Accounting Software for Small Business

Navigating the financial landscape is a core task for small businesses.

But there’s one tool that can make the process much easier – small business accounting software.

Robust accounting software not only simplifies this journey, but also propels businesses toward sustainable growth by ensuring financial accuracy and compliance.

In this article, we will explore the wide variety of small business accounting software available and how the right tool can become a cornerstone of your company’s financial stability and success.

Contents

- What is accounting software?

- enefits of accounting software for small business

- How to choose the right small business accounting software

- Building your own small business accounting software in Openkoda

- 10 Best accounting software for small business in 2023

- Free accounting software for small business – Top 5 picks

What is accounting software?

Accounting software is a special kind of software that helps businesses keep track of their money.

Think of it as a smart digital accountant that never sleeps. Pretty neat.

It does a lot of things: it can keep track of how much money you make and spend, figure out what you owe in taxes, and even pay your employees.

Instead of filling out reams of paper or spending hours with a calculator, this software does the math quickly and reduces errors.

It simplifies complex tasks such as recording transactions, managing expenses, invoicing customers, and reconciling bank statements. This software is critical because it gives small business owners a clear picture of their financial health, which is essential for making informed decisions.

For example, it automates the billing process, ensuring that invoices are sent on time and are accurate, helping to speed up payments. It also keeps an eye on expenses, making it easier to control costs and maximize profits. When tax season rolls around, the software can be a lifesaver by keeping all the necessary financial records organized, making tax filing less of a headache. In addition, it often includes features such as payroll processing, which simplifies how employees are paid and ensures that all tax requirements are met.

In essence, the accounting system acts as the financial backbone for a small business that need digital finance transformation, doing the heavy lifting of financial management so business owners can focus more on growing their business rather than getting bogged down in numbers and spreadsheets.

Benefits of accounting software for small business

In the dynamic landscape of small business management, accounting software stands out as a transformative tool, offering a multitude of benefits that can revolutionize financial management.

Here are eight key advantages that illustrate why such software is not just a luxury but a necessity for small businesses looking to thrive in today’s market.

Time-Saving

In the fast-paced business environment, time is a critical asset.

Accounting features streamline financial operations through automation, significantly reducing the time spent on routine data entry and complex calculations. This efficiency gain allows small business leaders to allocate more resources toward strategic growth initiatives and customer engagement.

Accuracy Improvement

Precision is paramount in financial management.

Accounting software minimizes the risk of human error associated with manual accounting methods. With robust computational accuracy, these tools ensure that financial records are meticulous and error-free, laying a trustworthy foundation for financial analysis and decision-making.

Cost Efficiency

For small enterprises operating on tight budgets, accounting software is a cost-effective solution.

It diminishes the necessity for extensive accounting departments and mitigates the financial impact of errors through automated systems. This leads to leaner operations and the potential for reallocating funds to areas such as product development or market expansion.

Tax Compliance

Navigating the complexities of tax regulations can be daunting for small businesses.

Accounting software simplifies this process by systematically recording taxable transactions and generating comprehensive reports. This aids in maintaining compliance with tax laws and streamlining the tax filing process, thus avoiding costly penalties and ensuring fiscal responsibility.

Financial Oversight

Maintaining a real-time snapshot of a company’s financial health is crucial.

Accounting software provides dashboards and reporting tools that offer insights into cash flow, profitability, and financial trends, empowering business owners to make data-driven decisions that can positively impact their company’s financial trajectory.

Invoicing and Payment Efficiency

Promptly issuance of invoices and efficient tracking of payments are vital for maintaining positive cash flow.

Accounting software automates these processes, ensuring timely billing and follow-up on receivables, which is essential for the liquidity and financial stability of a small business.

Payroll Management

For small businesses, managing payroll can be a complex and regulation-heavy task.

Accounting software simplifies this by automating payroll calculations, tax withholdings, and ensuring that payments to employees are processed accurately and on time, contributing to employee satisfaction and regulatory adherence.

Data Security

The safeguarding of financial data is a top priority, given its sensitivity and the potential consequences of a breach.

Accounting software offers secure platforms with access controls, encryption, and data backup features, providing business owners with the assurance that their financial information is protected against unauthorized access and loss.

How to choose the right small business accounting software

Choosing the right accounting software for a small business is a critical decision that can significantly impact the efficiency and success of the company’s financial management. The first step in this process is a thorough assessment of your business needs. Understand what specific financial processes need to be managed: Is it invoicing, payroll, tax filing, or all of the above? This clarity will guide you to software solutions that are tailored to your specific needs.

Cost is a key consideration for small businesses.

They often look for the most cost-effective solution to reduce administrative costs as much as possible.

But it’s important to look beyond the sticker price. Examine the value the software brings in relation to its cost, considering both the short- and long-term financial implications. A low up-front cost may result in higher expenses down the road due to missing critical features or costly add-ons. We also often associate

When it comes to features, prioritize software that offers the capabilities that meet your organization’s needs. Comprehensive reporting, multi-user access, cloud-based functionality, and compatibility with other business systems are often key features that can streamline financial operations.

