How to Build a Custom Accounting Software

Finance and accounting is one of the most critical aspects of running any business, regardless of the industry.

Enterprise accounting software must provide top-notch functionality to ensure good information flow and proper security. Since out-of-the-box solutions are often not sufficient to meet the complex needs of businesses, developing a custom accounting solution is often the best choice for many companies out there.

In this guide, we will explore the basic steps involved in planning, designing, and developing a custom accounting software. Join us as we navigate through the practicalities of custom software development and provide you with the essential knowledge to strengthen your company’s financial management.

Contents

- What is a custom accounting software?

- Who needs custom accounting software?

- Importance of custom accounting software development

- Types of custom accounting software

- Five steps of accounting software development process

- Accounting software development cost

- Choosing the right accounting software development company

- Role of low code in custom accounting software development

What is a custom accounting software?

Custom accounting software refers to a software solution that is specifically designed and developed to meet the unique accounting needs of a particular organization or business.

Unlike off-the-shelf solutions that offer a one-size-fits-all approach, custom accounting systems are intricately designed to accommodate the unique and often nuanced operational frameworks of businesses, ensuring optimal synergy between financial activities and business objectives.

Who needs custom accounting software?

Why do people buy tailored suits?

Usually, it’s because they want something that fits their unique tastes and needs. Something beyond the standard designs.

It’s a similar story with custom software.

Businesses may seek custom accounting software for a variety of reasons, but typically it’s because they have unique or specific needs that can’t be met by standard, off-the-shelf software. Sometimes they need a software solution that is designed to fit perfectly with the organization’s financial workflows and that can evolve with the business.

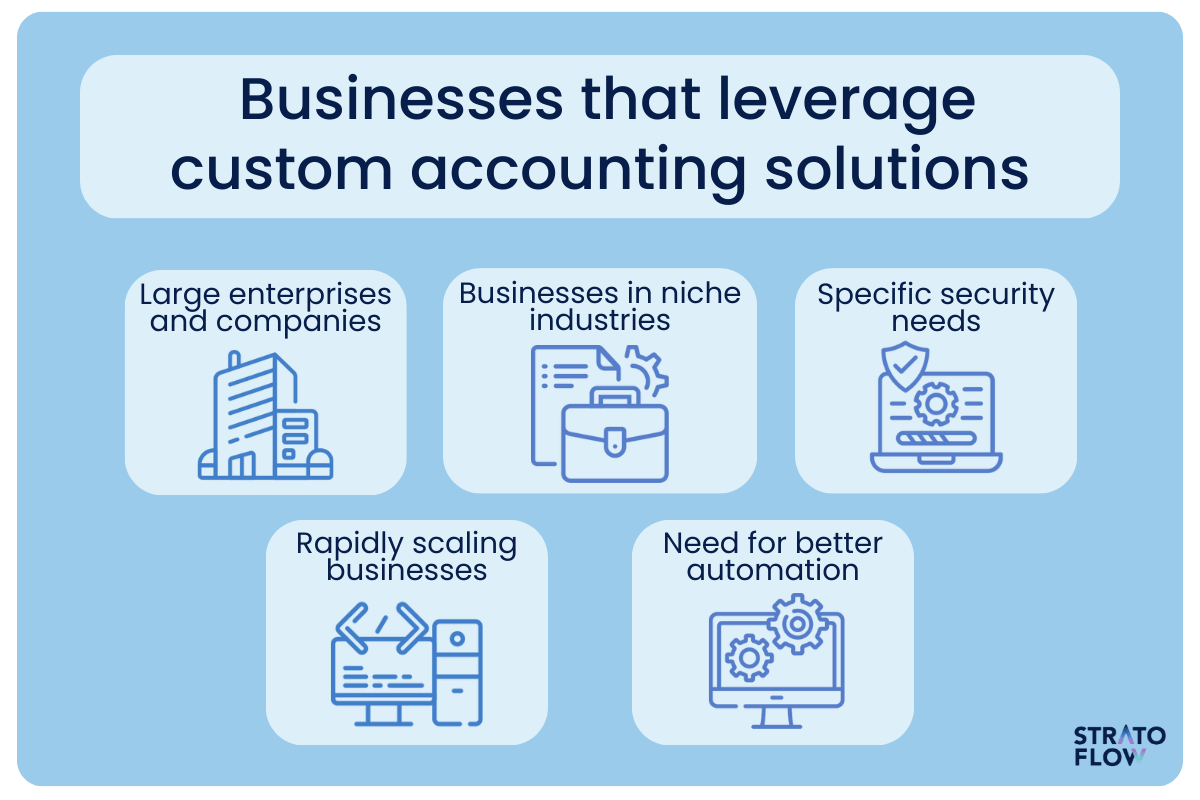

Examples of businesses that might want to leverage custom accounting solutions include:

