AI Insurance: The Impact of AI on The Insurance Industry In 2024

AI is having on the insurance industry, and now, in 2024, over 90% of companies are already integrating or considering AI to revolutionize their businesses.

This shift towards AI in insurance is not just about staying competitive; it’s about redefining service delivery, the accuracy of risk assessments, and customer engagement.

Join us as we unpack the essential roles AI plays in modernizing insurance, from automating claims to leveraging predictive analytics for better decision-making.

Contents

Key Takeaways

- AI is radically transforming the insurance industry by enhancing customer experiences, reducing operational costs, and improving insurers’ profitability, with over 90% of insurance companies either utilizing or implementing AI technologies.

- AI applications within insurance range from streamlining claims management and fraud detection to leveraging telematics for personalized coverage, with predictive analytics reshaping proactive risk management and policy personalization.

- The advancement and integration of AI in insurance rely on accurate and diverse data, raising significant concerns for data privacy and security. The industry must also navigate ethical and regulatory challenges to ensure transparent and unbiased AI applications.

How Artificial Intelligence is Transforming the Insurance Landscape

Artificial intelligence (AI) is changing the world of insurance in a big way, and it’s arguably the most disruptive of all emerging technologies.

Soon, from the moment a policy is underwritten to the time a claim is settled, AI will be able to improve customer satisfaction, reduce operational costs, and boost insurers’ bottom lines.

The ripple effect of AI’s influence is particularly evident in the health insurance sector, where providers are finding innovative ways to streamline operations, mitigate risk, and deliver a superior customer experience.

This evolution is more than just a competitive advantage; it’s a necessity for insurers to adapt and thrive in an ever-changing landscape.

In the insurance value chain, AI technologies are proving to be a game changer.

AI models not only optimize insurance processes, but also enable insurers to unlock new value streams and redefine the role of insurance agents. The use of AI tools across the industry is paving the way for more responsive, customer-centric service models, setting a new standard for how insurance is delivered. Find out what tools offer AI solutions: The Best Insurance Agency Management Systems You Must Know.

AI In Insurance Industry – Key Statistics

The numbers speak loudly: AI’s invasion of the insurance sector is in full swing as insurtech is becoming a backbone of business operations. Over 90% of insurance companies have either already welcomed AI into their fold or are in the process of doing so, leveraging AI tools to enhance their offerings and operations.

The market value of AI in the insurance sector is projected to reach USD 35.77 billion by 2030, with a Compound Annual Growth Rate (CAGR) of 33.06% during the forecast period.

This growth is driven by the increasing use of AI in chatbots, claims management, and investigation, emphasizing the transformative impact of AI on the industry.

The statistics prove that we are entering a new era where AI solutions are as commonplace in the insurance sector as policies and premiums.

