10 Best Insurance Agency Growth Strategies In 2025

Looking for concrete ways to grow your insurance agency in 2025?

This article spotlights ten insurance agency growth strategies that are practical, straightforward, and effective.

Cut through the complexity and discover how to harness technology, broaden your service offerings, and engage with your community to not just meet but exceed your growth targets.

Contents

- How To Grow Your Insurance Business In 2025?

- Strategy #1: Embracing Digital Transformation Through Software

- Strategy #2: Diversifying Your Insurance Offerings

- Strategy #3: Building a Strong Brand Identity

- Strategy #4: Focusing on Customer Retention and Loyalty

- Strategy #5: Networking and Community Involvement

- Strategy #6: Investing in Employee Development

- Strategy #7: Adopting a Data-Driven Marketing Strategy

- Strategy #8: Expanding Geographic Reach and Market Penetration

- Strategy #9: Implementing Efficient Operational Processes

- Strategy #10: Setting and Tracking SMART Goals

Key Takeaways

- Insurance digital transformation with CRM software, insurtech, management systems, and data analytics is essential for improved efficiency and tailored customer experiences in insurance agencies.

- Diversifying insurance offerings and using cross-selling and upselling techniques can enhance customer retention and revenue growth.

- Investing in building a strong brand identity, focusing on customer retention programs, and engaging in community outreach are key to differentiating and growing an insurance agency.

How To Grow Your Insurance Business In 2025?

In today’s dynamic market, insurance providers must continually innovate to maintain a competitive edge and deepen customer engagement.

With 2025 ushering in transformative technological breakthroughs—especially in artificial intelligence—and evolving consumer expectations, the need to redefine growth strategies has never been greater.

Let’s look at some kmey strategies to guide you this year.

Strategy #1: Embracing Digital Transformation Through Software

In a world increasingly driven by technology, insurance agencies must embrace digitalization in insurance to stay competitive and become successful insurance agency.

Using digital tools isn’t just a way to promote your business online or just slightly speeding upt the claims management process as it was 10 years ago. In 2025 software is key to improving business efficiency and reaching new customers.

Incorporating digital records and providing online access to policies and claims information significantly improves the customer experience.

Implementing Custom Insurance Software Solutions

Implementing custom insurance software solutions is a strategic advantage that can significantly differentiate an insurance company in a crowded marketplace.

Implementing custom Insurance software solutions can transform your operations by tailoring technology to meet your unique needs. When you adopt a bespoke system, you streamline complex processes—such as policy management, claims handling, and regulatory compliance—through smart automation and integration, reducing your operational costs and error rates.

So, what are your options when it comes to software solutions used in insurance companies?

Key apps include:

- Insurance Broker Management Systems

- Insurance Agent Portal Software

- Insurance Agency Management Systems

- Policy Administration System

- Policy Management Software

- Claims Management Software

As you can see there are various options available on the market, each designed to support very specific insurance business needs and it’s up to you to decide which one should have the top priority.

But be careful!

The insurance market is a complex and niche space.

That’s why, when developing custom insurance software, it’s critical to partner only with custom insurance software development companies that have a deep understanding of the insurance industry and extensive experience in the field.

Choosing Best Insurance Agency Management Software

Choosing the best insurance agency management software is a critical decision for companies operating in the insurance market, as the right system can streamline operations, improve customer service, and increase overall efficiency.

It’s essential for insurance companies to select a platform that offers robust features such as customer management, policy administration, claims tracking, and analytics to stay competitive and responsive to customer needs.

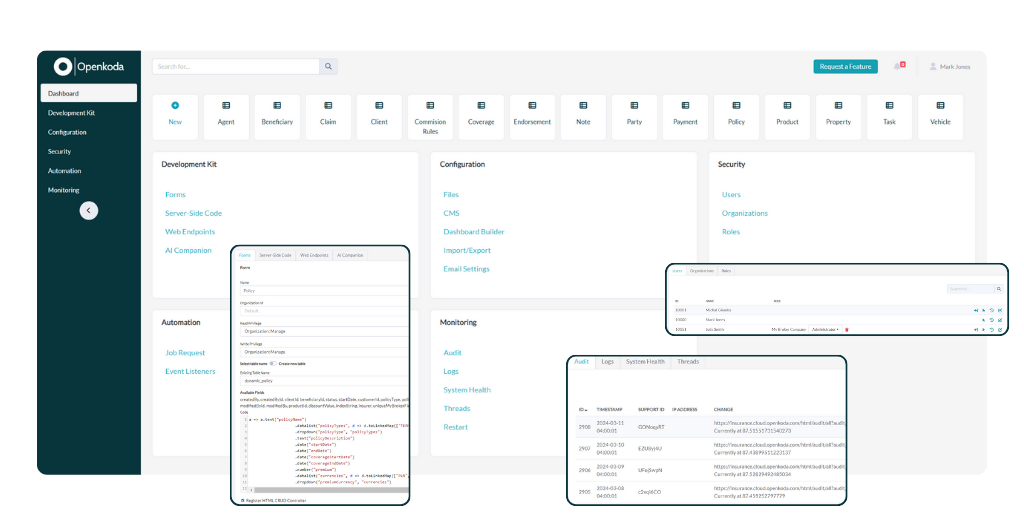

Let’s look at Openkoda Policy Management System since it is one of the prime examples of modern insurance software systems that address key pain points that insurance professionals struggle with.

