How to Build Insurance Policy Management Software

In the insurance industry, managing policies efficiently is crucial.

Insurance policy management software is a go-to solution that helps streamline this process.

Let’s take a look of how you can build your own custom policy system quickly and efficiently.

Contents

- What is insurance policy management software?

- How does insurance agency management system work?

- Custom vs Out-of-the-box Insurance Management Solution

- How to build insurance policy administration software in 5 steps

- Key features of insurance policy administration system

- Business benefits on custom software in insurance industry

- Example of cost-effective solutions for building insurance policy software

What is Insurance Policy Management Software?

One such tool is policy administration software also known as insurance policy management software.

At its core, this software provides a centralized database that makes policy information easily accessible. Just to make it easier for the insurance brokers and agents to manage their work.

But it doesn’t stop there.

The policy administration system also automates routine tasks such as policy renewals and claims processing. This not only reduces manual effort, but also minimizes errors.

For those who focus on customer relationships, and this is definitely the case for insurance agencies, policy administration software is an invaluable tool for day-to-day tasks.

In summary, the policy management system is responsible for keeping detailed records of all customer data, policy details, and all communication touchpoints and making them easily accessible to all members of your organization.

How Does the Insurance Agency Management System Work?

Understanding the functionality of an insurance agency management system is crucial for selecting the best solution for your business and grasping how the system operates.

Let’s take a closer look at how data is ingested and processed by these systems on a daily basis.

How Does Information Flow in the System?

Agents input client details, including contact information, policy preferences, and risk profiles, directly into the system. This data forms the foundation for all subsequent processes, enhancing operational efficiency.

Agents interact with the software using user-friendly dashboards.

For example, when generating a quote, the system retrieves relevant client data and applies predefined underwriting rules to create accurate proposals. These proposals can be emailed directly to clients from within the platform, minimizing manual effort and ensuring timely delivery.

Once a proposal is accepted, the system securely stores it in its database. Agents can track policy statuses, set renewal reminders, and make updates with minimal manual intervention—saving time and reducing errors.

Claims processing is also automated.

The system captures claim details, assigns adjusters based on predefined rules, and tracks progress at each stage. Notifications and alerts prompt agents to follow up and provide status updates to clients.

Ultimately, the system enables agents to access and manage all client information, documents, and claims in one place—boosting insurance operations efficiency and improving service delivery.

