Insurance Digital Transformation: Future of Insurance Technology

The world of insurance is rapidly evolving, thanks to digital transformation.

This shift is not only changing the way we manage risk, but it’s also creating new opportunities for both insurers and policyholders.

In this article, we’ll explore how technology is reshaping the industry, from personalization to real-time claims processing.

Contents

- The role of digital transformation in the insurance industry

- Importance of insurtech in 2025

- Key digital transformation in insurance statistics

- Eight digital transformation trends in insurance in 2025

- 5 software solutions in the insurance industry that every professional should know

- Going custom: the value in insurance software development

< h2 id=”definition” data-pm-slice=”1 1 []”>The role of Digital Transformation in the Insurance Industry

Digital technologies are increasingly present in our everyday lives, and that includes the insurance industry.

As the insurance landscape continues to change, companies are under pressure to not only keep up, but to get ahead.

This means embracing modern technology and software solutions that can improve efficiency, enhance the customer experience, and unlock new opportunities for growth.

From artificial intelligence and machine learning to blockchain and big data analytics, these advancements provide insurance companies with powerful tools to refine their operations, tailor their offerings, and manage risk more effectively.

Importance of Insurtech in 2025

Insurtech, a blend of insurance and technology, is revolutionizing the insurance industry by integrating cutting-edge technology into traditional insurance models. By 2025, the importance of insurtech cannot be overstated

Insurtech companies are leveraging technology to streamline and improve the customer experience, making insurance more accessible and user-friendly. For example, mobile apps and online platforms allow for quick policy management, claims submission and processing which are curtuail for modern users.

This shift is proven by data and research.

For example, according to an EY report, 80% of customers are willing to use digital and remote contact channels, including video, chat, and email, underscoring the demand for digital-first approaches.

In 2025, as digital interaction becomes more prevalent, the importance of insurtech will escalate as it meets the growing demand for immediate, accessible services, making insurance more responsive to today’s consumer needs.

Key Digital Transformation in Insurance Statistics

The insurance industry is evolving fast, driven by digital transformation—and the numbers speak for themselves.

Here’s a look at some key stats that show just how quickly technology is reshaping the industry, improving efficiency, and enhancing customer experience.

- Statista reports that the global big data analytics market in the insurance industry is expected to reach $3.6 billion by 2027, up from $1.8 billion in 2019, illustrating the growing reliance on data for risk assessment.

- A survey by Willis Towers Watson found that 74% of insurance companies believe that AI will significantly alter or completely transform the industry over the next three years, indicating the importance of technology in achieving operational efficiency.

- According to a PwC survey, 48% of insurers say that innovation is helping to redefine their processes and products, emphasizing the role of technology in driving product development.

Eight digital transformation trends in insurance in 2025

In 2025, the insurance industry will undergo significant digital transformation. This transformation will be driven by eight key insurance industry trends.

These include the rise of software development platforms, the integration of artificial intelligence in insurance.

These trends are streamlining operations, enhancing customer service, and opening new avenues for growth, signaling a major shift in how insurers do business in a digital-first world.

