Financial Management Systems: Best Software Solutions in 2025

Looking for a reliable way to manage your organization’s finances?

Financial Management Systems (FMS) offer tools for budgeting, forecasting, reporting, and more—streamlining operations and driving growth.

In this article, we explore the essentials of FMS and highlight top tools to enhance your financial management.

Contents

- What is a financial management system?

- How does a financial management software work?

- Features of an effective financial management system

- Benefits of modern financial management systems

- How to choose the right financial management software?

- Custom financial management solutions

- 8 Best financial management systems in 2025

What is a financial management system?

A Financial Management System (FMS) is like the brain of a business when it comes to managing money.

It’s a tool that helps businesses keep track of their finances, ensuring they know where their money is coming from and where it’s going.

The main goals of an FMS include keeping an eye on cash flow, which is the money coming in and going out, and making sure that the business is using its resources wisely to grow. It also helps in planning for the future by creating budgets and forecasts, which are like financial roadmaps.

How does a financial management software work?

A financial management system starts by collecting data from different parts of the business, such as sales, purchases, and expenses.

This data is then organized and analyzed to provide a clear picture of the company’s financial health. Through the FMS, companies can track their cash flows, ensuring they have enough money to run their day-to-day operations, while also identifying areas for cost reduction and investment.

It facilitates budgeting and forecasting, allowing the business to plan ahead and allocate resources efficiently. The system also helps to ensure compliance with financial regulations and standards, which is essential for maintaining stakeholder confidence and avoiding legal hurdles.

[Read also: Your Guide to Digital Finance Transformation]

Features of an effective financial management system

Here is the list of critical features and functionalities that most financial management systems include:

Data Collection and Integration

A good Financial Management System (FMS) should be capable of collecting data from various sources within a business, such as sales, purchases, and payroll. It should also integrate seamlessly with other business systems to ensure accurate and comprehensive financial data.

Real-Time Analysis

The FMS should provide real-time analysis of financial data, financial statements, and business processes enabling businesses to monitor their financial performance continuously and make informed decisions promptly.

Budgeting and Forecasting

It should facilitate the creation and management of budgets and financial forecasts, helping businesses plan for the future and allocate resources efficiently.

Compliance Management

A robust FMS should have features that help businesses comply with financial regulations and standards, reducing the risk of legal issues.

Reporting and Dashboards

The system should be able to generate detailed financial reports and provide user-friendly dashboards for easy visualization and understanding of financial data.

