What Is Insurtech: How Technology Can Reshape Your Insurance Company

What is Insurtech and how is it changing the insurance industry?

With innovative applications ranging from artificial intelligence to big data analytics, insurtech is streamlining underwriting, claims processing, and customer engagement.

This article explores the significant ways in which technology is transforming the insurance industry to make it more adaptable, efficient, and user-friendly.

Contents

Key Takeaways

- Insurtech is experiencing exponential growth and is transforming the traditional insurance landscape through significant investments, with an expected market value of $166.4 billion by 2030. The rate of growth, especially in Asia-Pacific, indicates a global trend towards embracing technology-driven insurance solutions.

- Technological advancements such as AI, IoT, and blockchain are revolutionizing insurance processes, from automated underwriting to claims management, by providing rapid and personalized services, thus enhancing customer experience and operational efficiency across the sector.

- Many insurtech companies are actively pursuing customer-centric solutions and personalization, utilizing big data and digital channels to tailor insurance policies and elevate the customer experience. Collaborations between traditional insurers and insurtech startups are forming to leverage niche market opportunities, despite regulatory and pace challenges.

Understanding Insurtech

Insurtech, a blend of “insurance” and “technology“, refers to the innovative use of technology to streamline and enhance the efficiency during the entire insurance value chain.

It encompasses a wide range of applications and insurance technology.

These include using of big data and analytics to evaluate risk more accurately, to the deployment of mobile apps and online platforms that make buying insurance and filing claims simpler and faster for consumers.

Insurtech startups are at the forefront of this transformation. They offer new tools and services that challenge traditional insurance models with more personalized, accessible, and cost-effective solutions.

For businesses, insurtech means not only improved operational efficiencies and customer experiences but also the opportunity to tap into new markets and revenue streams, as technology enables the development of new insurance products tailored to evolving consumer needs and lifestyles.

The Emergence of Insurtech – Key Statistics

Over the years, the insurtech market has grown exponentially due to the rapid digital transformation in the insurance industry.

Valued at $8.8 billion in 2021, it is projected to reach a staggering $166.4 billion by 2030.

The insurtech space is expanding rapidly, with a projected CAGR of 39.1% from 2022 to 2030, thanks to increasing investments and the entry of new players.

In 2022, the insurtech industry was worth $5.4 billion, and by 2023, it had already attracted $4.5 billion in investments.

This robust funding is a testament to the industry’s potential, attracting both traditional insurance companies and startups. The entry process has been simplified, providing a conducive environment for these players to engage in the insurtech industry.

While North America will lead the insurance technology market in 2021 at over $3.2 billion, it’s not the only region making significant strides in the insurtech sector.

Driven by factors such as growing populations and industries, Asia-Pacific is expected to lead growth by 2030. This global embrace of insurtech underscores its pivotal role in reshaping the insurance landscape.

