Best Insurance Broker Management Systems In 2024

By 2024, insurance broker management systems have evolved to offer more powerful and user-friendly options than ever before.

This article will introduce you to the best insurance broker management systems available, highlighting key features, ease of use, and how these platforms can streamline operations for brokers.

Whether you’re looking to improve client communication, automate workflows, or integrate advanced analytics, this guide will provide essential insight into choosing the right system for your agency.

Contents

- Introduction to Insurance Broker Management System

- What to Look For in a Insurance Broker Management Software Solution

- Importance of Insurance Broker Management Software – Key Statistics

- 5 Best Insurance Broker Management Software Solutions of 2024

- Going Custom – How to Develop Insurance Broker Management Software Faster and More Efficiently?

- Stratoflow – Your Go-to Experts for Developing Custom Insurance Software

Introduction to Insurance Broker Management System

An Insurance Broker Management System is a specialized software designed to streamline the operations of insurance brokers. It serves as a digital toolkit in the insurance industry for brokers who act as intermediaries between clients seeking insurance and insurance companies offering policies.

These systems are tailored for insurance agencies, insurance agents, and independent brokers to meet their unique needs in managing client policies, sales, and administrative tasks. The primary purpose of these systems is to increase efficiency by enabling brokers to manage customer data, process insurance transactions, and seamlessly track interactions with both customers and insurance providers.

By automating routine tasks and organizing customer information, these systems not only save time, but also improve the accuracy and quality of service provided to customers.

In essence, Insurance Brokerage Management Systems are the backbone of a broker’s operations, allowing them to focus more on providing personalized advice and solutions to their clients, rather than being bogged down by paperwork and manual processes.