Its key features include:

- Modular Architecture: Ready insurance-specific data model

- Policy Management: Centralized handling of policy issuance, renewals, and lifecycle tracking.

- Claims Processing: Automated workflows streamline the submission, review, and resolution of claims.

- Customer Self-Service Portal: Empowers policyholders to view details, submit claims, and access documents online.

- Document Management: Secure, centralized repository for storing and retrieving policy and claims documents.

- API & Integration Capabilities: Facilitates seamless integration with third-party systems and external services.

- Reporting & Analytics: Built-in dashboards and reports support performance monitoring and data-driven decisions.

- Regulatory Compliance: Tools designed to help meet industry standards and local regulatory requirements.

Openkoda serves as a solid open-source foundation upon which companies can craft management systems tailored to their unique needs.

With a customized interface, Openkoda‘s comprehensive dashboard provides direct access to key metrics for monitoring and in-depth analysis.

If you want to see how Openkoda can fit into your organization schedule a free personalized demo below:

Strategy #2: Diversifying Your Insurance Offerings

Offering a variety of insurance products, including different types of insurance, is a proven growth strategy that helps manage risk and promotes sustainable agency growth. Offering a broader range of products allows agencies to meet a wider range of client needs, thereby improving client retention and lifetime value.

Cross-selling and Upselling Techniques

Cross-selling and upselling techniques can boost revenue by providing existing clients with additional products and services. Agents can pinpoint more relevant products for clients by identifying insurance needs that arise during changes in a customer’s life.

Offering customer incentives and adjusting commission structures can incentivize agents and expand the customer base.

Embedded Insurance as a New Sales Channel

Embedded insurance solutions are rapidly emerging as a promising sales channel for insurers, enabling seamless integration of insurance products directly within digital consumer experiences leveraging cross-selling in the process.

By embedding insurance offerings into everyday platforms, insurers can enhance customer engagement, streamline the buying process, and drive higher conversion rates.

Openkoda offers functionality for the easy and seamless development of embeddable insurance forms, making it simpler than ever to implement digital-first insurance solutions.

To see how using Openkoda you can easily design custom logic and embedded personalized insurance forms watch this quick demo:

Strategy #3: Building a Strong Brand Identity

Building a strong brand identity is more than a marketing strategy; it’s a way to differentiate an insurance agency from the competition. A well-developed brand identity fosters:

- Customer trust

- Customer loyalty

- Increased sales

- Increased referrals

Developing a Unique Selling Proposition (USP)

Developing a unique selling proposition (USP) sets an agency apart in the marketplace by highlighting its distinctive values and benefits. By creating clear and relevant messaging around a key differentiator, a well-crafted USP can be memorable to potential clients and help promote the agency.

Enhancing Your Online Presence

An enhanced online presence is essential in today’s digital age. This includes developing a content marketing plan, leveraging social media platforms, and making your agency easily accessible and engaging online. These efforts will not only increase awareness, but also attract customers and expand your client base.

[Read also: Best Insurance Broker Management Systems In 2025]

Strategy #4: Focusing on Customer Retention and Loyalty

Prioritizing customer retention and loyalty is a critical growth strategy for insurance agencies. Delivering exceptional service to all customers helps agencies build a positive reputation and generate referrals that are essential to growing their business.

Providing Personalized Services

Delivering personalized services boosts customer satisfaction and nurtures enduring relationships. Anticipating customers’ needs allows insurance agencies to offer more relevant product suggestions and support, significantly improving their customer service.

Implementing Customer Loyalty Programs

Customer loyalty programs are an effective way to incentivize clients to refer new customers and remain loyal to the agency. Offering rewards during key customer moments can enhance customer satisfaction and retention.

Strategy #5: Networking and Community Involvement

Networking and active participation in the community are vital growth strategies for insurance agencies. Some ways to implement these strategies, which can help in becoming a successful insurance agent, include:

- Participating in industry conferences

- Engaging in community outreach

- Attending networking events

- Joining professional associations

- Volunteering for local organizations

These activities allow independent agencies, including their own agency, to broaden their networks, showcase their expertise, and demonstrate their commitment to community enrichment.

Attending Industry Conferences and Events

Attending insurance industry conferences and events has many benefits for independent insurance agents. These platforms provide valuable insight into industry trends and developments, and facilitate networking with other professionals, including meeting an insurance agent from different companies.