- Large enterprises – Custom accounting software allow companies with complex and multifaceted accounting operations to go beyond standard practices and help with specialized integrations with existing systems and software.

- Niche industries or sector-specific businesses – Industries with specialized accounting practices or regulatory compliance that aren’t catered to by generic accounting software and require a tailored approach.

- Organizations with specific security needs – Entities that require extremely high levels of security and financial data protection, beyond what is provided by commercial software, can greatly benefit from bespoke accounting software.

- Rapidly scaling or evolving businesses – Small businesses that are growing or evolving rapidly require software that can scale with them, and only a custom accounting software solution can provide sufficient level of scalability.

- Businesses seeking enhanced automation – Companies looking to leverage advanced automation features that may not be available in generic software and require custom solution.

Importance of custom accounting software development

Explaining the importance of accounting software development services is a complex task.

Why is that?

The multitude of benefits it brings to modern businesses is hard to grasp, and some of them may not be so obvious at first glance.

Customized accounting software solutions are part of financial transformation. Thet not only provide a framework that is closely tailored to a company’s specific financial management and reporting needs, but also improve overall operational efficiency by automating specialized workflows and reducing the potential for human error.

This improved efficiency will undoubtedly translate into further cost savings down the line.

Enhanced integration capabilities also ensure a seamless flow of data between different internal systems, promoting data consistency and automated data transfers.

In addition, custom software allows businesses to maintain strict compliance with industry-specific regulations and tax laws, and facilitates both internal and external audit processes through specialized features such as detailed audit trails.

And let’s not beat around the bush – the upfront investment in custom accounting software development can be substantial.

However, the long-term benefits in terms of efficiency, compliance, and competitive advantage will surely outweigh the cost and provide an excellent return on investment.

Custom accounting software development provides businesses with a tool that fits their operations perfectly, allowing them to manage their finances more effectively and strategically.