The importance of scalability cannot be overstated.

As your business grows, your accounting software should be able to grow with it. This means being able to handle an increased volume of transactions, more complex financial management needs, and additional users.

Custom accounting software can be valuable because it is tailored to the unique processes and needs of your business. While off-the-shelf software can be robust, it may not fit your workflow perfectly, resulting in inefficiencies or the need for workarounds. Custom software, on the other hand, is designed with your business model in mind and can provide a better return on investment by streamlining financial operations.

In summary, knowing your business needs, carefully evaluating the costs and features of each option, and understanding the value of custom software are critical steps in choosing the right accounting software.

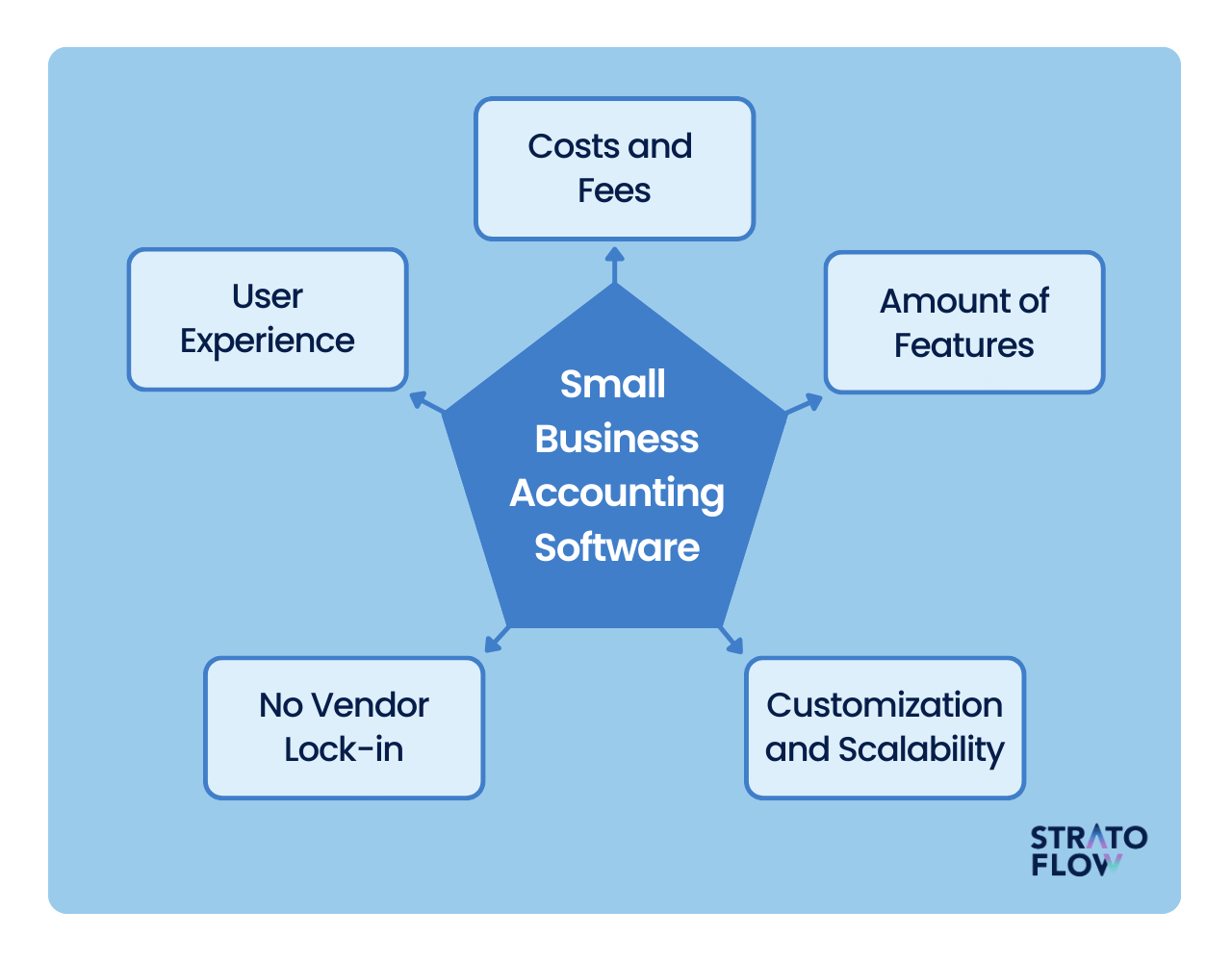

Here is a handy 5-point list of what to look for when choosing accounting software for your business:

- User Experience: A straightforward and intuitive interface is crucial, as it minimizes the learning curve and enhances productivity among your team.