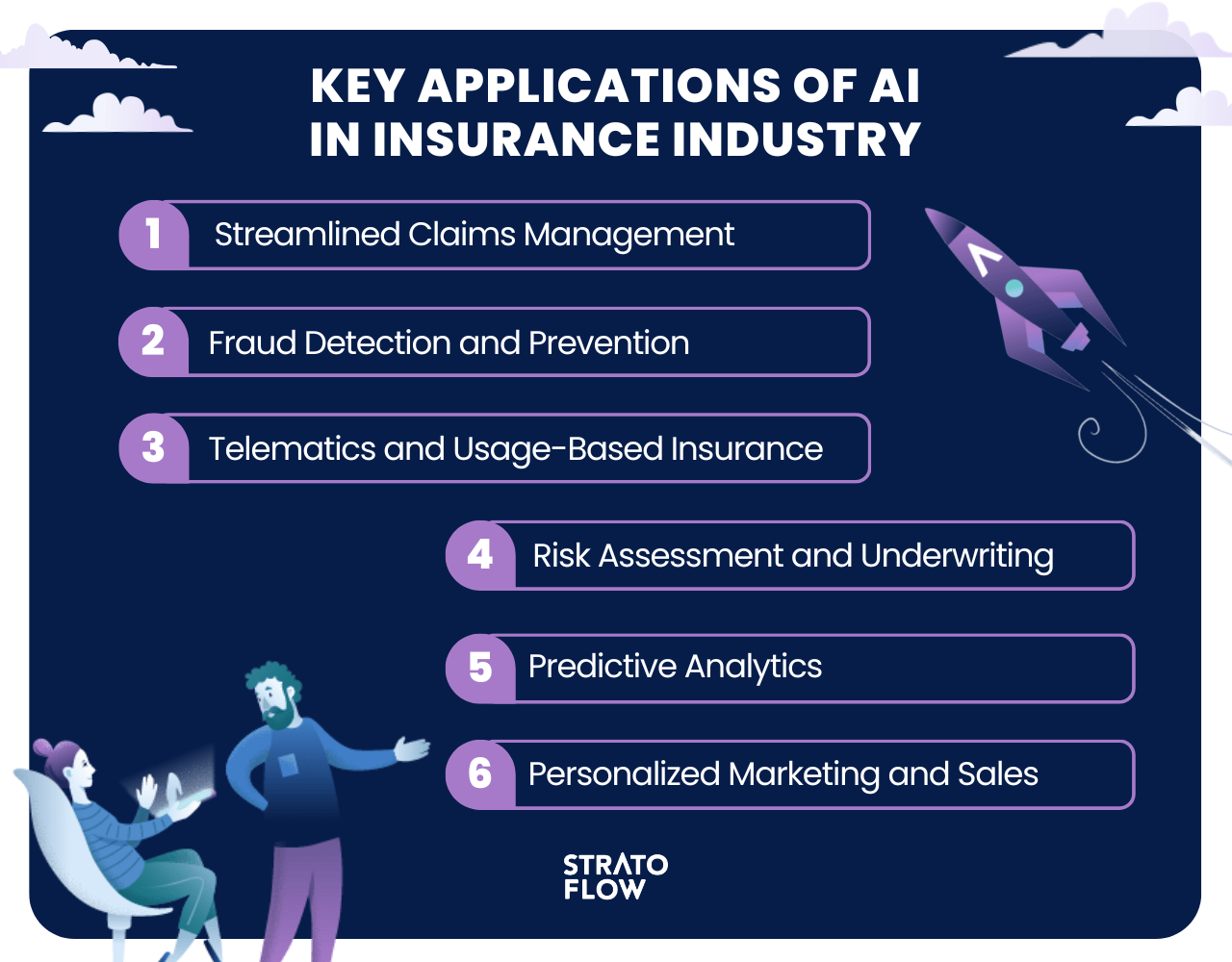

Key Applications of AI in Insurance

Insurance providers are tapping into the power of machine learning techniques and advanced analytics to:

- Enhance insurance processes

- Pioneer new insurance solutions that align with modern customer expectations

- Streamline claims management

- Detect fraud

- Leverage telematics to conduct risk assessments

AI applications are abundant and transformative in the insurance industry.

One of the most pivotal shifts aided by AI is the transition from traditional policy models to continuous coverage cycles that adapt to an individual’s behavioral patterns.

This is complemented by the capacity of machine learning models to analyze more abstract data sources, such as social media or customer reviews, providing a more nuanced understanding of risks.

The drive to integrate new technologies like AI into the insurance value chain is fueled by the pursuit of expanded market share and optimized profitability.

Levering AI for Rapid Software Development

Low-code has been a major trend in software development, and it’s role will only grow in the near future.

