Buyer Guide To Insurance Claims Management Software 2025

Navigating the complex world of insurance claims management software can be daunting, but choosing the right system is crucial for streamlining your operations and enhancing customer satisfaction.

From understanding the variety of software available for different insurance sectors to weighing the benefits of bespoke solutions, this ultimate buyer’s guide will arm you with the knowledge you need to make an informed decision. Let’s dive into the essentials of selecting the perfect insurance claims management software for your company’s unique needs.

Contents

- What is insurance claims management software?

- What are the key features of insurance claims management software to look for?

- How to choose the right insurance claims management software? Industry expert tips

- Other types of insurance software needed to streamline processes in insurance companies

- Benefits of insurance claims management software

- Challenges with insurance claims management software

What is insurance claims management software?

Insurance claims management software is a digital tool designed for companies in the insurance industry to streamline and simplify the process of handling insurance claims.

Essentially, this software acts as a central platform where insurance claims can be submitted, processed and tracked from start to finish.

The role it plays is critical; it automates many of the tasks involved in managing a claim, such as verifying policy details, managing documents, assessing the validity of the claim, and facilitating communication between all parties involved. This automation not only speeds up the claims process, but also reduces the likelihood of errors, ensuring a smoother and more efficient operation.

[Read also: Insurance Software: How to Choose the Right One for Small Agencies]

Software solutions and digitalization in insurance industry – key statistics

Insurance claims management software is not the only software solution changing the face of the insurance industry.

There’s a systemic change happening right now as companies invest serious money in digital solutions to improve their efficiency and competitiveness.

Investments in insurtech solutions worldwide grew significantly, from $1 billion in 2004 to $14.6 billion in 2021.

More than 40% of insurtechs focus on marketing and distribution channels.

59% of respondents from the insurance companies in Europe were already implementing their digital transformation plans.

Digitizing key processes can take out 30-50% of human service costs while delivering a better customer experience.

These kinds of increases in efficiency has been seen in other aspects of the insurance companies.

The online underwriting process has already brought about 30% higher efficiency with 45% Year-Over-Year net income growth.

Who uses insurance claims management software?

Insurance claims management software is primarily used by insurance companies, including those specializing in health, auto, property, and life insurance, among others.

Within these companies, the software is used by various professionals such as claims adjusters, claims managers, and other employees involved in the claims process. In addition, third-party administrators (TPAs) who manage claims on behalf of insurance companies also use the software extensively. In some cases, insurance brokers and agents may access certain features of the software to assist their clients with their claims or even dedicated software for insurance brokers or custom insurance agency management systems.