- Costs and Fees: Understand the full cost of ownership, including initial purchase price, subscription fees, maintenance costs, and charges for additional features or upgrades.

- Amount of Features: Evaluate the breadth and depth of features offered, ensuring they align with your business processes and financial management needs.

- Customization and Scalability: Select software that is adaptable to your business’s evolving needs and can grow with your company without significant additional investments.

- No Vendor Lock-in: Choose a solution that offers flexibility and doesn’t bind you to a single vendor for upgrades, support, or additional services, ensuring you maintain control over your accounting software environment.

[Read also: What You Need to Know About Custom Development in 2023]

Building your own small business accounting software in Openkoda

Before we dive into the most popular choices for accounting software providers for small businesses, let’s briefly cover a more uncommon approach – building your own, custom accounting software programs.

But I hear you ask – isn’t the custom software development process an incredibly costly and time-consuming endeavor? Shouldn’t I have advanced programming skills before embarking on such a project?

Not anymore!

All thanks to the power of low-code development – a new approach to software development that allows companies to build enterprise applications super fast.

So, what is the process of developing comprehensive accounting software in Openkoda – an open-source Java low-code development platform? Follow these five simple steps to find out!

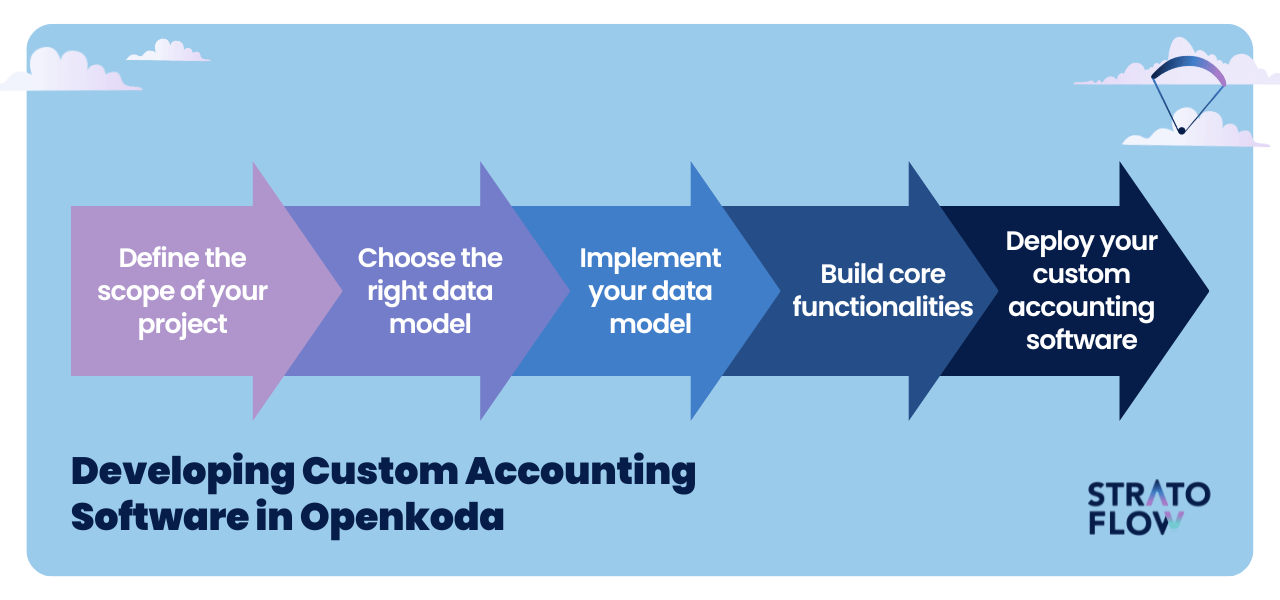

Step 1: Define the scope of your project

The first step of every custom software development project is defining the scope of desired functionalities – and that applies to working with Openkoda as well.

What’s the usual scope of accounting software?

First of all,custom accounting software for small businesses should offer core functionalities such as invoicing and billing, expense tracking, and financial reporting to monitor cash flow and profits.

It should also include tax preparation features to streamline end-of-year filings and provide integration capabilities with banking systems and payment processing to automate and reconcile transactions. User-friendly dashboards for real-time financial overview and multi-user access with permission levels are essential for collaborative financial management.

All of that is easily manageable within the Openkoda framework.

Step 2: Choose the right data model

Now it is time for the most important step – designing a domain data model that fits your accounting software solution.

In fact, Openkoda comes with a great collection of out-of-the-box data models for common SaaS applications that will surely come in handy in your project as well. The only thing you need to do is to create a data model for our unique functionalities.

In the case of accounting software, that would be things like contractors, types of financial statements, and financial reports.

Creating a data model for an accounting platform is the part we should actually spend the most time and effort on when building such a system in Openkoda.

Why is that?

This data model will be the foundation for an entire accounting software application that will be built on top of it.

