Open Source Insurance Software: Best Solutions in 2024

Choosing the right open source insurance software can feel like navigating a maze.

With so many options available, it’s important to find a solution that not only meets your technical needs, but also aligns with your business goals.

This article is designed to help you navigate the world of open source insurance software and make a more informed decision. Dive in and find out how the right open source software solution can mean a more streamlined and effective insurance process.

The Importance of Open-Source Software in Insurance Industry

The adoption of open source software by insurance companies represents an opportunity to create a more transparent, collaborative, and cost-effective technology environment for future operations.

Why it’s important?

Open source tools provide insurance companies with unparalleled flexibility to customize solutions to meet their unique business needs.

By tapping into the collective intelligence and innovation of global developer communities, insurance companies can improve services, streamline processes, and ultimately deliver more value to their customers.

Key Open-Source Software Solutions Worth Keeping Track Of

In the rapidly evolving insurance industry, staying abreast of technological advances is critical.

Below, we’ve listed key open source software solutions for insurance companies that stand out for their innovation, flexibility, and ability to address the complex challenges facing insurance professionals today.

Each tool offers unique features designed to streamline operations, enhance customer engagement, and improve overall efficiency.

Openkoda Insurance Agency Management System

Openkoda Insurance Agency Management System is an innovative AI insurance software designed to meet the evolving needs of insurance brokers and agencies.

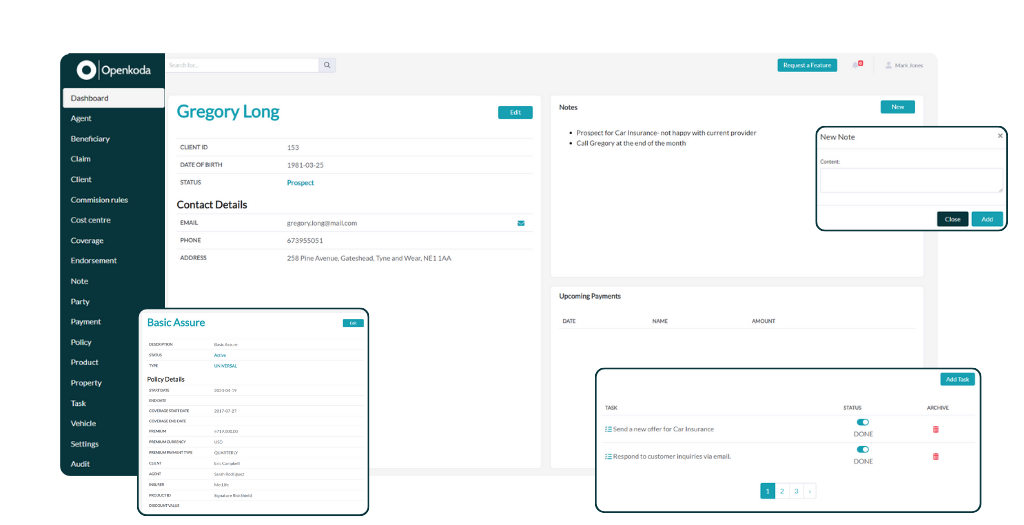

Openkoda gives insurance companies and independent brokers complete control over policy management, enabling agents to streamline their operations.

With its customizable interface, Openkoda features a comprehensive dashboard that provides instant access to key performance metrics critical for oversight and in-depth analysis.

In addition, Openkoda includes an efficient document management tool that effortlessly organizes critical documents for all customers. This feature not only supports regulatory compliance, but also reduces errors and improves customer service by refining document management practices.

Key features of the Openkoda Insurance Agency Management System include:

- Streamlined Policy Management: The platform offers streamlined policy administration system, automating routine tasks such as client interaction and policy renewals, thus improving operational efficiency.

- AI-Powered Reporting Automation: It enables instant reporting and accurate record searching, significantly enhancing the insurance administration process and allow agents to quickly respond to any changes.

- Customization for Business Needs: Designed to be fully customizable, Openkoda meets the unique requirements of insurance businesses, offering fast data processing and escaping vendor lock-ins.