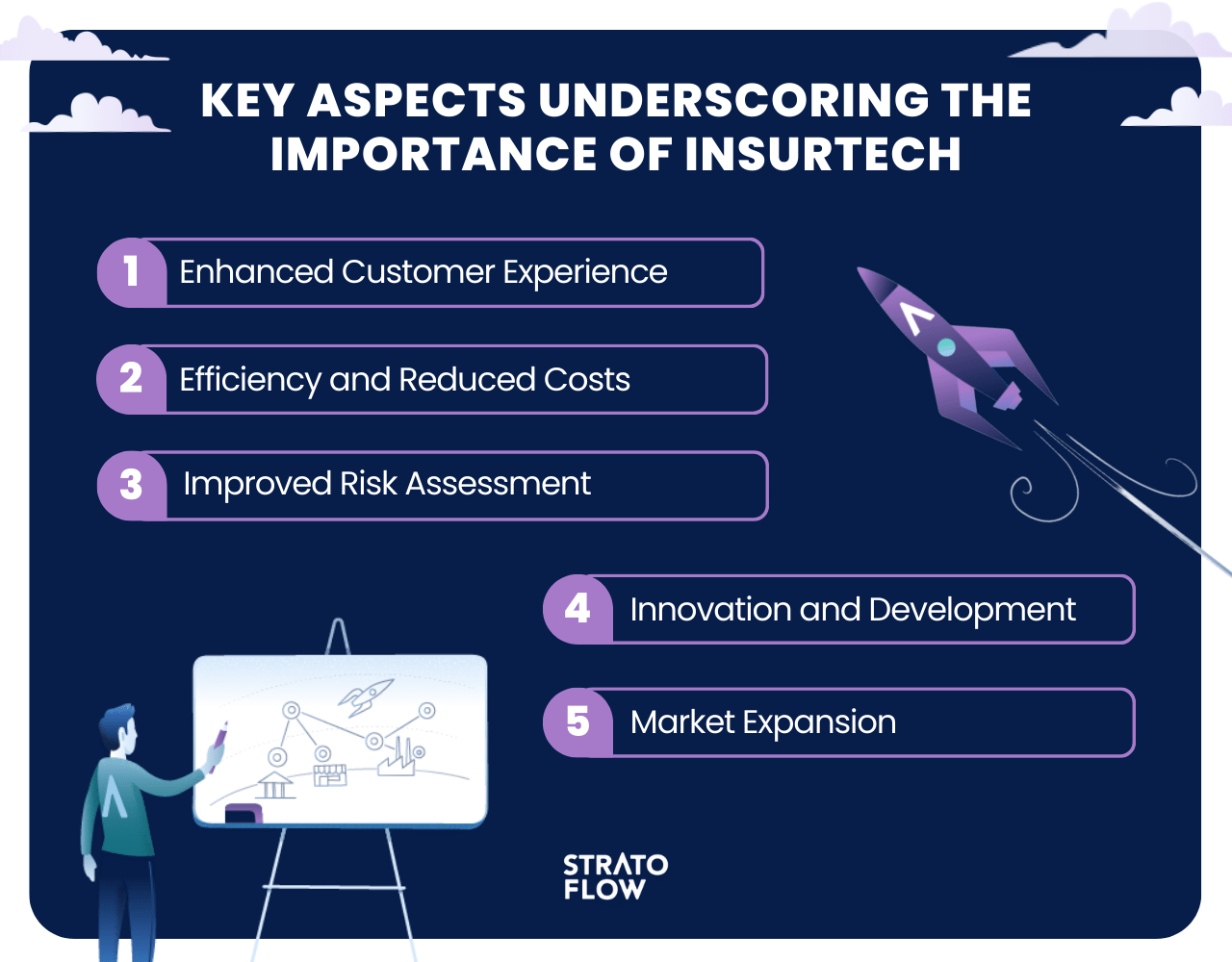

Importance of Insurtech

The emergence of insurtech within the insurance industry marks a significant shift towards incorporating technology to enhance, streamline and innovate traditional practices.

The importance of insurtech is highlighted by several key factors that reflect its role in transforming the insurance industry for the better.

Here is an in-depth look at the key factors that underscore the importance of insurtech in today’s insurance landscape:

- Enhanced Customer Experience

Insurtech uses technology to simplify and speed up the process of purchasing insurance and filing claims, making it more user-friendly and accessible. Customers can get quotes, buy policies, and seek customer support through digital platforms without the need for time-consuming face-to-face meetings or paperwork. - Increased Efficiency and Reduced Costs

By automating processes and utilizing artificial intelligence in insurance for tasks such as data entry, risk assessment, and claims processing, insurtech companies can operate more efficiently than traditional insurers. This not only reduces operational costs but can also lower premiums for consumers. - Improved Risk Assessment

The use of big data analytics allows insurtech agencies, companies and insurance brokers to assess risks more accurately. By analyzing vast amounts of data from various sources, including social media, GPS data, and IoT devices, insurers can offer more personalized policies and pricing models based on the actual behavior and risk profile of individuals. - Innovation and Product Development

Insurtech fosters innovation by introducing new insurance products and models that meet changing consumer needs, such as on-demand insurance for gig economy workers or cyber insurance for businesses. This helps the insurance industry stay relevant in a rapidly changing world. - Market Expansion

Insurtech makes insurance more accessible to underserved markets by lowering entry barriers. Mobile apps and online platforms enable companies to reach customers in remote areas or those who have been excluded from traditional insurance due to high costs or lack of understanding

[Read also: How to Build Insurance Policy Management Software: Expert Guidance]