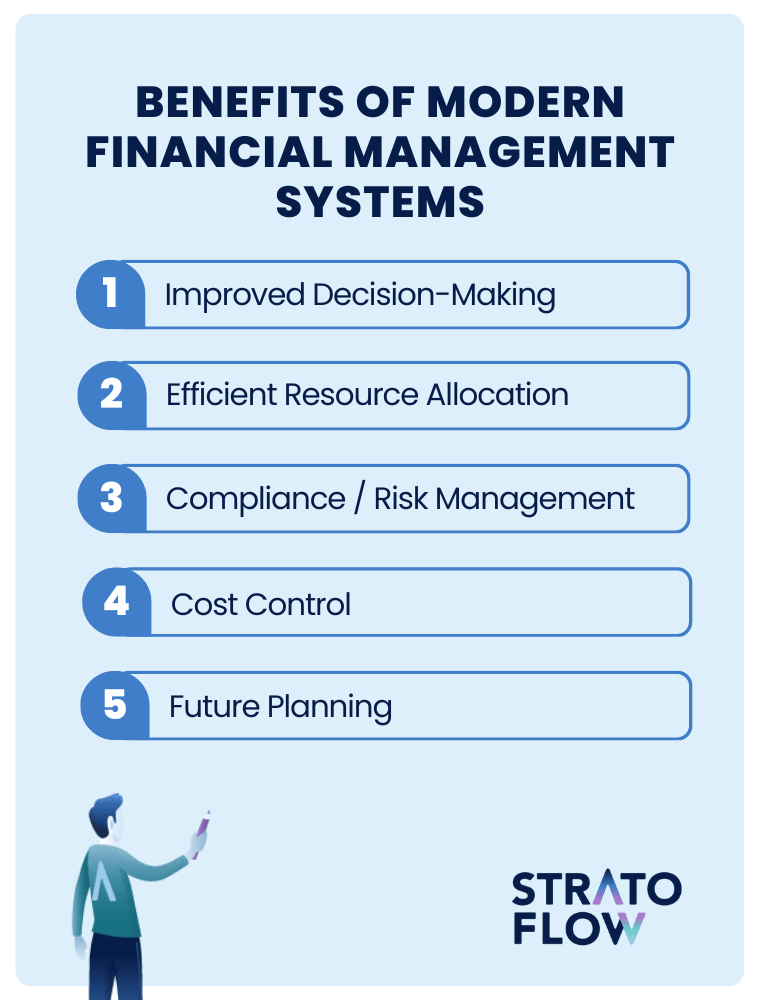

Benefits of modern financial management systems

Financial management systems don’t just provide a better view of the company’s financial situation, they also improve other aspects of its operations. Here are some examples of the key benefits of modern financial management systems:

Improved Decision-Making

Financial Management Systems (FMS) provide a clear snapshot of a business’s financial health. With accurate and timely financial data at their fingertips, managers can make well-informed decisions swiftly.

Efficient Resource Allocation

Resources in a business are like ingredients in a recipe; they need to be used wisely to create a successful outcome. An FMS helps in identifying where the resources are being spent and where they are needed the most. This ensures that every dollar is put to good use, contributing to the company’s goals.

Compliance and Risk Management

Every business operates within a framework of legal and financial regulations.

An FMS acts like a watchful guardian, ensuring that the business stays in line with these regulations, thereby reducing the risk of legal troubles. It’s like having a roadmap that helps in navigating the complex regulatory landscape.

Cost Control

Keeping a tight leash on costs is crucial for a business’s survival and growth.

An FMS provides a clear view of where the money is going, helping in identifying areas where costs can be trimmed without impacting the quality of products or services.

Future Planning

A business without a plan is like a ship without a compass.

The financial management system provides insights into cash flows and financial trends, allowing for better planning and preparation for what lies ahead, ensuring the business remains on a path of steady growth.

[Readl also: Banking Technology: Top 10 Trends for 2025]

How to choose the right financial management software?

Choosing the right financial management software (FMS) is like choosing a trusted financial companion for your business.

The first step, as always, is to clearly understand your company’s needs and strategic vision.

Different businesses have unique financial operations and goals, so the software must be well aligned with these specifics to provide meaningful insights and support informed decision-making. For example, a retail business may prioritize inventory management and point-of-sale integration, while a manufacturing company may need robust cost accounting capabilities.

It’s important to identify the key features that are essential to your business and make sure the software you choose excels in these areas. In addition, consider the software’s ability to adapt as your business evolves. Scalability is critical to ensure the software remains a valuable asset as your business grows and diversifies.

Custom financial management solutions

Custom Financial Management Software solutions are like tailor-made suits for businesses, designed to fit the specific financial needs and processes of a company.

Unlike off-the-shelf software, custom accounting software solutions are crafted from the ground up with the company’s unique requirements in mind. Developing one involves a thorough analysis of the business’s financial operations, identifying the necessary features, and ensuring compliance with relevant financial regulations.

[Read also: In-Depth Guide to Accounting System: Definition, Types and Ideas for Custom Solutions]

The journey from conception to a fully functional financial management system demands a blend of financial acumen, technical expertise, and a deep understanding of the business’s strategic objectives.

It’s a complex task where the importance of partnering with experienced software development experts cannot be overemphasized. These experts not only bring in technical prowess but also a wealth of experience in developing financial software that adheres to the highest standards of accuracy, security, and regulatory compliance.

They work in tandem with the business stakeholders to ensure the software aligns with the company’s vision and can adapt to future financial challenges and opportunities.