Trend 1: Rise of Rapid Insurance Software Development Platforms

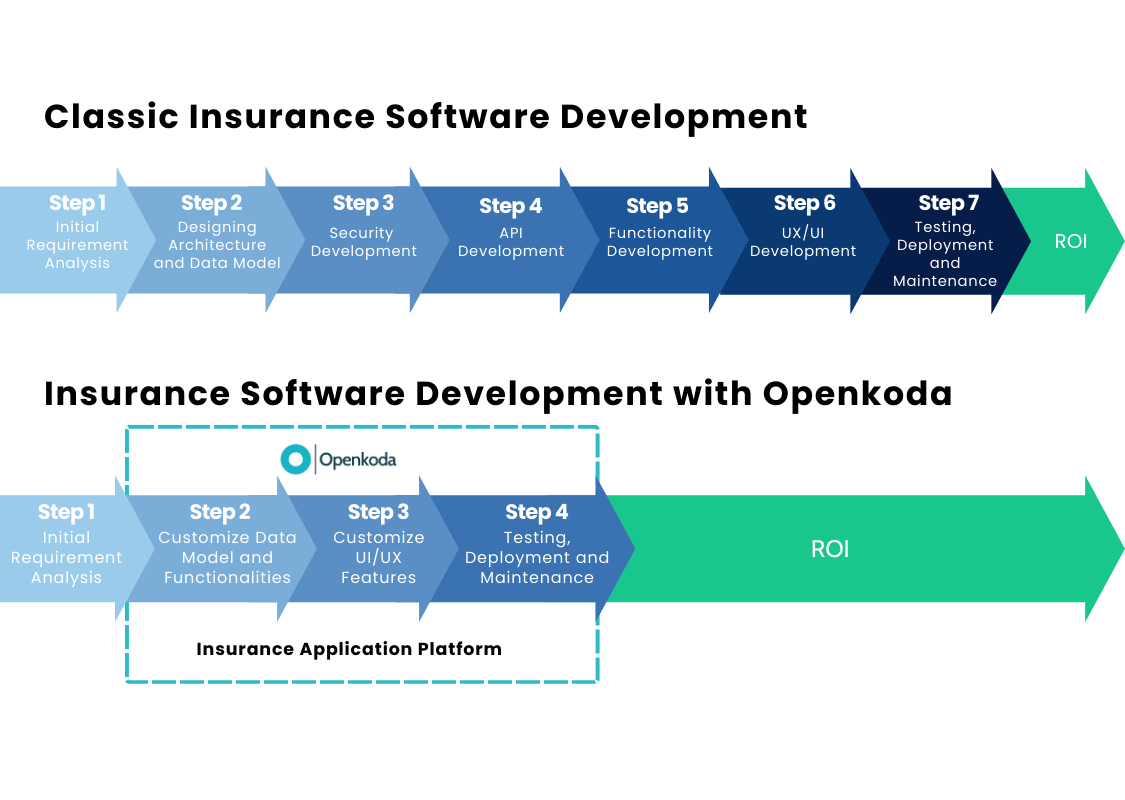

For insurers, the ability to swiftly develop and refine applications enhances customer experience, optimizes operations, and accelerates time-to-market for new products—all while minimizing dependence on limited IT resources and controlling development costs.

However, traditional software development is complex, time-consuming, and expensive, often leaving critical tasks stalled in backlogs for weeks.

Out-of-the-box solutions, on the other hand, may offer faster deployment but often lack the flexibility required to meet insurers’ specific business needs, leading to compromises in functionality and scalability.

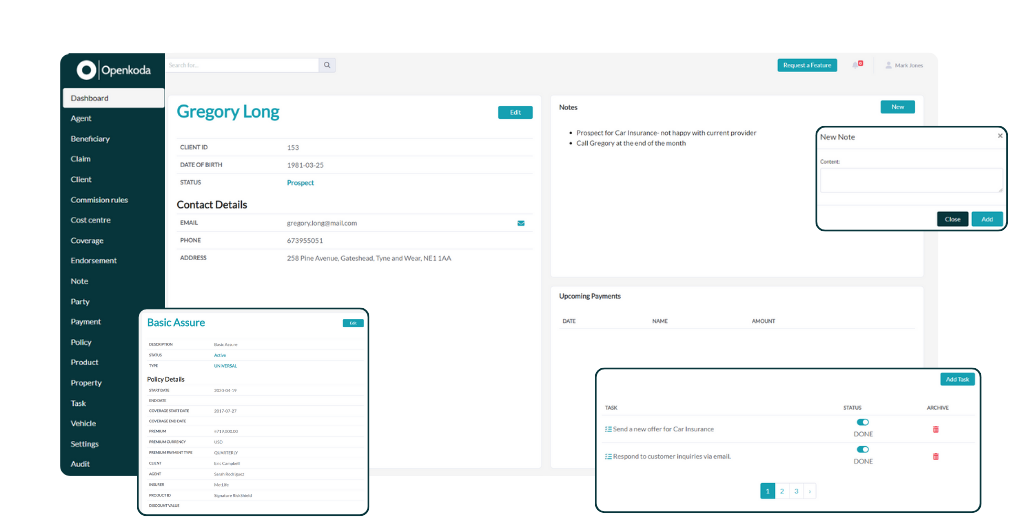

That’s why a rapid development platform like Openkoda provides a strategic advantage in building custom insurance software by drastically reducing both development timelines and associated costs.

Openkoda bridges this gap, providing the perfect middle ground for insurers who need both speed and customization.

It enables rapid prototyping of new insurance products, allowing companies to test, iterate, and launch innovations faster than ever.

Openkoda’s open-source architecture eliminates one of the biggest drawbacks of most insurance low-code platforms: vendor lock-in.

By blending pre-built components with custom development flexibility, it enables insurers to stay ahead of market demands while optimizing costs and resources.

But how would the process of building a new insurance app look when leveraging such a platform?

Let’s take a closer look.