Custom vs Out-of-the-box Insurance Management Solution

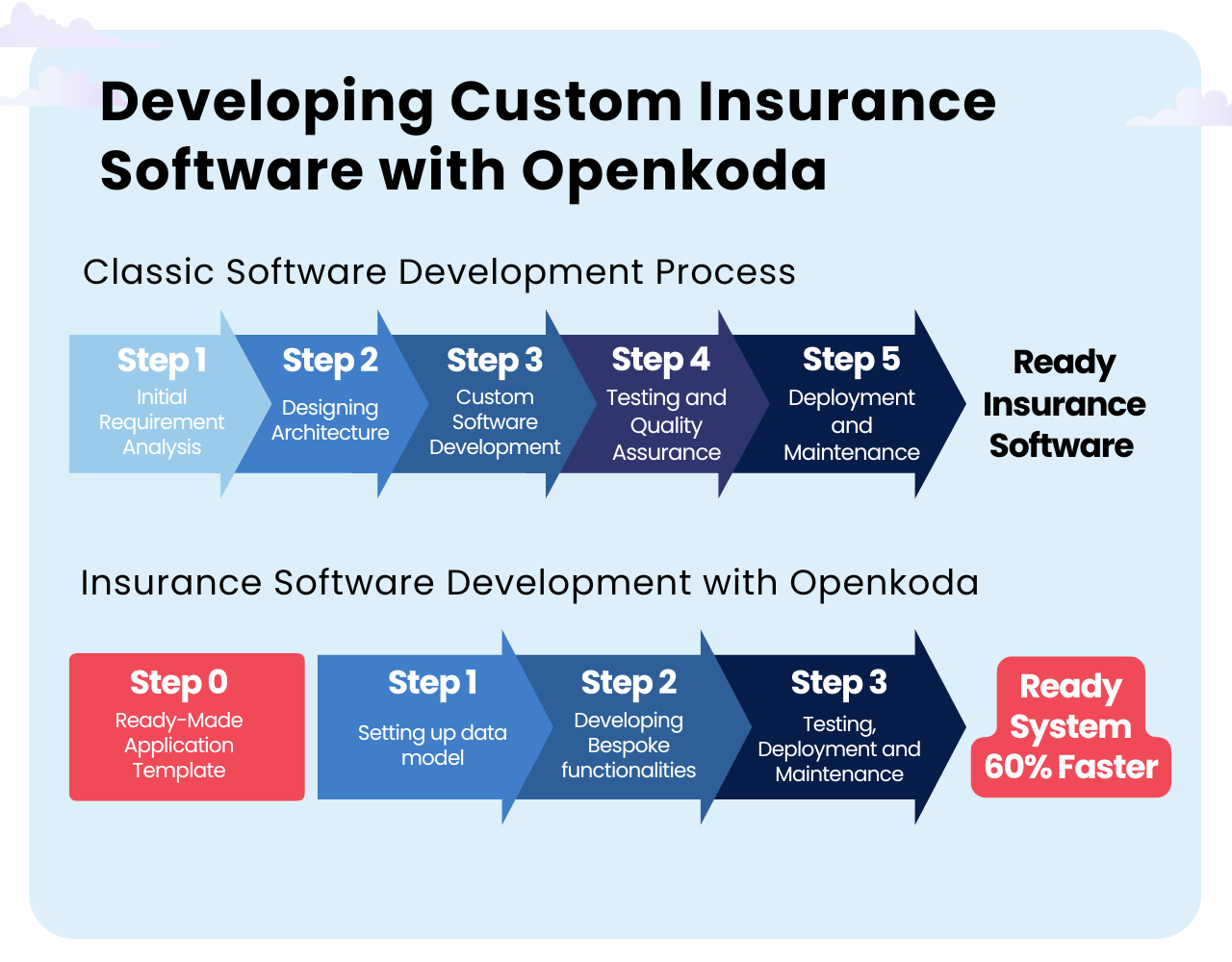

When choosing a policy management system, your company must first evaluate its business needs and then decide between custom and off-the-shelf systems.

Let’s take a look at the differences.

Off-the-shelf (or “out-of-the-box”) insurance software solutions are known for their rapid deployment and easy-to-use interfaces.

However, modifying out-of-the-box solutions can be challenging.

Imagine your company needs an easily embeddable insurance quote form for integration into partner websites or mobile applications. An out-of-the-box system may lack the flexibility to quickly build and customize such a feature.

Custom solutions, on the other hand, offer scalability, flexibility and long-term value.

They are designed to align with your company’s specific processes and requirements, ensuring seamless integration, adaptability and complete data security.

As a quick recap let’s compare these approaches:

Out-of-the-Box Software

Pros:

- Quick and easy setup.

- Community and customer support available.

- Low initial cost.

Cons:

- Customization is limited.

- Difficult to modify or integrate.

- Vendor lock-ins.

Custom Software

Pros:

- Tailored scalability.

- Long-term cost savings.

- Complete ownership and control.

- Enhanced data protection.

Cons:

- Higher initial investment.

- Longer development time.

