must keep pace to remain effective. Integrating new technologies such as AI in insurance and machine learning can enhance CRM capabilities, but it also presents a challenge in terms of keeping skills current and adapting to insurance digital transformation.

Insurance CRM Software – Key Statistics And Trends

In 2024, the CRM industry will continue to show robust growth and significant value to businesses in various sectors, including the insurance industry. Here’s a detailed look at the role and value of CRM software systems and specific insights into their use in the insurance industry, based on the latest statistics and data:

CRM Software Systems: Overview and Value

- Market Growth and Value: The CRM industry is set to grow by 12% over the next five years, reaching an estimated $129 billion by 2028. Businesses get an average return on investment (ROI) of $8.71 for every dollar spent on sales CRM software.

- Adoption and Impact: Around 64% of companies report that CRM tools are impactful or very impactful, reflecting CRM’s significance in enhancing business operations and customer relations.

- CRM in Sales and Marketing: CRM software can boost sales by up to 29% and is crucial for lead generation, nurturing, and improving customer engagement rates. A remarkable .300% boost in conversion rates has been reported by businesses leveraging CRM effectively

CRM Software in Insurance

- CRM systems play a key role in improving insurance businesses’ ROI.

- More than half of insurance customers expect 24/7 support from insurance agents. CRM systems help companies in ensuring customer needs by automating processes and managing data on a single platform.

- CRM systems enhance customer retention rates, leading to a profit gain ranging from 25% to 85%.

- CRM systems have the potential to increase revenue by 29%.

- Companies that implement CRM can see a 300% increase in conversion rates.

[Read also: The Role of Digitization in Insurance Industry And Its Future]

CRM for Insurance Agents – Conclusion

In conclusion, implementing an insurance-specific CRM system can significantly change the way agents manage customer relationships, streamline operations, and drive sales.

While challenges such as data integration, user adoption, and regulatory compliance may arise, the benefits of a well-implemented CRM system far outweigh these hurdles.

By carefully selecting a CRM that meets the specific needs of your insurance business and investing in proper training and customization, you can improve customer service, increase efficiency, and ultimately increase your ROI.

Related Posts

Thank you for taking the time to read our blog post!