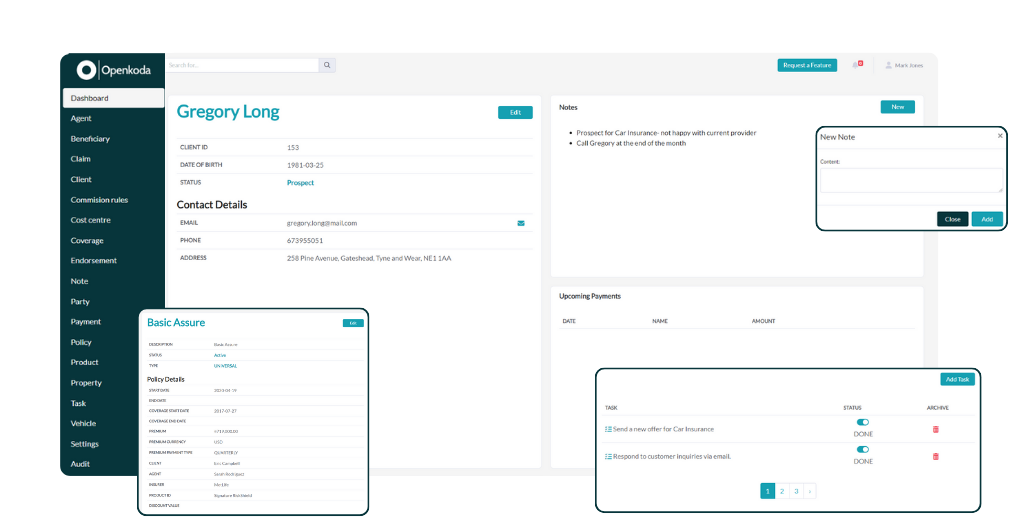

But with the emergence of generative AI, low-code is about to enter a new and exciting era. A glimpse of what this could mean for the insurance industry can be seen in Openkoda’s Insurance Policy Management Software.

Openkoda Insurance Agency Management System is an innovative, AI-enabled software designed to meet the evolving needs of insurance brokers and agencies. Its low-code core allows for significant expansion and customization, making it adaptable to a business’s growing needs without the risk of vendor lock-in. Users can own and modify their code, ensuring flexibility and independence. The addition of an AI companion automates and simplifies tasks like report generation and client communication, enhancing efficiency and service quality.

Need another feature for your super-specific use case?

With AI companion that’s not an issue.

You can quickly and efficiently develop and deploy additional features without a lengthy development process. That’s an area where generative AI can really improve the business efficiency of insurance companies in a tangible way.

Sounds interesting?

Check out Openkoda for yourself today!

Improved Data Management and Processing Through Generative AI

Let’s stay with Openkoda for a while and talk about an interesting use of generative AI technology in this system.

Let’s say you need to generate a report about the payments due for this month that would display the results in three columns: UNPAID, PAID, and PENDING and include all of the basic information on the clients.

Normally you would need a person who is well versed in SQL to write a custom query and it might take them 15-20 minutes. Not bad, but with the power of AI we can do better.

In Openkoda there’s AI reporting functionality built in. It works by using LLM to generate SQL queries from the natural language prompts. User can just ask for a table with all the required fields and AI will do the rest.

But wait, what about data security? Surely uploading customer data to the Open AI’s servers can’t be a good idea.

You’re right, and Openkoda has thought about that, too.

The only information that Openkoda AI Reporting uses to generate SQL queries is the names of tables and their types, without going through any actual records. Then you execute the SQL query directly against your database, without the need for uploading the sensitive data anywhere.

So what kind of time savings are we talking about in this example?

The initial 15-20 minutes it would take to create an SQL statement the traditional way, we can cut that time to 1-2 minutes, all thanks to the power of AI. This 10x increase in efficiency really underscores the transformative power of generative AI adoption in some specific scenarios within the insurance industry.

Personalization of Insurance Products

One of the prominent manifestations of Artificial Intelligence (AI) in the insurance industry is the development of tools that significantly enhance the personalization of insurance products.

Personalization has been a trend in fields like ecommerce but in 2024 it’s starting to make an influence in the insurance market as well.

These AI-driven tools leverage vast amounts of data, including personal information, lifestyle habits, and risk factors, to tailor insurance offerings to meet the specific needs and preferences of individual customers. By analyzing this data, AI algorithms can identify unique customer profiles and predict their specific insurance requirements, enabling insurers to offer highly customized policies. This level of personalization not only improves customer satisfaction by providing them with products that closely match their needs but also optimizes pricing strategies, making insurance more affordable for some and adequately priced for higher-risk individuals.