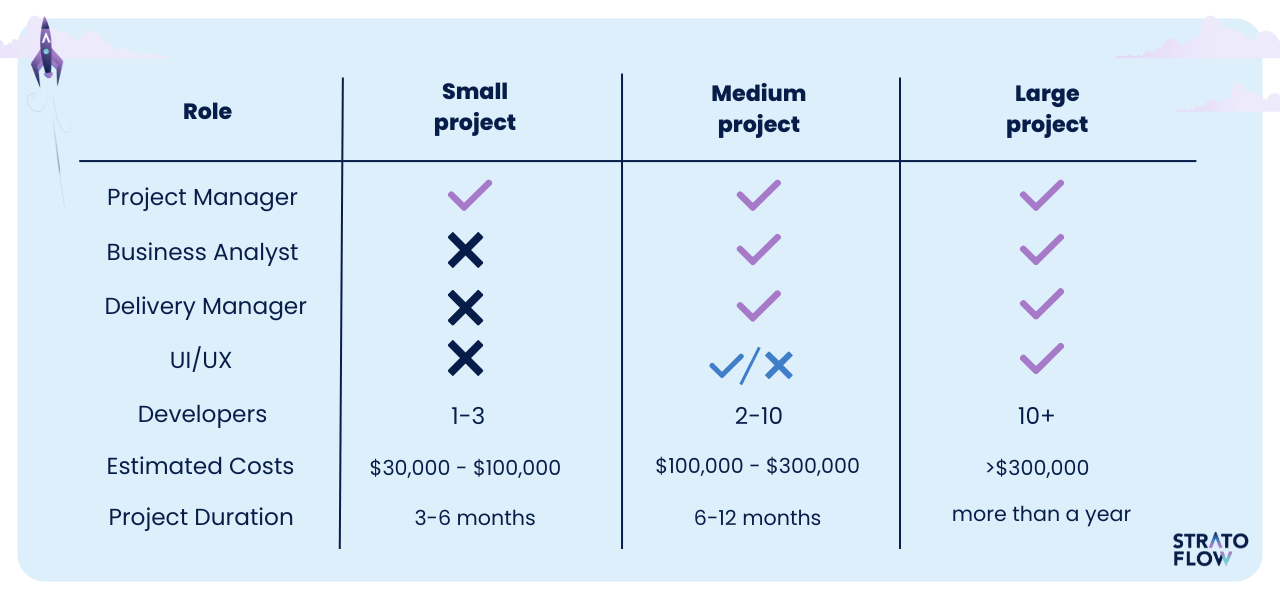

How to Build an Insurance Policy Administration System in 5 Steps

However, there is a third way that combines the best of both approaches: Openkoda.

It offers a robust foundation with pre-built features such as authentication, role-based security, multitenancy, REST APIs, AI reporting, and audit trails, significantly accelerating the insurance software development process beyond traditional methods.

Openkoda uses pre-built modules and data models specific to the insurance industry, while still allowing for a degree of customization with reduced coding.

Openkoda also streamlines integration with existing systems and third-party services through automatically updated REST APIs and support for widely used technologies like Java, JavaScript, and PostgreSQL.

By providing a scalable, flexible, and developer-friendly framework, Openkoda reduces development timelines by up to 60%, helping organizations achieve faster time-to-market while maintaining full customization capabilities and avoiding vendor lock-in.

In this 2-munite demo, you’ll see how you can easily set up a simple policy management system in a few munites using the Openkoda platform:

And here’s the entire process broken down into five easy-to-follow steps:

Step 1: Define The Key Objectives

To get started, it’s crucial to define the primary objective before replacing your old legacy policy administration system.

For insurance agency owners, this involves identifying the application’s unique value proposition.

What is this?

A value proposition is the core functionality your application delivers to users, highlighting how it solves their problems or fulfills their needs better than existing solutions.

By clearly defining this, software developers can prioritize features that reinforce this value, ensuring the application tackles real market challenges and drives adoption.

Step 2: Select the Appropriate Data Model

The next critical phase is to design a domain data model that aligns with your business application.

Openkoda offers a significant advantage here by providing a general data model suitable for business applications.

Your task is to consider the unique value-add specific to your insurance domain – you don’t need to worry about the standard entities; just focus on your unique business domain, such as policyholders and claims records.

This step is actually the most important one of the whole process.

Why is that?

Because when your application takes off, that model will serve as the foundation for the entire system that evolves from it.

Step 3: Implement Your Data Model

Setting up a data model in Openkoda typically involves translating a business model into a database schema by defining business entities within the database.

While this process might seem intimidating to those without a technical background, it’s actually quite simple. Any software developer with experience in enterprise applications can complete it in just a few hours.

Once this step is complete, you’ll have a fully operational Openkoda instance ready for data entry—essentially a basic CRUD application.

Here consider the fact that a process that might take weeks using a traditional approach can be accomplished within a day or two with Openkoda.

Step 4: Develop Core Functionalities

Now comes the exciting part – creating the features that will bring real value to your application.

Here is how Openkoda saves you time when building your application.

Developers have the ability to build functionality the traditional way in Java, but using Openkoda’s pre-built components allows them to focus on what’s really important to end users.

User management, dashboard building tools, organization management, user role assignments and permissions, file storage, load balancing, LDAP and social authentication methods, and multi-tenancy are just a few of the pre-made features available to accelerate application development.

Step 5: Launch Your Business Application

Finally, the deployment of your business application.

With Openkoda, you have the flexibility to deploy your application anywhere.

Whether you choose to run your application in your own environment or in Openkoda’s managed cloud, you retain full control.