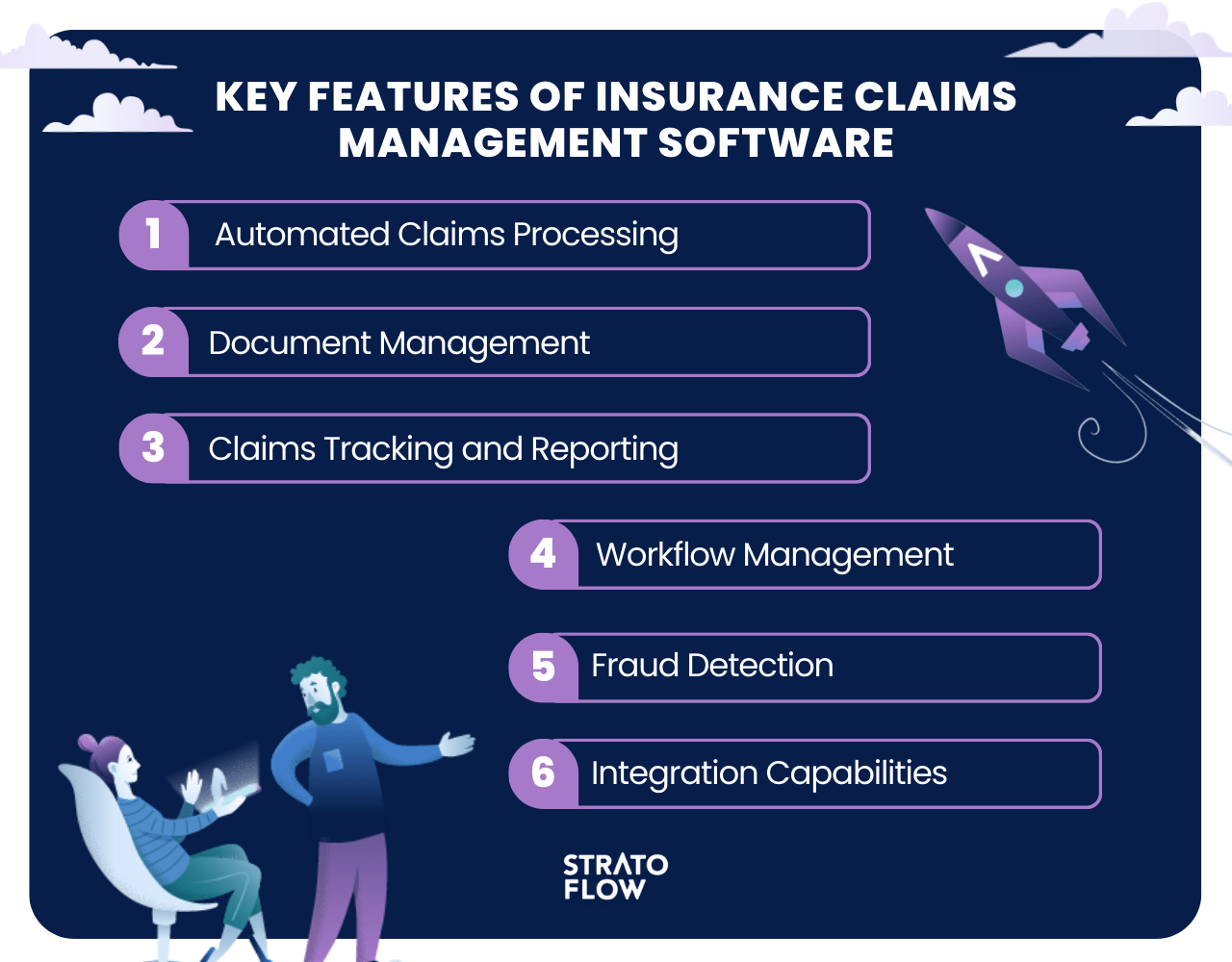

What are the key features of insurance claims management software to look for?

Which claims management software is right for your company?

When evaluating insurance claims management software, there are several key features to look for, each designed to streamline the claims process and improve operational efficiency. Keep them in mind as you research all available options.

Automated Claims Processing

This feature automates the initial filing, categorizing, and routing of claims and claims information, reducing manual data and claim details entry and speeding up the claims lifecycle. It helps in identifying duplicate claims and ensures that claims data is processed according to the policy terms.

Document Management

A central repository for storing and managing all claim-related documents, including forms, correspondence, evidence, and other claim information. This makes it easy to access and retrieve documents, facilitating a smoother claims process.

Claims Tracking and Reporting

Enables users to monitor the status of claims in real-time and generate reports on various metrics such as claim volumes, processing times, and outcomes. This visibility helps in identifying bottlenecks and improving decision-making.

Workflow Management

Customizable workflows allow for the automation of tasks based on predefined rules, ensuring that claims move smoothly through each stage of the process. This feature helps in maintaining consistency and efficiency in handling claims.

Fraud Detection

Incorporates tools and analytics to identify potentially fraudulent claims by analyzing patterns and flags unusual activities. This is crucial for minimizing financial losses and maintaining the integrity of the claims process.

Integration Capabilities

The ability to integrate with other systems, such as policy administration software, insurance customer relationship management systems, and external databases, is essential for a seamless flow of information across the enterprise.

How to choose the right insurance claims management software? Industry expert tips

Choosing the right insurance claims management software requires a careful assessment of your company’s specific needs and objectives.

Start by identifying the key features you need based on your: claims volume, the types of insurance products you offer, and the complexity of your claims.

It’s important to look for software that offers:

- a high level of automation,

- robust security measures,

- and the ability to integrate seamlessly with your existing systems,

- the scalability of the software to ensure it can grow with your business,

- intuitive user interfaces and comprehensive customer support.

Regardless of the type of software system in the insurance industry, it’s always beneficial to consider a custom, tailored solution.

Insurance companies often operate in very specific niches, and only custom software can meet all of their unique needs.

By taking a customized approach, you can ensure that every aspect of the claims management process is optimized for your business, resulting in improved efficiency, accuracy, and customer satisfaction.

In 2024, the specialty insurance market has emerged as a significant trend, driven by the need to cover unique risks and niche markets that standard insurance products don’t adequately address.

This sector’s complexity and the specific nature of the risks involved require a bespoke approach to software solutions.