The synergy between the business’s financial vision and the expertise of seasoned software developers is the cornerstone in building custom financial management software that can become a powerful catalyst in achieving the company’s financial and strategic goals.

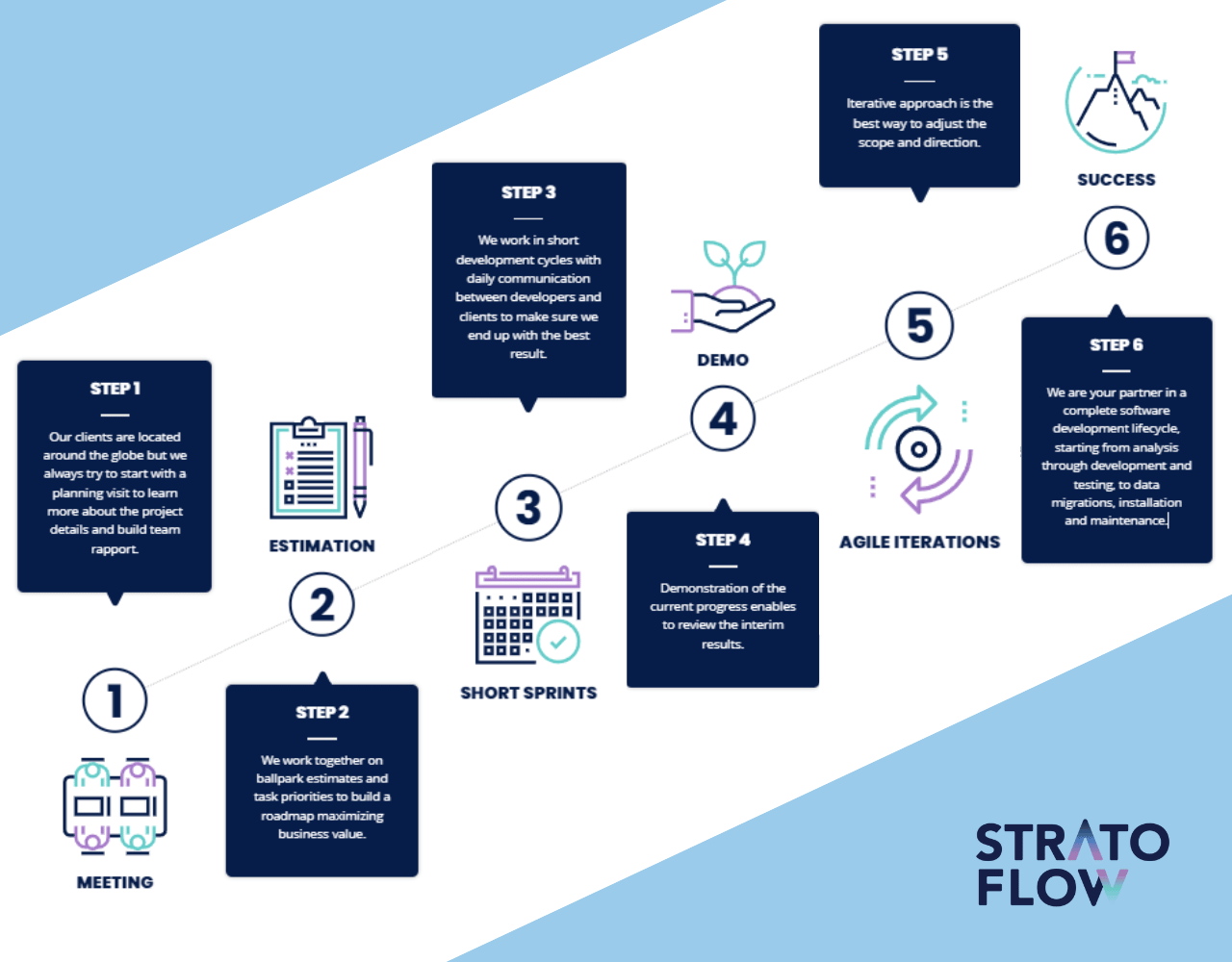

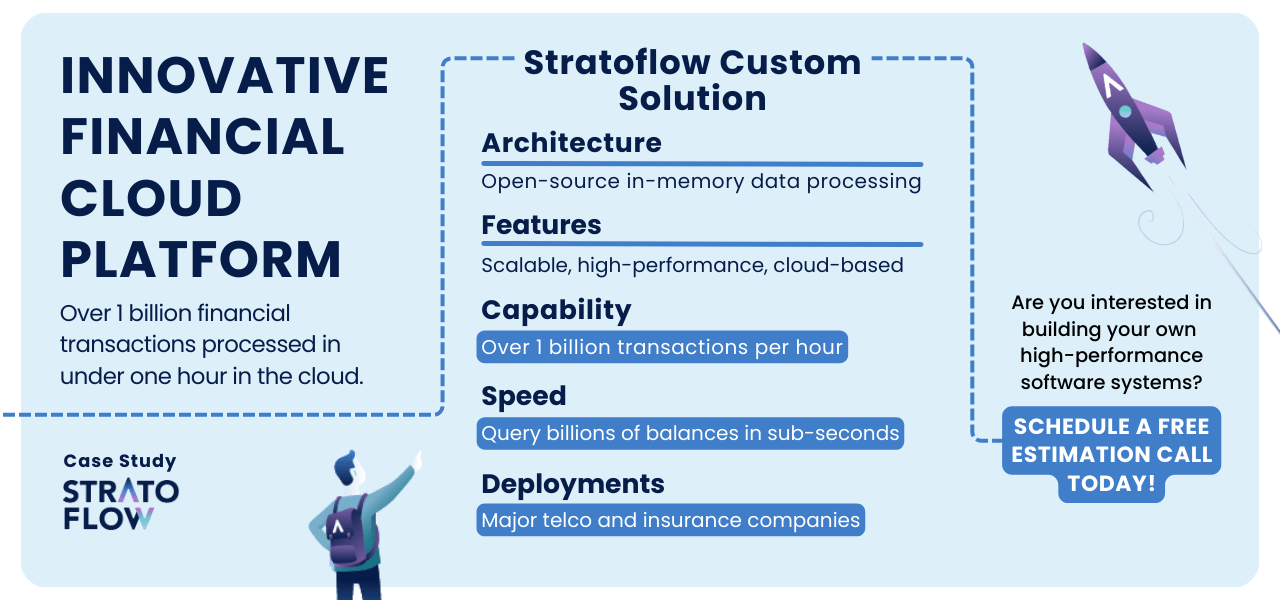

Stratoflow developers clearly understand the need and importance of knowledge and experience when building custom accounting software and financial systems.

That’s why when we were tasked by finance experts and industry veterans to develop a next-gen leading-edge accounting engine we knew what to focus on.

Agile processes, short delivery cycles, and close collaboration were necessary to effectively build high-quality software for the fintech industry.

The system is now live and capable of processing in the cloud over one billion financial transactions within an hour and querying billions of balances in sub-second times. The product was successfully implemented in major telco and insurance companies around the world and directly competing with systems offered by Oracle, SAS, and SAP.

[Read also: What You Need to Know About Custom Development in 2023]

8 Best financial management systems in 2025

What is the best financial management software on the market today?

To be honest, we cannot give you a definitive answer. With so many great options out there, the decision should come down to the individual needs of each business. That said, here is a list of the eight most popular choices out there:

Sage Intacct

Sage Intacct is a cloud-based financial management platform designed to meet the unique financial needs of a business by adapting to its workflow and reporting requirements.

This platform allows companies to manage their financial and operational data from one central location, simplifying accounts payable, standard and custom reporting, and cash management, among other functions.

Features

- Intelligent General Ledger using Artificial Intelligence (AI): Sage Intacct features an intelligent general ledger that utilizes artificial intelligence to enhance financial operations.

