The Best Insurance Agency Management Systems in 2025

Choosing an agency management system can feel like picking the perfect partner to keep your agency running smoothly.

With so many options on the market, it’s easy to get overwhelmed by feature lists and pricing tiers. In this article, we’ll cut through the noise and highlight the best AMS solutions that can help you streamline your processes and prepare for growth.

Key Takeaways

- Comprehensive insurance agency management systems like Applied Epic and AMS360, specialized platforms like AgencyBloc and Jenesis, and cloud-based solutions such as NowCerts and QQCatalyst and open source tools like Openkoda offer varied features for different agency needs, emphasizing the importance of CRM, automation, and seamless carrier connectivity.

- An effective management system must provide robust policy management, a 360-degree CRM view, data security, and built-in analytics, and agencies should evaluate systems based on customer reviews, scalability, and pricing to suit their specific operational needs and growth strategies.

- The insurance agency management system industry is evolving with emerging trends like AI, predictive analytics, IoT, AR, and cloud-based platforms, which are set to improve customer interactions, risk monitoring, and provide greater flexibility and scalability for agencies.

Top Insurance Agency Management Systems

One of the most essential tools for any insurance agency is insurance agency management software (AMS). However, choosing the right system can be a challenging task.

But don’t underestimate it!

Insurance agency management systems are a backbone of many day-to-day processes so the decision on what path to go for should be made very carefully.

From automating processes to improving sales performance, these management systems are greatly improving the efficiewncy of how insurance agencies operate and how insurance agents serve their clients

Let’s look into the best insurance agency management systems that are redefining industry standards.

Agency Management System vs. a Generic CRM Software

AMS solutions are purpose-built for agencies, offering specialized features such as policy management, claims tracking, carrier integrations, and compliance tools that address the unique operational and regulatory needs of insurance businesses.

In contrast, generic CRM software focuses broadly on customer relationship management, providing versatile tools for contact management, sales pipelines, and marketing automation but often lacking insurance-specific capabilities.

The data models in generic CRM systems are often incompatible with the specific needs of insurance operations.

By choosing custom software, insurance businesses can develop solutions tailored to their unique processes, avoid vendor lock-in, and stay agile when introducing innovative insurance products or adapting to major internal process changes.

In such scenarios, a custom agency management system can be quickly implemented, whereas a generic CRM would require cumbersome integrations with external tools or a lengthy customization process.