The strategic investment in custom software can provide a competitive advantage in the dynamic and complex landscape of the insurance industry.

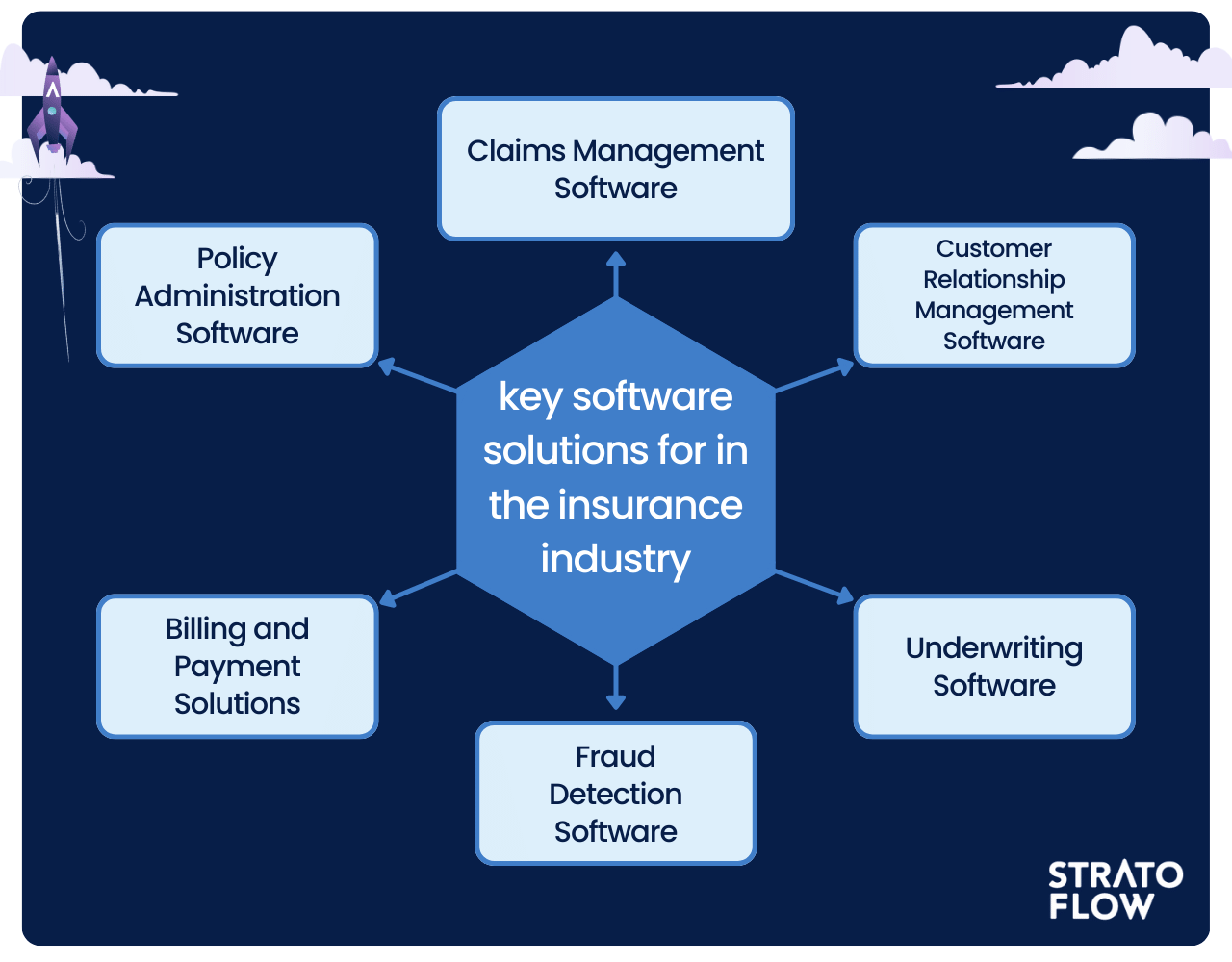

Other types of insurance software needed to streamline processes in insurance companies

Beyond claims management, insurance companies require a variety of software solutions to streamline operations and improve service delivery.

Policy management software is critical for managing the lifecycle of insurance policies, from issuance to renewal or cancellation.

Customer relationship management (CRM) systems help insurers maintain detailed records of customer interactions, improving service and enabling personalized marketing strategies. Underwriting software automates the assessment of risks associated with insuring customers or assets, enabling faster and more accurate policy pricing.

