Top Software for Insurance Brokers in 2024

In the dynamic world of insurance brokerage, selecting the most adept software for insurance brokers is the key to success. If you’re looking to optimize your business, this no-fluff guide provides a critical analysis of top-notch software solutions that will drive your agency ahead in 2024. Expect to uncover features, benefits, and considerations that matter, easing your journey towards a well-informed decision.

Contents

- Top Insurance Broker Software Solutions

- Insurance Policy Management System

- Key Features to Look for in Insurance Broker Software

- Implementation and Customer Support

- Pricing Considerations

- Benefits of Using Insurance Broker Software

- Integrating Insurance Broker Software with Existing Systems

- Key statistics about Insurance software for brokers

- Tips for Choosing the Right Insurance Broker Software

Key Takeaways

- Innovative insurance broker software solutions such as Openkoda, Applied Epic, and Zoho CRM can significantly enhance policy, claims, and relationship management, enabling agencies to thrive with efficiency and agility.

- A successful software implementation requires careful planning, from selecting the software and setting up user training to ensuring ongoing support and updates to facilitate growth and integration with existing systems.

- The right insurance broker software can lead to increased productivity, improved customer engagement, streamlined workflows, and competitive advantages in the rapidly evolving insurance market.

Top Insurance Broker Software Solutions

Stepping into the digital arena, insurance brokers are met with an arsenal of software tools designed to elevate their business operations.

From the robust policy management systems to the cutting-edge customer relationship platforms, the insurance broking software solutions of today cater to every nuance of the insurance industry.

From the extensive array of software tools available, there are a handful that stand out as the premier choices for insurance brokers in the year 2024:

- Policy management systems

- Customer relationship platforms

- Claims management software

- Quoting and underwriting tools

- Document management systems

These tools can streamline processes, improve efficiency, and enhance customer service for both insurance brokers and independent insurance agents in the insurance brokerage industry.

Let’s explore the top insurance agency management software that are essential for brokers and contemporary insurance agencies and understand what sets them apart in the industry.