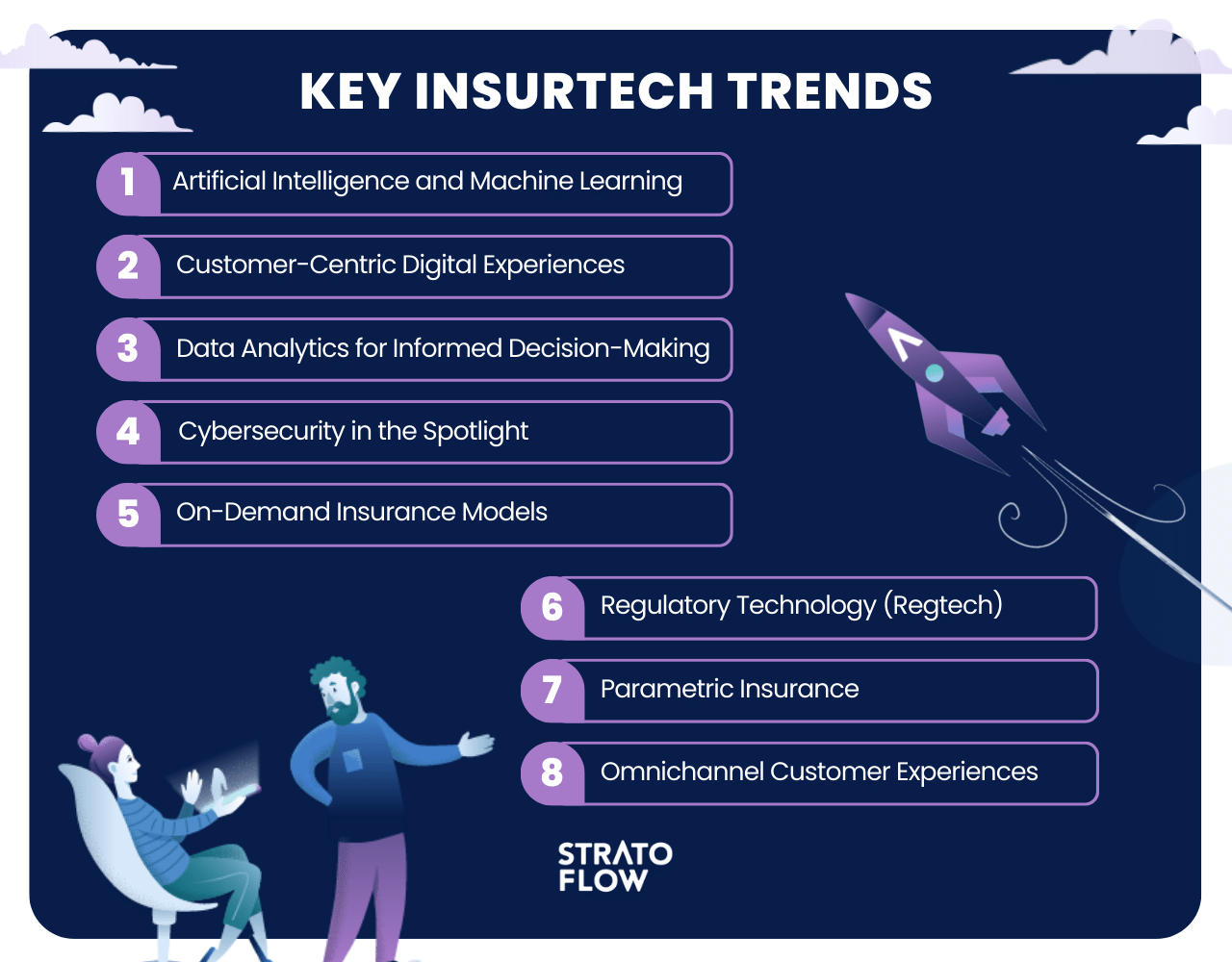

The Future of Insurtech: Trends and Predictions

Insurtech’s future is ripe with immense potential for sustained growth and innovation. Some key insurance trends and advancements in the industry include:

- Cloud computing, which is being leveraged for enhanced scalability and agility

- Adoption of microinsurance models tailored to individual customer needs

- AI-driven solutions, such as the use of chatbots and computer vision for efficient claim processing

- Setting new standards in customer interactions and accuracy in claims handling

These advancements are shaping the future of insurtech and driving innovation in the industry.

The COVID-19 pandemic has also significantly influenced the insurtech market. The value of insurance plans and customer interest in insurance products increased markedly due to the impacts of the pandemic, underscoring the market growth for insurtech.

