7 Trends in the Insurance Industry in 2025

Grasping the current trends in the insurance industry is crucial for stakeholders within this rapidly evolving field. The article delineates key developments shaping the insurance landscape, including the use of technology to enhance customer engagement and address emerging risks. While not going into excessive specifics, it sketches out how these trends influence business practices, client interactions, and strategic positioning within the competitive insurance market.

Contents

- Modern Insurance Constrained with Out-of-Sync Operating Model and Legacy Technology Foundation

- Streamlining Policy and Claims Management with AI and Automation

- Accelerating Digital Transformation in the Insurance Sector

- The Rise of Personalized Customer Service in Insurance

- Changing Business Models: Embedded Insurance and More

- Democratization and Demonetization of Insurance Data

- Protecting Against New Emerging Risks

Key Takeaways

- Personalization and Embedded Insurance: Leveraging data and platforms like Openkoda enables insurers to deliver tailored solutions, automate insurance processes and capitalize on embedded insurance opportunities.

- Agile Software Architecture: Adaptable and scalable systems are essential for addressing trends like climate risks, cyber threats, and usage-based models.

- Collaboration and Proactivity: Working with insurance clients, regulators, and partners, while adopting proactive models like Protection as a Service, ensures resilience and stronger engagement.

Trend 1: Modern Insurance Constrained with Out-of-Sync Operating Model and Legacy Technology Foundation

Legacy software severely limits the agility of modern insurance organizations, a challenge particularly pronounced in the insurance industry.

Many carriers still rely on decades-old systems designed for a vastly different business landscape. These systems were built to support traditional approaches to products, channels, pricing, and customer engagement rooted in outdated business assumptions and operating models.

Over time, extensive patches and complex integrations have created a “spaghetti architecture”—a tangled system that hinders meaningful data capture and analysis.

Meanwhile, the landscape has shifted dramatically.

Customers, competition, risk types and severity, and technologies have evolved, exposing the limitations of legacy systems.

This outdated operating model and technology foundation now contribute to declining profitability, higher expense and loss ratios, talent retention challenges, and difficulties maintaining customer and agent satisfaction.

Insurers must transform the economics of loss ratios, expense ratios, risk selection, and risk prevention. Achieving this requires a fundamental rethinking of business operating models and processes.

Leveraging emerging technologies such as cloud computing, APIs, AI/ML, generative AI (GenAI), IoT, and more can drive significant operational optimization. These innovations not only streamline current operations but also lay the groundwork for sustained growth and innovation in an ever-evolving market.

However, to fully capitalize on these advancements, your company must have a software architecture that is agile and customizable enough to adapt to new data streams and support rapid insurance product development.

Transitioning to Modern Technology Mainframe

Transitioning to a new operating model is essential but comes with risks that must be managed.

Legacy processes and outdated business assumptions often persist due to a “we’ve always done it this way” mindset. Allowing these to influence the new operating model and technology foundation can hinder progress.

Overcoming this mentality is critical to aligning with modern realities and achieving operational efficiency, faster time-to-market, and improved customer experiences.

Equally important is adopting an ecosystem approach. Strategic partnerships with insurtech firms, AI providers, and data analytics companies can significantly accelerate transformation.

As new data sources like IoT devices, telematics, and social media emerge, legacy systems often struggle to process or interpret this information effectively. This misalignment impedes strategic decision-making and the ability to identify emerging market trends.

Experienced insurance professionals have witnessed these limitations firsthand. They understand that addressing legacy hurdles is vital for staying competitive.

Whether through complete core system replacements or phased migration approaches, the industry recognizes that the path forward depends on modern, flexible technology foundations.