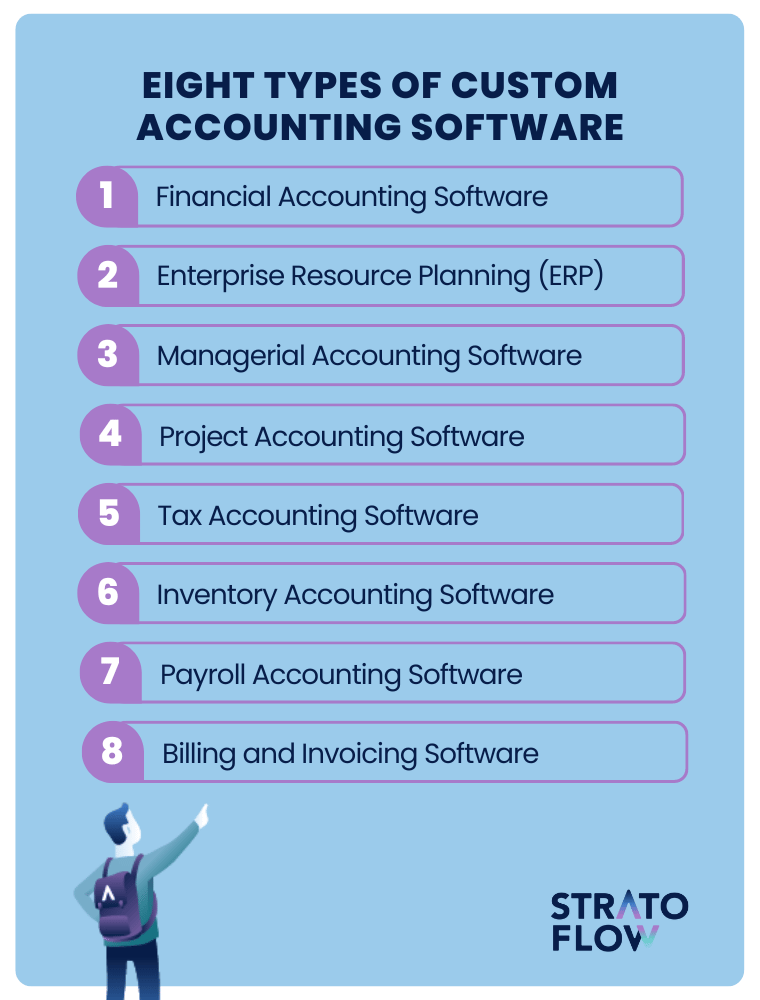

Types of custom accounting software

Custom accounting software can be developed to meet various financial and managerial accounting needs of different companies and organizations. Depending on the specific requirements and scale of operations, various types of custom accounting software can be developed:

Financial Accounting Software

Financial accounting software is a specialized application that helps organizations manage and automate their financial transactions and processes to ensure accurate record keeping, financial compliance, and effective financial management.

It’s by far the most robust type of financial software on this list because it incorporates the functionality of other applications.

It can be both web-based and native accounting software. It helps track financial transactions, manage invoices and bank accounts, process payroll, and generate various financial reports to provide a comprehensive view of the organization’s financial status.

Enterprise Resource Planning (ERP) software

Although a broader category, ERP software often includes comprehensive accounting functionality.

Tailored ERP accounting system solutions may include custom accounting modules that integrate with other business functions, such as human resources, procurement, and supply chain management, to provide a holistic view of a company’s finances and operations.

Managerial Accounting Software

Focused on providing detailed financial and operational information to support internal decision-making processes, managerial accounting software can include budgeting, forecasting, performance tracking, and analytical capabilities that help management with strategic planning and controlling organizational costs.

Unlike financial accounting, which is externally focused and compliance-oriented, managerial accounting is internally focused and aims to provide data that helps plan, control, and evaluate the organization’s operations and strategic initiatives.

Project Accounting Software

This type is designed to manage the financial aspects of specific projects or jobs, tracking project costs, revenues, and profitability.

It can include budget management, expense tracking, invoicing, and financial reporting capabilities for individual projects to ensure they remain financially viable.

Tax Accounting Software

Designed to manage an organization’s tax-related activities, tax accounting software helps calculate taxes, file returns, and ensure compliance with local, state, and federal tax regulations. It may include features for managing different tax categories and deductions, and maintaining detailed tax records.

Inventory Accounting Software

This type specifically handles inventory valuation, tracking, and management to ensure that the cost of goods sold and inventory levels are accurately reflected in the financial statements.

It may include functions for tracking inventory levels, managing purchase orders, and optimizing inventory carrying costs.

Payroll Accounting Software

Payroll software manages all aspects of employee compensation and ensures that payroll is processed accurately and on time.

It can handle wage calculations, deductions, tax withholdings, and payroll disbursements while ensuring compliance with employment and tax laws.

Billing and Invoicing Software

Customized billing and invoicing software helps organizations create invoices, track payments, and manage receivables.

It can be tailored to handle different billing models, support multiple currencies, and comply with specific invoicing regulations and standards applicable to the business domain.

[Read also: What are Financial Management Systems: Best Tools to Choose From in 2023]