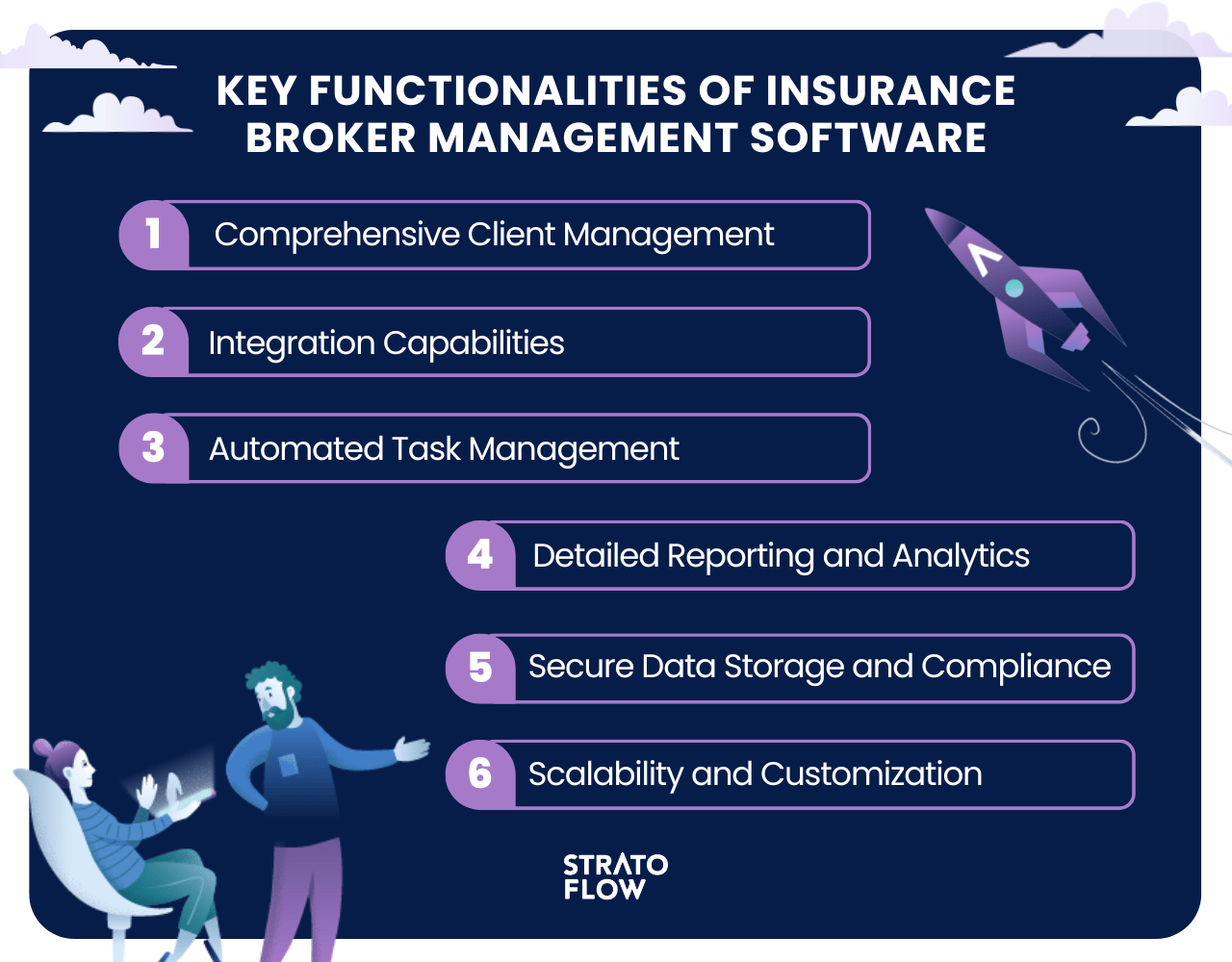

What to Look For in an Insurance Broker Management Software Solution

When selecting an Insurance Agency Management System, it’s important to focus on features that increase efficiency, streamline operations, and improve customer service. A well-rounded system should support your agency’s growth and adapt to evolving industry needs.

Here are key features to look for:

- Client Management Hub: All client data, policies, and communication history are stored in one place, making personalized service easier.

- Integrated Systems: Connects effortlessly with insurance carriers and financial tools, enabling real-time data exchange for faster quotes and policy processing.

- Automated Tasks: Modern insurance broker management systems handle routine tasks automatically, streamlines operations, and reduces manual errors, making your workflow more efficient.

- Insightful Reporting: Offers detailed reports that provide a clear view of business performance, helping guide strategic decisions.

- Data Security & Compliance: Good management software keeps client data safe and ensures regulatory compliance, building trust and maintaining legal standards.

- Customizable & Scalable: The system should be able to be tailored and expanded to fit your agency’s needs as it grows and the insurance landscape shifts.

Choosing an insurance agency management system with these functionalities will empower your agency to operate more effectively, offer superior client service, and stay competitive.

[Read also: Top Software for Insurance Brokers in 2024]

Five Best Insurance Broker Management Software Solutions of 2024

There are various insurance agency management systems and the task of finding the right one is without a doubt a challenging one.

To help you out we’ve compiled a list of the five best Insurance Broker Management Software Solutions that are currently on the market and listed their key features and advantages for your convenience:

Solution #1: Openkoda Insurance Agency Management Software

Openkoda Insurance Agency Management System is an innovative, AI insurance software designed to meet the evolving needs of insurance brokers and agencies.

Its open-source nature gives users complete ownership of the code and the flexibility to run it anywhere, a significant advantage for those who want to customize and extend their software without being tied to vendor-specific limitations.

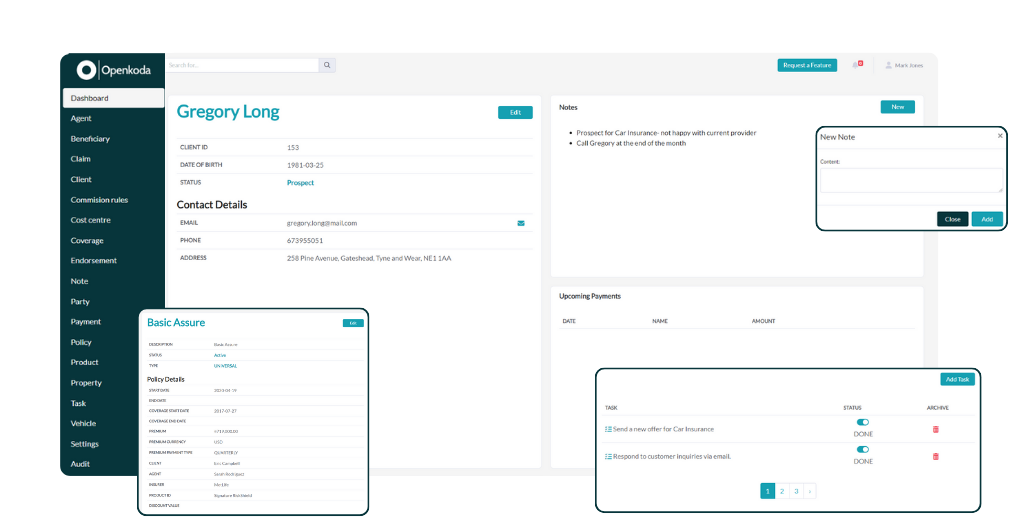

Openkoda gives both insurance companies and individual insurance brokers complete control over policy management, allowing agents to streamline their workflow.

Through its customizable interface, Openkoda presents a detailed dashboard that provides instant insight into key performance indicators necessary for monitoring and in-depth evaluation.