Openkoda in Action: Enhancing Policy Document Management

Imagine an insurance company that needs a custom solution for generating and managing policy documents.

Traditionally, this would involve extensive development cycles to design templates, implement version control, and ensure compliance with industry standards.

With Openkoda, developers can leverage its template customization feature to create fully compliant policy documents in hours instead of weeks.

Built-in integrations with AI-powered decision-support tools also allow analysts to validate policy details with minimal manual input, further saving time and resources.

Check out this demo to see how we built simple policy management app in minutes using prebuilt components and ready insurance data model.

This app can be a great starting point in developing your own robust system tailored perfectly to the internal processes and workflows of your organization.

A Game-Changer for Insurance Businesses

By combining speed, cost-effectiveness, and flexibility, Openkoda empowers insurance companies to respond quickly to market demands while maintaining control over development.

For a business analyst, this means fewer bottlenecks in project delivery, a higher ROI for IT investments, and the ability to focus on delivering business value rather than troubleshooting technical inefficiencies.

Does it sound interesting?

Check out Openkoda’s full capabilities Today!

Trend 2: Putting Artificial Intelligence to Smart Use

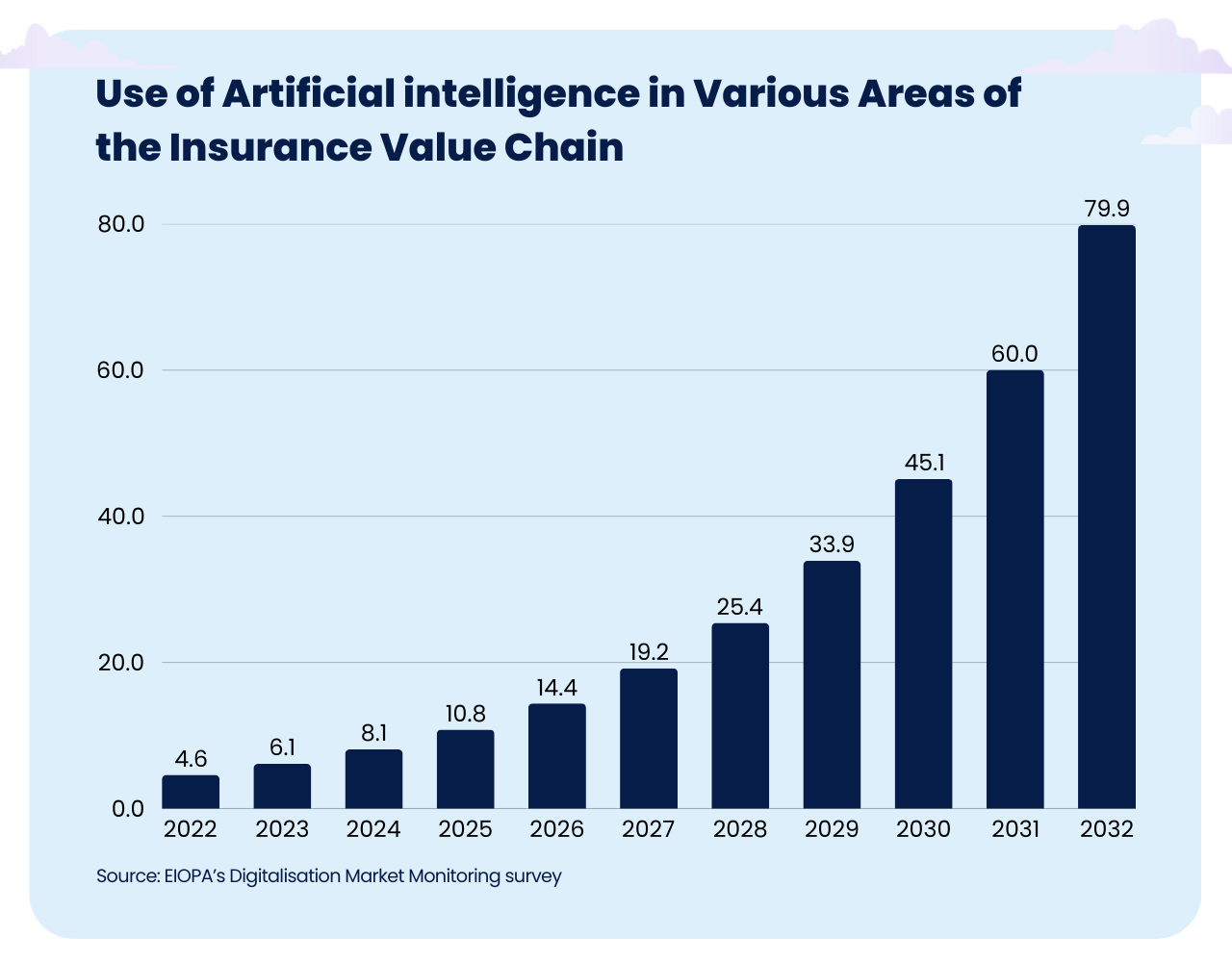

For the last two years, AI has becoming a major trend in almost every business sector, including insurance.