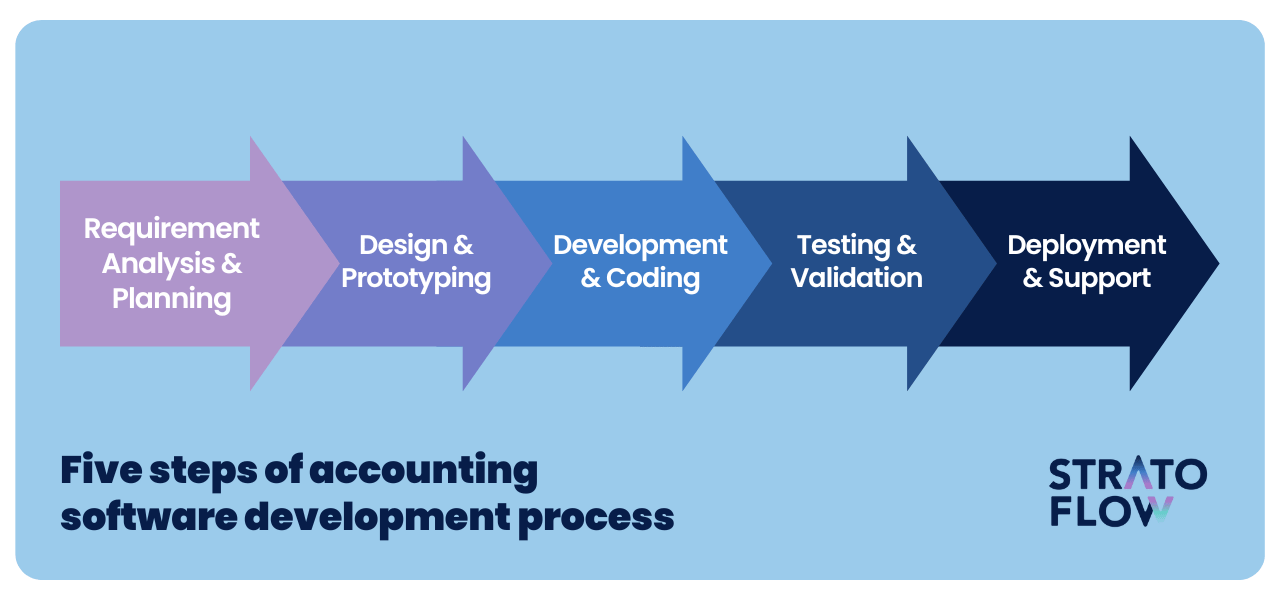

Five steps of accounting software development process

The accounting software development process is critical for several reasons to ensure that the final product is not only robust and reliable, but also tailored to meet the specific needs and challenges of an organization or its users.

Here’s a breakdown of the entire accounting software development process into 5 key phases. This can serve as a guide for your own custom software development process and a reminder of what to consider at each step of the process, from initial development planning to final deployment.

Step 1: Requirement Analysis & Planning

In this first step, requirement analysis, organizations work with developers to conduct thorough analyses to understand and document specific accounting needs, challenges, and desired outcomes for the software.

Communication is critical.

From a business perspective, it’s critical to ensure that each requirement is fully detailed and clearly communicated to avoid inconsistencies in future phases, and that all regulatory and compliance requirements are thoroughly understood and integrated into the plan.

Key takeaway

Detailing in a clear and conhise way all the business requirements of the project.

Step 2: Design & Prototyping

Now it’s time to turn ideas into a real and tangible plan for the entire development cycle.

During the design phase, visual layouts, Proof of Concept, and Minimum Viable Product prototypes of the software are often created. It’s critical for organizations to prioritize user-friendly design and ensure that the prototype seamlessly aligns with real-world accounting workflows and processes.

Active involvement at this stage to validate the design and functionality against real business needs is essential to avoid costly adjustments down the line.

Key takeaway

Creating functional clarity and ensuring project feasibility.

Step 3: Development & Coding

Now comes the active development phase.

In this step, developers start coding the software based on the agreed design and requirements.