Trend 2: Streamlining Policy and Claims Management with AI and Automation

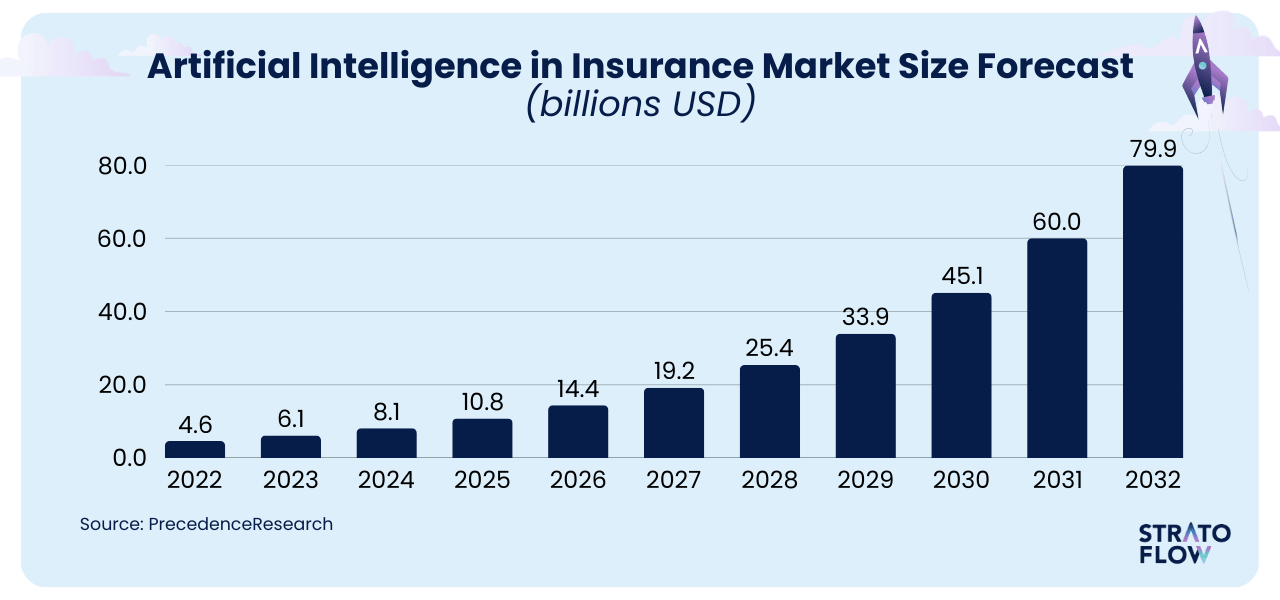

Artificial intelligence continues to impact many industries and insurance is surely one of them.

In 2025 as insurers strive to reduce costs and deliver seamless customer experiences, they are placing a premium on technology that can handle repetitive tasks, analyze vast data sets, and provide actionable insights.

Artificial Intelligence Continues to Grow: How Insurance Industry Adapts?

Although it has long been evident that artificial intelligence (AI) has the potential to revolutionize corporate processes, insurance companies have been slow to embrace change.

Many prefer to rely on legacy software architectures rather than pursue true innovation.

A Boston Consulting Group (BCG) report from October 2024 highlights this hesitancy. According to the study, only 4% of companies have developed cutting-edge AI capabilities across their operations and consistently generate significant value. Another 22% have implemented AI strategies, built advanced capabilities, and are beginning to see meaningful results.

EIOPA survey wasn’t that pessimistic.

Out of 209 insurance companies, 41% of respondents leveraged AI to enhance interactions and support in customer service.

Claims management (37%), sales and distribution (35%), pricing (34%), and underwriting (30%) also see significant AI integration, showcasing the technology’s versatility in streamlining core processes.

As we can see from these stats, many companies have yet to fully unlock AI’s potential, its transformative power is undeniable, and the industry leaders who have embraced it are already gaining a significant competitive edge.

In fact, over the past three years, companies leading in AI have outperformed their peers, achieving 1.5 times higher revenue growth and 1.6 times greater shareholder returns, according to the same BCG report.

