How to Build Insurance Policy Management Software: Expert Guidance

In the insurance industry, managing policies efficiently is crucial. Insurance policy management software is a technological solution that helps streamline this process. This blog post is dedicated to explaining how to build such software, which is essential for improving the operations of insurance companies.

Contents

- What is insurance policy management software?

- How does insurance agency management system work?

- Custom vs Out-of-the-box Insurance Management Solution

- Business benefits on custom software in insurance industry

- Key features of insurance policy administration system

- How to build insurance policy administration software in 5 steps

- Example of cost-effective solutions for building insurance policy software

What is insurance policy management software?

In today’s digital age, insurance companies are leveraging technology to improve their operations. One such tool is policy administration software also known as insurance policy management software.

At its core, this software provides a centralized database that makes policy information easily accessible. Just to make it easier for the insurance brokers and agents to manage their work.

But it doesn’t stop there. The policy administration system also automates routine tasks such as policy renewals and claims processing. This not only reduces manual effort, but also minimizes errors.

For those who focus on customer relationships, and this is definitely the case for insurance agencies, the policy administration software is a game changer.

Insurance policy management system keeps detailed records of customer data, policy details, and all communication touchpoints, ensuring that every customer feels valued.

The ability to integrate with other systems-whether CRM tools or payment processing gateways is also a great asset, ensuring a consistent flow of data across platforms.

But what about insights and compliance? The insurance policy management system has you covered. With built-in analytics, companies can run reports, drill down into performance metrics, and identify industry trends. And in an industry where compliance is key, this tool ensures that every policy and every underwriting process always meets regulatory standards.

How does insurance agency management system work?

It is important to understand the nuances of an insurance agency management system in order to select the best solution for your business and learn how the system is built.

As we enter the digital age, these applications have evolved to offer a wide variety of advanced features tailored for professionals. These are as follows.

Unified data repository

At the heart of these systems is a consolidated database. This ensures rapid and easy access to client portfolios, policy details and transaction history, eliminating data silos and improving operational efficiency.

Enhanced client interaction tracking

Accuracy is key. Every client touchpoint, whether an email or a phone call, is logged and time-stamped. This detailed tracking, offered by a policy administration systems, ensures consistent and informed customer interactions. This is essential for maintaining high service standards.

Automation capabilities

Time is of the essence. An advanced and complete solution for policy administration can automate repetitive tasks, such as policy processing and renewals or premium reminders. This not only streamlines operations, but also minimizes the margin for error.

Seamless integration

Interoperability is a buzzword for a reason. Best-of-breed systems are designed to integrate effortlessly with other enterprise software solutions, be they CRMs, financial software, or digital communication tools. This ensures cohesive data flow and streamlined processes.

Robust reporting tools

Knowledge is power. With built-in analytics, these systems empower agencies to gain actionable insights. Whether evaluating sales performance, tracking policy churn, or analyzing customer demographics, the data is at your fingertips.

Regulatory compliance management

The insurance sector is full of regulations. Advanced insurance policy administration systems are equipped with features that ensure adherence to the latest compliance standards, protecting agencies and insurance organizations from potential pitfalls.

Custom features & AI integration

The future is personalized. Advanced systems now offer customized features tailored to the unique needs of each agency. And with the integration of AI, these systems can predict trends, provide insights, and even automate complex tasks, creating a truly personalized software experience for users.

Custom vs Out-of-the-box Insurance Management Solution

When an insurance company faces the choice of implementing a policy management system, one of the first steps—right after analyzing its business needs—is to choose between custom and off-the-shelf systems. Let’s take a look at what the differences are.

Off-the-shelf, also called out-of-the-box, insurance software solutions are known for their ease of installation and user-friendly entry point for new users. They come with the benefit of a user community and customer support that can be invaluable resources for troubleshooting and learning. Initially, these solutions are cost-effective, offering a set of standard features without a hefty price tag. Learn more about how SaaS companies work.