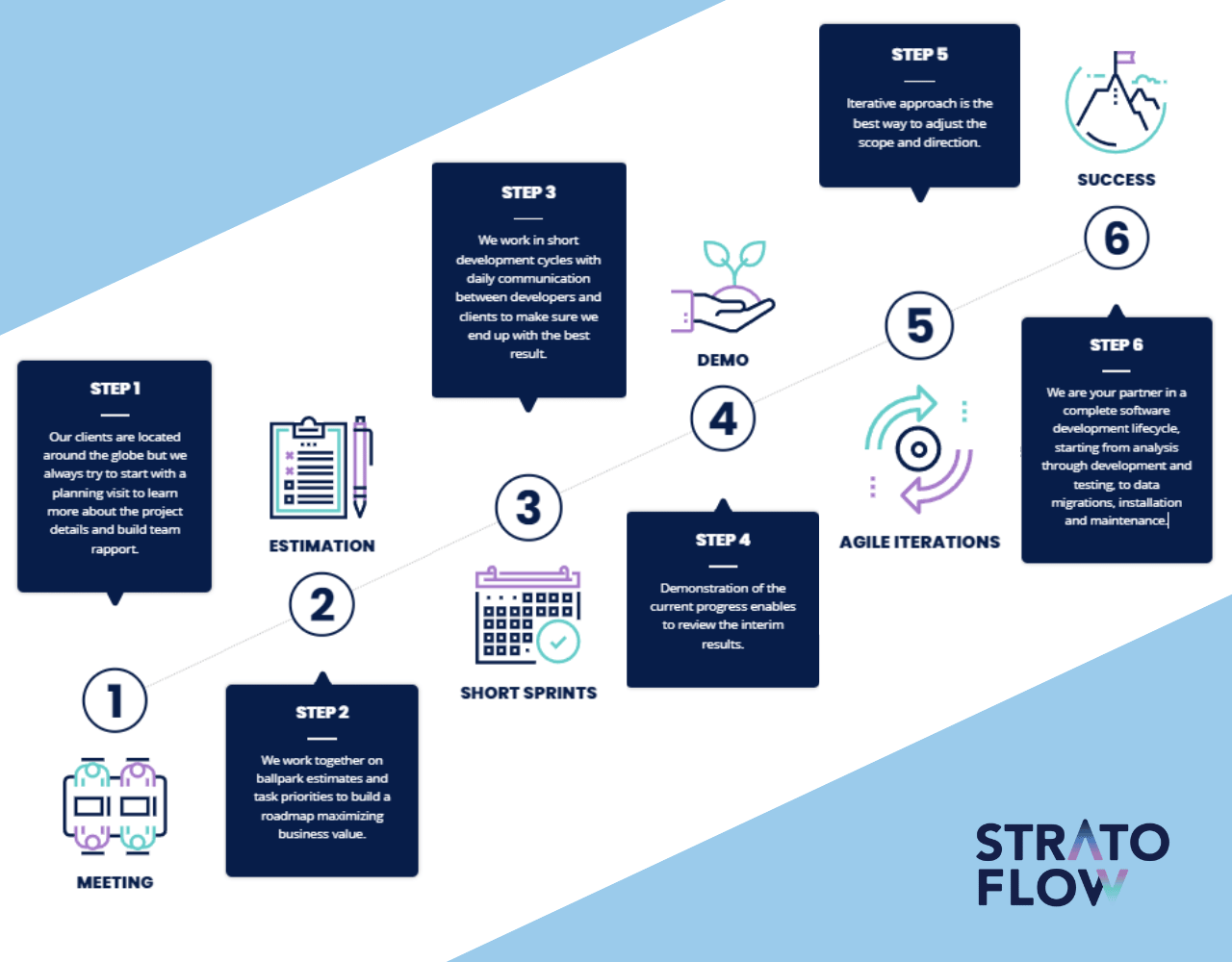

To ensure the best possible results, the development team should work in short development cycles with daily communication between developers and clients. Iterative approach is the best way to adjust the scope and direction.

It’s important to implement a quality assurance process in parallel with development to identify and resolve issues early and ensure that the software is built to the specified specifications and standards.

Key takeaway

Development team should leverage agile methodology, regular progress tracking, quality assurance and solid communication links to deliver best possible results.

Step 4: Testing & Validation

Once software is developed, it should be rigorously tested to ensure that it’s bug-free and meets the outlined requirements.

Organizations must ensure that test scenarios accurately replicate real-world use cases and that all intended users are involved in the testing phase.

Paying attention to the performance, accuracy, and usability of the software during this phase and providing constructive feedback will go a long way toward ensuring the efficiency and reliability of the final product.

Key takeaway

Thorough testing is the key to ensuring sufficient software quality.

Step 5: Deployment & Ongoing Support

In the final phase, it’s time to go live with the final product.

After successful testing, the software is deployed. The organization must facilitate a smooth transition by ensuring adequate training for end users and establishing a support and feedback system to address any challenges encountered during real-time use.

Establishing a mechanism for continuous improvement and ongoing support is critical to adapting to evolving business needs and ensuring the longevity and effectiveness of the software over the long term.

Key takeaway

It’s important to ensure smooth transition and continuous improvement.