Step 3: Implement your data model

Implementing a data model involves a fairly standard mapping of a business model to a database within Openkoda. This means creating business objects in the database.

This may sound intimidating to someone with no technical knowledge, but don’t worry!

This is a simple task that any software developer who has worked on enterprise applications will be familiar with.

So, how much time will it generally take?

It all depends on the amount of functionality you want to implement. If we are talking about a simple custom accounting software application without a significantly large data model, this is a job for only a few hours for a single programmer.

At this point, you’ll have an instance of Openkoda that we can use to feed data into – your own simple but perfectly working accounting software application.

That’s another advantage of Openkoda – you can reach this level of development incredibly fast compared to classic development using standard frameworks like Spring.

What does this mean for you as an entrepreneur?

Developing custom software applications is no longer an option reserved only for the biggest players in the market, but also for smaller companies – all thanks to the power of low-code platforms like Openkoda.

Step 4: Build core functionalities

Now development in the classical sense can begin.

But here too, Openkoda can offer a unique and much faster approach.

Usually, this process is the most time- and resource-consuming part of the entire development cycle.

Openkoda aims to greatly simplify and accelerate this process with the introduction of AI Companion – an advanced generative AI tool designed to streamline the software development process by providing developers with ready-made snippets of code as they work on your application.

When you need additional functionality, you can work with this tool and use natural language commands to generate new features that are immediately integrated into your accounting software.

In most cases, you don’t even need to know how to code. AI Companion does all the programming, and all you have to do is provide the prompts.

The goal is to provide the best value to companies looking for a customized accounting software solution without spending unnecessary time and effort while maintaining the highest software quality.

Step 5: Deploy your custom accounting software

Now it’s time for what we’ve been waiting for the final deployment.

The deployment phase marks the transition from development to real-world use.

Deploying a custom accounting application within a small business requires a strategic rollout plan that ensures minimal disruption to daily operations. It typically begins with setting up the necessary hardware and software infrastructure, followed by migrating financial data from existing systems to the new application.

Openkoda gives you more freedom because you have the option to deploy your software both on-premises and in the cloud.

That’s the magic of an open-source platform – you retain full ownership of your code while gaining unprecedented levels of agility and performance.

Want to see the capabilities of Openkoda in action?

Check out this demo to find out how can you quickly set up and develop a time-tracking application using this breakthrough low-code platform:

[Read also: 16 Best Time Tracking Software Applications in 2023]

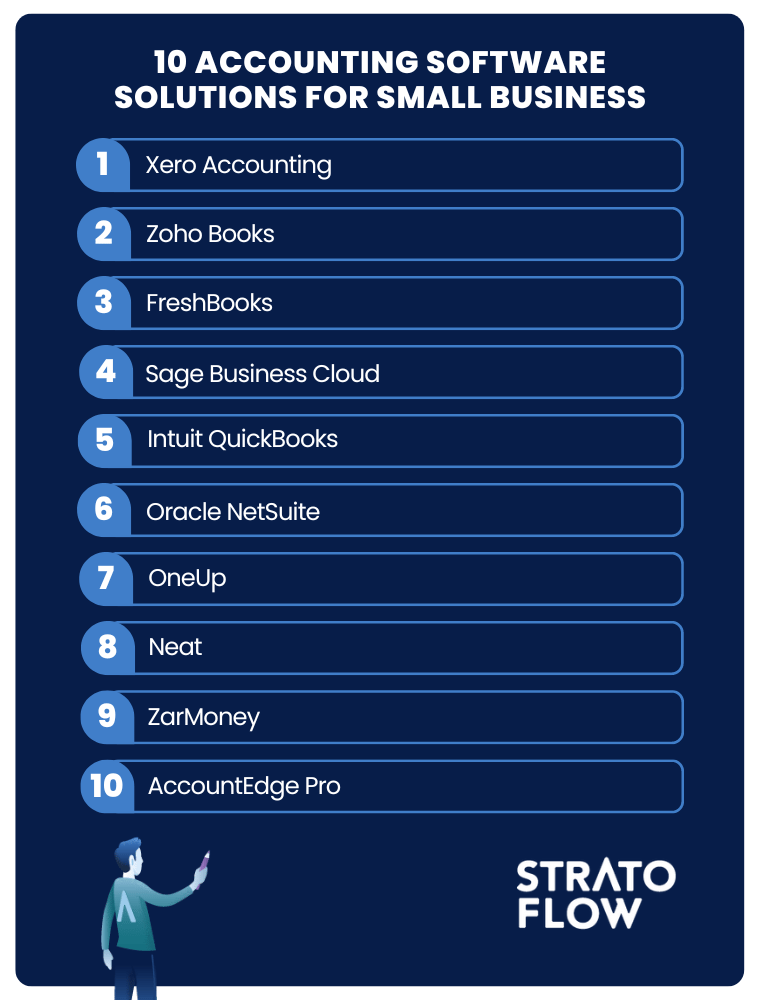

10 Best accounting software for small business in 2023

And now, let’s cut to the chase – eight of the most popular accounting software options best suited for small businesses and startups.