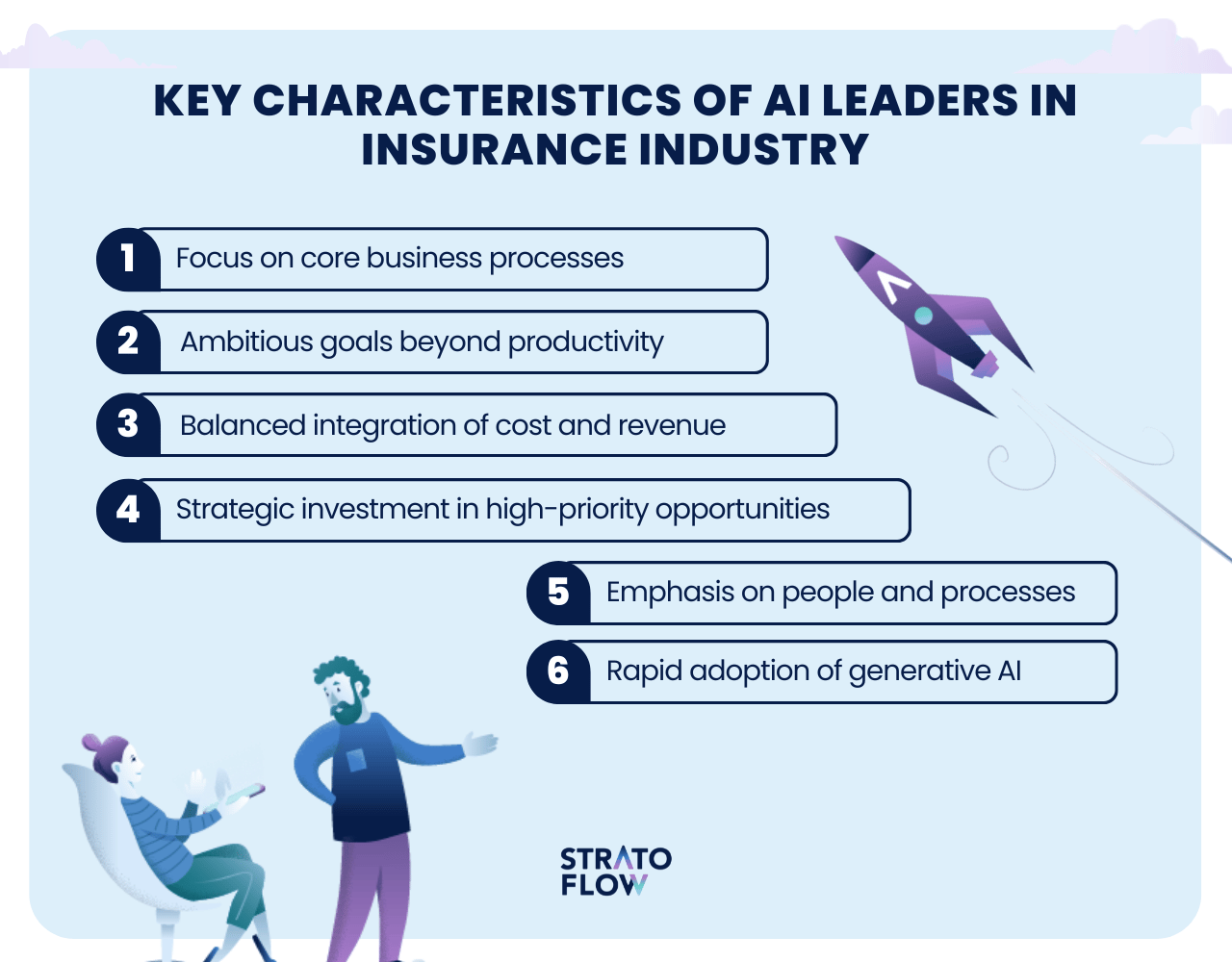

What distinguishes these AI leaders? BCG identified six key characteristics:

- Focus on core business processes for competitive advantage – Prioritizing areas that directly impact their market position.

- Ambitious goals beyond productivity – Emphasizing AI-driven revenue growth and workforce enablement.

- Balanced integration of cost and revenue generation efforts – Leveraging AI across multiple dimensions of the business.

- Strategic investment in high-priority opportunities – Scaling AI applications to maximize value.

- Emphasis on people and processes over technology – Ensuring alignment between human expertise and AI capabilities.

- Rapid adoption of generative AI (GenAI) – Harnessing its transformative potential.

Early benchmarking results indicate a 10- to 20-fold improvement in productivity as a result of integrating artificial intelligence into workflows, with the potential to revolutionize front-office operations and customer service.

This transformation enhances quality, consistency, and operational efficiency, ultimately reducing unit costs and cost ratios. These gains can lead to more competitive product pricing and a stronger market position.

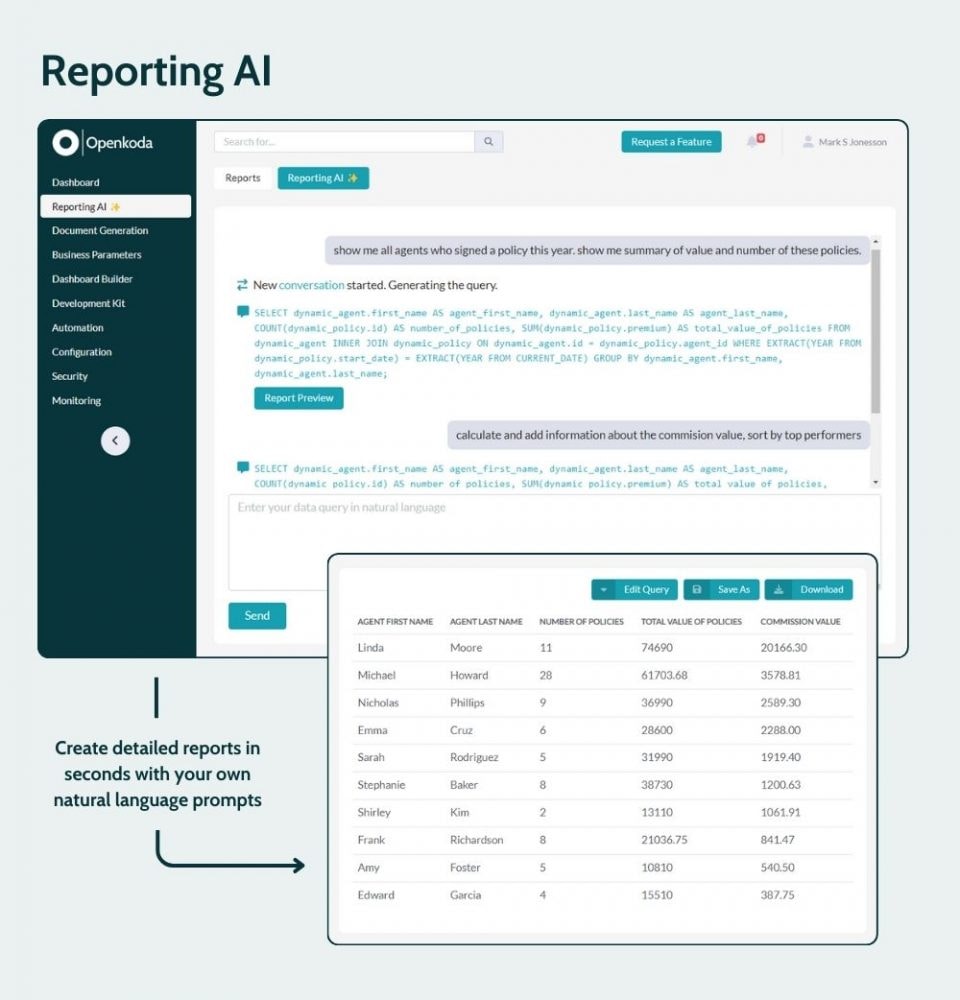

How Artificial Intelligence Can Enhance Insurance Data Management: Reporting AI

Custom policy management software with functionalities powered by AI can be a game-changer for companies leveraging them.

The reason is pretty simple: no human can ever match the speed and efficiency in data processing and management.

So custom, AI-enabled insurance software with human oversight is currently recipe for gaining a strategic edge in the industry.

A great example of that is Openkoda‘s reporting AI functionality.