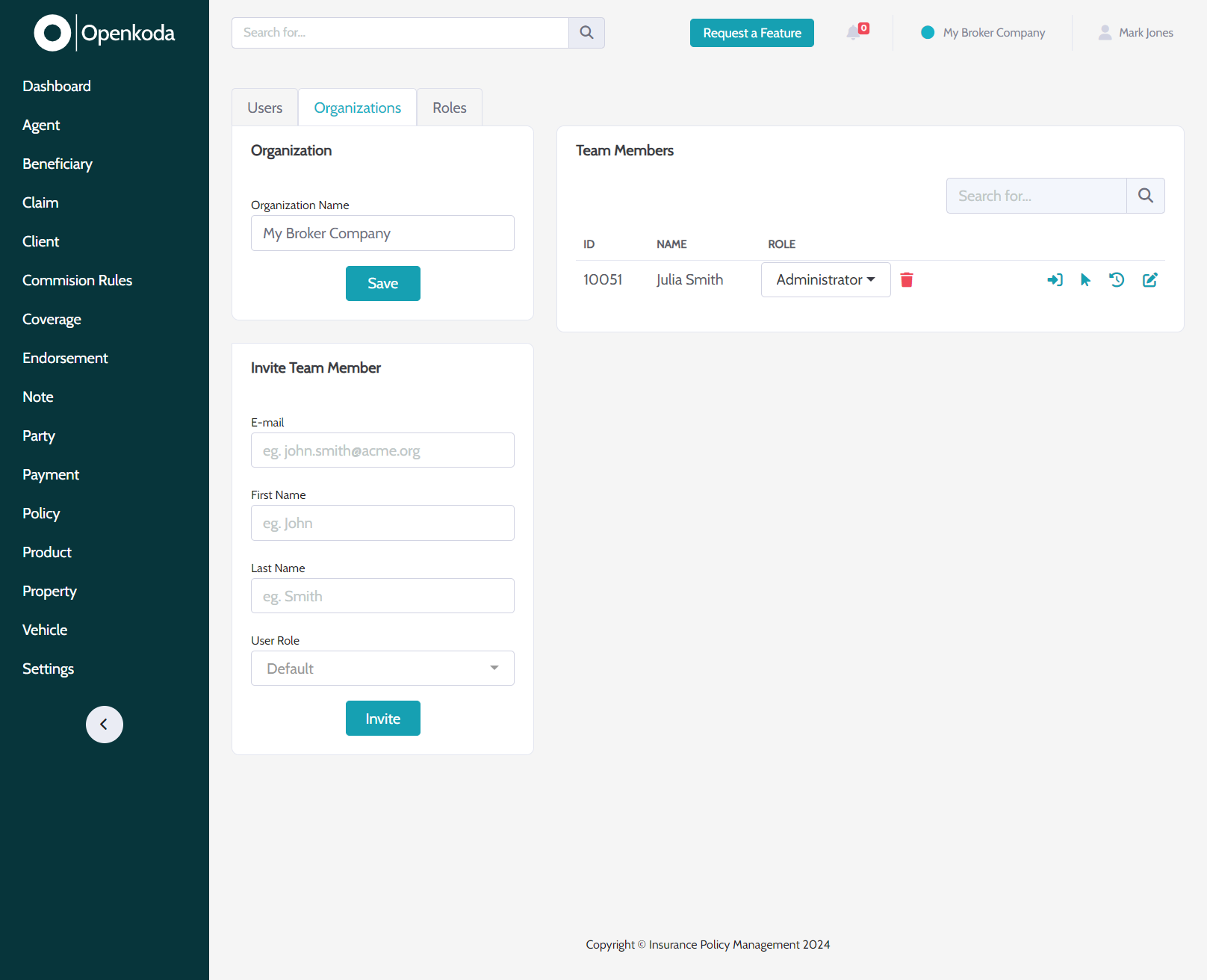

Openkoda Insurance Policy Management System

At the forefront of innovation is the Openkoda Insurance Policy Management System, an AI-powered insurance software system that is redefining policy management.

Key features of Openkoda include:

- Fully customizable platform designed for the dynamic insurance industry

- The capability to precisely tailor and enhance operational workflows

- Possibiloty to request new features tailored to your specific business needs

- Complete ownership and control of policy administration

- Ready-to-use suite of tools

- No vendor lock-ins

- No user-based pricing

- AI Companion

With Openkoda software solution, insurance agencies can take full control of their policy administration and empower brokers to streamline their operations.

Openkoda’s customizable 360 degree dashboard enables real-time monitoring and analysis of key performance indicators. This dashboard is designed not only for oversight, but also for deep interaction.

Complementing the dashboard, Openkoda’s intuitive document management tool streamlines the handling of the vast amounts of paper and digital documents typical of the insurance industry. This tool simplifies the organization, storage and retrieval of documents, making it easier for agencies to maintain compliance, reduce errors and improve customer service.

Going one step further, Openkoda integrates an AI-driven feature that guides the creation of personalized emails to customers. This ensures that communications are not only timely and relevant, but also tailored to each customer’s unique needs and preferences, improving the customer experience and fostering stronger relationships.

In addition, the platform includes smart alerts that proactively notify users of critical events, deadlines, or anomalies detected in operations. These alerts are customizable, ensuring that each agency can set them to focus on what is most important to their business.

What is more, The Openkoda platform facilitates the modernization of legacy systems. By replacing outdated and inefficient systems, you gain access to cutting-edge technology and streamline your processes through increased speed and automation.

Applied Epic

Applied Epic insurance agency software emerges as a game changer in managing multiple business lines, acting as the central system that unifies data and processes across diverse insurance operations. Its extensive capabilities are not just limited to property & casualty but extend to benefits brokerage as well, providing tailored screens for nuanced sector requirements.

With its advanced automation and customer relationship management tools, Applied Epic ensures that tedious processes are a thing of the past, offering agencies a panoramic view of their client interactions and a strategic edge in the market.

Zoho CRM

Zoho CRM stands out as a versatile player in the field, boasting robust customization options that mold perfectly to the unique demands of insurance agencies. Its sales automation and contact management tools are not just about data – they’re about improved client relationships.

The platform’s cloud-based software ensures that your customer engagement and experience are not bound by the office walls but can soar high with the flexibility and accessibility offered by Zoho CRM.

AgencyBloc

Specifically designed for life and health insurance agents, AgencyBloc is the cloud-based software that brings policy and contact management into the modern age. With features like automatic email campaigns and analytics tools, it’s the perfect management solution for brokers who are looking to streamline their workflow and keep a pulse on their business’s performance.

Radiusbob

Radiusbob enters the stage as a comprehensive CRM solution tailored to insurance brokers’ needs for rapid growth. The platform’s robust lead management system and centralized database ensure that brokers can manage their clients’ journeys from prospects to loyal customers.

With automated email campaigns and customized workflows, Radiusbob positions itself as a pivotal tool for brokers who aim to excel within a few months, not years.

Insureio

In the quest for a streamlined insurance management solution, Insureio stands tall with its cloud-based agency management system. It’s designed to simplify the intricate web of policy tracking and management, ensuring that insurance brokers can keep their focus on crafting the best insurance deals and providing top-tier service.

Freshsales (formerly Freshworks CRM)

Freshsales rounds out the list with its no-cost entry point, making it a highly attractive option for insurance agencies on a budget. As a flexible CRM platform, it provides dynamic contact management tools and sales automation features that help insurance brokers close deals efficiently and foster lasting client relationships.

Key Features to Look for in Insurance Broker Software

As the software landscape for insurance brokers continues to evolve, identifying the key features that will drive your agency forward becomes crucial.

A centralized contact database is the cornerstone of any insurance management solution, ensuring that up-to-date customer information is always at your fingertips.

Lead management tools, CRM systems, and policy and claims management functionalities form the backbone of a strong insurance broker software, each playing a pivotal role in streamlining your business operations, including marketing management.