According to McKinsey, companies that excel in personalization can generate up to 40% more revenue from these activities compared to average players.

But make no mistake, there are hardly any ready-made tools of that kind available on the market.

If you want to harness the power of personalization you have to go for the customized approach.

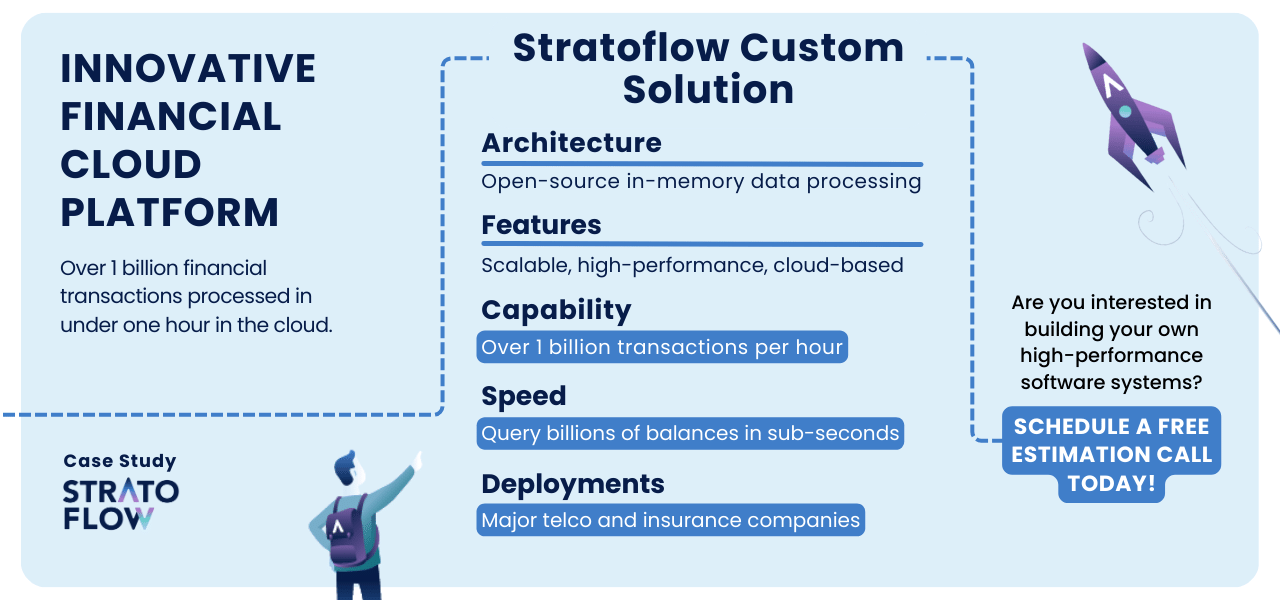

It is why partnering with a custom insurance software company like Stratoflow becomes invaluable. Stratoflow specializes in developing bespoke software solutions tailored specifically to the needs of an insurance provider. Working with such a company allows for the creation of a personalization tool that is not just another generic application but one that aligns perfectly with the unique business model, customer base, and strategic goals of the insurer.

Investing in a tailor-made personalization tool through a partnership with a specialized software company can be a true game-changer. It not only makes an insurance company stand out from the competition but also sets the stage for enhanced insurance agency growth, customer loyalty, and market leadership.

Check out what Stratoflow can do for your insurance business!

Streamlined Claims Management

First of all, AI can transform the claims process into a more efficient and customer-friendly operation.

By automating tasks like damage assessments and document processing, AI is significantly reducing the time and human error associated with claims processing. This automation extends to the entire claims workflow, from intake to settlement, diminishing the manual labor involved and thereby cutting costs.

Moreover, predictive models in claims management software solutions utilizing AI are reshaping how insurers handle claims, enabling them to:

- Identify complex and high-cost cases early on

- Improve the accuracy of claims decisions

- Prioritize based on urgency, which is crucial for both insurers and policyholders

That’s what we have available today, but what about the future? Shortly visual analytics tools, powered by AI, swiftly evaluate photos and videos, accelerating preliminary investigations and fraud detection, leading to a more efficient claims process and the identification of fraudulent claims.