By enabling users to generate complex SQL queries through natural language prompts, Openkoda democratizes data access, allowing professionals without technical expertise to extract actionable insights efficiently.

Traditional reporting methods often involve manual data extraction and query formulation, processes that are both time-consuming and prone to error.

Openkoda’s Reporting AI streamlines this workflow by interpreting user inputs and automatically generating the corresponding SQL queries.

This automation significantly reduces the time required to produce reports, thereby enhancing operational efficiency and enabling insurance professionals to focus on strategic decision-making.

Whether it’s providing faster responses to queries, automating routine tasks, or generating detailed reports, AI-powered policy administration system is helping insurers stay competitive in the digital age.

AI Enhanced Claims Processing

Another area where artificial intelligence can improve the insurance industry is claims processing.

Typically, it is a rather tedious process as it involves validation, adjudication, and settlement of insurance claims, requiring the collection and verification of policyholder information, incident details, and supporting documentation.

AI streamlines the claims process by automating repetitive tasks such as data entry, document review, and initial assessments. This reduces manual errors and accelerates the claims lifecycle. For example, AI-powered document processing can more efficiently extract data from claim documents, freeing human staff to focus on higher-value tasks.

In turn, AI lowers operational costs by reducing the time and resources required to process claims.

Automated systems handle large volumes of claims efficiently, allowing insurers to allocate resources to more complex cases.

Advanced Fraud Detection Techniques

As insurers continue to automate their processes, they are also investing in advanced fraud detection techniques.

Machine learning technologies, for example, enable higher predictive accuracy in insurance fraud detection, proactively uncovering new fraud tactics and improving detection in unbalanced samples where fraud is a small fraction of total claims.

Alternative data sources such as social networks, sensors, credit card transactions, psychometric and telecommunications data provide a more complete view of user behavior and potential fraud patterns.

Integrating such diverse data streams is no small feat, but with a customizable and scalable software platform, it is doable.

Insurance software that enables predictive analytics, enhanced by machine learning capabilities, helps insurers understand, predict and identify outlier claims, enabling them to take preventative action against potential fraud and reduce claims costs.

The use of insurance telematics helps detect fraudulent claims by tracking customers’ driving habits, leading to more personalized and accurate risk assessments.

Trend 3: Accelerating Digital Transformation in the Insurance Sector

As we’ve already mentioned legacy software is an ongoing issue that many insurance organizations struggle with.

Many companies are still tethered to outdated systems—rigid, costly to maintain, and unable to adapt to the demands of modern customers.

Luckily the change is on the horizon.

As customers demand integrated, omnichannel experiences, insurers can no longer afford outdated processes or slow-moving technology upgrades.

In 2025, the push towards more modern digital software solutions will continue to grow in strength, with many insurers devoting significant budgets toward new software and digital systems.

The push toward advanced digitization spans everything from sales and marketing platforms to core administrative functions like underwriting and policy servicing.

Insurers are leveraging technologies like AI, big data, IoT, and digital omnichannel platforms to enhance business processes, products, and services.

One key indicator of this momentum is the rapid growth of the InsurTech sector, which is projected to expand at a compound annual growth rate (CAGR) of 10.8% and reach a global market value of $33.73 billion by the end of this year.

Cloud platform integration further demonstrates how quickly the industry is modernizing.

In the United States, 95% of insurance companies have adopted cloud-based solutions, aiming to boost scalability, reduce operational costs, and accelerate the pace of innovation.

However, this transformation doesn’t come without its own set of challenges.

Concerns over data privacy, the high cost of infrastructure investments, regulatory compliance issues, and increased operational risks are all factors that insurers must navigate.

Technology companies are leading the way, using digital service platforms and mobile apps to improve customer satisfaction and gain a competitive advantage, ultimately increasing their market share.