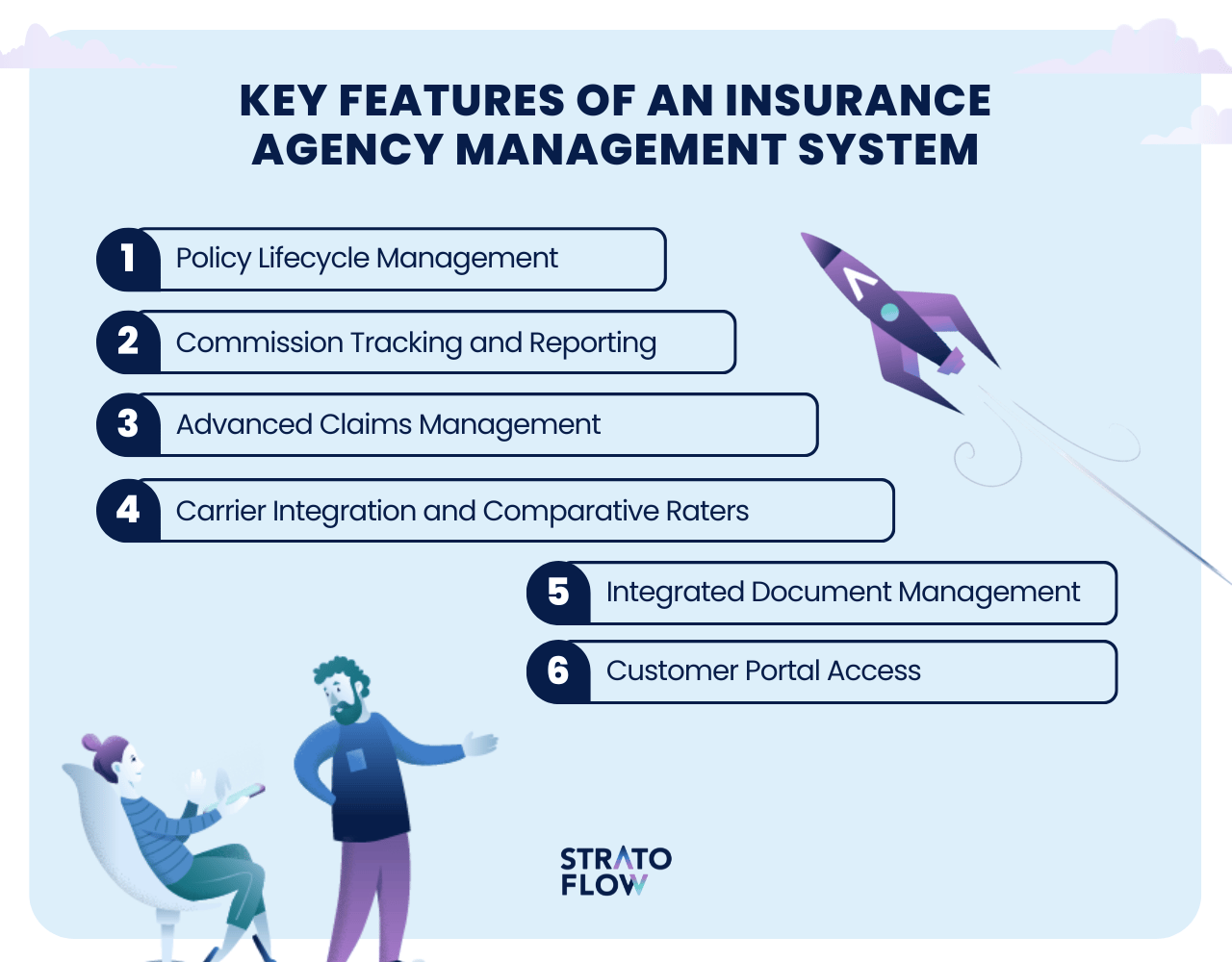

Key Features of an Insurance Agency Management System

So what features are must have when reviewing different insurance agency management systems?

Here are a brief rundown:

- Policy Lifecycle Management: Above all else you have to be able to track and manage policies of your cluents across the whole customer journey from initial quotes to renewals and cancellations. An AMS provides automated reminders for renewals, ensures accurate policy details are maintained, and integrates directly with carriers to streamline updates.

- Carrier Integration and Comparative Raters integration with multiple insurance carriers allows for real-time access to carrier-specific systems. Comparative raters enable agents to provide customers with accurate, side-by-side premium comparisons quickly and efficiently.

- Advanced Claims Management: Modern agency management system includes tools for monitoring claim statuses, managing documentation, and communicating updates to both clients and carriers. This ensures claims are handled efficiently, with transparency for all stakeholders.

- Commission Tracking and Reporting: Specialized modules track commission payments across different carriers, policy types, and agents. Customizable reports provide insights into commission trends and individual agent performance.

- Report Builder:

- Integrated Document Management: Centralized storage for policy documents, endorsements, and client correspondence ensures quick retrieval and eliminates manual filing errors, enhancing operational efficiency and customer satisfaction.

- Customer Portal Access: Many AMS solutions include self-service portals where clients can access policy details, request changes, and file claims, reducing administrative overhead and improving client experience.