Accounting software development cost

By now we understand the benefits of custom accounting software and the process of building one.

So how much does it cost?

That depends.

The cost of custom software can vary widely based on a number of factors, including the complexity of the features desired, the integrations required, the technologies chosen, and the expertise and location of the development team.

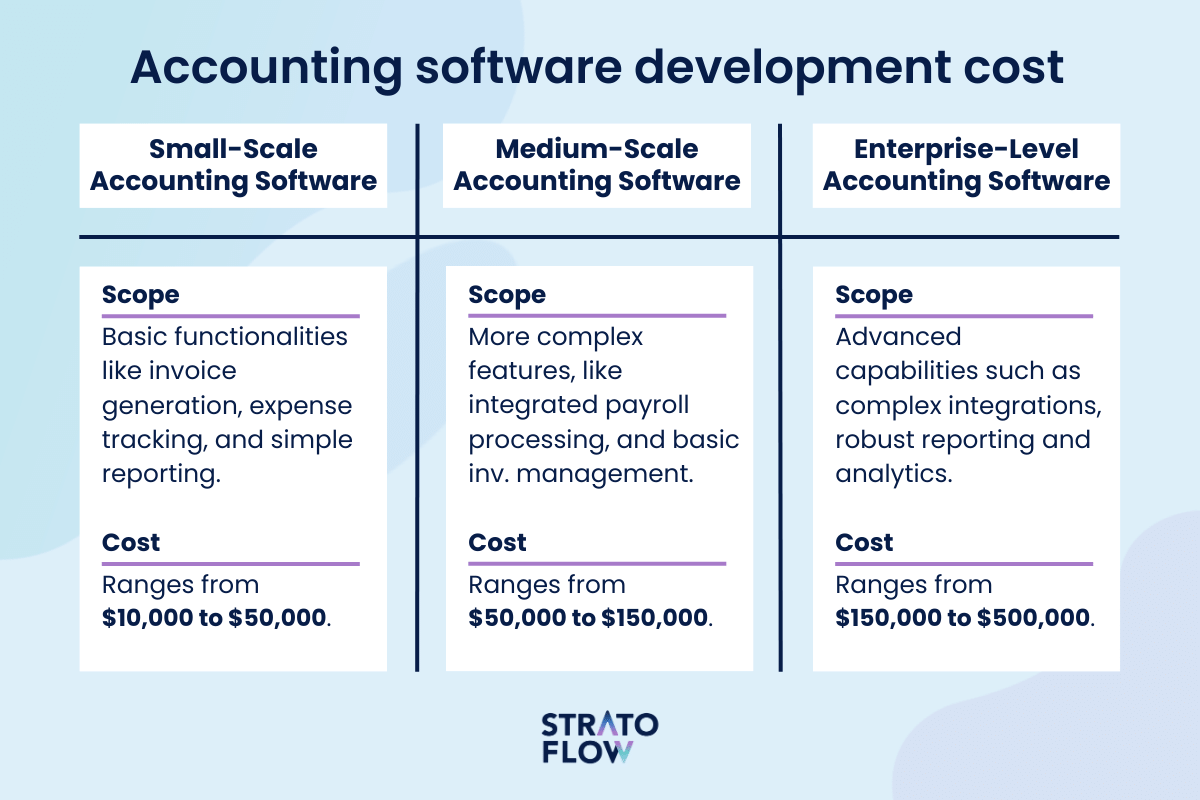

Here’s a general breakdown with some potential scenarios:

Small-Scale Accounting Software:

- Scope: Basic functionalities like invoice generation, expense tracking, and simple reporting.

- Cost: Could range from $10,000 to $50,000.

Medium-Scale Accounting Software:

- Scope: More complex features, like integrated payroll processing, multi-currency support, and basic inventory management.

- Cost: Expected to be in the range of $50,000 to $150,000.

Large-Scale or Enterprise-Level Accounting Software:

- Scope: Advanced capabilities such as complex integrations with existing systems, robust reporting and analytics, high-security protocols, and scalable architecture.

- Cost: Can exceed $150,000 and go up to $500,000 or more, depending on the specifications.