On the other hand, custom insurance software solutions offer scalability and long-term cost-effectiveness. Unlike off-the-shelf, they can be tailored to fit a specific company’s unique business processes and needs.

Modifications and integrations with out-of-the-box solutions can be a huge challenge, often leading to vendor lock-ins, where moving to different technologies or vendors is not only difficult, but sometimes impossible.

What’s more, you don’t really own the software. In contrast, custom solutions provide full ownership, greater control over user privacy, and the flexibility to evolve with the changing needs of the business, ultimately providing a strategic advantage in the industry.

To sum it up, let’s list the pros and cons of both types of solutions.

Out-of-the-Box Software

Pros:

- Quick and easy setup.

- Community and customer support available.

- Low initial cost.

Cons:

- Customization is limited.

- Difficult to modify or integrate.

- Vendor lock-ins.

Custom Software

Pros:

- Tailored scalability.

- Long-term cost savings.

- Complete ownership and control.

- Enhanced data protection.

Cons:

- Higher initial investment.

- Longer development time.

Business benefits on custom software in insurance industry

When looking for the most effective policy administration system, agency owners should pay special attention to the specific problems that custom software solutions for the insurance industry solve.

These custom solutions offer significant business benefits and are designed to meet the unique challenges of insurance agencies.

Customized solutions

Custom software is designed specifically for your agency’s unique needs and challenges. This ensures that the insurance policy management system is perfectly aligned with an agency’s business processes, operational models, and specific requirements.

Integration capabilities

Custom software can be seamlessly and fully integrated with other tools and existing products that insurance agencies already use. Whether it’s CRM systems, financial software, or communication tools, a custom solution ensures interoperability and a cohesive data flow.

Enhanced security

Given the sensitive nature of insurance data, custom software can be designed with advanced security features. It ensures that customer information, and transaction details are protected from potential threats.

Competitive advantage

A custom software solution can give a competitive edge for insurance agents. It offers key features and functionality that off-the-shelf solutions may not, setting your agency apart in the marketplace.

Cost efficiency

While the initial investment may be higher, a custom insurance policy administration system can prove cost-effective in the long run. It reduces the need for frequent updates, additional licenses, or modifications that may be required with generic software.

Improved customer experience

Custom software can improve the customer experience by offering personalized features, faster response times, and easy-to-use interfaces. Satisfied customers lead to more referrals and business growth.

Data-driven insights

With built-in analytics and reporting tools, custom software can provide valuable insights into customer behavior, policy performance, and market trends. This data can inform new business strategies and drive decision-making.

Automation & efficiency

Custom solutions can automate repetitive tasks of policy administration systems. From manual processes to policy renewals to customer communications. This not only streamlines operations, but also ensures accuracy and consistency.

Future ready

The insurance industry is constantly evolving. Custom software can be designed with future trends and technologies in mind, keeping your agency or company at the forefront of innovation.

In summary, in today’s modern insurance landscape, the right custom software is critical for insurance agency owners. It provides precision in policy management, reduce processing time, helps with reporting, streamlines claims management, and integrates seamlessly with the policy administration system.

Moreover, it provides automated regulatory compliance, safeguarding against evolving industry regulations. Investing in such a customized solution isn’t just about adopting a tool; it’s about aligning with the agency’s vision and goals. By taking a customized approach to digital transformation, agency owners are strategically positioning themselves for success, growth, and leadership in the competitive insurance space.

Key features of insurance policy administration system

We have already mentioned a number of key functionalities of such software, so let’s put it in order and look at all the key features that such software should have.

Lifecycle management

A comprehensive life insurance and policy management system manages the entire lifecycle of a policy, from inception to renewal or termination.

Automation with AI

Streamlined workflows powered by AI ensure efficiency, predict trends, and offer proactive solutions, reducing manual errors and speeding processes.