In this list, we take into consideration aspects such as accounting features, ability to generate financial reports, and accounting software cost to provide you with the most comprehensive list to meet your needs.

Xero

Xero is a cloud-based small business accounting software from New Zealand that caters to small and medium-sized businesses, freelancers, and entrepreneurs.

It’s an affordable choice with plans starting as low as $7.50 per month according to one source, although another source mentions a starting price of $13 per month, indicating that there may be different pricing for different regions or promotional pricing at times. The software is designed to streamline administrative and accounting tasks, making business operations more efficient.

Xero’s software design allows for a wide range of accounting processes, making it suitable for businesses of varying sizes. Its ability to handle complex accounting tasks, competitive pricing, and allowance for unlimited users make it a strong contender for the Best Accounting Software title.

Pros

- Competitive Pricing: Xero offers competitively priced plans which can be a great advantage for startups and small businesses looking for cost-effective accounting solutions.

- Unlimited Users: All pricing levels support unlimited users which is a rare feature and can be significantly beneficial as the business grows.

- Numerous Integrations: The software offers numerous integrations that can be helpful in creating a seamless workflow by connecting with other business tools.

- Advanced Features: It provides advanced features like double-entry accounting which is essential for accurate financial record-keeping.

Cons

- Learning Curve: There is a learning curve involved especially for individuals new to accounting software or those accustomed to another system.

- Limited Invoicing on Lower-tier Plan: The lowest-priced plan limits the number of invoices and quotes to 20 per month which may not be sufficient for some businesses.

- Multiple Currencies Support Limited to Highest Subscription Tier: This limitation could be a drawback for businesses with international transactions unless they opt for the highest subscription tier.

- Poor Customer Support: Customer support is mentioned as a downside, which could be a concern when encountering issues or seeking guidance on the software’s functionality.

Zoho Books

Zoho Books is an intuitive cloud-based accounting software that is well-suited for small and medium-sized businesses (SMBs).

It offers ease of use and a range of features designed to streamline financial management processes within a business. With Zoho Books, businesses can efficiently handle tasks such as invoicing, inventory management, and project management.

Zoho Books also has decent integrations and unique features such as custom fields, which can be very beneficial. However, it’s worth noting that some reviewers find other online accounting software to have more advanced features or better integrations.

Pros

- Cost-Effectiveness: One of Zoho Books’ major strengths is its cost-effectiveness. It offers a competitive free plan, which is especially beneficial for micro businesses or startups on a tight budget. Additionally, its paid plans are reasonably priced starting at $15 a month if paid annually, with extra users costing just $2.50 per user per month.

- Excellent Customer Support: Zoho Books is recognized for providing excellent customer support, which is crucial for resolving issues and ensuring smooth operations.

- Feature-Rich: It’s a feature-rich accounting software with functionalities like retainer invoices, custom fields, inventory management, and advanced reporting that can cater to various accounting needs of a business.

- Robust Mobile App: The robust mobile app ensures that you can manage your finances on the go, which is essential for modern businesses.

Cons

- Limited User Capacity: One downside is the limited user capacity, with a maximum of 10 users. This could be a drawback for growing businesses with a larger team.

- Investment in Higher-Level Plans for Advanced Features: To access more advanced features, businesses need to invest in higher-level plans, which may increase the cost.

- Limited Integration: Some reviews mention limited integration capabilities, which might restrict the software’s interoperability with other systems or applications your business uses

FreshBooks

FreshBooks accounting software is a cloud-based accounting software for small businesses, freelancers, and independent contractors.

It’s known for its user-friendly interface and powerful invoicing features that simplify the billing and payment process for users. The software offers features such as time tracking, expense tracking, and easy project management, making it a reliable tool for managing various financial aspects of a business. FreshBooks has grown from a solution primarily for managing invoices to a more comprehensive accounting product that is used in more than 160 countries.

FreshBooks is highly regarded for its ease of use and the value it provides, especially in the areas of invoicing and time tracking, which are critical for freelancers and small business owners.

It’s also praised for its excellent customer service, which can be a big plus for users who are new to accounting software or who prefer to have reliable support at their fingertips.

Pros

- Ease of Use: FreshBooks is praised for its simplicity and ease of use, especially for freelancers and very small businesses.

- Strong Invoicing Features: It excels in hassle-free invoicing, allowing the creation and sending of professional invoices, along with the ability to add billable hours and expenses to invoices.

- Time Tracking: The built-in time tracker is a notable feature that simplifies the tracking of billable hours, which is crucial for accurate billing.

- Mobile App: The robust mobile app enables invoice creation on the go, receipt scanning, and mileage tracking, thereby enhancing the flexibility and mobility of users.