In addition, Openkoda provides a highly effective document management feature that seamlessly categorizes important documents. This capability not only supports regulatory compliance, but also minimizes errors and improves customer service by improving document handling procedures.

Openkoda’s low-code core significantly accelerates and simplifies the development of additional functionality for insurance companies and brokers. This is primarily because its smart architecture allows users to build and customize applications with minimal coding effort, making it accessible to users with varying levels of technical expertise. This approach dramatically reduces the time and resources typically required for software development, allowing organizations to quickly adapt and respond to changing business needs or regulatory requirements.

In addition, Openkoda’s open-source license is a critical aspect that ensures users retain full ownership of their code and application regardless of how many users will use it within the organization.

Key Features

- AI-Driven Enhancements: Openkoda leverages artificial intelligence to streamline policy management, automate client interactions, and facilitate policy renewals, enhancing efficiency across operations.

- Streamlined Policy Management: The system offers a platform for effortless management of policies, improving client communication and simplifying operations for insurance brokers and agencies.

- Central Repository for Documents: It features a central location for all policy documents, supporting PDF uploads/downloads, and simplifying document management.

- AI-Powered Reporting and Automation: Openkoda enables instant reporting and accurate data searching through AI, alongside automating routine tasks to boost operational efficiency.

- Integration Capabilities: It supports integration with a wide range of applications to enhance functionality, from scheduling tools to claims management solutions.

Pros

- Open Source: Users have full control over the software, enabling them to customize and adapt the platform as their business grows.

- AI Capabilities: The inclusion of AI tools for tasks like report generation and customer communication personalization enhances efficiency and effectiveness.

- No Vendor Lock-Ins: The freedom from vendor restrictions allows for greater flexibility in managing and extending the software’s capabilities.

Cons

- Technical Requirement: While being open-source offers customization flexibility, it may require technical expertise to fully leverage this potential.

- Integration Efforts: Depending on the existing systems within an agency, integration efforts may vary and could require additional setup.

Solution #2: Applied Epic

Applied Epic is a widely used insurance agency management software designed to help insurance agencies streamline their operations. It offers a centralized platform where agencies can manage client information, policies, claims, and renewals.

Applied Epic integrates various functions, such as customer relationship management (CRM), accounting, document management, and reporting, making it easier for agencies to track and manage all aspects of their business in one place.

One of the key features of Applied Epic is its ability to automate routine tasks, which can save time and reduce errors. For example, it allows for policy renewals and updates to be processed more efficiently.

Applied Epic is scalable, making it suitable for both small and large agencies. Its cloud-based structure ensures that users can access the platform from anywhere, which is especially useful for agencies with remote or distributed teams.

Key Features

- Cloud-based solution

- integrated policy and benefit administration, document and claims management, and seamless carrier connectivity

Pros

- Advanced and scalable, suitable for large agencies.

- Extensive integration capabilities with third-party applications.

Cons

- Complexity and breadth of features may require a steep learning curve.

- The cost might be a barrier for smaller agencies.

Solution #3: AgencyBloc AMS+

AgencyBloc focuses on life and health insurance agencies, with an emphasis on customer communications, customer relationship management, and back-office automation.

It’s designed to improve operational efficiency and customer service through integrated CRM capabilities, automation of routine tasks, and streamlined communication with policyholders.

Key Features

- Tailored CRM

- back-office automation

- client communication tools

Pros

- Specialized for life and health insurance agencies.

- CRM functionality and automated workflows for improved efficiency.

- Supports email marketing integration.

Cons

- Focused on a specific insurance sector, which might not suit all agency types.

- May lack features necessary for agencies outside of life and health insurance.

Solution #4: Guidewire Digital

Guidewire Digital is a cloud-based suite for property and casualty (P&C) insurers that provides a comprehensive platform for managing the entire policy lifecycle, including enrollment, renewal, billing, and claims.

It’s celebrated for its agile, low-code integration approach that improves operational efficiency and decision-making agility. Guidewire’s digital-first strategy aims to increase policyholder engagement and streamline processes through strategic automation, predictive analytics, and an easy-to-use, omnichannel experience.

Key Features

- Low-code integration,

- omnichannel experiences,

- predictive analytics,

- AI-driven insights.

Pros

- Integrated suite for the entire policy lifecycle.

- Digital-first approach enhances policyholder engagement.

- Scalable and customizable to adapt to agency growth.

Cons

- Can be complex and might require significant setup time.

- The extensive feature set could be overwhelming for smaller operations.

[Read also: 10 Best Insurance Agency Growth Strategies You Must Know In 2024]

Solution #5: NowCerts

NowCerts provides a complete, cloud-based management solution for insurance agents.