The top market leaders have already started adopting to this change.

According to latest studies, 90% of insurers are already adopting machine learning algorithms for claims and underwriting tasks. This really speaks volumes about the critical role of AI in modernizing the commercial insurance industry.

[Read also: How to Build Insurance Policy Management Software: Expert Guidance]

Fraud Detection and Prevention

AI also excels in its ability to analyze patterns and anomalies in vast datasets, and that skill is essential for identifying fraudulent activities.

Through advanced analytics and machine learning, AI systems scrutinize data patterns to unearth irregularities that may indicate fraudulent activity. The ability of AI to adapt to new fraud tactics while minimizing false positives is a significant step forward in risk management.

What’s more, the future promises automated decision-making for routine approvals or fraud rejections, allowing human adjusters to focus on more complex cases.

In an arms race against increasingly sophisticated digital fraud, AI is constantly evolving.

Systems are being developed to spot manipulated images and deepfakes within the claims submission process. Companies like Metromile are already harnessing AI for fraud detection, accelerating claims handling, and ensuring that customer service tools are fortified with multiple layers of fraud prevention.

Telematics and Usage-Based Insurance (UBI)

Telematics involves collecting data on an individual’s driving habits directly through in-vehicle devices.

By analyzing real-time data from connected devices, insurers can offer personalized coverage and pricing that reflects actual driving behavior, and establishing more equitable insurance models. This technology not only benefits individual drivers (those driving safely will see a significant decrease in their fees) but also has significant implications for commercial fleets.

The interplay between AI and telematics is particularly effective in combating issues like distracted driving, as AI can provide actionable insights to both the insurer and the insured. The result is a dynamic insurance process that not only tailors to the individual’s needs but also promotes a culture of safety and responsibility on the roads.

Risk Assessment and Underwriting

AI can also enhance the underwriting process by enabling more precise risk assessments.

AI’s predictive models harness extensive data to identify potential risks and forecast trends with a degree of accuracy previously unattainable. Insurance companies are leveraging this capability to categorize customers into specific pricing groups and adjust premiums accordingly, creating a more nuanced and fair underwriting process.

Keep in mind that the reliability of these AI systems hinges on the accuracy of the data they utilize, making data quality paramount. If your company is lacking in that regard consider data modernization in insurance.

Additionally, AI tools can sift through large volumes of complaint data, pinpointing trends and enabling insurers to proactively address customer dissatisfaction. This proactive approach not only benefits the insured by ensuring fairer treatment but also positions insurance companies to mitigate risks more effectively.

Predictive Analytics

Harnessing the predictive power of artificial intelligence, insurance carriers are now able to not only react to trends and risks but also to anticipate them.

By analyzing historical data and employing machine learning techniques, AI can provide forecasts that inform business strategies and pricing adjustments. The integration of predictive analytics into the insurance industry signifies a monumental shift towards proactive rather than reactive management.

The applications of predictive analytics in insurance are vast, ranging from fraud detection to natural language processing, which can interpret unstructured data like social media posts or customer service transcripts.

Data scientists, equipped with generative AI and deep learning models, are at the forefront of this analytical revolution, crafting machine learning models that translate massive amounts of data into actionable insights. This evolution in data analysis is reshaping customer expectations and pushing the boundaries of what’s possible in risk management and policy personalization.

Personalized Marketing and Sales

Last but not least we have to talk about marketing – the field that has been influenced by AI the most, and that applies to insurance companies as well.

Advanced analytics allow for a deep dive into customer data and preferences, revealing insights that lead to highly tailored policies and improved customer retention.

This level of personalization is not only key to business growth but also enhances the customer experience, making insurance more relevant and responsive to individual needs.

AI-driven customization doesn’t stop at policy offerings; it extends to customer interactions.

Machine learning algorithms can shape policies based on individual client behavior and lifestyle patterns, ensuring a level of precision that reduces human error and increases satisfaction. Additionally, AI-powered chatbots and virtual assistants are revolutionizing customer service by providing real-time assistance and policy recommendations, further solidifying the bond between insurer and policyholder.