Configurable templates

Pre-built and AI-enhanced customizable templates enable rapid product and plan setup, ensuring flexibility and adaptability to market changes.

Regulatory compliance

Given the dynamic nature of insurance regulations, a insurance company management system ensures automated compliance, reducing the risk of non-compliance.

Easy-to-use interface with AI assistance

An intuitive, user friendly interface complemented by AI assistants ensures ease of use for agents and administrators, providing real-time suggestions and reducing training time.

Reporting & predictive analytics

Built-in AI analytics tools provide insights into policy performance, predict customer behavior, and forecast market trends for informed decision-making.

Scalability

As the agency grows, the insurance policy management software can scale to accommodate more policies, customers, and data, ensuring it remains relevant over time.

Security features

Advanced security features protect sensitive customer data and transaction details from potential threats.

AI-generated custom features

AI can analyze specific agency needs and generate custom features tailored to unique requirements, ensuring a truly personalized system.

For insurance agency owners, adopting a insurance policy management software with these AI-powered capabilities isn’t just about streamlining operations, but also about ensuring agility, compliance, customer satisfaction, and a competitive edge in the rapidly evolving insurance landscape.

How to build insurance policy administration software in 5 steps

We have already discussed the differences between out-of-the-box solutions and custom-developed software, each with its own set of benefits and limitations.

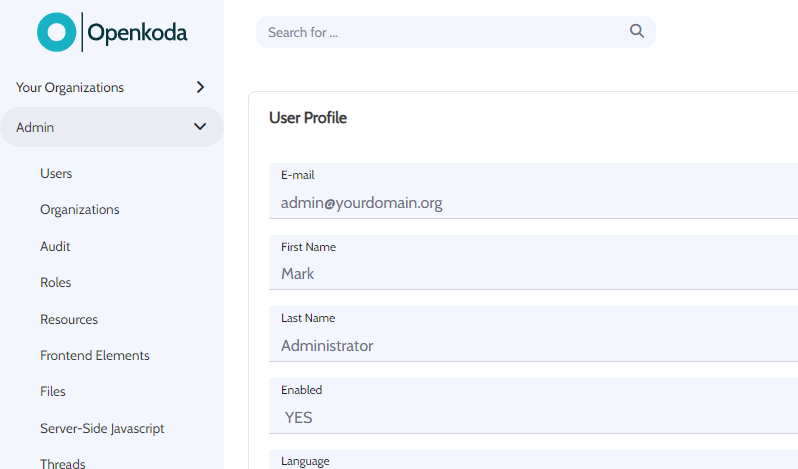

However, there is a third way that combines the best of both approaches: Openkoda. This innovative platform revolutionizes the way enterprise applications are built in Java, significantly accelerating the insurance software development process beyond traditional methods.

Openkoda uses pre-built modules that function similarly to a low-code approach, while still allowing for a degree of customization with reduced coding. What sets Openkoda apart is its AI-driven low-code engine, which uses the power of artificial intelligence to generate new, custom functionality along with an AI Companion to streamline the development workflow.

A key benefit of Openkoda is the elimination of cloud or vendor lock-ins, giving organizations full ownership of their code and the flexibility to deploy their applications on any platform. Applications built on the Openkoda platform are inherently secure, scalable, and extensible, while being developed at an unprecedented pace.

Based on our application template for insurance policy software, we were able to modify and build the necessary functionality for one of our clients to meet their individual needs in just two days.