In addition, billing and payment solutions ensure the efficient processing of premiums and payouts, supporting multiple payment methods and schedules. Fraud detection systems use advanced analytics to identify suspicious activity and protect organizations from potential losses.

Finally, data analytics and business intelligence tools provide insight into market trends, customer behavior, and operational efficiencies to guide strategic decisions.

Together, these software solutions work together to optimize every facet of an insurance company’s operations, from front-end customer interactions to back-end administrative tasks, ensuring a seamless and efficient insurance ecosystem.

Regardless of your company’s needs, we at Stratoflow are here to help and can be your technology guide in designing your software architecture.

We have extensive experience in developing custom insurance software solutions, and thanks to our Openkoda platform, we can deliver your custom insurance software faster and more efficiently than ever before.

Sounds intriguing?

Contact us and let’s discuss how our custom software can improve your business efficiency today!

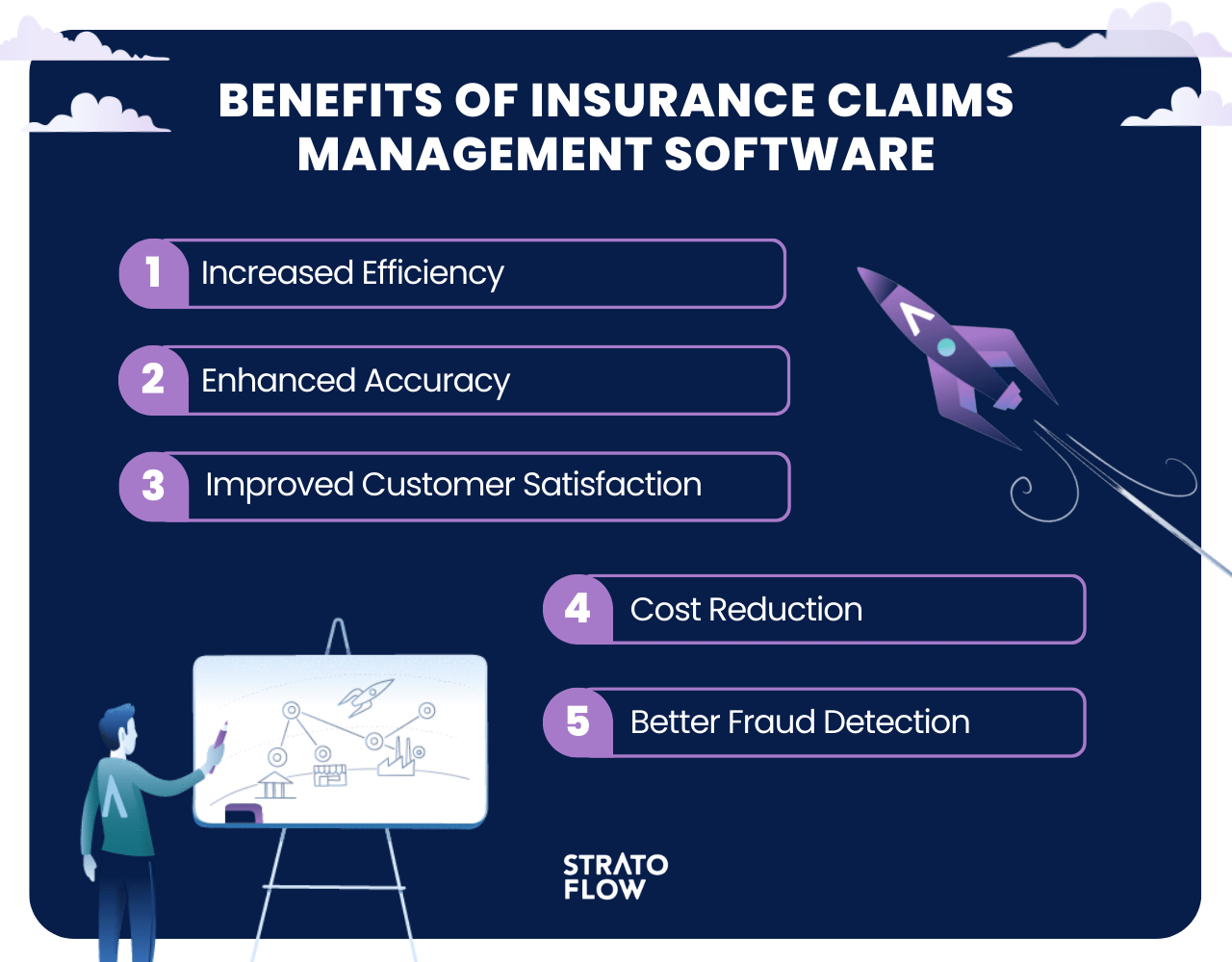

Benefits of insurance claims management software

The adoption of insurance claims management software brings numerous benefits to insurance companies and their clients, significantly impacting efficiency, customer satisfaction, and financial performance. Here are some key benefits:

Increased Efficiency

By automating routine tasks and streamlining the claims process, this software reduces the time and effort required to manage claims. It allows claims to be processed faster, which means that adjusters can handle more claims in less time, significantly boosting operational efficiency.

Enhanced Accuracy

Automated processes reduce the risk of human error in claims filing and processing. The software ensures that claims are assessed and processed based on the precise terms of the policy, improving the accuracy of claims handling and reducing the likelihood of disputes. It is thus a great help in risk management strategies for insurance companies.

Improved Customer Satisfaction

Faster claims processing and real-time communication features mean that claimants are kept informed about the status of their claims, leading to a more transparent and reassuring experience. This responsiveness can greatly enhance customer satisfaction and loyalty.

Cost Reduction

By automating the claims process and reducing the need for manual intervention, insurance claims management software can significantly reduce operating costs. Reduced errors and improved efficiency also mean reduced costs associated with claims disputes and rework.

Better Fraud Detection

Advanced analytics and pattern recognition capabilities help in identifying potentially fraudulent claims more effectively, protecting the company from financial losses and helping to keep premiums more affordable for all customers.

[Read also: The Impact of AI in Insurance Industry in 2024]

Challenges with insurance claims management software

At last, let’s tackle some of the key issues that insurance claims management systems struggle with.

Insurance claims management systems are undoubtedly highly specialized and sophisticated software products, and their operation presents many challenges and risks. Before deciding which system to choose, you should consider these issues and verify that the system you are considering will provide an efficient solution.

First, there’s the issue of compatibility.

These systems must seamlessly connect to multiple databases, policy management systems, customer relationship management (CRM) tools, and external data sources to ensure a smooth flow of accurate and up-to-date information.

Another challenge is ensuring data security and privacy, especially given the sensitive nature of personal and financial information handled during the claims process. This requires sophisticated encryption and security audits to protect against data breaches and cyber threats.

In addition, maintaining regulatory compliance is complex, as laws and regulations can vary widely by region and are subject to change. Software must be flexible enough to quickly adapt to these changes to avoid legal issues.

Not to forget scalability!

As insurance companies grow and process more claims, their software must be able to scale without sacrificing performance or requiring significant changes to the system architecture.

Only by balancing and addressing these technical challenges can insurance claims systems deliver the high levels of efficiency and accuracy that are so important to the companies that use them in their day-to-day operations.

[Read also: Top Insurance Industry Trends to Watch]

Conclusion

Choosing the right insurance claims management software boils down to understanding your specific needs, budget, and the software’s ability to improve your claims process efficiently. By considering factors such as ease of use, customization, integration capabilities, and customer support, you can find a solution that not only streamlines your operations but also enhances customer satisfaction. Remember, the best software is one that aligns with your business goals and grows with you.

Remember, the best software is one that aligns with your business goals and grows with you.

FAQ

What is insurance claims management software?

Insurance claims management software is a digital tool designed to streamline and automate the process of handling insurance claims from filing to settlement. It helps insurance companies manage claims efficiently, ensuring accurate processing, fraud detection, and enhanced customer service.

How does software help streamline the claims process?

The software streamlines the claims process by automating routine tasks, organizing data, and providing tools for quick and accurate claim assessment, reducing processing times and improving overall efficiency and accuracy in handling claims.

Types of insurance claim management software?

The types of insurance claim management software include specialized systems for different insurance sectors such as health, auto, property, and life insurance, each tailored to handle the unique requirements and processes of its respective domain.

How much does insurance claims management software cost?

The cost of insurance claims management software varies widely based on features, scalability, and customization options, ranging from monthly subscriptions of a few hundred dollars for basic cloud-based solutions to several thousand dollars for comprehensive, customized systems.

How the right software help with the claims management process?

The right software helps with the claims management process by automating administrative tasks, streamlining workflows, enhancing data accuracy, and providing real-time insights, leading to faster claims resolution and improved customer satisfaction.

Related Posts

Thank you for taking the time to read our blog post!