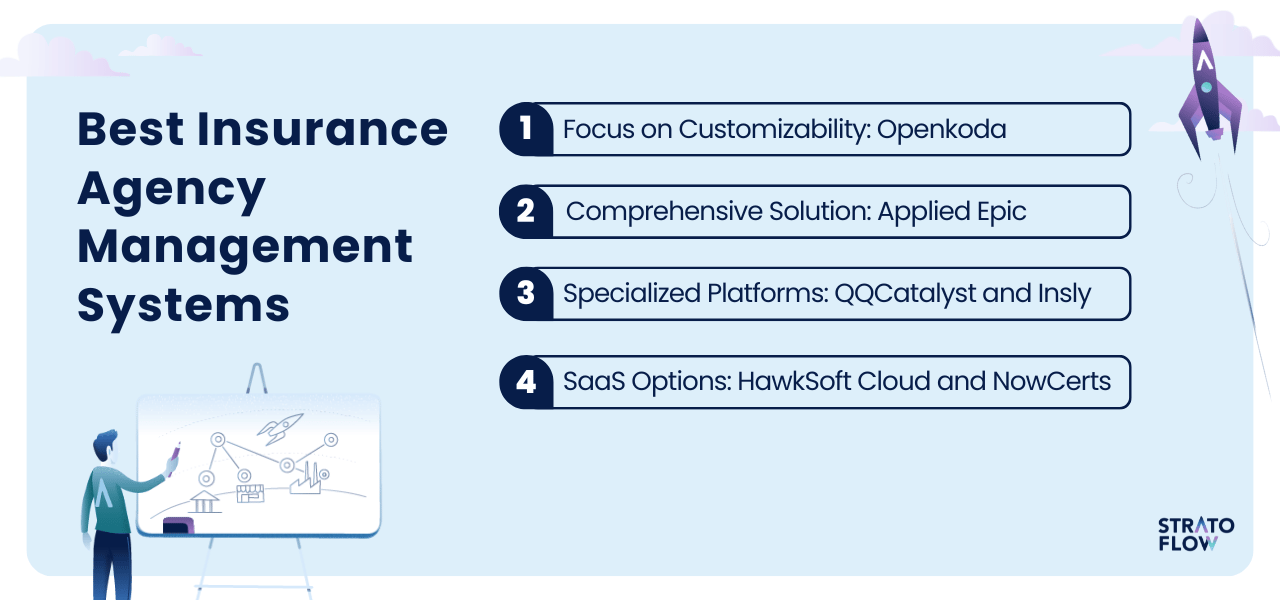

Best Insurance Agency Management Systems in 2025

Choosing the right insurance agency management system (AMS) is a balancing act.

The key factors to consider—customizability, comprehensiveness, and budget—often feel like a tug-of-war.

There’s also a question whether you want to go for something bespoke, ready made system or something in between.

Let’s dive into some of the best AMS options in 2025, broken down by their primary strengths so that you can make the decision for yourself.

Focus on Customizability: Openkoda

For agencies that value flexibility and the ability to adapt to specific business needs, Openkoda is a standout choice.

Unlike many off-the-shelf solutions, Openkoda emphasizes customization without locking you into a rigid framework.

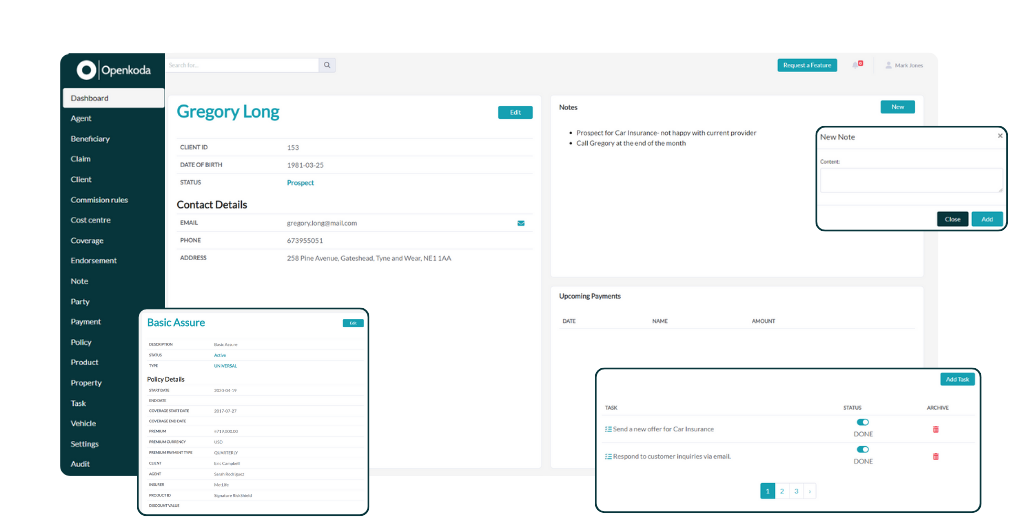

Whether you need a client portal, embeddable quote forms, or custom dashboards, Openkoda provides the tools to build them your way.

Key features of Openkoda include:

- A bespoke platform designed to meet the evolving needs of the insurance industry

- The capability to refine and enhance operational workflows

- Options to add custom functionality based on unique business requirements

- Complete control over policy management

- Online client portal

- An all-in-one toolkit that’s ready to use

- No vendor lock-in

- No pricing based on number of users

Insurance businesses often have unique workflows and operational quirks, and Openkoda excels at accommodating these.