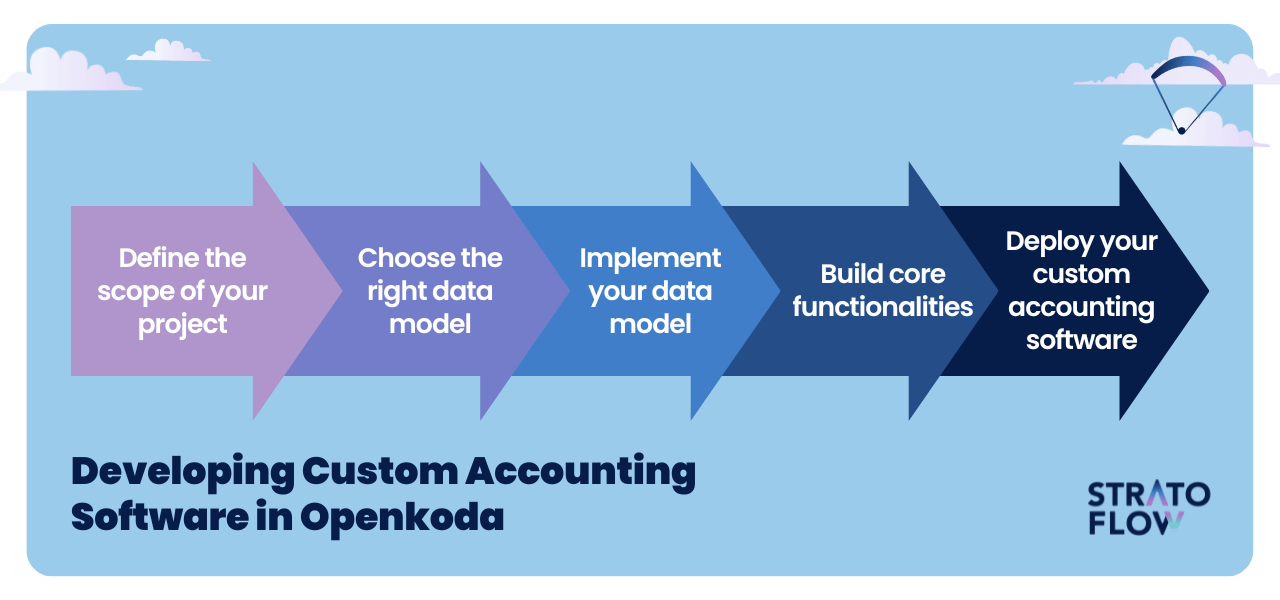

The whole process of creation is as follows:

Step 1: Define the business application value proposition

To get things started, it’s important to identify the primary objective before embarking on the development of your business application. For an insurance agency owner, this means identifying your business application’s “value proposition”, the benefits and features that will meet the needs of your customers.

This value is the cornerstone of your application and will drive most of your Key Performance Indicators (KPIs) in the future. For example, if you’re building an application to streamline policy management, the core value might be providing a comprehensive policy tracking and claims dashboard.

By solidifying a robust value proposition, software developers can focus on building features that directly contribute to that fundamental value. This focus ensures that your business application solves a real problem in the marketplace, increasing its chances of success and user adoption.

Step 2: Select the appropriate data model

The next critical phase is to design a domain data model that aligns with your business application.

Openkoda offers a significant advantage here by providing a general data model suitable for business applications. Your task is to consider the unique value-add specific to your insurance domain – you don’t need to worry about the standard entities; just focus on your unique business domain, such as policyholders and claims records.

Investing time and effort in developing a data model for your business application is critical with Openkoda. Why is that? Because when your application takes off, that model will serve as the foundation for the entire system that evolves from it.

Step 3: Implement your data model

Setting up a data model in Openkoda typically involves translating a business model into a database schema, which involves defining business entities within the database.

While this process may seem daunting to those without a technical background, it’s actually quite straightforward. It’s a routine process for any software developer with enterprise application experience.

And with that, we have an operational Openkoda instance ready for data entry, effectively giving us a basic CRUD application. Our application now has all the basic capabilities of Openkoda, along with the ability to manipulate data within the model we established earlier.

This rapid development cycle to achieve a functional CRUD application is another area where Openkoda shines, offering a significant speed advantage over traditional development methods based on standard frameworks such as Spring.

Step 4: Develop core functionality

Now comes the exciting part – creating the features that will bring real value to your application.