[Read also: Top Software for Insurance Brokers in 2024]

Value of Custom AI Software Solutions for Insurance Industry

The bespoke nature of custom AI software solutions presents a valuable proposition for the insurance industry.

These tailor-made tools are designed to address specific challenges and opportunities within an insurer’s specific niche, automating workflows, and optimizing human-in-the-loop processes. Tailored software supports nuanced risk assessment, policy customization, and enhanced customer engagement, ultimately enabling insurers to more effectively serve their target markets and achieve their business objectives.

Custom AI solutions in the insurance industry can:

- Mitigate fraud

- Enhance the customer experience

- Speed up processing times

- Improve decision accuracy

By utilizing custom AI solutions, insurance companies can gain a competitive edge in the market.

Moreover, AI-driven software systems like compliance solutions help navigate the complex and ever-changing regulatory landscape of the insurance industry, ensuring auditability and transparency. These technologies offer several benefits, including:

- Automating data analysis and repetitive tasks, which supports business efficiency

- Enabling a decentralized workforce, allowing secure and instant access to claims data from anywhere and facilitating collaboration among insurance professionals

- Creating a more streamlined operation that can rapidly respond to client needs and market changes

Stratoflow – Your Guide in Developing AI-Enabled Insurance Software

At Stratoflow, we pride ourselves on being experts in crafting tailored software solutions for the insurance industry, including systems that harness AI technology.

In our insurance software development projects prioritize performance, ensuring our software operates smoothly even under heavy loads. Our approach emphasizes collaboration and agile methodologies, allowing us to deliver solutions that not only meet but exceed our clients’ expectations.

If you have your own concept for insurance software system leveraging AI technology get in touch with us! Let’s discuss how we can transform your vision into reality!

The Role of Data in AI-Driven Insurance Solutions

As AI continues to establish its dominance in the insurance sector, the role of data becomes increasingly central. The explosion of data from connected consumer devices offers unprecedented opportunities to refine client understanding, support new product categories, and introduce personalized pricing models. However, the power of AI-driven insurance solutions hinges on having access to accurate and diverse data that can feed the advanced analytics engines.

The veracity and variety of data are the building blocks upon which AI models make reliable risk assessments and policy decisions. Data scientists are the architects of this new era, tasked with the critical responsibility of ensuring data accuracy and managing the vast data assets that power AI applications. It’s a delicate balance between leveraging more data for more accurate assessments and maintaining the integrity and security of that data.

Importance of Accurate and Diverse Data

The saying ‘garbage in, garbage out’ holds particularly true when it comes to artificially intelligence.

The importance of accurate and diverse data cannot be overstated, as it is the foundation upon which AI tools build their analyses and predictions. This diligence is essential for AI systems to provide more accurate assessments and avoid the pitfalls of biased or incomplete data sets.

The pursuit of extensive data is not without its challenges, as insurers must navigate the collection and utilization of non-traditional data, such as from wearable devices or other forms of massive amounts of unstructured data.

The goal is to enrich the decision-making process with as much relevant information as possible, while also safeguarding the accuracy and reliability of the insights gleaned from that data and being mindful of data usage.

[Read also: Complete Guide to CRM for Insurance Agents [+ 6 Best CRMs]]

Data Privacy and Security Concerns

Apart from the quality of the data used by AI systems another key aspect of it is security.

The insurance sector, with its vast collection of personal data, must tread carefully to avoid breaches that can have far-reaching effects on policyholders and the industry as a whole. Navigating AI-related liabilities is complex, with the potential for unintentional biases in underwriting and claim settlement processes requiring vigilant oversight.

To manage these risks, the insurance industry is exploring strategies for robust data governance. This includes:

- Establishing high standards for data quality, security, and regulatory compliance

- Earning policyholder trust through proactive measures to ensure privacy, security, and fairness

- Implementing ethical AI practices at the core of this effort, laying the groundwork for a future where AI-enabled insurance solutions are both powerful and trusted.