To see this process in more detail check out this quick Openkoda demo

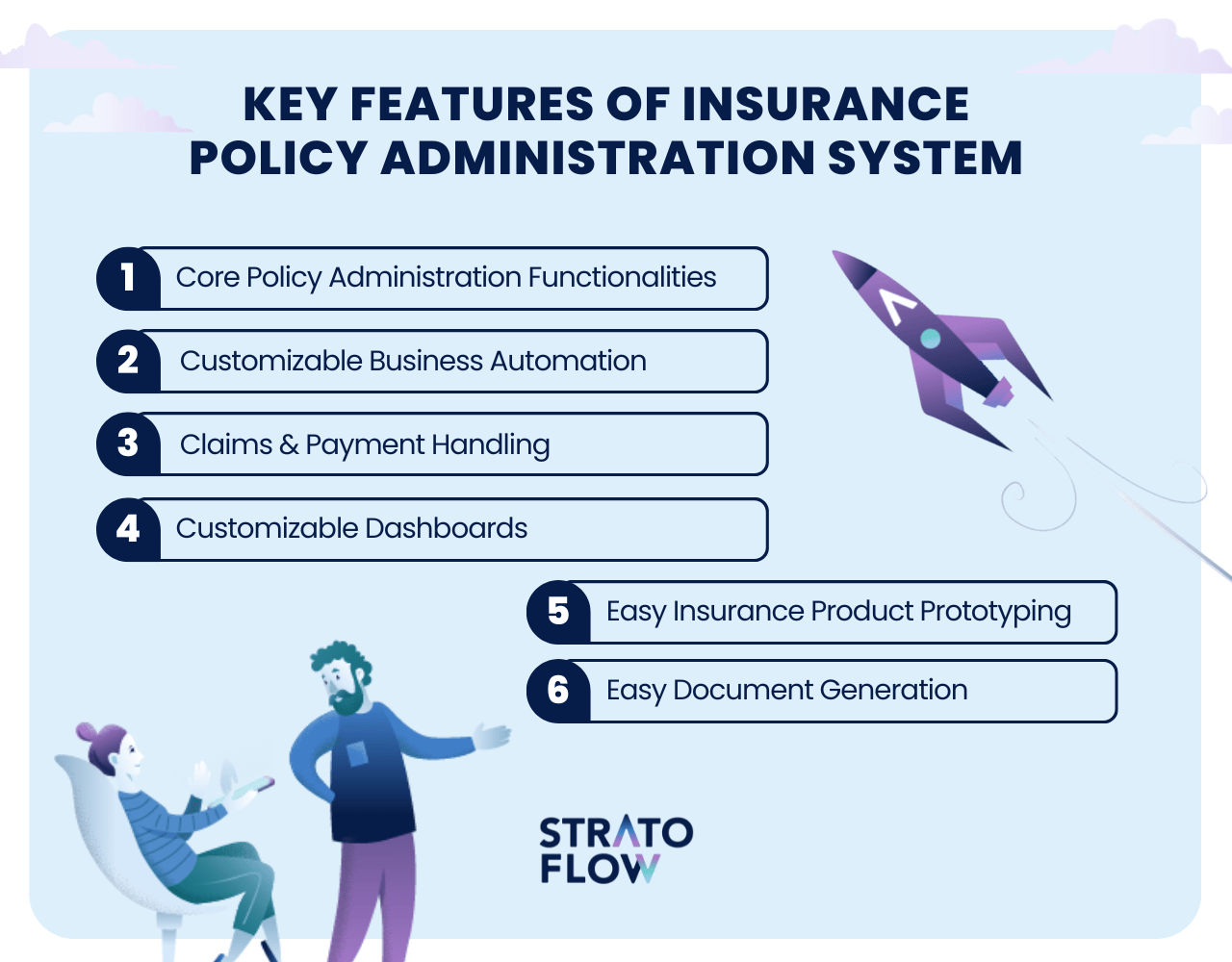

Key Features of Custom Insurance Policy Administration Systems

We have already mentioned a number of key functionalities of such software, so let’s put it in order and look at all the key features that every solid insurance policy administration system need to have.

Core Policy Administration Functionalities

Robust core policy administration capabilities form the backbone of any insurance policy management software.

These functionalities must support policy creation, issuance, endorsement, renewal, and cancellation workflows.

Customizable Business Automation

Automation is critical to reducing manual intervention and improving operational efficiency.

Insurance companies need software that allows them to create custom workflows tailored to their unique processes, from underwriting to claims.

This includes customer and agent notifications, custom reminders, and automatic renewals. The ability to quickly set up custom rules for these notifications is important to further optimize your insurance operations and customer satisfaction.

Claims & Payment Handling

Efficient claims and payment management capabilities are essential for the timely and accurate processing of claims, payouts, and premium collections.

Modern policy administration systems should support end-to-end claims processing, from first notice of loss (FNOL) to settlement, along with built-in fraud detection mechanisms that can be further enhanced by AI and machine learning.

Customizable Dashboards

No two insurance companies are alike and require a high level of software customization.

That’s why customizable dashboards are so important.

They enable decision makers to monitor key performance indicators (KPIs) and operational metrics while providing valuable insight into sales performance, claims trends, profitability, and compliance.

Compliance & Regulatory Tracking

Regulatory compliance is non-negotiable in the insurance industry.

Software must include compliance management capabilities that automatically track regulatory changes, generate reports, and flag non-compliant activity.

But that’s not all.

Rules and local regulations change from time to time.