- 360° Client and Policy Custom View: Users can personalize their workspace in a central hub, integrating documents, policies, meetings, calendars, notes, and other key functions for a streamlined policy management experience.

- Central Repository of Policy Documents: Offers a simplified document management system for uploading, downloading, and managing policy documents, which aids in reducing manual data entry and improving accuracy.

- Easy Report-Building AI Companion: This functionality allows users to generate reports quickly and automate tasks using AI, making the process more efficient

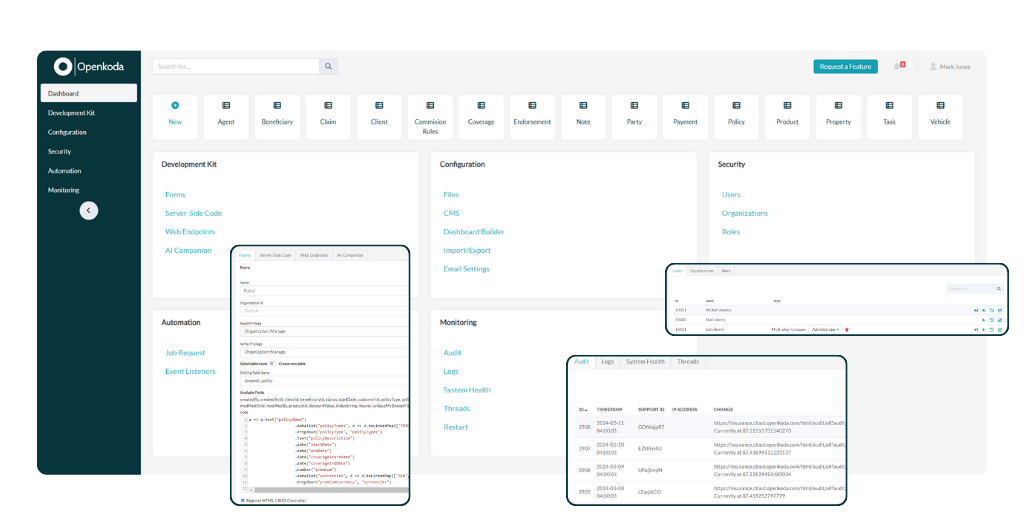

This insurance agency management system is built on an advanced development platform that allows it to be modified and tailored to the individual needs of the business.

It provides developers with a scalable, extensible and secure environment for creating applications more efficiently than traditional methods. Openkoda is unique in offering a combination of pre-built application templates and customizable solutions designed to reduce the time required to create custom functionality by up to 60% and deliver significant cost savings.

Of course, the entire application is open source.

What does this mean for the insurance company?

The company can take its source code and data anywhere it wants without fear of vendor lock-in.

In other words, it retains full ownership of the code – something crucial in a world of ever-increasing fees and user-based pricing.

Openkoda’s approach for managing insurance agencies focuses on personalization, productivity, and support for expansion, positioning it as an attractive open-source insurance software for agencies aiming to utilize contemporary technology to enhance their processes.

Intrigued?

Openkoda is an insurance open-source solution that’s available today!

SuiteCRM

SuiteCRM is open source customer relationship management (CRM) software that provides a 360-degree view of your customers and your business. It enables the integration of CRM with core business systems, increasing productivity across the enterprise. The platform is known for its freedom and flexibility, enabling customization to meet specific business needs.

[Read also: The Role of Digitization in Insurance Industry And Its Future]

InsurancePro CRM

InsurancePro CRM is designed as a software solution for life insurance agents, with an emphasis on a comprehensive and intuitive platform to manage various aspects of their work. The project is developed using modern web technologies such as ReactJS and the MERN stack (MongoDB, Express.js, React.js, Node.js), which suggests that it will provide a dynamic and responsive user experience suitable for today’s web standards.

[Read also: Top Software for Insurance Brokers in 2024]

Develop Your Custom Software On Open-Source Tech Stack

What should your company do when none of the tools available on the market have the functionality you need?

The answer is custom software, and the insurance industry is one area where custom software can really make a difference and significantly improve business operations.