It secures documentation with dynamic data encryption, and provides predictive analytics and AI to anticipate market and customer needs. NowCerts automates carrier downloads and policy updates, calculates commissions, and integrates with industry-specific raters for fast rate quotes. Its dashboard provides a 360-degree view of policyholders, making it an excellent choice for agencies that prioritize operational efficiency and customer relationship management.

Key Features

- End-to-end management solution

- predictive analytics

- automated task assignments for operational efficiency

Pros

- AI-powered tools for policy updates and carrier downloads.

- Intuitive dashboard for a comprehensive view of policyholders.

- Cloud-based for easy access and management.

Cons

- May require additional training to fully leverage AI capabilities.

- Some features might be more advanced than needed for very small agencies.

[Read also: Ultimate Guide To Insurance Agent Portal Software In 2024]

Going Custom – How to Develop Insurance Broker Management Software Faster and More Efficiently?

But what if your company needs functionality that no other tool on the market offers?

This is where the value of custom software for insurance companies comes into play. Custom software allows you to create a system that is perfectly tailored to your specific operational needs, customer service strategies, and compliance requirements.

This is also where Openkoda Insurance Broker Management Software stands out as a interesting option.

With its focus on extensibility and customization, Openkoda provides an open-source foundation on which companies can build, develop and integrate unique functionality tailored to their operational needs.

This customization capability means that companies can develop an Insurance Broker Management System that perfectly suits their specific needs, ensuring efficiency and customer satisfaction without the high costs typically associated with custom software development.

Importance of Insurance Broker Management Software – Key Statistics

In today’s fast-paced insurance market, Broker Management Software (BMS) plays a pivotal role in the operational efficiency and competitive edge of insurance agencies. As we delve into the significance of these platforms, key statistics reveal how quickly the digital transformation in the insurance industry is progressing and how companies are leveraging software solutions to improve client satisfaction, and overall business growth.

- Brokerages utilizing a single view of customers through integrated systems report a 35% higher revenue per employee.

- The global insurance software market size reached US$ 3.8 Billion in 2023 and is expected to reach US$ 6.3 Billion by 2032, exhibiting a growth rate (CAGR) of 5.7% during 2024-2032.

- Insurance companies are significantly ramping up their adoption of cloud services, with a projected annual growth rate of 32% in cloud services by 2025.

- In a 2020 survey, 59% of respondents in Europe were already implementing their digital transformation plans, slightly more than in North America, and significantly more than in the Asia Pacific region.

[Read also: Ultimate Buyer Guide To Insurance Claims Management Software: How to Choose One?]

Conclusion

In conclusion, as digitalization in insurance is becoming an increasingly important insurance trend, adopting Openkoda as your insurance broker management system in 2024 could be a game-changer for your agency.

Its standout features, like the AI module for personalized communication and a customizable interface, not only streamline daily operations but also enhance customer relationships.

As the insurance industry continues to evolve, Openkoda represents a forward-thinking solution that meets the current and future needs of insurance brokers.

FAQ

What is an Insurance Broker Management System and how does it benefit my agency?

An Insurance Broker Management System is a specialized software designed to help insurance agents manage their day-to-day operations more efficiently. It streamlines tasks such as client data management, policy administration, communication, and reporting. This system benefits agencies by improving operational efficiency, enhancing customer service, ensuring data accuracy, and providing valuable insights into business performance.

Can an Insurance Broker Management System integrate with existing software and platforms used by my agency?

Insurance Broker Management Systems like Openkoda Insurance Broker Management Software are designed with integration capabilities to work seamlessly with existing software and platforms. This includes CRM systems, accounting software, email marketing tools, and more. Integration allows for smoother workflows, data modernization, and eliminates the need for redundant data entry, making it easier for agencies to maintain comprehensive and up-to-date information.

How does an Insurance Broker Management System ensure data security and compliance with regulations?

Insurance Broker Management Systems are built with robust security features to protect sensitive client information and ensure compliance with industry regulations such as GDPR or HIPAA.

This includes encryption of data in transit and at rest, secure access controls, audit trails, and regular security updates. Additionally, these systems often include compliance management tools to help agencies adhere to legal standards and regulatory requirements.

What are the key features in Insurance Broker Management Systems?

When choosing an Insurance Broker Management System, look for key features like client relationship management (CRM), policy management, automated workflow, document management, reporting and analytics, communication tools, and integration capabilities. Additionally, consider systems that offer scalability, user-friendly interfaces, and strong customer support.

How customizable are Insurance Broker Management Systems?

Insurance Broker Management Systems often offer a high degree of customization to adapt to the specific needs of different insurance agencies.

This can include customizable workflows, policy templates, reporting tools, and the ability to add or modify features according to business requirements. The level of customization will vary among systems, so it’s important to choose a solution that aligns with your agency’s unique processes and growth plans.

Related Posts

Thank you for taking the time to read our blog post!