Cons

- Cost: Despite its benefits, FreshBooks can be relatively expensive, especially for very small businesses or individuals just starting out. The pricing starts at $17 per month, which may be a deterrent for some potential users.

- Limited User Capacity: The highest-tier Select plan comes with only two users, and lower-tier plans put limits on billable clients. This can be a limitation for growing businesses or those with a larger team.

- Limited Features and Scalability: The entry-level Lite plan lacks some crucial features like bank reconciliation tools, accountant access, and double-entry accounting reports. Moreover, the software is not ideal for fast-growing businesses due to user and client limits on some plans

Sage Business Cloud Accounting

Sage Business Cloud Accounting is a cloud-based accounting software that is easy to set up and use, making it a favorable choice for small businesses, startups, freelancers, and sole traders.

It comes in two versions: Sage Business Cloud Accounting Start, which is ideal for sole traders, entrepreneurs, and freelancers, and Sage Business Cloud Accounting, which is more suited for startups, and micro, and small businesses.

The software is known for its open-source API which allows for customization by enabling the creation of unique integrations for a tailored solution.

Sage Business Cloud Accounting also offers good inventory management and can connect with more than 100 apps, making it a scalable solution for growing businesses. However, it’s mentioned that the entry-level application might be outgrown quickly, and there is no payroll module available which might be a deal-breaker for some businesses.

Pros

- Cost-Effectiveness: Sage is noted for its low starting price, making it an affordable choice for small businesses and freelancers. The pricing starts at $10.00 per month, which is quite competitive compared to many other accounting software applications in the market.

- Customization: One of the standout features of Sage Business Cloud Accounting is its open API, which allows businesses to create customized solutions. This feature is particularly beneficial for businesses with unique accounting needs or those that require special integrations.

- Community Support: Sage maintains an active community forum where users can get help from experts and fellow users. This community support can be invaluable for resolving issues and learning how to make the most of the software.

Cons

- Lack of Recurring Invoices: One of the limitations of Sage is that it doesn’t have the option to create recurring invoices. This feature is often essential for businesses that offer subscription products or services.

- No Automatic Payment Reminders: The inability to schedule automatic payment reminders can be a drawback as it requires manual follow-up on overdue payments, which can be time-consuming.

- Limited Tracking of Billable Hours and Expenses: Sage doesn’t allow the time tracking functionalities and adding billable expenses, which could be a disadvantage for service-based businesses or those that need to track employee time and expenses against client projects

Intuit QuickBooks

Intuit QuickBooks is a highly regarded accounting software solution designed to meet the financial management needs of small to medium-sized businesses.

As cloud-based software, it provides easy access to financial data anytime, anywhere, which is a boon for business owners and their accountants or bookkeepers. QuickBooks Online offers several pricing plans to accommodate different business sizes and needs.

Pricing starts with the Simple Start Plan at $30 per month, designed for micro-businesses. As business needs grow, there are other plans such as the Essentials Plan at $60 per month, which adds invoice management, support for three users, and time tracking, and the Plus Plan at $90 per month, which offers more advanced features.

The customizable dashboard, a variety of reporting tools, and the ability to run efficiently on low system configurations or low Internet speeds are some of the features that stand out. Plus, it’s not too expensive for the value it provides, making it a cost-effective solution for many businesses.

Pros

- Widespread Usage: It’s a popular choice among bookkeepers and accountants, which can be advantageous when seeking professional assistance.

- Ease of Finance Tracking: Provides a straightforward way to monitor finances, making it easier to manage cash flows and financial health.

- Simple Implementation: The setup is relatively straightforward, allowing businesses to get up and running quickly.

- Customizable Dashboard: The dashboard can be tailored to meet user requirements, aiding in better financial management and decision-making.

Cons

- Cost: The subscription can be expensive, especially for tiny businesses or startups.

- Limited Support: Some users find the support to be lacking, which can be challenging when encountering issues or needing guidance.

- Learning Curve: Correcting errors or making adjustments in the system can be frustrating, indicating a learning curve that might require additional time and patience to overcome

NetSuite

NetSuite, an Oracle company, is a cloud-based enterprise resource planning (ERP) platform that offers a comprehensive suite of applications including payroll, human resources (HR), the ability to track expenses and bank account, customer relationship management (CRM), and e-commerce.

It operates on a Software-as-a-Service (SaaS) model, giving companies the flexibility to scale without worrying about infrastructure and personnel changes. NetSuite’s long list of modules and customization tools are designed to increase efficiency and reduce costs, regardless of business size or industry.

NetSuite is an integrated, cloud-based solution that can be an excellent asset for larger companies or companies with complex operations. However, its complexity and pricing model may not appeal to smaller businesses or startups.

Pros

- Versatility: It’s designed to adapt to a wide range of business processes and industries.

- Customizable Features: NetSuite provides a variety of customization tools enabling businesses to tailor the platform to meet their specific needs.

- Integration Capabilities: It easily integrates with other tools enhancing operational efficiency.