The platform leverages open-source technology, which not only reduces long-term costs but also ensures you’re not tied to a single vendor.

You can deploy your custom Openkoda application in cloud of your choice or on premise, and thanks to no proprietary technology, all developers familiar with Java track can work on further customizations.

Openkoda’s modular approach enables users to build applications component by component. Developers can add or remove features as required, ensuring that the platform scales and adapts to changing requirements.

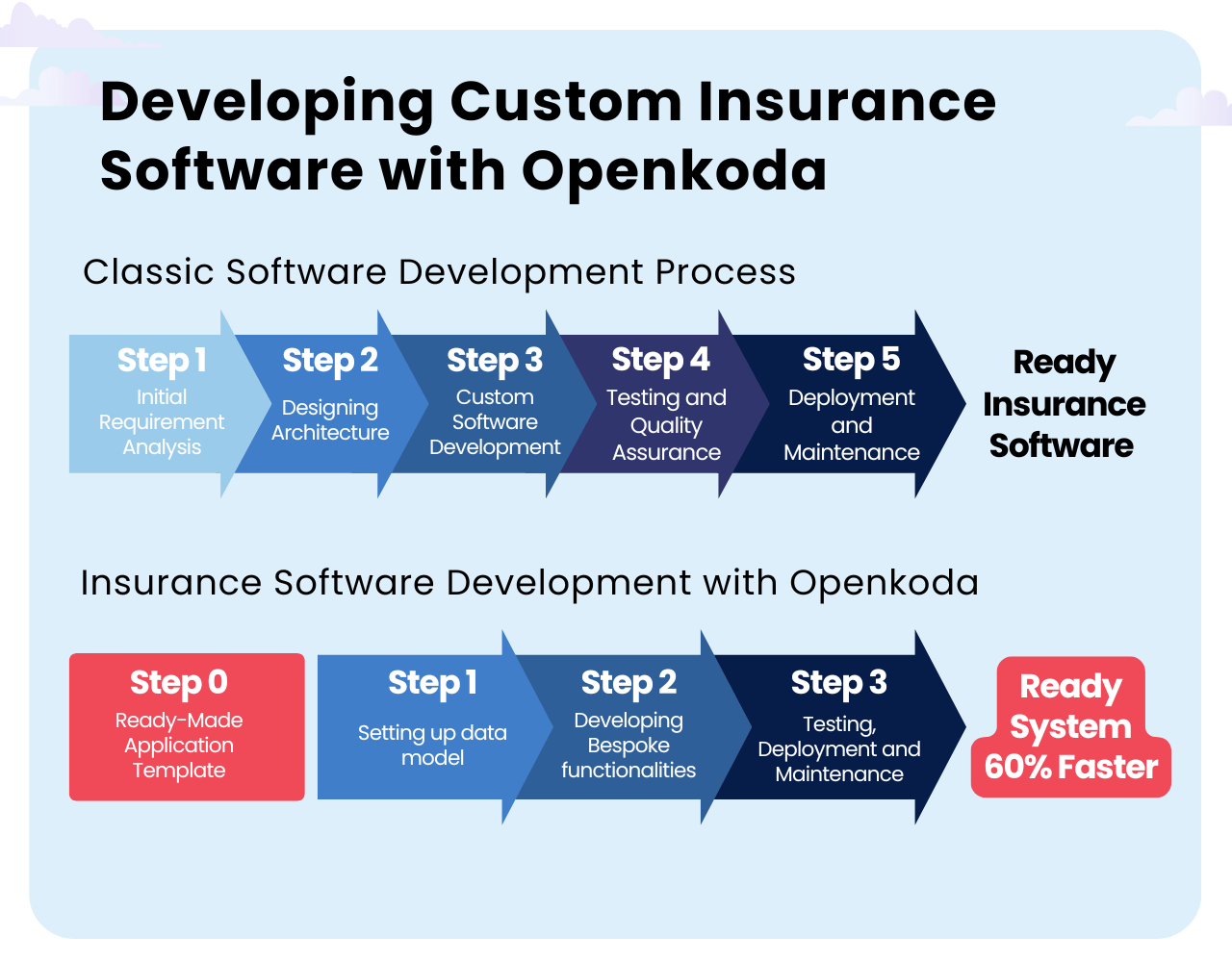

So what’s the key value of Openkoda compared to other alternatives?