[Read also: Accounting Software for Small Business]

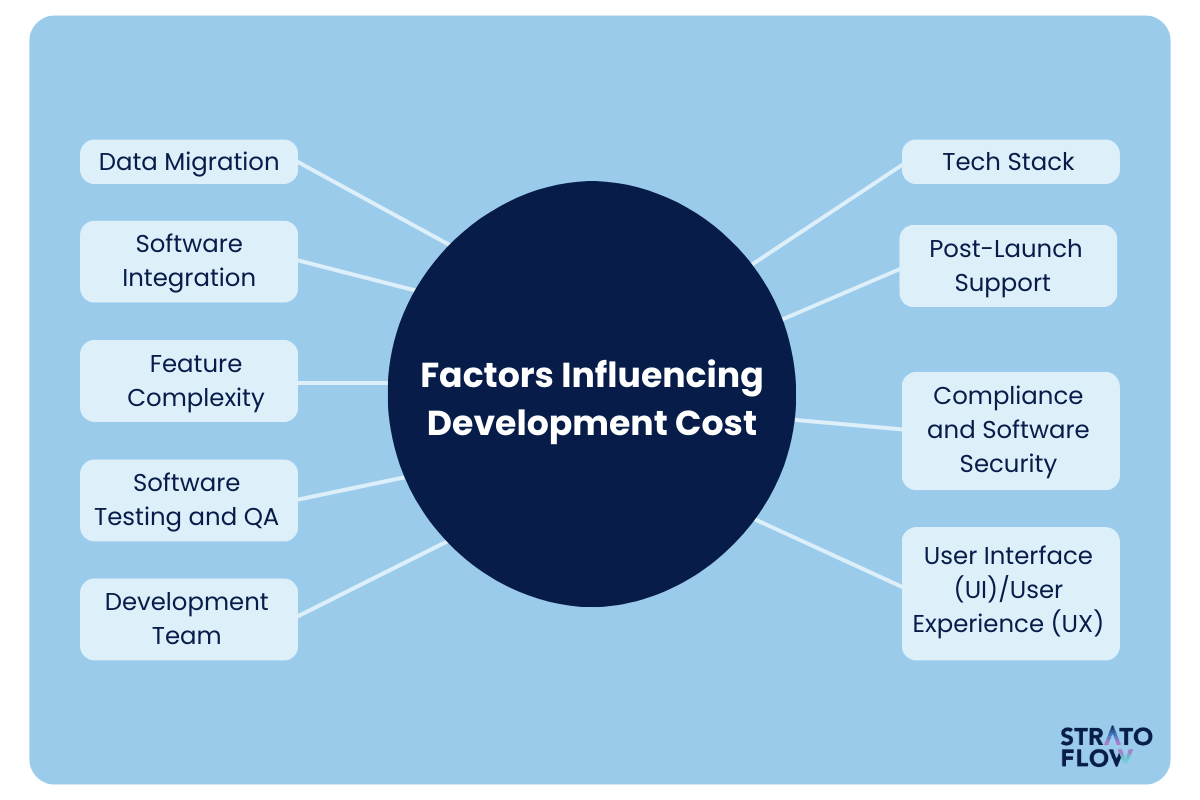

Factors Influencing Development Cost:

- Feature Complexity: More advanced and numerous features will require additional development hours, thus increasing cost.

- User Interface (UI)/User Experience (UX) Design: A more sophisticated and user-friendly design can escalate development costs due to the requirement of specialized skills.

- Software Integration: Integrating the software with existing systems, third-party applications, or external data sources can add complexity and therefore, cost.

- Data Migration: Transferring data from an existing system to the new software, especially if it involves cleaning and organizing the data, can be a resource-intensive task.

- Compliance and Software Security: Ensuring that the software complies with regulatory standards and is secure against cyber threats can involve additional expertise and tools, impacting the cost.

- Tech Stack: The choice of technologies and platforms used for development can also influence the cost, especially if they involve licensing fees.

- Software Testing and QA: Rigorous testing and quality assurance to identify and rectify issues can add to the overall development time and cost.

- Post-Launch Support and Maintenance: Ongoing support, maintenance, and potential future upgrades should also be factored into the overall cost assessment.

- Development Team: Depending on whether you hire freelancers, an in-house team, or an external development agency, and depending on their geographical location, the development cost can vary significantly.