Implementation and Customer Support

The transition to a new insurance broker software system is a significant milestone for any agency, and it’s one that comes with its own set of challenges and considerations.

From selecting an implementation strategy to preparing your team for the changes ahead, every step must be carefully planned and executed.

Training, testing, and quality assurance are critical components of a successful software launch, ensuring that your team is ready to capitalize on the new system’s capabilities from day one.

Post-implementation support is equally important, providing the assistance and updates necessary to scale the software with your business.

Pricing Considerations

Navigating the financial landscape of insurance brokerage software can be as complex as the policies you manage.

With pricing models ranging from flat fees to scalable costs, and the potential for significant customization costs, understanding what you’re investing in is paramount.

Installation, setup, and ongoing maintenance all contribute to the total cost of ownership, underscoring the need for a comprehensive assessment of both immediate and long-term financial implications.

In addition, you have the option to choose between user-based pricing and open source solutions like Openkoda, where costs can vary based on usage, giving you the flexibility to adapt to your organization’s specific needs and budget constraints.

Benefits of Using Insurance Broker Software

The benefits of integrating insurance broker software into your business cannot be overstated. Here are some of the key benefits:

- Enhanced agent productivity

- Improved customer engagement

- Efficiency and growth with streamlined workflows

- Better team collaboration

- More effective management of insurance policies

- Customized functionalities

Agencies that leverage advanced insurance software solutions see tangible improvements in their operations.

The adoption of these systems can lead to higher growth rates and a competitive edge in the bustling insurance marketplace.

Integrating Insurance Broker Software with Existing Systems

Integration is a critical aspect of implementing new insurance software, requiring a seamless melding of new technology with existing systems.

This process must be handled with care to ensure that client data remains secure and that the new software complements and enhances your current operations.

Open-source options, like Openkoda, offer the flexibility and ownership that allow for customizations and extensions, ensuring your software grows with your business.

Key statistics about Insurance software for brokers

Staying informed about the trends and statistics in the insurance software market is essential for brokers looking to make strategic decisions. The market is set for considerable growth, with key regions like the United States and Europe playing significant roles.

Understanding these dynamics can help insurance agencies position themselves for success in the insurance business, as the industry rapidly evolves.

Here are some key statistics and figures that highlight the importance and influence of insurance software for brokers:

Market Size and Growth: The global insurance software development market size is projected to reach significant figures, with a Compound Annual Growth Rate (CAGR) of approximately 7-9% over the next few years, indicating a growing demand for technology solutions in insurance (Insurtech)

Adoption Rates: Surveys suggest that over 70% of insurance brokers now use some form of digital platform or software to manage policies and client relationships, reflecting the sector’s digital transformation.

Cost Efficiency: By implementing insurance broker software, agencies report up to 30-50% reduction in operational costs due to automation of repetitive tasks and streamlined processes.

Customer Satisfaction: The use of insurance software has been linked to higher customer satisfaction rates, with improvements of up to 20% reported, due to enhanced customer service and personalized experiences.

Time Savings: Insurance brokers report saving an average of 10-20 hours per week on administrative tasks, thanks to the automation and efficiency provided by their software.

Customization Costs: While the initial setup of insurance software can vary widely, customization and integration with existing systems can constitute up to 20-30% of the total implementation cost.

Tips for Choosing the Right Insurance Broker Software

Choosing the right software provider is a strategic decision that can have a lasting impact on your agency. Defining clear objectives, outlining your business requirements, and prioritizing user experience are all critical steps in the selection process.

Ensuring that the software you choose is scalable and agile will help your agency remain adaptable in the face of an ever-changing industry landscape.

Summary

As we conclude this guide, it’s clear that the right insurance broker software can significantly elevate the way agencies operate. By automating routine tasks, enhancing client relationships, and streamlining data management, these tools not only improve day-to-day efficiency but also pave the way for long-term growth and success. As the industry continues to advance, staying abreast of these software solutions will be imperative for any insurance broker aiming to provide the best possible service to their clients.

Frequently Asked Questions

What is insurance broker system?

An insurance broker system is a digital tool designed to help individual insurance brokers and intermediaries enhance productivity, efficiency, and customer experience while reducing costs. It’s a powerful resource for streamlining operations.

How much is insurance agent software?

The pricing for insurance agency management system varies. You can explore different options to find one that fits your budget.

What are some of the key benefits of using insurance broker software?

Using insurance broker software can boost agent productivity, improve customer engagement, streamline workflows, enhance team collaboration, and effectively manage insurance policies. It’s a game-changer for insurance brokers!

How does insurance broker software integrate with pre-existing systems?

Insurance broker software seamlessly integrates with pre-existing systems, ensuring data security and enhancing current operations. Open-source options offer flexibility for customization and future scalability.

Are there ongoing costs associated with insurance broker software?

Yes, there are ongoing costs for maintenance, updates, and technical support that are necessary to maximize the benefits of the software. Be sure to consider these expenses when budgeting for insurance broker software.

Related Posts

Thank you for taking the time to read our blog post!