It reduces development timelines by offering ready-made components and templates. This accelerates the creation of critical insurance functionalities like policy creation, claims tracking, sales automation and compliance management.

If you are thinking about building custom insurance agency management software with a focus on innovation, Openkoda can be a gamechanger for your organization.

By leveraging Openkoda, insurance companies and brokers can modernize legacy systems, improve operational efficiency, and deliver enhanced customer experiences.

If you’re tired of trying to make a one-size-fits-all AMS fit your unique agency, Openkoda offers a refreshing alternative.

Comprehensive Solutions: Applied Epic and AMS360

For agencies that need a robust, all-encompassing solution, Applied Epic and AMS360 are the heavyweights in the industry other agency management systems.

These platforms are designed to handle every aspect of agency management, from policy tracking and billing to claims management and analytics.

Applied Epic is widely regarded for its ability to support large, multi-location agencies. It integrates seamlessly with third-party applications and offers advanced reporting capabilities, making it a go-to for agencies with complex needs.

On the other hand, AMS360 is a favorite among midsize agencies.

It shines in its user-friendly interface and strong policy management features, while also offering integrations with carrier systems to simplify everyday operations. Both systems require a significant financial and training investment, but their comprehensive capabilities make them worth the effort for larger agencies.

Specialized Platforms: QQCatalyst and Insly

Sometimes, the best AMS isn’t the biggest or the most customizable—it’s the one tailored to your specific niche.

For example, QQCatalyst is ideal for small agencies focused on personal lines, while Insly caters to MGAs and wholesale brokers. These specialized platforms provide targeted features that are difficult to replicate with broader systems.

If you run a specialty agency, choosing a platform that understands your market’s unique demands can make a world of difference.

In that case you should either go for one of these specialized platforms or customize your own using Openkoda platform if your budgets allow for that.

SaaS Options: HawkSoft Cloud and NowCerts

For smaller agencies or startups, Software-as-a-Service (SaaS) solutions can offer a cost-effective entry point without skimping on functionality. Examples like HawkSoft Cloud and NowCerts provide easy-to-use interfaces, cloud-based accessibility, and the ability to scale as your agency grows.

SaaS platforms typically operate on a subscription model, which makes budgeting straightforward especially for independent insurance agents.

They’re often praised for their low upfront costs, quick setup, and built-in maintenance. However, they may lack the depth or customization options of more comprehensive or tailored solutions. That said, for agencies looking for speed and simplicity, SaaS AMS options can be a perfect fit.

Criteria for Evaluating Agency Management Systems

Over many years in the industry, we’ve seen that the key isn’t just about checking boxes like policy tracking or commission reports—it’s making sure the software can adapt and scale with your business.

Workflows change, regulations shift, and your client base grows in all sorts of unpredictable ways.

It’s vital to have an AMS that won’t break a sweat when you need to tweak a data field for a new line of insurance or adjust your processes to satisfy a sudden compliance requirement.

If you’ve ever tried to cram your workflows into a system that wasn’t built with flexibility in mind, you know how frustrating (and expensive) it can be.

Openkoda’s architecture is designed for continual evolution—so as your agency grows, your AMS can grow with you, without painful overhauls.

Adapting to Insurance Industry Trends: The Future of Insurance Systems

Just like in many other branches of business, digital transformation in the insurance industry is pushing insurers to look for more agile, efficient, and customer-centric software solutions, and in the past few years, we’ve seen some pretty exciting innovations that are just hitting the broader market.

Let’s tackle the most obvious insurance industry trend – Artificial intelligence.

With generative AI hitting broader markets many time-consuming internal processes can be greatly sped up.