More and more Insurance Agency Management Systems and other enterprise grade systems have already introduced AI-driven tools that automates routine tasks.

What sort of tasts are the best to automate with AI?

Any repetitive process is a strong candidate for automation. AI excels at analyzing vast datasets from diverse sources—such as social media, IoT devices, and historical claims data—to identify patterns and make highly accurate predictions.

With advancements in generative AI, artificial intelligence can now handle unstructured data and natural language processing, unlocking new levels of business efficiency.

For example, in claims processing, AI automates claim verification, assesses damages through image recognition, and even predicts fraud, significantly accelerating processing times, reducing human error, and enhancing customer satisfaction.

On the customer service front, AI-powered chatbots and virtual assistants provide 24/7 support, deliver personalized recommendations, and efficiently manage routine inquiries.

Beyond improving operational efficiency, these technologies enable insurers to offer more competitive, tailored products that better meet individual customer needs.

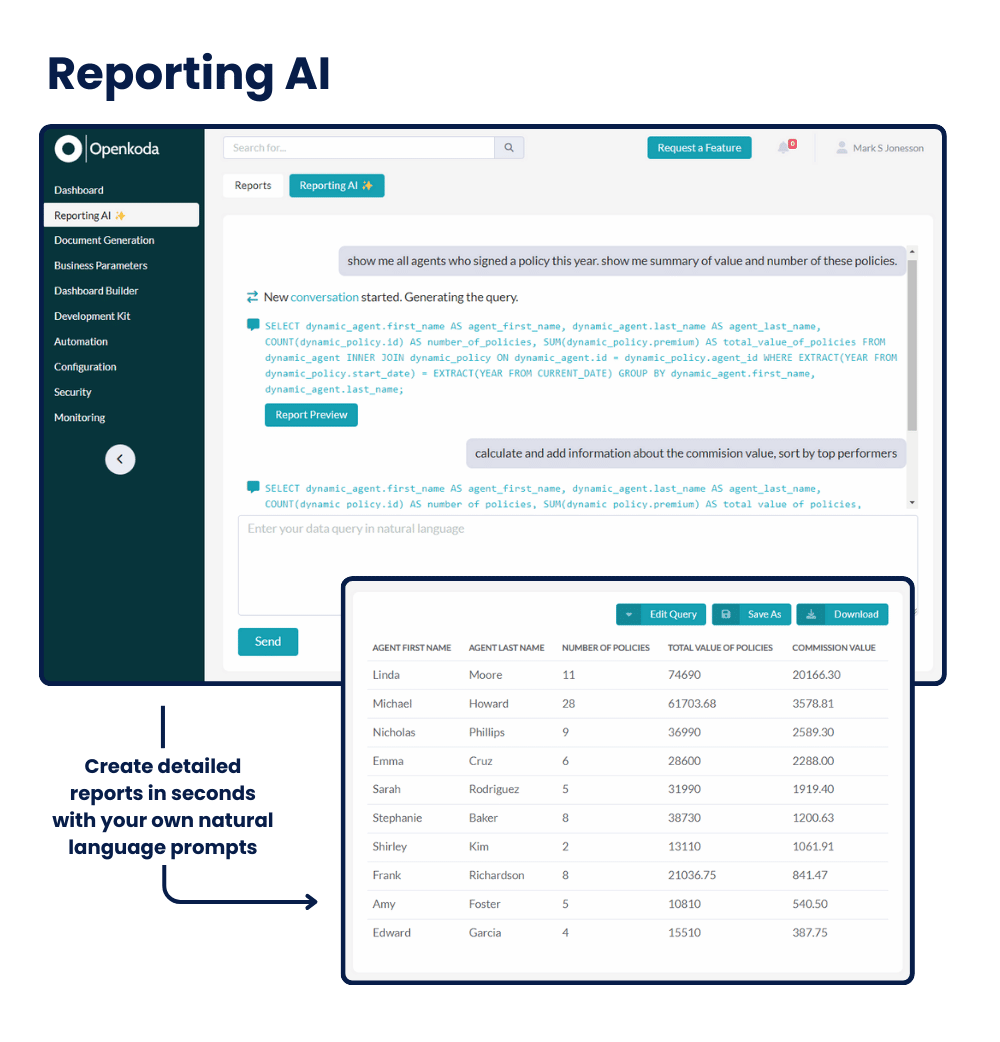

To look more closealy at insurance market, within Openkoda Insurance Agency Management System there’s already a smart AI feature – Reporting AI.