- Robust Accounting and Supply Chain Management Capabilities: NetSuite offers strong accounting and supply chain management features.

Cons

- Pricing Transparency: There’s a need to schedule a consult to get the pricing, which may deter some potential users.

- Complexity: The platform can be overwhelming, especially for startups or those new to ERP systems.

- Cost: Starting at $999.00 per month, it may be too expensive for smaller businesses or startups.

- No Free Trial: Lack of a free trial can be a downside for businesses wanting to test the platform before committing

OneUp

OneUp is an online accounting software designed for small businesses, especially those that sell physical products.

It excels in inventory management and has a built-in customer relationship management (CRM) feature that, along with its budget-friendly plans, makes it a solid option for specific business needs.

OneUp is highlighted for its strong inventory management and CRM features, which are critical for businesses that deal with physical products and customer relationships. The software’s affordability makes it an attractive option for small business owners, although the lack of certain features such as payroll and third-party integrations may require them to use additional platforms or tools to cover all of their operational needs.

Pros

- Inventory Management: OneUp shines in the area of inventory management, making it a reliable choice for small businesses dealing with physical products.

- Budget-Friendly: With plans starting at $9 per month, it is an affordable option for small businesses, especially those that don’t require support from customer representatives or a large number of users.

- Built-in CRM Functions: The software has built-in CRM functions that help in tracking incoming leads, thus aiding in managing customer relationships effectively.

Cons

- Lack of Payroll Feature: OneUp does not have a payroll feature, which might be a downside for businesses looking to manage payroll within the same platform.

- Limited Third-Party Integrations: It does not offer integration with third-party applications, which could limit its functionality and flexibility, especially in terms of payment integration as it doesn’t support Stripe for credit card payments.

- Invoicing Limitations: Although the invoicing feature works well with the inventory feature, it lacks reminders or recurring entries for billing and invoicing which could lead to manual tracking and potential errors.

- Complex Layout: The layout of the software is described as more complicated compared to its competitors as it’s divided into many different pages which could pose a usability challenge.

Neat

Neat is a cloud-based accounting software designed to simplify bookkeeping for small businesses and professionals. It provides a centralized place to manage expenses, invoices, and receipts, which helps to stay organized and track finances more efficiently.

It is a relatively new bookkeeping software that came on the scene in 2021 and is designed to help small businesses and entrepreneurs manage their finances, in addition to serving as an invoicing and document management tool.

The software is appreciated for its ease of matching receipts with expenses, automatic and customized accounting reports, and guided workflows that simplify processes. However, it falls short in areas such as time tracking, payroll, and CRM integration, and is noted for being more expensive than some of its top competitors. The software starts at $24 per month, with a clean interface and a bundled offering of three separate products in one.

Pros

- Centralized Management: With Neat, users can manage their expenses, invoices, and receipts in one place, aiding in better organization and financial tracking.

- Ease of Use: Neat replaces the guesswork associated with spreadsheets, handwritten records, and manual invoices, thus making accounting and bookkeeping processes simpler and more straightforward.

- Real-Time Reporting: Neat offers real-time reporting which increases efficiency in financial management

Cons

- Limited Users: Neat may not be the best option for larger teams as it allows up to only five users, which could be restrictive as the business grows.

- Lackluster Customer Support: Some secondary ratings highlight a lack of satisfaction in terms of customer support and value for money

ZarMoney

ZarMoney is a cloud-based accounting solution tailored for businesses of all sizes, providing an all-in-one platform for managing invoices, billing processes, and inventory.

It also facilitates online payments while ensuring data security and compliance through location- and access-based controls. For business owners on the go, ZarMoney promotes real-time collaboration, which is critical for building solid relationships and maintaining organized, up-to-date financial records.

Pros

- Customer Service: Provide excellent customer service to help with any inquiries.

- User-Friendly Interface: Known for its easy-to-navigate interface, especially compared to other systems like QuickBooks.

- Informative Tutorials: Offers helpful tutorials for better understanding and utilization of the software.

Cons

- Dashboard Customization: The dashboard lacks adequate customization options, missing a graphical data display or charts.

- Tutorial Voiceover: Some users find the voiceover in tutorial videos hard to listen to.

- Credit Card Processing: Limited options for credit card processing, restricting certain businesses and industries

AccountEdge Pro

AccountEdge Pro is a robust desktop accounting software for small businesses on Mac and Windows.

This software stands out for its depth, ease of use, and customizability, surpassing competing desktop and cloud-based applications in these areas. It’s designed to help business owners organize, process, and report on their financial information so they can focus more on running their business and less on accounting.

Pros

- Ease of Use: The software is easy to use despite its wide range of features.

- Flexibility and Efficiency: Known for its flexibility, efficiency, and supportive customer service.

- Fair Pricing: Offers a fair pricing model, providing good value for the features it offers

Cons

- Performance Issues: Some functions may slow down the performance of the software.