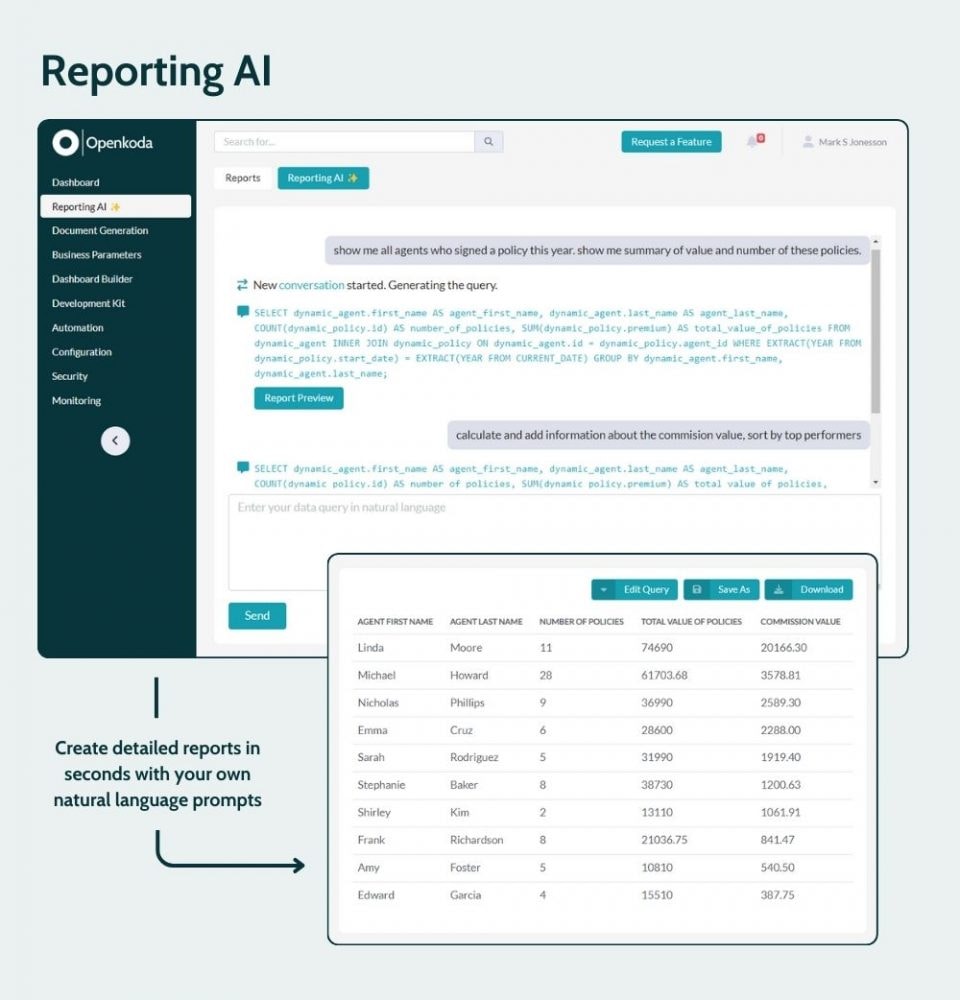

Openkoda’s Reporting AI is one such feature that enables users to generate detailed reports by simply posing questions in natural language. This functionality translates user queries into SQL commands, allowing for rapid data analysis without requiring technical expertise.

Thanks to the increasingly important role of AI, Insurtech, which combines insurance with cutting-edge technology, has become a key element in making insurance more accessible and engaging for consumers.

Partially thanks to that, the insurance agency software market size is projected to reach USD 6248.2 million by 2030, growing at a CAGR of 7.0%.

This transformation isn’t just about adopting new technologies; it’s about reimagining the insurance business model to thrive in a digital-first world.

Summary

This comprehensive exploration of insurance agency management systems underscores their transformative potential for insurance agencies.

With the right system, agencies can achieve streamlined operations, deepened client relationships, and sustainable growth.

Frequently Asked Questions

What is an agency management systems for insurance?

An agency management system (AMS) is a software that helps insurance agencies organize their business, generate leads, and manage sales effectively. It operates as a SaaS technology.

How much does insurance agency management systems cost?

Insurance Systems can cost anywhere from $60/user/month to over $300/user/month, depending on the features required.

What is insurance management system?

An insurance management system (IMS) is a comprehensive tool that optimizes agency business processes, tracks insurance policy details, and improves agent productivity by providing instant access to client data. It includes features for end-to-end policy lifecycle management, accounting, document forms management, and reporting.

What is a CRM system in insurance?

A CRM system in insurance is a software tool that helps insurance companies manage interactions with customers, track customer data, manage leads, and automate communication with customers.

What are the primary benefits of using an insurance agency management system?

Using an insurance agency management system brings benefits such as automated tasks, improved client service, targeted communication, personalized client experiences, and strategies for high client retention rates.

Related Posts

Thank you for taking the time to read our blog post!