With Reporting AI, users can generate SQL statements using simple natural language prompts. The system ensures security by sharing only the database schema with OpenAI’s API, while executing SQL queries locally.

This functionality can save analysts hours of repetitive work when preparing reports.

Check out this quick demo to see it in action:

Trend 3: Custom Approach to Software Architecture

In today’s rapidly evolving insurance landscape, off-the-shelf solutions often fall short in addressing the industry’s complex regulatory requirements, dynamic risk assessment models, and evolving customer expectations.

A custom-built software ecosystem enables insurers to optimize workflows for their exact business models, enhance customer engagement, and gain a strategic edge in an increasingly competitive market.

Custom insurance software allows carriers, brokers, and MGAs to tackle specific operational challenges with tailored functionalities. Whether it’s:

- Developing an AI-driven claims processing system to automate adjudication, fraud detection, and policyholder communication,

- Implementing an advanced Customer Relationship Management (CRM) platform that delivers a 360-degree customer view, integrates behavioral analytics, and personalizes interactions,

- Building a real-time underwriting platform that leverages predictive analytics, IoT data, and machine learning for enhanced risk assessment and pricing accuracy—

bespoke solutions ensure seamless integration with existing infrastructure, greater agility in responding to market shifts, and improved regulatory compliance.

Furthermore, the rise of Insurtech collaborations underscores the industry’s shift towards innovation.

However, achieving the highest level of software quality and performance requires partnering with industry-leading technology providers who possess deep expertise in insurance-specific challenges, regulatory landscapes, and emerging trends.

Stratoflow – Your guides to custom insurance software

Custom insurance software development is critical in the insurance industry to streamline operations, improve customer experience, and adapt to changing market demands.

At Stratoflow, we specialize in developing custom insurance software, combining deep industry expertise with advanced technology to help insurers optimize operations, enhance customer engagement, and accelerate digital transformation.

With years of experience in enterprise software development, we design and deliver tailored solutions that address the unique challenges of the insurance industry.

Our team of technology experts emphasizes close collaboration, innovation, and engineering skills to deliver high-performance, scalable data processing systems. Their agile methodology ensures that solutions are efficiently aligned with business needs.

Do you have your own custom insurance software project?

Contact us today!

Trend 4: Embedded Insurance as Leading Insurance Trend

Among the most disruptive developments i nthe insurance sector is embedded insurance, a model that seamlessly integrates insurance products into the purchasing journey of other goods and services.

Unlike traditional standalone policies, embedded insurance offers coverage at the point of sale, eliminating friction in the customer experience and significantly expanding insurers’ reach.

For example, when booking a flight, customers may be offered travel insurance as an add-on, or when purchasing electronics, they might have the option to include device protection plans.

This approach not only simplifies the purchasing journey but also increases the accessibility of insurance products, thereby expanding market reach.