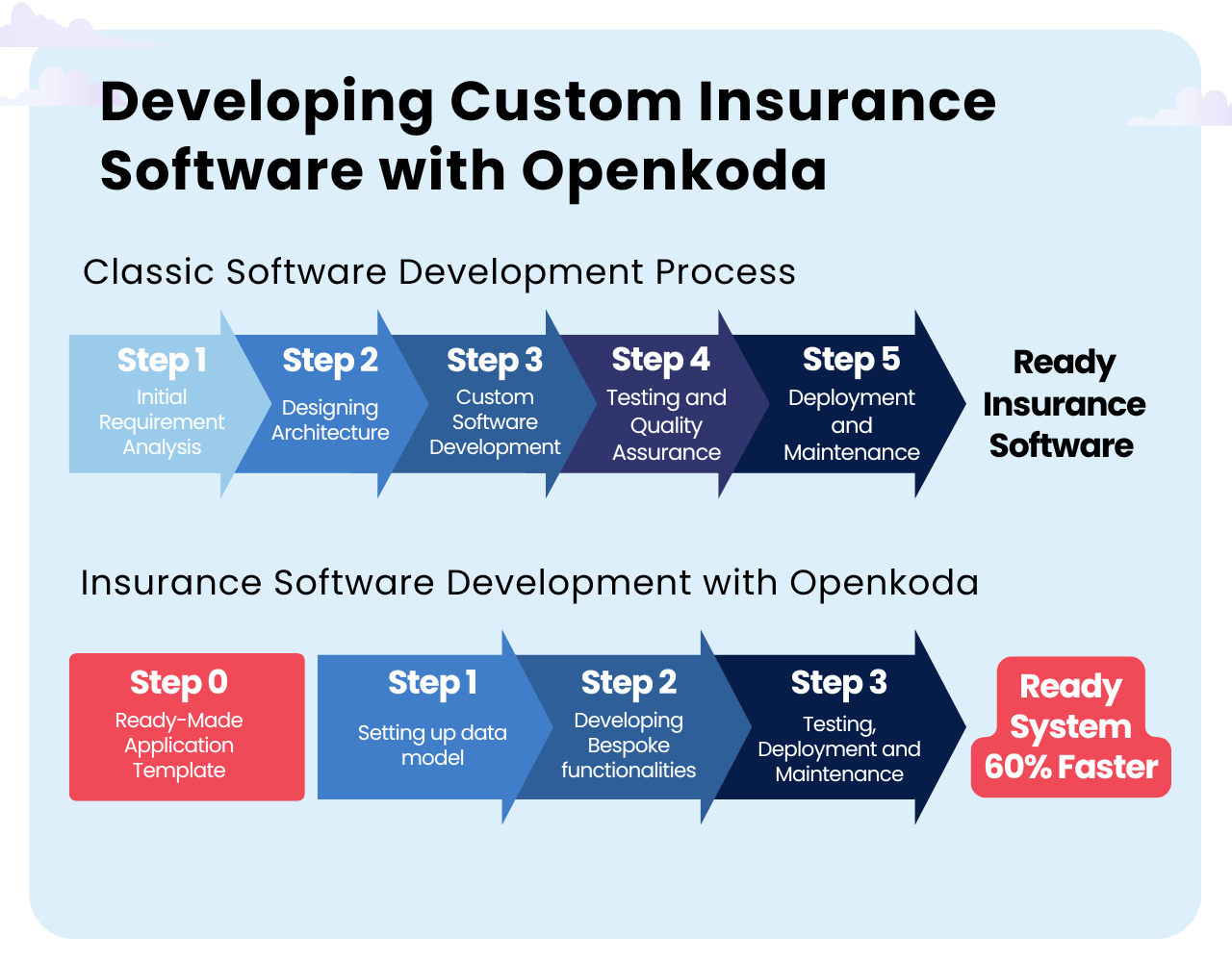

Development of Bespoke Insurance Products: Smart Approach

In the world of custom software development, customizability and agility is king.

Openkoda provides pre-built application templates designed specifically for insurance solutions, including embedded insurance, risk assessment, and policy and claims management.

These templates serve as a robust starting point for custom insurance software development projects, enabling insurance professionals to prototype new products rapidly without building from scratch.

The result?

A significant reduction in time-to-market and development costs.

One of Openkoda’s standout features is its high degree of customizability. Built on widely-used open-source technologies like Java and PostgreSQL, it allows insurers to tailor applications precisely to their business requirements.

The key takeaway?

Adopting platforms like Openkoda for the development of bespoke insurance products offers a strategic advantage. The combination of rapid prototyping, extensive customization, seamless integration, and scalability positions insurers to meet the dynamic needs of the market effectively.

If you are looking to start new digital project this year, make sure to consider all available options and not to overpay on your software!

Selecting Tech Partners with Industry Expertise

Right tools are one thing but right people are another.

Choosing the right technology partner is a critical decision for any insurance business: insurance agencies, insurance companies or insurance brokers.

To succeed in the digital age, insurers must ensure that their technology partners have industry expertise and a history of successfully completed projects in the insurance sector. Traditional insurers are increasingly expected to either develop technology capabilities in-house or form partnerships with InsurTech companies that understand the specific challenges of the industry.

So how to choose the right technology partner?

The key here is industry experience.

A technology partner with genuine industry expertise will understand the intricacies of insurance operations, from underwriting and claims management to compliance and customer engagement.

This deep knowledge ensures they can anticipate your needs and design systems that integrate seamlessly into your workflows. Without it, you risk ending up with a generic solution that fails to address the unique challenges of the insurance business.

But, that’s not all.

There’s also issues of software development methodology they follow, time zones and different outsourcing markets to consider.

Here are five key rules to follow when selecting the right custom isnruance software development company in 2025:

- Industry Expertise: Choose a company with a proven track record in insurance-specific projects, showcasing deep knowledge of underwriting, claims, compliance, and customer needs.

- Customization and Scalability Balance: Ensure they can deliver tailored solutions that are also scalable and adaptable to future market trends and technological advancements.

- Regulatory Compliance: Verify their understanding of industry regulations (e.g., GDPR, HIPAA) and their ability to design systems that meet all legal requirements.

- Avoiding Vendor Lock-In: Opt for partners offering open-source or flexible technologies, ensuring you maintain ownership of your data and future development options.

- Strong Communication and Cultural Fit: Select a partner who listens, collaborates effectively, and provides constructive feedback while aligning with your company’s values and goals.

Trend 4: The Rise of Personalized Customer Service in Insurance

In 2025, personalization has solidified its position as one of the most critical insurance industry trends.

Customers no longer accept generic policies or one-size-fits-all solutions; they demand tailored offerings that reflect their unique circumstances, preferences, and behaviors.

Research by McKinsey & Company shows that 71% of consumers now expect companies to deliver personalized interactions, and those who do see a 40% increase in customer satisfaction. For insurers, this trend is both an opportunity and a challenge.