Preparing for the Future: AI Trends in Insurance

As the insurance industry looks to the horizon, it’s clear that AI will continue to be a transformative force as it’s one of the key trends in the insurance industry.

The near future promises novel AI applications, such as generative AI, that will further disrupt traditional models, leading to innovative products, new data sources, and improved operational processes. Insurers are bracing for this shift by formulating robust data strategies and fortifying their technological infrastructure to support a rapidly evolving AI landscape.

Younger generations, with their digital-first mindset, are driving demand for a seamless user experience. Insurers are responding by focusing on digitalization and leveraging AI to enhance omnichannel customer engagement.

These efforts are complemented by recent advances in AI technology, such as OpenAI’s ChatGPT and Google’s Bard, which are expanding the capabilities of AI beyond current narrow – AI applications and offering a glimpse into the future of the insurance sector.

[Read also: Insurance Digital Transformation: What is the Future of Insurance Technology]

Generative AI Disruption

Generative AI is one of the most exciting developments on the technology horizon.

Advances in machine learning and deep learning are empowering AI to create content, predict outcomes, and interact with users in ways that were previously the exclusive domain of human intelligence. OpenAI’s ChatGPT and Google’s Bard are just the beginning of this new wave of AI, hinting at a future where machines can generate insights and solutions with minimal human interaction.

This new technology is not without its challenges, as the insurance industry must prepare for the implications of AI that can reason, negotiate, and even empathize. Generative AI is poised to redefine the landscape, introducing new ethical considerations and potentially reshaping the role of professionals within the industry.

Ethical Considerations and Regulatory Challenges

The journey into the AI-augmented future of insurance is not without its ethical considerations and regulatory hurdles.

Transparency in AI decision-making processes is paramount to ensure that customers understand how their data is used and how decisions that affect their coverage are made. Insurance providers must strive for unbiased decision-making, and this requires a collaboration between AI and human intelligence to review and validate AI-generated insights.

Regulatory frameworks are also evolving to keep pace with AI’s advancement. Insurers must navigate these frameworks carefully, balancing the desire for innovation with the imperative of consumer protection. As data sharing ecosystems expand, aligning with common regulatory and cybersecurity standards becomes a crucial challenge that insurers must address. Adhering to both global ethical standards and local compliance requirements is essential for the responsible deployment of AI in the insurance sector.

Summary

To wrap up, artificial intelligence is not just altering the insurance industry; it’s revolutionizing it.

By enabling insurers to streamline processes, customize policies, and enhance the customer experience, AI is driving the industry towards a future that’s more efficient, responsive, and equitable.

With the solid foundation of accurate and diverse data, coupled with ethical practices and regulatory compliance, AI is poised to deliver unprecedented value to both insurers and policyholders.

Frequently Asked Questions

How is AI being used in insurance?

AI is being used in insurance to rapidly determine claims, forecast costs, assess risk, detect fraud, and enhance customer service through virtual assistants or chatbots. This technology is revolutionizing the industry by enabling automation and optimizing claims.

Will AI replace life insurance agents?

No, AI is more likely to be integrated as a tool for augmented intelligence in the life insurance industry, combining the strengths of human agents with analytical power of AI to create a synergistic relationship.

What is the insurance term AI?

AI in insurance refers to the use of artificial intelligence in claims processing, enabling insurers to process claims more efficiently and quickly. This technology utilizes big data sets to achieve rapid claim processing.

How Generative AI can help insurance companies?

Generative AI can help insurance companies by improving risk assessment, data-driven product development, cost reduction, and providing data analysis and insights. It can also assist in identifying patterns and anomalies in data for fraud detection and risk assessment, leading to better underwriting decisions and prevention of fraudulent claims, ultimately reducing financial loss.

What are the key applications of AI in the insurance sector?

AI is used in the insurance sector for streamlined claims management, fraud detection, risk assessment, predictive analytics, and personalized marketing and sales strategies. It helps in improving efficiency and accuracy across various aspects of the industry.

Related Posts

Thank you for taking the time to read our blog post!