It’s important to approach software development cost estimation with a thorough understanding of the desired outcome and a clear requirement specification.

It’s recommended to consult with a custom software development company and estimate the cost of your project based on a detailed analysis of specific needs and objectives.

Remember that investing in a well-developed, customized accounting software solution can provide significant value and efficiencies in the long run. Always ensure that the solution you choose is the best fit for your organization’s unique needs.

Choosing the right accounting software development company

Choosing the right accounting software development company is by far the most important aspect.

The reason is obvious.

Accounting software development is a complex task, and only by working with top professionals can you ensure timely delivery and proper understanding of the specific needs of your business.

While there are numerous factors to consider when developing accounting software, let’s delve into the key aspects to consider when choosing the right partner company for the job.

Developers’ experience

Developer experience, particularly in accounting software development, is critical because it ensures that the team has the necessary knowledge of financial processes, compliance requirements, and specific challenges that may arise.

Experienced developers have likely encountered and resolved various challenges and issues in previous projects, enabling them to provide valuable insight and potentially anticipate and mitigate issues before they become problematic.

Agile approach

Using an agile approach to software development facilitates flexibility and iterative improvement throughout the development process.

Agile software development methodologies allow for continuous reassessment and refinement of the software based on regular feedback loops, ensuring that the final product is closely aligned with user needs and expectations. This approach is particularly valuable for efficiently managing change, whether due to evolving requirements, unforeseen challenges, or adjustments based on testing and feedback.

Transparency

Transparency throughout the development process is essential to building trust between the business and the development organization.

Transparent practices include clear communication about project progress, challenges encountered, and changes to schedules or budgets. This ensures that the business is always informed and can make data-driven decisions. For example, a transparent breakdown of development stages, associated costs, and estimated timelines allows stakeholders to effectively manage budgets and expectations, avoiding unforeseen costs or delays.

Communication between development team and stakeholders

Robust and regular communication between the development team and stakeholders is critical to ensuring that the project remains aligned with business goals and user needs.

This includes not only sharing updates, but also establishing a collaborative platform where ideas, feedback, and concerns can be shared openly and constructively. Effective communication also facilitates a mutual understanding of challenges and goals, fostering a collaborative partnership that is conducive to the successful execution of the project.

[Read also: Comprehensive Guide to Software Development Agreement [+Template]

Role of low code in custom accounting software development

As we are already established, the process of creating custom accounting software is a complicated journey that takes a lot of time and money.

Is there a way to make it more efficient?

There might be in the form of low-code platforms.

Open-source platforms such as Openkoda have gradually cemented their role as a catalyst in the field of custom software development, demonstrating that custom software solutions can be developed with greater efficiency and agility.

These platforms serve as a conduit for developers to create applications through graphical user interfaces and pre-built templates, significantly reducing traditional coding efforts and enabling rapid development and faster time to market.

In the context of accounting software, where organizations often face unique and complex financial workflows, the ability to quickly and efficiently customize software to meet specific needs becomes an invaluable capability.

In addition, the open-source nature of these platforms mitigates vendor lock-in, giving organizations the autonomy to modify, scale, and migrate solutions to meet their evolving needs without being tied to the constraints and costs associated with proprietary platforms. This freedom not only gives organizations control over their technology architecture and data, but also fosters an environment where innovation can be seamlessly integrated, ensuring that software is always aligned with business needs and industry advancements.

As a result, the combination of rapid low-code development, rapid time to market, and the liberating absence of vendor lock-in synthesizes a framework that is inherently aligned with the dynamic, customizable, and scalable demands of modern businesses in their quest for customized accounting software solutions.

Conclusion

In summary, the development of custom accounting software is a strategic investment for organizations, enabling accurate financial management and decision-making.

The process, from planning to implementation, requires a focused approach to ensure that the software meets specific business needs and provides a secure, scalable, and efficient financial management solution.

Related Posts

- Financial Management Systems: Best Software Solutions in 2025

- Guide to Accounting System: Definition, Types and Custom Solutions

- 11 Fintech Trends That Shape Financial Future in 2023

- How to Build an Inventory Management System: Key Steps and Tips

- How to Build a Document Management System: Alternative Approach

Thank you for taking the time to read our blog post!