In 2025 insurance customers expect their insurers not only to recognize their individual needs and preferences, but also to respond to them by offering products and services tailored to them

To align with these expectations, insurance firms are leveraging consumer data and engaging in cutting-edge customer interactions to deliver customized services.

Let’s explore how personalization is redefining the customer experience.

Harnessing Consumer Data for Tailored Policies

The foundation of personalized insurance lies in data. While traditional policies relied on broad demographic data, today’s insurers have access to a far more diverse range of information, allowing for more nuanced risk assessments and policy customization.

- Behavioral Data: Wearables and fitness trackers provide insights into health and lifestyle habits, helping insurers design tailored health and life insurance products.

- Telematics: Connected cars deliver driving behavior data, enabling insurers to reward safe drivers with lower premiums.

- Social and Environmental Data: Social media activity and geolocation data can offer context around customer behaviors and risks, such as their hobbies or proximity to natural disaster-prone areas.

- IoT Data: Devices like smart home sensors provide real-time information on property risks, such as water leaks or fire hazards, allowing insurers to offer preventative solutions.

By leveraging these unconventional data sources, insurers can go beyond standard metrics like age or income to craft hyper-relevant policies that feel bespoke to each customer or even engage in some proactive actions to minimize future risks.

Investing in digital data collection and implementing advanced analytics are key to securing high-quality, accurate customer data, including sensitive customer data, which subsequently facilitates proactive interventions like:

- identifying policy cancellation risks

- predicting customer behavior

- detecting fraud

- optimizing pricing strategies

With a deep understanding of customer needs, preferences, and potential growth opportunities, insurers can effectively tailor their insurance policies, providing a truly personalized customer service experience.

Usage-Based and On-Demand Insurance Models

The rise of personalization has driven interest in usage-based and on-demand insurance models, which are emerging as critical trends in 2025.

These models allow customers to pay premiums based on actual usage or opt for coverage only when needed, making insurance more flexible and cost-effective.

- Usage-Based Insurance (UBI): Leveraging telematics, UBI tracks metrics such as miles driven, speed, and braking patterns to determine premiums. Drivers who use their cars infrequently or drive safely benefit from lower costs.

- On-Demand Insurance: Ideal for gig workers or occasional travelers, this model offers coverage only for the time it’s needed. For example, a photographer can purchase insurance for a one-day shoot instead of a year-round policy.

These models are particularly popular among younger, tech-savvy customers who value transparency and control over their insurance products. They also allow insurers to expand into previously untapped markets, such as microinsurance for specific events or short-term needs.

GenAI-enhanced Customer Interactions

Generative AI will play an even more significant role in transforming customer interactions and internal operations in 2025. Currently, over 40% of insurance executives already see GenAI’s positive impact on customer experience and productivity. Investments in GenAI will continue to increase in 2025 with 89% of insurers already earmarking budgets to leverage GenAI.

A key area of transformation will be hyper-personalized experiences.

By harnessing AI tools capable of producing natural language responses, insurers can create seamless, conversational experiences across various channels.

- Virtual Assistants and Chatbots: GenAI-powered chatbots can handle complex customer queries, offer tailored policy recommendations, and guide users through claims processes in real-time. For instance, Lemonade Insurance’s AI bot Maya can approve claims in minutes by analyzing customer input and available data.

- Proactive Engagement: AI tools can analyze patterns in customer behavior to anticipate needs and send timely recommendations. For example, an AI assistant might suggest travel insurance a week before a customer’s upcoming vacation based on booking data or inform that there’s a risk of flooding in a given area.

- Personalized Communication: GenAI can craft customized emails, policy updates, and other communications that resonate with individual customers, increasing engagement and loyalty.

These innovations not only streamline processes but also foster a sense of trust and care, showing customers that insurers are paying attention to their specific needs.

Trend #5: Changing Business Models: Embedded Insurance and More

Insurers are constantly seeking new revenue streams, and embedded insurance has emerged as a promising solution.

This approach integrates insurance products directly into the purchase process of non-insurance goods or services, providing coverage at the point of need.

By 2030, embedded Property and Casualty (P&C) insurance sales are projected to reach $70 billion in the United States and $700 billion globally.

Companies like Tesla and Ford are leading the way by embedding insurance into vehicle sales and services. Instead of relying on traditional advertising, they engage consumers with insurance options during the vehicle purchase process, enhancing the customer experience and redefining distribution strategies.

This model benefits everyone: insurers boost sales, while customers can quickly and effortlessly obtain the insurance they need.

Integration with E-commerce and Online Platforms

Where does embedded insurance work best?

Ecommerce and travel sites are among those where this novel approach to insurance can generate significant revenue for insurers.

This integration provides customers with instant access to relevant insurance products, enhancing their overall experience and confidence in the platform.

For example, travel sites can offer trip cancellation insurance during the booking process, while e-commerce platforms can offer shipping protection or extended warranties at checkout.

The challenge is to create embeddable insurance forms that can be modified later if the premium formula requires adjustments.

Platforms like Openkoda facilitate this integration by allowing companies to quickly build customizable embedded insurance systems.

Openkoda’s open source platform enables the creation of embeddable insurance forms that can be easily customized to meet specific business needs.

To see how this works in practice, take a look at this quick demo of the embedded insurance form creation process for travel.