- Cash Management and Automated Bank Reconciliation: It provides tools for managing cash and automating bank reconciliation processes to ensure accuracy in financial data.

- Accounts Receivable and Payable: Manage receivables and payables efficiently to maintain a healthy cash flow

- Integration APIs: Sage Intacct provides integration APIs to connect with other business applications and extend functionality.

Pros

- Multi-Dimensional Reporting Capabilities: Sage Intacct excels in providing multi-dimensional reporting capabilities, enabling users to analyze financial data from various perspectives.

- Ease of Use and User-Friendly Interface: Users find Sage Intacct to be easy to handle due to its user-friendly design, which is particularly beneficial for simplifying accounting processes.

QuickBooks Online

QuickBooks Online is a cloud-based financial management system that covers a wide range of accounting needs.

It’s suitable for a variety of industries and is especially useful for those who regularly work with a bookkeeper or accountant, giving them access to your financial files.

Features

- Invoicing: Create professional custom invoices, send payment reminders, and match payments to invoices automatically.

- Expense Tracking: All your expenses are organized in one place, which is beneficial come tax time.

- Tax Management: The software helps in managing taxes, including submitting VAT directly to HMRC, preparing for self-assessment, and providing Income Tax estimates3.

- Report Generation: Generate over 230 customizable and industry-specific reports to gain insights into business performance

Pros

- Widely Used: QuickBooks Online is a popular choice among bookkeepers and accountants, indicating a level of trust and reliability in the industry.

- Easy Financial Tracking: This financial management system provides an easy way to track finances which is beneficial for managing the financial health of a business.

Xero

Xero is a cloud-based, double-entry financial management system designed for small businesses, with over 3.5 million users worldwide using it for billing and invoicing.

Among various financial management systems, it stands out as a robust accounting solution with a host of sophisticated features and is known for its modern user interface, making it a primary accounting solution for many accounting firms around the world.

Features

- Unlimited Users: All plans allow for an unlimited number of users which is a strong selling point for small businesses with multiple individuals needing access to the software.

- Project and Time Tracking: Especially on the Established plan, users can access Xero’s native project and time-tracking tool to monitor time spent on tasks and invoice it to a particular project.

- Financial Reporting: Offering more than just billing and invoicing, Xero provides financial and accounting reporting features like a 1099 report, balance sheet report, aged receivables report, and more.

Pros

- Extensive Online Support: Xero provides an array of online tutorials and support to help users navigate the more complex systems, ensuring they make the most out of the software.

- Seamless Integrations: With more than 1,000 prebuilt connections in the Xero app store, it’s likely to integrate well with the tools a business is already using, making it a flexible choice for many.

- Guided Setup Process: For those new to accounting software, Xero offers a guided setup process with pop-up windows and tutorials, and even provides a demo company account for practice.

FreshBooks

FreshBooks is a web-based accounting solution for small business owners, sole proprietors, freelancers, and independent contractors known for its focus on invoicing and billing.

Since its inception in 2003, FreshBooks has evolved from a simple invoicing software to a more well-rounded and robust accounting platform that now includes double-entry accounting tools, client management, expense and mileage tracking, and online payment processing, among other features.

Features

- Ease of Use: FreshBooks is designed with an intuitive interface that simplifies navigation from entering expenses to collecting payments.

- Tax Filing: It aids in tax filing by providing a snapshot of overall revenues for accurate business income reporting.

- Time Tracking: FreshBooks has a specialized Time Tracking Software that integrates seamlessly for quick and easy invoicing. It assists in managing projects and clients by tracking employee hours worked on various tasks

- Automated Invoicing: FreshBooks automates the invoicing process, reducing the manual workload and ensuring timely billing.

- Customizable Invoices: It offers customizable invoices, allowing businesses to maintain a professional image while billing their clients

Pros

- Intuitive and Easy to Use: The platform is known for its user-friendly interface that makes it easy for individuals with no accounting background to navigate and use the software.

- Affordable Pricing: FreshBooks offers competitive pricing, especially at lower tiers, making it a cost-effective choice for small businesses and freelancers

Oracle Financials Cloud

Oracle Financials Cloud is a global financial management system designed to streamline and automate financial management processes.