Here is how Openkoda saves you time when building your application.

Openkoda accelerates this process with its AI Companion, an innovative AI tool that assists the software development process by generating code snippets on the fly.

Developers have the ability to build functionality the traditional way in Java, but using Openkoda’s pre-built components allows them to focus on what’s really important to end users.

User management, dashboard building tools, organization management, user role assignments and permissions, file storage, load balancing, LDAP and social authentication methods, and multi-tenancy are just a few of the pre-made features available to accelerate application development.

Step 5: Launch Your Business Application

Finally, the deployment of your business application.

This phase marks the transition from development to deployment, where the true value of your application is tested by its users.

It’s a critical moment in the lifecycle of a successful application. It lays the foundation for ongoing enhancement and expansion.

With Openkoda, you have the flexibility to deploy your application anywhere. Whether you choose to run your application in your own environment or in Openkoda’s managed cloud, you retain full control.

Embarking on this journey may seem like a big challenge, but with the right partner and platform, it’s a road paved with opportunity.

If you are interested in building your own insurance software in this way, please do not hesitate to contact us. We invite you to a one-of-one meeting with our experts, where we can explore your specific needs, answer any questions you may have, and outline a roadmap for your agency’s digital transformation.

Examples of cost-effective solutions for building insurance policy software

Openkoda Insurance Policy Software

Navigating the complexities of the insurance industry requires a software solution that’s both robust and agile. Openkoda Insurance Policy Software is emerging as a leader in this space, offering a cost-effective approach to building best-in-class insurance policy platforms.

Its low-code elements, packed with enterprise-level features, ensures a fast and efficient development process. Insurance gencies benefit from the best of both worlds: out-of-the-box solutions for immediate needs and the flexibility of custom configurations for unique requirements.

One of Openkoda‘s distinguishing key features is its commitment to client autonomy. Insurance agencies are given full ownership of the software, eliminating concerns about vendor lock-in. This freedom extends to hosting, as the platform can be hosted anywhere, providing unparalleled flexibility.

In addition, Openkoda’s AI companion is a major innovation. This AI-driven assistant can quickly create new custom features, ensuring that the software evolves with an agency’s growth and changing needs.

myCOI

myCOI provides a Certificate of Insurance (COI) tracking software that allows users to store all their insurance details in one place. It’s designed for cost-effective certificate of insurance tracking, ensuring that businesses and insurers remain compliant and reduce the risks associated with uninsured claims.

Oracle’s Digital Insurance Platform

Oracle offers a digital insurance platform that provides efficient, cost-effective policy creation, retrieval, and web capabilities. The standard Oracle insurance platform, is designed to meet to the modern needs of insurance agencies, ensuring streamlined operations and an enhanced customer experience.

For insurance agency owners, these solutions represent a blend of functionality, cost-effectiveness, and industry-specific features. It’s important to evaluate each based on the agency’s unique requirements and choose a solution that aligns with the business’s goals and operational needs.

Conclusion

In short, building the right policy management software is key to helping insurance companies work better and faster. The guide we’ve been talking about shows you how to build software that fits your business like a glove, whether you’re starting from scratch or using something that’s already built. With tools like Openkoda, you can have the best of both worlds, building software that’s secure, grows with you, and doesn’t lock you into one vendor. Choosing the right software helps your business take better care of your customers and stay ahead of the game.

Related Posts

We are Stratoflow, a custom software development company. We firmly believe that software craftsmanship, collaboration and effective communication is key in delivering complex software projects. This allows us to build advanced high-performance Java applications capable of processing vast amounts of data in a short time. We also provide our clients with an option to outsource and hire Java developers to extend their teams with experienced professionals. As a result, our Java software development services contribute to our clients’ business growth. We specialize in travel software, ecommerce software, and fintech software development. In addition, we are taking low-code to a new level with our Open-Source Low-Code Platform.