Engaging in Community Outreach

Engaging in community outreach can have several benefits for agencies, including:

- Building goodwill among customers and partners

- Enhancing the agency’s reputation and standing in the community

- Forming alliances with non-profit organizations

- Participating in community events

- Enhancing visibility and attracting new business

[Read also: Top Software for Insurance Brokers in 2025]

Strategy #6: Investing in Employee Development

Investing resources in employee development through learning and development programs increases agent confidence, motivation, and productivity. This investment also prepares agents to stay abreast of changing insurance products, regulations, and market trends, improving their ability to serve customers effectively.

Strategy #7: Adopting a Data-Driven Marketing Strategy

The adoption of a data-driven marketing strategy empowers insurance agencies to:

- Decipher insurance shopping patterns

- Concentrate on behaviors, not just demographics

- Result in more effective customer engagement

- Bolster the agency’s growth strategy

Utilizing Customer Segmentation

Employing customer segmentation allows insurers to:

- Deliver customized services and communication

- Enhance satisfaction and retention

- Group insurance customers based on factors like needs, preferences, behaviors, and demographics

- Offer personalized experiences that boost engagement and sales conversions.

Tracking and Analyzing Marketing Metrics

Tracking and analyzing marketing metrics is critical to understanding the effectiveness of data-driven strategies and ensuring a positive return on investment. By tracking key performance indicators such as contact rates, quote rates, and bind rates, agencies can assess their productivity and refine their strategies accordingly.

Strategy #8: Expanding Geographic Reach and Market Penetration

Expanding geographic reach and market penetration through mergers, acquisitions and niche market targeting can quickly increase an insurance agency’s market share, revenue and customer base. Integrating another agency allows an insurance company to gain a competitive edge by expanding its market presence.

Targeting Niche Markets

Targeting niche markets is a proven growth strategy for insurance agencies. By offering tailored insurance solutions that resonate with a specific market segment, agencies can create a compelling USP and attract more customers.

Strategy #9: Implementing Efficient Operational Processes

Implementing efficient operational processes and streamlining workflows is essential to prevent errors, ensure that critical tasks are not overlooked, and increase operational efficiency. Through the use of digital tools and customized calendars, insurance agents can effectively manage their time and monitor their progress.

Streamlining Workflows

Streamlining workflows is a critical strategy for improving operational efficiency. By streamlining and simplifying processes, agencies can increase efficiency, minimize redundancy and improve overall productivity.

Regular monitoring and evaluation of new processes is critical to validate their effectiveness and identify potential for further workflow improvements.

Automating Routine Tasks

Automating routine tasks can significantly enhance operational efficiency. Tasks like data entry and policy issuance can be automated to reduce paperwork, streamline the purchase process, minimize human error, and increase productivity.

[Read also: The Impact of AI in Insurance Industry in 2025]

Strategy #10: Setting and Tracking SMART Goals

The establishment and monitoring of SMART goals offer a structured growth framework and keep team efforts synchronized. Covering various business areas, such as general business goals, operations goals, and precise sales targets, enables insurance agencies to assess their success and make data-driven decisions.

Establishing SMART Goals

Establishing SMART goals provides a clear and focused path for insurance agents to achieve business objectives. By setting goals that are:

- Specific

- Measurable

- Achievable

- Relevant

- Timely

Independent agents can pinpoint key areas of growth and track their progress towards these aims.

Monitoring Progress and Adjusting Strategies

Monitoring progress and adjusting strategies is crucial for achieving SMART goals. Regular performance evaluations and a clear roadmap with short-term milestones enable adaptability and ensure that goals are always aligned with the agency’s vision and mission.

Summary

In conclusion, the insurance industry is a dynamic realm where growth strategies are key to thriving and staying competitive. By embracing digital transformation, diversifying offerings, building a strong brand identity, focusing on customer retention, networking, investing in employee development, adopting a data-driven marketing approach, expanding geographic reach, implementing efficient operational processes, and setting SMART goals, insurance agencies can achieve sustainable growth and success.

Frequently Asked Questions

How to grow in the insurance industry?

To grow in the insurance industry, take advantage of the skills shortage, focus your efforts, create a development plan, and stay updated with the latest trends. These steps can help you boost your career in insurance.

What is a good profit margin for an insurance agency?

A good profit margin for an insurance agency typically ranges between 2 percent and 10 percent. It’s important to consult with an accountant or tax advisor for your specific agency.

Why is digital transformation important for insurance agencies?

Digital transformation is important for insurance agencies because it improves efficiency, extends reach to new clients, and provides a competitive edge in the evolving industry. It helps in staying ahead of the competition and meeting the needs of modern consumers.

What are the benefits of diversifying insurance offerings?

Diversifying insurance offerings helps manage risk, ensures sustainable growth, and improves customer retention, ultimately benefiting the company.

How does building a strong brand identity benefit insurance agencies?

Building a strong brand identity benefits insurance agencies by differentiating them from competitors, fostering customer trust, and enhancing customer loyalty. This ultimately leads to increased business success and growth.

Related Posts

Thank you for taking the time to read our blog post!