Trend #6: Democratization and Demonetization of Insurance Data

The insurance industry in 2025 is undergoing a transformative shift driven by the democratization and demonetization of data.

This trend refers to the increasing accessibility and affordability of high-quality data, enabling insurers of all sizes to harness insights once reserved for industry giants.

With open data initiatives, IoT proliferation, and advances in AI, insurers can now access diverse datasets at lower costs, fostering innovation and competition.

The result?

More personalized products, refined risk models, and better service for customers.

Alternative Insurance Data Sources

Traditional insurance data often revolved around demographic information and historical claims records. In 2025, insurers are leveraging more and more unconventional data sources to improve their offerings.

Here are a couple of interesting examples:

- IoT Devices: From wearable health trackers to smart home sensors and connected cars, IoT provides real-time data on customer behavior and risk factors. For example, fitness trackers can inform health insurance premiums based on activity levels.

- Satellite and Drone Imagery: These tools are increasingly used to assess property risks, monitor environmental factors, and even validate claims in remote or disaster-prone areas.

- Social Media Activity: With proper consent, social media insights can reveal lifestyle habits, travel patterns, or even customer sentiment toward their existing insurance policies.

- Behavioral Data: Analyzing customer behavior, such as driving habits or spending trends, helps insurers create tailored policies that align with individual lifestyles.

The alternative data market has seen rapid expansion, with a compound annual growth rate estimated at 54.4% from 2022 to 2030. This highlights the rising significance of alternative data in investment choices and the role it plays in optimizing investment strategies for insurers.

Protection as a Service

With access to rich, real-time data, insurers are adopting the Protection as a Service (PaaS) model, which redefines the insurance relationship.

Rather than focusing solely on claims, PaaS emphasizes prevention, real-time risk management, and ongoing protection.

For example, auto insurers leveraging telematics can provide drivers with instant feedback to improve safety, reducing the likelihood of accidents. Similarly, home insurers can integrate smart home devices to alert customers to potential risks, such as water leaks or fire hazards, before they escalate into costly claims.

This shift transforms the insurer-client relationship from transactional to continuous, creating long-term value for both parties.

Predictive Analytics for Asset Allocation

The same data driving personalized policies and proactive protection is also revolutionizing how insurers manage their investments and allocate assets.

Predictive analytics, powered by advanced software and AI, enables insurers to analyze historical trends, market conditions, and customer behaviors to make smarter financial decisions.

For instance, life insurers can use AI models to align their investment strategies with anticipated future payouts, ensuring long-term stability. Property insurers can simulate various economic