[Read also: 10 Best Insurance Agency Growth Strategies You Must Know In 2024]

Custom software – a key trend in insurtech in 2024

Custom software is becoming a major trend in the insurtech industry because it allows insurance companies to create solutions that are perfectly tailored to their specific needs and challenges.

Unlike off-the-shelf software, which offers a one-size-fits-all solution, custom software can be designed to fit each insurance company’s unique processes, products, and customer service strategies. This customization helps insurers process claims faster, assess risk more accurately, and provide more personalized service to their customers.

For example, an insurance company can use custom software to automatically adjust insurance premiums based on real-time data from smart home devices or cars, offering customers fairer and more dynamic pricing.

In addition, custom software can integrate seamlessly with existing systems, reducing operational costs and improving efficiency.

In essence, custom software gives insurance companies a competitive edge by enabling them to deliver innovative, efficient, and customized services that meet the evolving expectations of today’s consumers.

[Read also: Off the Shelf vs Custom Software: Pros & Cons + Examples]

Top Insurtech Companies

While the landscape is continually evolving, some of the top insurtech companies known for their innovation, market presence, and transformative business models include:

Stratoflow

Stratoflow is a custom insurance software development company with a focus on crafting bespoke software solutions specifically for the insurance industry.

Leveraging deep expertise in insurtech and financial technology, Stratoflow collaborates closely with insurance companies to develop high-performance insurance software solutions that streamline operations, enhance customer engagement, and drive insurtech innovation.

Stratoflow specializes in developing custom insurance systems such as:

- Insurance Agent Portal Software

- Agency Management Systems

- Software for Insurance Brokers

- Claims Management Software

- Policy Management Software

- Customer Relationship Management Software

Their approach prioritizes understanding each client’s unique challenges and goals, ensuring the delivery of tailor-made, scalable software that aligns with business objectives and propels the insurance sector forward.

Consult your insurance project with us!

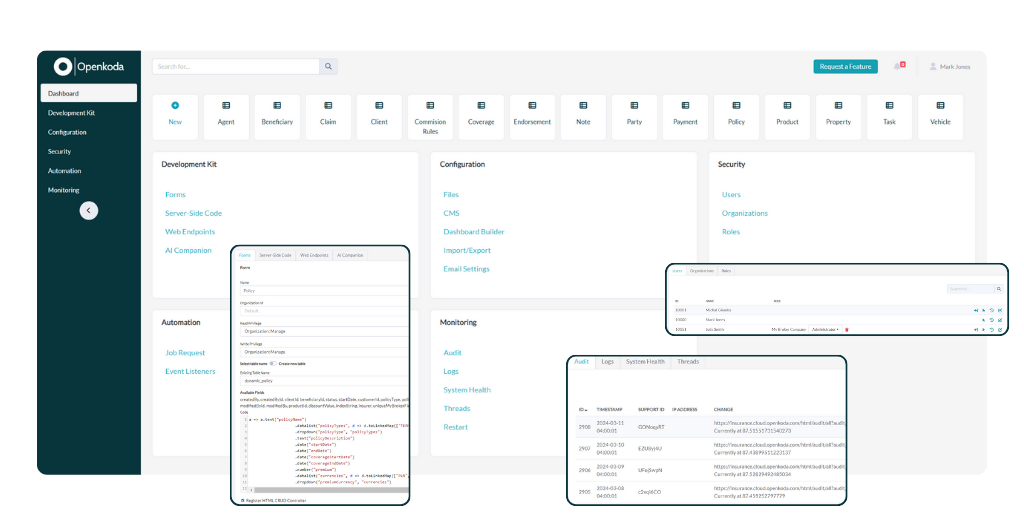

Openkoda Policy Management System – Stratoflow Case Study

A prime example of Stratoflow’s deep understanding of the insurance market is Openkoda Policy Management System – an innovative software tool created by Stratoflow developers and designed for the insurance sector. It leverages a rapid development platform for easy customization and scalability, ensuring businesses can adapt to changes without heavy reliance on the vendor.

Openkoda offers impressive customizability compared to similar solutions as well as an open-source core.

Its key features include:

- A custom platform designed to meet the needs of the insurance companies

- Customizable application core to meet unique business requirements

- An all-in-one toolkit that’s ready to use

- No vendor lock-in thanks to open-source architecture

- AI Companion

These features together allow insurance firms to handle policies with greater efficiency, enhance relationships with clients, and customize the software according to their unique requirements, all the while maintaining data security and ensuring the scalability of operations.