Embedded Insurance Growth: Trends and Statistics

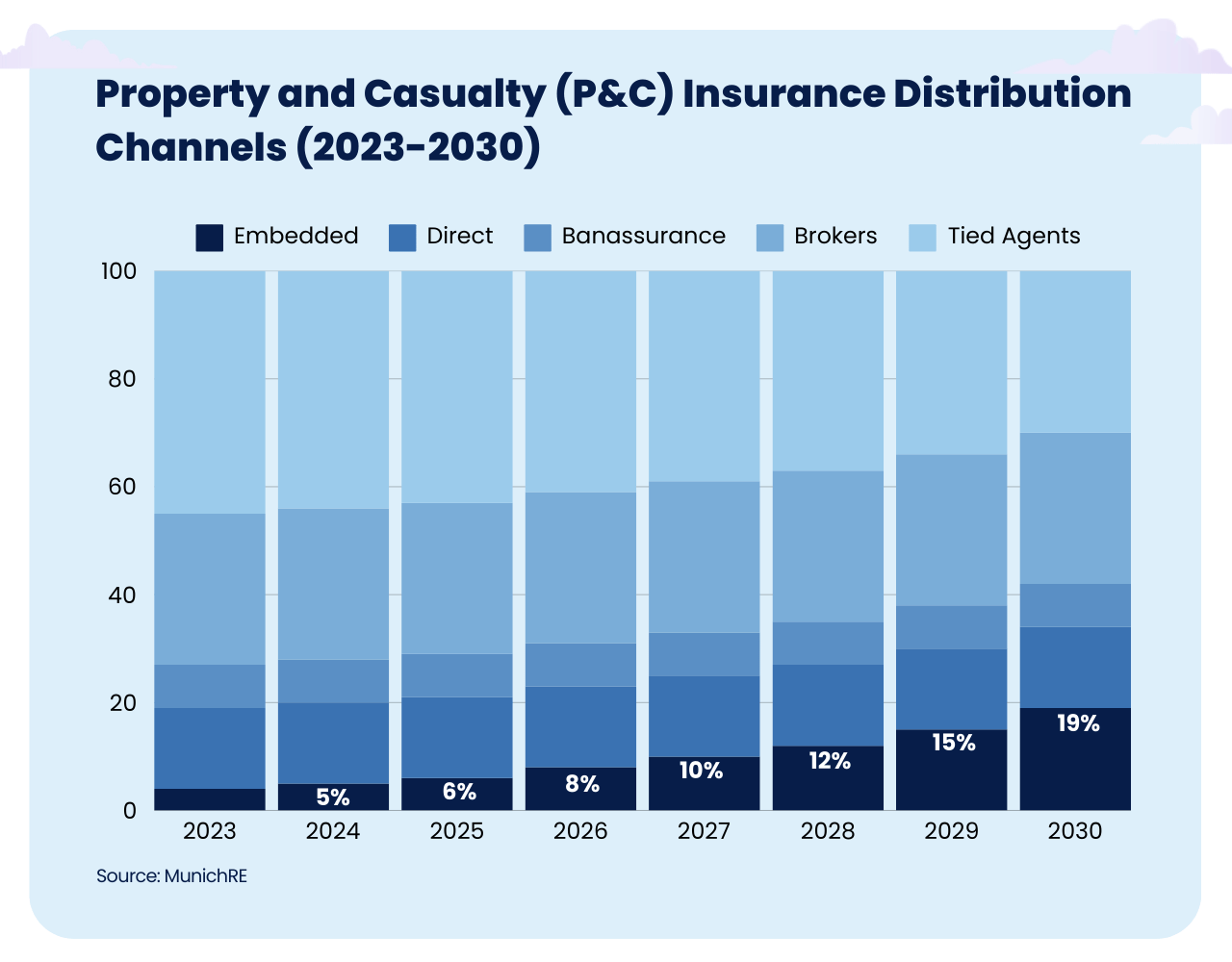

From a financial perspective, the embedded insurance market is experiencing substantial growth.

Embedded insurance is experiencing rapid growth, transforming how consumers access coverage.

The global market is projected to reach approximately $700 billion in gross written premiums (GWP) by 2030, more than six times its current size.

By 2033, it is expected to account for 15% of global GWP, reaching approximately $1.1 trillion, up from its current 3-5%. In the UK, embedded insurance partnerships can reduce customer acquisition costs by 75%, from £200 to £50 per customer.

Offering insurance at the point of sale can increase purchase intent by as much as 25%.

Additionally, 94% of insurance executives view embedded insurance as critical to future strategies, and approximately 63% of insurers are now partnering with industries such as e-commerce, automotive, and healthcare to leverage their platforms to reach broader customer bases.

To effectively prepare for the rise of embedded insurance, insurers should consider the following strategies:

- Technological Integration: Leverage digital platforms like Openkoda that facilitate seamless integration with various partners, ensuring that insurance offerings can be effortlessly embedded into diverse purchasing processes, and adjusted and customized quickly and effortlessly.

- Strategic Partnerships: Collaborate with businesses across multiple sectors—such as retail, travel, and e-commerce—to embed insurance products within their sales channels, thereby reaching customers at the most opportune moments.

- Product Customization: Design flexible insurance products that can be tailored to align with the specific needs and contexts of different partner offerings, enhancing relevance and appeal to consumers.

Trend 5: Thift Away From Legacy Software Systems

Talking about legacy software is always a bit controversial.

On the one hand, these are usually software systems that were built using outdated technology stacks and technologies, and may lack scalability and adaptability.

On the other hand, they still provide core functionality to the business.

So what approach should insurance companies take?