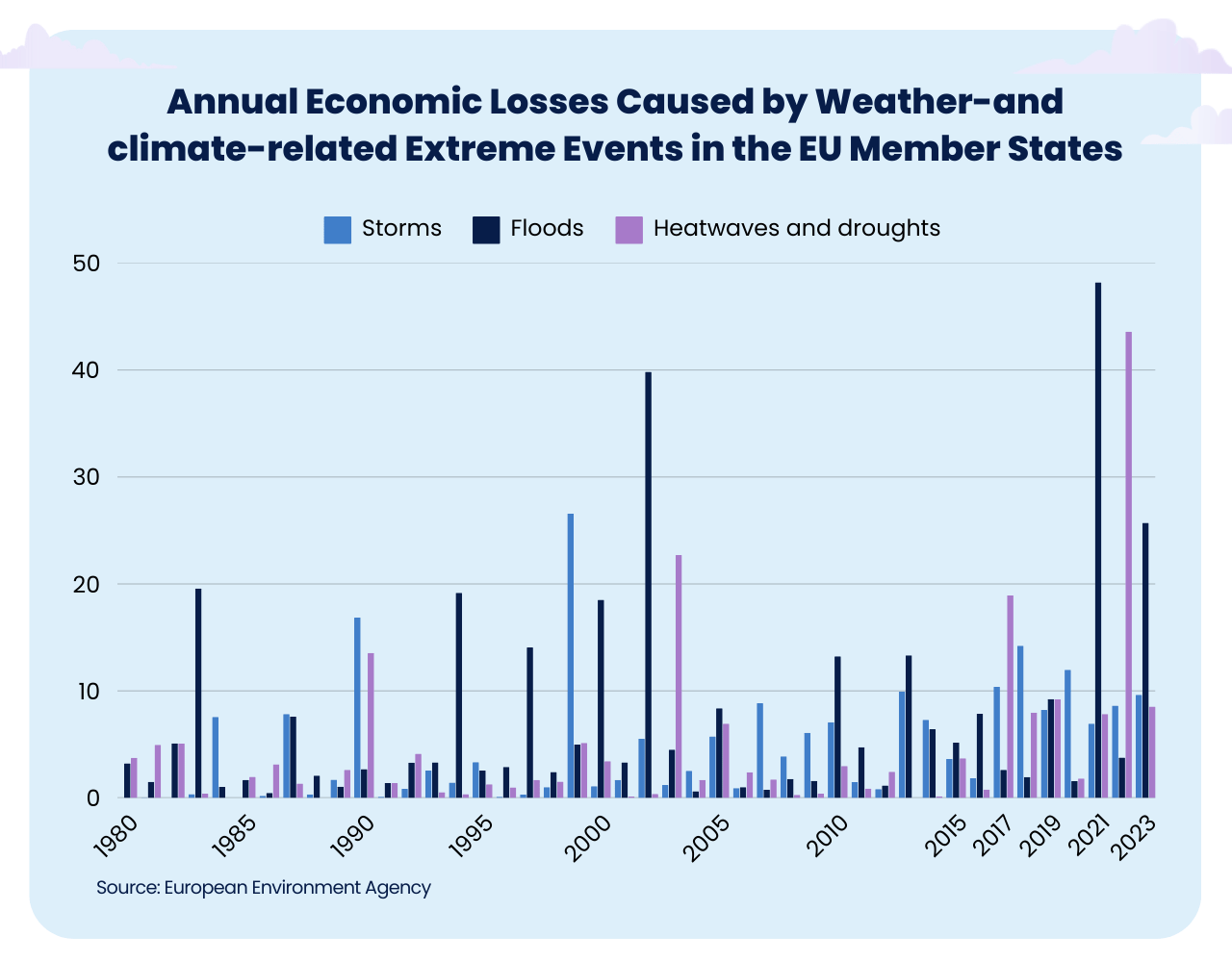

Trend #7: Protecting Against New Emerging Risks

As the world continues to evolve, so too do the risks that insurers must protect against.

Climate change, for example, is posing significant challenges to the insurance industry.

With declining profitability and increased consumer challenges in affording insurance due to climate change impacts, insurers are forced to adapt their strategies. This includes efforts focusing on improved weather event predictions and enhanced risk pricing related to climate change.

In addition to climate change, cybersecurity represents another major emerging risk in the global insurance market

Climate Change Adaptation Strategies

Insurers are adopting a variety of adaptation strategies in response to the escalating threat of climate change.

These include:

- New frameworks to align their risk management with various stages of the risk value chain and state of climate adaptation initiatives

- Developing enhanced forecasting capabilities

- Investing in open-source catastrophe models to improve their ability to manage climate risks.

Insurers are also actively engaging with their clients to foster the adoption of effective climate mitigation measures and elevate their risk consciousness.

Through collaboration with policymakers and regulators, insurers are working to reshape ecosystem rules to better reflect current and anticipated climate challenges.

Insurers are proactively interacting with their customers to promote the implementation of effective climate change mitigation strategies and to raise awareness of the associated risks. They are also working with policymakers and regulators to reform ecosystem regulations to better address current and future climate-related challenges.

[Read also: How to choose the right software development company: checklist]

Cyber Insurance Growth

The rise of cyber insurance is a testament to the expanding digital landscape and its inherent risks.

The cyber insurance market has remained stable despite a rise in ransomware attacks, attributed to effective risk controls by insurers. The persistent cyber threat landscape, highlighted by the escalating frequency of DDoS attacks, underscores the need for robust cyber insurance coverage.

The global cyber insurance market, valued at approximately $11 billion in 2023, is projected to exceed $22 billion by 2027, driven by escalating cybersecurity risks and stringent regulatory requirements.

The emergence of a new cyber Insurance-linked securities (ILS) market, marked by Beazley’s procurement of the first cyber catastrophe bond at USD 45 million in reinsurance coverage in early 2023, highlights the innovative solutions being developed to manage cyber risks. As cyber threats continue to evolve, the cyber insurance market will need to adapt and grow to protect against these emerging risks.

The global cyber insurance market has expanded threefold over the past five years, with gross direct premiums estimated at USD 13 billion in 2022. This rapid growth is expected to continue, with cyber insurance premiums projected to increase to approximately USD 23 billion by 2025.

Summary

The insurance industry in 2025 is undergoing transformative changes driven by technological innovation, evolving customer expectations, and emerging risks.

From accelerating digital transformation and personalization to addressing climate-related and cyber threats, insurers are redefining their strategies to remain competitive and relevant.

At the core of these advancements lies the need for robust software architecture—one that is both agile and adaptable to the ever-changing landscape of insurance.

Frequently Asked Questions

What is the most significant trend affecting the insurance industry?

Driven by the demand for bespoke insurance solutions, the surge of usage-based insurance stands as a prominent trend within the insurance sector. Within that field artificial Intelligence in insurance is acting as a key technological catalyst.

What are the trends in the insurance industry in 2025?

In 2025, the insurance industry is being reshaped by advancements in technology, including the integration of artificial intelligence (AI) and the Internet of Things (IoT) to deliver hyper-personalized products and enhance real-time risk assessment. Embedded insurance solutions are becoming increasingly prevalent, allowing seamless integration of coverage into non-insurance ecosystems such as retail, travel, and eCommerce platforms.

What is going on with the insurance industry?

Due to a combination of weak financial results, escalating inflation, the migration of risks to areas with higher vulnerability, and increasing costs for reinsurance, the property insurance industry is facing considerable strain. These elements are exerting substantial stress on the sector.

What is the role of digital transformation in the insurance industry?

The insurance industry is greatly impacted by digital transformation, which serves to enhance customer experience and support data-oriented decision-making via the utilization of advanced technologies such as AI, big data, IoT, and robotics. This shift not only improves business operations, but also upgrades products and services offered within the sector.

How is personalized customer service being implemented in insurance?

Insurance companies are leveraging consumer data and utilizing AI-driven chatbots along with voice assistants to craft innovative interactions for personalized customer service. By doing so, they can customize their services to meet the unique requirements and tastes of each individual.

Related Posts

Thank you for taking the time to read our blog post!