Openkoda gives insurance companies and brokers complete control over their policy management processes, enabling agents to improve their operational efficiency.

Do you think that Openkoda fits your insurance business needs? Check it out today!

Lemonade

Lemonade stands out in the insurtech sector for its use of artificial intelligence and behavioral economics to offer homeowners, pet insurance and renters insurance.

Founded with the mission to make insurance both simple and transparent, Lemonade utilizes a chatbot named “AI Jim” to handle claims and underwriting processes.

This AI-driven approach allows for incredibly rapid claim processing, with a significant portion of claims being paid out in just a few seconds.

Oscar Health

Oscar Health has made a name for itself by focusing on simplifying health insurance and making healthcare more accessible.

Founded on the principle that healthcare should be easy to navigate, Oscar uses technology to provide a user-friendly interface and personalized health care experience. Members can easily manage their health benefits, search for doctors, and schedule appointments through the Oscar app.

Additionally, Oscar offers free telemedicine consultations, allowing members to receive medical advice without leaving their homes.

Collaborative Approach: Insurtechs and Incumbents Working Together

Collaboration between insurtech startups and traditional insurers is becoming the norm.

Such partnerships allow traditional insurers to expand their product offerings and access new distribution channels. This is particularly beneficial as insurtech startups often specialize in niche areas and have established digital platforms.

However, this collaboration isn’t without its challenges.

Differences in scale, pace, cultural practices, and strategic priorities can make the process complex. There’s also the potential for clashes between the innovative drive of insurtechs and the more risk-averse mentalities of traditional insurers.

That’s why, when looking for a technology partner in the insurance industry, insurance executives should find companies that are culturally aligned with your organization and understand your specific needs.

Despite these challenges, the future looks bright.

By 2024, it’s expected that insurtechs will pursue inorganic growth through strategic alliances, mergers and acquisitions. This will facilitate closer collaboration with traditional insurance companies, further fueling the growth of the insurtech industry.

[Read also: How to Streamline Your Insurance Business with Policy Administration System]

Stratoflow – your own insurtech experts

Custom software plays a critical role in the industry, enabling many insurance companies to streamline operations, improve customer service, and effectively adapt to market changes.

Stratoflow is emerging as one of the leading technology companies with a reputation for developing custom software solutions specifically for the insurance industry.

With a commitment to innovation, collaboration and agility, Stratoflow works closely with clients to deliver high-performance, scalable software tailored to their unique needs. Their iterative development approach ensures that solutions are aligned with business goals, maximizing value and efficiency.

Do you have an idea for a custom insurance application? We would love to hear from you to see how we can make your vision a reality!

Summary

In summary, insurtech is revolutionizing the insurance industry.

From its rapid market growth to its innovative customer-centric solutions, insurtech is transforming the insurance landscape, making it more efficient, customer-friendly, and adaptive to modern needs.

It’s a new dawn in the insurance sector, where technology and innovation blend harmoniously to provide a seamless and personalized customer experience. Exciting times are ahead as insurtech continues to disrupt and reshape the industry.

Frequently Asked Questions

What is an example of InsurTech?

Insurtech enables insurance companies to create new types of insurance products, such as cover for rental properties and peer-to-peer insurance.

What is the primary goal of InsurTech?

The primary goal of InsurTech is to use technology and innovation to improve processes, create efficiencies, and boost profitability in the insurance industry, which in turn makes it easier for customers to apply for insurance and save on their policies.

What is the difference between insurance and InsurTech?

InsurTech refers to the integration of traditional insurance and technology, leading to innovative insurance products through advancements in areas like Artificial Intelligence and Blockchain. This has transformed the insurance industry significantly.

What is the impact of InsurTech?

Insurtech has boosted the development of massive amounts of data, impacting businesses’ ability to understand themselves and serve their customers. This has had a big impact on the industry.

What is an InsurTech company?

An InsurTech company leverages technology to drive innovation in the insurance industry, helping companies manage operations more efficiently and reduce costs. Insurance company leveraging insurtech combines insurance and technology, and aims at finding cost savings and efficiency from the current insurance industry model

Related Posts

Thank you for taking the time to read our blog post!