It is important to set up your policy administration system so that it can be easily modified in the future as insurance regulations change.

Easy Insurance Product Prototyping

Rapid development and testing of new insurance products is a competitive advantage.

Policy administration software should support development tools that allow insurers to quickly prototype products, test variations, and bring new offerings to market faster.

Configurable product templates and rules engines make it easier to adapt to niche markets and evolving customer needs without extensive redevelopment.

AI-driven Reporting

Generative AI is finding its way into more and more enterprise software applications.

One such example is the use of Gen AI to generate SQL queries in insurance policy management systems.

It works in a simple way: users describe in natural language the data they want to retrieve from the database, and the system generates a ready-made SQL query. Such AI-driven data reporting functionality can save hours of mundane and repetitive reporting work.

Easy Document Generation

Solid insurance policy administration software must enable fast and accurate generation of policy documents, contracts, and regulatory forms.

Built-in templates, dynamic fields, and batch-processing functionalities streamline document creation, ensuring consistency and compliance with industry standards while reducing administrative overhead.

Integration Capabilities

Finally, there’s the issue of integration.

Modern insurance businesses rely on a diverse ecosystem of tools and platforms, including CRM systems, accounting software, payment gateways, and third-party data providers.

Policy management software must provide robust integration capabilities via APIs and pre-built connectors to enable seamless data exchange and interoperability.

Business Benefits of Custom Software in Insurance Industry

When looking for the most effective policy administration system, agency owners should pay special attention to the specific problems that custom software solutions for the insurance industry solve.

These custom solutions offer significant business benefits and are designed to meet the unique challenges of insurance agencies.

- Tailored Fit – Designed specifically for your agency’s unique needs, ensuring alignment with business processes, operational models, and requirements.

- Seamless Integration – Easily integrates with existing tools like CRM systems, financial software, and communication platforms, enabling smooth data flow.

- Enhanced Security – Custom software insurance policy management systems are great for safeguarding sensitive data.

- Competitive Advantage – Provides features and functionalities that off-the-shelf solutions may lack, helping agencies stand out in the marketplace.

- Cost Efficiency – Offers long-term savings by minimizing the need for frequent updates, additional licenses, and costly modifications.

- Improved Customer Experience – Enhances user experience with personalized features, faster response times, and intuitive interfaces, driving referrals and growth.

- Data-Driven Insights – Includes analytics and reporting tools to deliver insights into customer behavior, policy performance, and market trends, supporting strategic decisions.

- Automation & Efficiency – Automates repetitive tasks, from policy renewals to customer communications, improving accuracy and streamlining operations.

- Future-Ready Design – Built to adapt to evolving industry trends and technologies, ensuring long-term scalability and innovation.

Five Examples of Insurance Policy Administration Software

Let’s take a closer look at five examples of tools that might help you build your own custom insurance policy administration system.

Openkoda Insurance Policy Software

Openkoda’s Insurance Policy Management Software is an open-source platform designed to enhance operational efficiency and customer satisfaction for insurance brokers and agencies.

Thanks to customizable templates, it allows seamless integration with third-party systems and the creation of personalized dashboards, enabling efficient claims processing and great alternative for outdated legacy systems.

Decerto Policy Administration System

Decerto’s Policy Administration System (PAS) is a modular solution designed to streamline insurance policy management.

It offers modules such as Policy Processor, Policy Register, Policy Service Module, and Payment Module, which can be implemented collectively or individually to suit specific business needs.

A key feature is its event-driven architecture, where every action is represented as an event, providing transparency and ease in policy processing, reversal, and reprocessing.

Guidewire InsuranceSuite

Guidewire is a well-established vendor, especially prominent in Property & Casualty (P&C).

Its InsuranceSuite platform covers policy, billing, and claims administration through modular components. Carriers appreciate its partner ecosystem, which supports smooth integration with third-party systems and data sources.

BriteCore

BriteCore is a cloud-native core insurance platform designed for Property and Casualty (P&C) insurers.

It delivers a full policy administration system that manages end-to-end policy processing through user-friendly interface tools, flexible workflows, and automated processes

Sapiens

Sapiens provides a digital ecosystem for managing insurance coverage lifecycles, offering comprehensive suites tailored to specific coverage sectors.

Sapiens’ platform is designed to optimize business practices, manage traffic and finances, and provide administration for various coverage structures.

Conclusion

The right policy management software is essential for helping insurance companies operate more efficiently and the choice between out-of-the box solution and a custom system can have a severe consequences on your business efficiency.

Luckily, with tools like Openkoda, you get the best of both worlds—secure, scalable software without vendor lock-in.

Related Posts

Thank you for taking the time to read our blog post!