The best option is something in the middle – a strangler pattern – gradually replacing existing software systems with new ones without disrupting system operations.

By gradually adopting modern IT architectures such as microservices, APIs, and cloud computing, insurers can achieve greater scalability, improve data accessibility, and accelerate the delivery of new services without disrupting their day-to-day insurance operations.

This cultural shift toward innovation encourages continuous improvement, experimentation, and the willingness to embrace disruptive technologies.

The value it brings is multifaceted: improved operational efficiency, better customer experiences through digital channels, and the ability to respond quickly to market changes and regulatory requirements.

Openkoda: A Smart Solution for Legacy System Modernization

Successfully modernizing insurance software requires a robust, flexible, and scalable development platform that simplifies integration with legacy infrastructure while enabling rapid development of new functionalities.

This is where once again Openkoda comes into play.

Openkoda provides insurers with a modular, open-source platform that supports a phased modernization strategy without disrupting existing operations. With pre-built components, seamless API integrations, and cloud-native architecture, Openkoda enables insurance companies to:

- Modernize Without Downtime – Gradually replace legacy modules while maintaining operational stability.

- Unify Disparate Insurance Processes – Build a cohesive, singular software architecture that integrates policy management, claims processing, and customer portals into one seamless ecosystem.

- Ensure Scalability & Compliance – Develop future-proof solutions that meet regulatory requirements while supporting long-term business growth.

[Read also: Data Modernization in Insurance Agencies]

Trend 6: The Growth of Insurance Telematics

Insurance telematics represents a significant evolution in the way insurers assess risk and price policies.

Using in-vehicle devices or smartphone applications that track driving behavior, insurers can collect real-time data on speed, acceleration, braking, and time of day driving occurs.

This data enables the creation of usage-based insurance (UBI) models, where premiums are tied directly to individual driving habits, encouraging safer driving and offering fairer, usage-based premiums.

The growth of telematics in insurance not only provides insurers with a more accurate understanding of risk, but also opens up opportunities for deeper customer engagement, providing feedback and incentives for safer driving practices.

Trend 7: Rising Importance of Cyber Insurance

As digital threats become more sophisticated, the demand for cyber insurance products has skyrocketed.

These products cover a range of cyber risks, including data breaches, cyber extortion, and business interruption due to cyber incidents. For insurers, the rise of cyber insurance presents both a challenge and an opportunity.

The challenge is in accurately assessing cyber risk, which requires a deep understanding of rapidly evolving cyber threats and the complex nature of digital ecosystems.

The opportunity lies in meeting a critical market need by providing financial protection and risk management services that help businesses safely navigate the digital landscape.

Insurers are leveraging advanced cybersecurity analytics and partnering with technology companies to enhance their underwriting and cyber risk mitigation capabilities, thereby building trust and expanding their market reach.

[Read also: Future of Digital Transformation and Trends: Expert View]

Trend 8: Innovative RegTech Solutions for Improved Compliance

Regulatory technology (RegTech) solutions are changing the way insurers manage compliance and regulatory reporting.

As the insurance industry faces an ever-increasing number of regulations, traditional manual processes for compliance are no longer viable.

RegTech uses advanced technologies such as AI and machine learning to automate compliance tasks, monitor regulations in real time, and ensure that insurers can quickly adapt to regulatory changes.

The adoption of RegTech solutions delivers significant value by reducing the cost and complexity of compliance, minimizing the risk of leaking sensitive customer data, and freeing up resources to focus on core business activities.

[Read also: 10 Best Insurance Agency Growth Strategies You Must Know In 2025]