- Overwhelming Features: The abundance of features, especially in reporting, can be overwhelming and confusing to users.

- Online Accessibility: Lacks online or bank feed-friendly features, and does not offer a full-service payroll option or robust report customization.

Which accounting software is the cheapest?

When it comes to financial management, especially for small businesses on a tight budget, the cost of accounting software can play a crucial role in the decision-making process.

While popular accounting solutions like QuickBooks and Xero offer a range of powerful features, they come with a price tag that may not be right for all small businesses.

On the other hand, an open source platform like GnuCash offers basic accounting functionality for free, making it a financially viable alternative for businesses with limited budgets.

Open source solutions are affordable because they are generally available without licensing fees, making them an attractive choice for cost-conscious organizations.

Unlike their commercial counterparts, these platforms offer the flexibility of customization without the burden of recurring subscription costs. While options like QuickBooks and Xero are popular for their comprehensive feature sets and easy-to-use interfaces, their subscription models and tiered pricing structures may not be financially feasible for all small businesses.

However, small businesses considering open source software like Wave should be aware of the potential need for technical expertise or outside support for customization or troubleshooting, which could result in additional costs.

In essence, while open source accounting software can offer significant cost savings, it requires a careful evaluation of the total cost of ownership, balancing the upfront savings against the future investments necessary to maintain and adapt the system to meet the evolving needs of the business.

What’s the easiest accounting software to use?

For small business owners, wrestling with complex financial systems can be an unwelcome distraction from their core business.

The easiest accounting software to use often becomes their ally, simplifying the daunting task of managing finances.

One standout option is FreshBooks, which has been praised for its intuitive design and easy navigation. This cloud-based software caters to small business owners by demystifying accounting jargon and presenting a clean, easy-to-use dashboard that highlights key information, such as outstanding invoices and overall profitability, at a glance.

With easy setup and step-by-step instructions, FreshBooks allows business owners to send invoices, track time, and manage expenses with minimal effort. The software’s mobile app makes it even more accessible, allowing business owners to complete financial tasks on the go.

By streamlining complex accounting tasks into a few clicks, FreshBooks enables small business owners to stay on top of their finances without being overwhelmed by complexity.

[Read also: The Complete Guide to Software Outsourcing: How to Make it Work for Your Business]

Free accounting software for small business – Top 5 picks

By now you should have a pretty good understanding of the accounting software market.

But when it comes to choosing small business accounting software, one factor is more important than any other – cost.

With that in mind, let’s take an exclusive look at the free accounting software options currently available to small business owners.

Zoho Books

Zoho Books is designed mostly for small businesses with less than $50,000 in annual revenue.

It allows you to add multiple bank and credit card accounts, import statements, create custom recurring invoices, manage a chart of accounts, and track mileage.

It is highly regarded for its customer support and seamless integration with the broader Zoho software suite, making it a robust solution for small businesses.

Key Features

- Multiple bank and credit card accounts management,

- customized recurring invoices,

- mileage tracking, and

- software suite integration.

Wave

Wave is known for its free accounting software, which is great for basic accounting needs.

It also excels in project tracking alongside accounting, making it a valuable tool for small businesses or freelancers who need to manage projects and finances simultaneously.

Key Features

- Basic accounting,

- project tracking.

Manager

Manager offers a comprehensive desktop version free of charge that supports both cash and accrual accounting methods.

It allows you to manage purchase orders, track accounts receivable and payable, send invoices, and generate a variety of reports. It also includes more advanced features such as creating separate tax codes for different line items on invoices, tracking inventory, and assigning production stages to items.

Key Features

- Cash and accrual accounting,

- purchase orders management,

- accounts receivable and payable tracking,

- invoice sending,

- various reporting.

Odoo

Odoo offers a single free app per month and is known for its seamless integration due to its open-source model.

Its accounting software syncs with your bank for easy transaction tracking, enables automated payment reminders and recurring billing, and provides a variety of reports. Odoo’s ecosystem of business software allows for a customized complete business software solution.

Key Features

- Bank synchronization,

- automated payment reminders,

- recurring invoicing,

- various reports,

- unlimited users for invoice management.

GnuCash

GnuCash is a free, open-source accounting software that appeals to those with some familiarity with programming.

It works on a desktop-based system and provides a checkbook-style register for managing transactions. It also allows you to split transactions and customize the display of the register.

The open-source nature of GnuCash allows for faster iteration and improvement through crowdsourced development and testing, making it a unique option for tech-savvy small business owners or individuals.

Key Features

- Checkbook-style register,

- manual transaction entry,

- split transactions,

- open-source.

Conclusion

Investing in reliable accounting software is critical to the success of a small business.

It streamlines financial management and ensures accurate and timely reporting. With the right free or paid software, businesses can significantly improve their financial processes, saving time and resources for other important operations.

Related Posts

Thank you for taking the time to read our blog post!