It covers a range of financial activities, including payables, receivables, fixed asset management, expense tracking, and reporting, providing a comprehensive view of an organization’s financial health.

Features

- Business Process Automation: Supports the automation of various business workflow processes, enhancing efficiency and accuracy3.

- Configurable Features: Offers a range of configurable features to meet specific business workflow requirements, ensuring a tailored fit for diverse operational needs.

- Cross-Device Accessibility: Available across various devices, facilitating on-the-go access and management of financial data

Pros

- Streamlined Bookkeeping: Oracle Financials Cloud streamlines the entire bookkeeping process from start to finish, making it a reliable and secure solution for managing financial documents and processes.

- Robust Analytics and Reporting: Offers robust analytics and reporting features, diving deep into accounts payable, revenue management, and other financial aspects, for insightful business analysis and decision-making

Zoho Finance Plus

Zoho Finance Plus is a unified financial management system platform designed to meet the back-office needs of small and medium-sized businesses, offering a wide range of tools for invoicing, order management, accounting, and expense management, among others.

Features

- Automated Approvals and Workflows: This feature allows the creation and enforcement of approval processes and workflows throughout the platform to enhance internal accounting controls.

- Scanning Transactional Documents: This feature allows scanning transactions, extracting relevant details, and entering those details directly into the financial management system platform.

- Cloud-based Platform: The cloud-based nature of Zoho Finance Plus allows team members to access the suite anytime, anyplace, and from virtually any device as long as they have an adequate internet connection.

Pros

- Integrated Suite: It integrates various financial tools into one platform, ensuring streamlined operations and real-time data updates across the suite.

- Extensive Feature Set: Offers an extensive set of features at a competitive price point, catering to different financial management needs of small and medium businesses.

Vena

Vena Solutions provides a financial process automation platform, known as Vena, designed for medium to large organizations.

The platform is designed to streamline corporate performance management, accounting, budgeting, regulatory compliance, and other finance-related processes.

Features

- Excel Integration: Vena integrates with Excel, providing a familiar interface for users while enhancing functionality for financial planning and analysis.

- Budgeting, Planning and Forecasting: Offers tools for budgeting, planning, and forecasting to help organizations create and implement foolproof budgets based on reliable financial data and analytics.

- Revenue Forecasting: Provides tools for revenue forecasting to aid in financial planning and decision-making.

Pros

- Streamlined Budgeting Process: The platform streamlines the budgeting process, increasing accuracy in financial predictions and ensuring seamless data consolidation.

- Scalable for Medium to Large-Sized Organizations: Vena is scaled to meet the needs of medium to large-sized organizations, providing a robust solution for their financial process automation needs.

Cube

Cube is a Financial Planning & Analysis (FP&A) platform designed to enable finance teams to be more strategic and contribute positively to business growth activities by reducing the time spent on manual, repetitive tasks.

It’s a deep tool that can be used for multiple business purposes, including financial reporting, account reconciliation, and budget analysis.

Features

- Role-Based Permissions: Cube provides role-based permissions to control access to different parts of the platform, ensuring security and appropriate access levels.

- Budget Control: It offers tools for budget control, aiding in effective financial planning and management.

- Custom Templates: Cube provides custom templates to streamline financial processes and ensure consistency across financial documentation.

Pros

- Depth and Flexibility: Cube is recognized for its depth and flexibility in catering to a variety of business financial management needs without sacrificing usability.

- Spreadsheet-Native Platform: Its spreadsheet-native feature makes it easy for anyone to use and adopt, especially for those familiar with spreadsheet tools.

Conclusion

Navigating your company’s financial landscape is a breeze with the right financial management system at your disposal.

By exploring the range of tools discussed in this article, you’ll be one step closer to achieving a streamlined financial workflow that will propel your business toward a horizon of sustainable growth and robust financial health.

Related Posts

Thank you for taking the time to read our blog post!