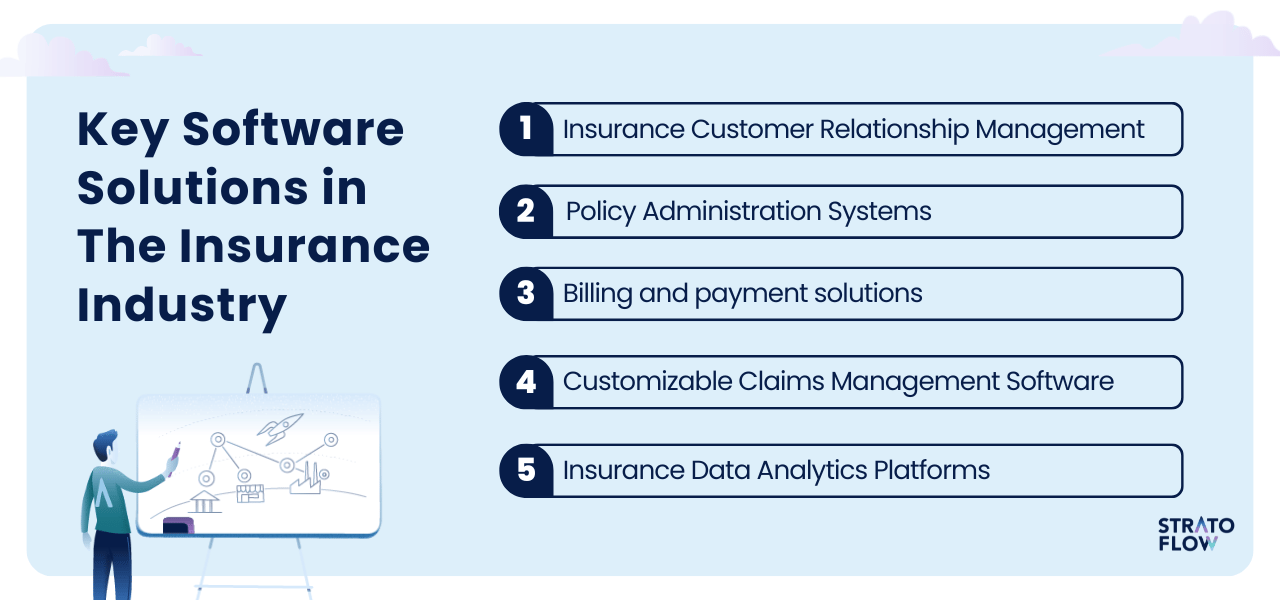

5 software solutions in the insurance industry that every professional should know

In the insurance industry a key for competetivness is knowing the right digital tools.

Here are five essential software solutions every insurance professional should be familiar with.

Do you know alnd leverage them all?

Customer Relationship Management (CRM) Systems for Insurance Companies

CRM systems are critical for managing interactions with current and prospective customers.

They help insurers gain insight into customer behavior, preferences, and history, enabling personalized service and efficient communication.

Popular CRM platforms for the insurance industry include Salesforce and Microsoft Dynamics 365, which offer customized solutions tailored to the needs of the industry.

Policy Administration Systems

Policy administration systems are designed to manage the entire lifecycle of insurance policies, including issuance, endorsement, renewal, and cancellation.

They enable insurers to create and manage policies more efficiently while ensuring regulatory compliance.

Platforms such as Openkoda, Majesco and Sapiens offer modular and flexible policy administration systems to meet the diverse needs of insurance companies.

Billing and payment solutions

Insurance billing and payment solutions are advanced software systems designed to streamline and manage financial transactions between insurers and policyholders.

These solutions automate the billing and invoicing process, ensure accurate and timely premium calculations, and support multiple payment methods to accommodate customer preferences.

Claims Management Software

Claims management software streamlines the claims process from initial notification to final settlement. It increases efficiency, reduces manual errors, and improves customer satisfaction by expediting the claims process.

Guidewire and Duck Creek are examples of platforms that provide comprehensive claims management solutions tailored to the insurance industry.

Insurance Data Analytics Platforms

Analytics platforms provide insurers and brokers with insights from customer data analysis to help them better understand risk, set premiums, predict trends, and make strategic decisions.

These platforms can analyze structured and unstructured data from multiple sources to provide predictive modeling, risk scoring, and customer segmentation. SAS and IBM offer analytics solutions that are widely used in the insurance industry for their advanced data analysis and interpretation capabilities.

[Read also: Insurance Software: How to Choose the Right One for Small Agencies]

Going Custom: Value of Custom Insurance Software Development

The development of custom software solutions offers transformative potential for companies in the insurance industry, particularly those operating in specialized niches.

The one-size-fits-all approach common to off-the-shelf software often fails to address the unique challenges and requirements of specific segments of the insurance market.

Custom software solutions can be tailored to address the nuances of these niches, enabling more accurate risk assessment, policy customization, and claims handling.

So what kinds of systems can be customized?

Possibilities are pretty much limitless and include:

- Insurance Agent Portal Software

- Agency Management Systems

- Software for Insurance Brokers

- Claims Management Software

- Policy Management Software

But that’s not all.

There are also all kinds of niche insurers targeting specific client groups that truly require tailored approach.

For cyber insurance for instance, custom systems can incorporate real-time data on emerging threats and offer dynamic coverage options.

If you want to know more about the custom software development as a whole we highly encourage you to check out our Custom Software Development Guide for 2025

Related Posts

Thank you for taking the time to read our blog post!