The need for custom software solutions in the insurance industry is largely driven by the vast number of niches in the industry, each requiring specialized functionality to address unique risks, regulatory requirements, and customer expectations.

But even when pursuing custom insurance software, it’s important to base the project on a solid and trusted open source technology stack.

The use of open source technologies in custom insurance software solutions offers significant benefits in terms of flexibility, security, and cost-effectiveness, but perhaps most importantly, it ensures that the technology stack will remain relevant for longer, minimizing the risk of dealing with outdated legacy software in the future.

Stratoflow – Your Custom Insurance Software Experts

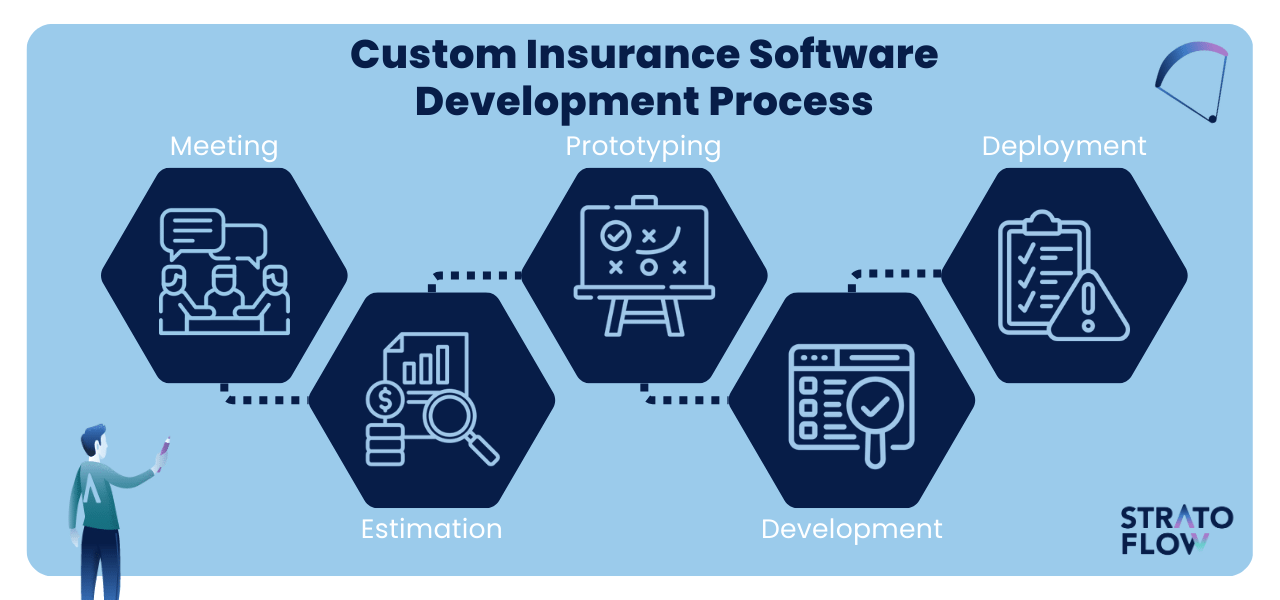

Stratoflow is a leading custom software development company focused on delivering world-class insurance software solutions.

Our approach focuses on delivering customized, efficient, and flexible systems designed to improve insurance operations, streamline policy management, and enhance customer engagement.

We can build for you custom:

And many more other insurance software systems tailored specifically to your insurance business.

By leveraging innovative technology and deep insurtech expertise, Stratoflow’s custom software development experts ensure that its clients achieve significant operational improvements and rapid insurance agency growth.

Do you have your own idea for an insurance software system?

Contact us to see how we can turn your vision into reality!

Conclusion

Wrapping up, exploring the landscape of open source insurance software, including standout options like Openkoda, reveals a wealth of possibilities tailored to enhance insurance operations. The right choice can significantly impact your business, so consider these insights as a foundational step towards empowering your insurance services with the best open source solution.

Related Posts

Thank you for taking the time to read our blog post!